Pavel Celunda: Flexibility, the Only Way to Deal with Challenging Times

Pavel Celunda, Process Engineering Director at Bilfinger Tebodin, evaluates the main impacts of the Green Deal, ongoing war in Ukraine and a rise in materials prices on the investment market as well as the operations of international engineering companies.

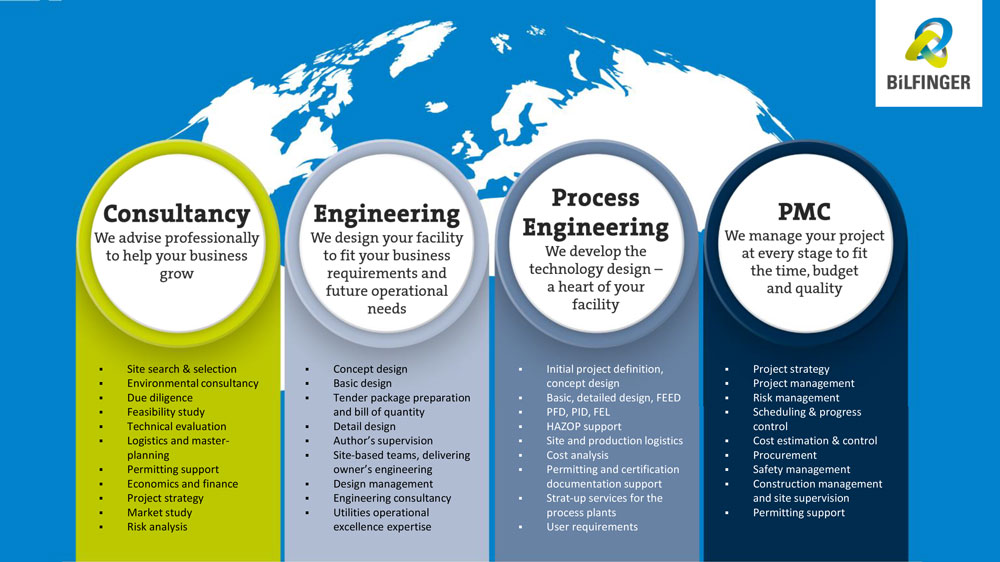

Bilfinger Tebodin, part of industrial services provider Bilfinger, is a multidisciplinary consulting, engineering, and project management firm. The company provides services in numerous fields including various industries such as oil & gas, chemical, pharma and the energy sector. The main services cycle includes all steps, from consultancy to process engineering, project management, procurement, and construction management.

Bilfinger Tebodin delivers added value with its expert technology solutions and process design with the use of advanced software and over 75 years of experience on the global market.

Pavel Celunda is an experienced and committed leader, focused on developing an international team of process experts at Bilfinger Tebodin within the CEE region.

He began his professional career as a construction supervisor and commissioning manager 16 years ago and, since then, has been continuously involved in the EPCM industry, gaining experience in European markets as well as on international assignments, including sites in India, Russia, and Africa. Pavel Celunda has a master’s degree in Mechanical & Process Engineering.

Mr. Celunda, after more than 16 years of working in the EPCM industry, how do you see the evolution of this global market and what are some major challenges in the future of the industry?

Pavel Celunda: We are definitely living in a very specific time and environment. Still, if you look back – each year has been challenging. These days are showing us, at least those of us from Central and Eastern Europe, how different it is to live in times of prosperity.

The specifics of today’s market evolution are that ongoing globalization is combined with intense tendencies to deliberate local markets. I have worked all over the world – in Russia, India, Nigeria, and Sri-Lanka. While working in those countries, I developed investment projects on behalf of international clients. I was just starting my career, so I was not involved in these projects for my technical expertise or extraordinary skills. The local teams I met were very technically capable, and I learned a lot from them. My role was to secure the assets of international companies – report the reality, follow priorities, focus on safety more than on a hasty construction. It was 20 years ago, and it was very different market then. All the major projects were happening in developing countries and international companies like ours had their role there. The projects served as a kind of knowledge transfer of well-known and proven technologies to the countries with a cheaper labour force and cheaper materials. This was globalization in practice for us.

Recently, an increasing number of investments are to be made in European countries again. Investment teams from industrial players, however, have been limited due to the lack of investment projects in past decades. Logically, local engineering companies do not have the required expertise, because for more than 30 years they have been doing mainly maintenance projects. In addition, recent CEE investment projects are not like “copy and paste” of well-known technologies. They are innovative start-ups and R&Ds, but on an industrial scale. They are very demanding when it comes to the quality and expertise of the entire project team. This is where we, as part of the international Bilfinger Group, can optimally support our customers with a pool of experienced and qualified specialists, technical expertise, and industry knowledge. I find it very important now, as the outlook is quite uncertain taking into account the ongoing war in Europe, inflation, issues with supply chain and materials price. Even in this context, the industrial market around us is very active. Our customers can focus on their core competence and current global challenges, and we are there to manage projects reliably from the technical point of view.

In Europe, the Green Deal has been discussed extensively. What will its impact on the investment market be, in your view?

Pavel Celunda: Unfortunately, I have to say that in CEE countries the Green Deal has not been communicated to the public very well. From my experience, people do not know much about the Green Deal here, except for its name, and some assume that it’s about regulating some part of the market by the European Union. For example, my children of different ages, who should be concerned about global warming because it will greatly affect their generation, were not aware of this topic when I asked them. Yes, they have heard about global warming, but nothing about the vision of how to fight it and strategies that could solve it, although they will be the ones solving it.

I believe that the Green Deal is a very good guideline. Moreover, it is a clear action strategy, which we as EU members agreed to follow to fight global warming. I see it as a good tool to direct public investments in technologies with a significant added value.

We have been talking about reducing the dependency on fossil fuels for decades now. But this transition is a long process and involves the whole of society – not just industry. One has to understand that just installing the new green technology will not help. We need to change our daily habits – when we do the laundry, when we drive to a shop, what we buy and how we buy it.

The industry has to find its way to operate despite the pandemic and the Russia-Ukraine crisis. What is the impact of these factors on international engineering companies?

Pavel Celunda: We are all very much impacted, and international companies are not an exception. At Bilfinger Tebodin, we have a timely advantage. As a company in CEE, we underwent a successful reorganization just before the pandemic. Since then, we have been operating with a new, more flexible structure that is focused on international Business Lines, not countries. In addition, we have been profiting from the advanced tools and procedures we use in our engineering work.

In a nutshell, I believe that today we are the only engineering company in the CEE region that is truly international – no local country managing directors, one quality system across the region, one technical discipline leadership and also a single system for supporting departments like HR or Safety. We invested a lot of market knowledge and resources in this reorganization.

The reorganization started in 2016, and completing the main steps took us at least 1-2 years. Once that process was completed, we began fine-tuning the systems, procedures and updating the project portfolio. Now we are a company of 600 colleagues in our region who work together on demanding international projects. I really admire all the enthusiasm of our teams who worked hard to actively reshape our company five years back.

The initial reason for the reorganization was our objective of winning large-scale projects that require the commitment of complex teams and could not be efficiently handled only locally because of the resource availability or the expertise. Working efficiently during the pandemic has been a kind of a side effect of the reorganization because our teams were able to switch from working in the office to home in a day. We have been working effectively because our company culture was ready for it by then – supported by our systems, which are set for mobile cooperation and communication.

Finally, the pandemic made us use the tools that we already had. It made us stronger. Additionally, we all managed to reduce travel costs, right? I was traveling so much before the pandemic – one day I was speaking to colleagues in Warsaw, the next day I was sitting with a client in Romania, the day after that in Russia. I didn’t really pay attention to it before, and now I appreciate every trip and every personal meeting. The fact that I am now able to sit at a table and have a coffee or a dinner with a client or colleagues brings a different feeling of doing business. The pandemic has built additional international bridges that weren’t necessarily there before.

And the impact of Russia-Ukraine crisis?

Pavel Celunda: The Russian aggression has had a very detrimental effect. In a few weeks, it has undermined some of the carefully built relationships that had been developed over decades. Our team is a good example. As is the case with any other international technology-oriented company, we work in an integrated manner, sharing all the resources and experience that we have. We rotate and mix the management to ensure a strong corporate culture and compliance with regulations. There were joint projects between Ukraine and Russia, all of them stopped immediately. We are not taking on any new business in Russia and we are allowing existing contracts to expire. All applicable sanctions imposed on Russia are strictly followed and constantly monitored.

We remain deeply troubled by the war in Ukraine and condemn all aggressive actions of the Russian government. Our top priority, however, is the safety and well-being of our Ukrainian colleagues. In one moment, our employees in Ukraine spread all over the country once the war started, with a great deal of uncertainty about how the situation will develop. Our international company structure and united team was a great support. From the first day of the war, our colleagues received help for relocations and teams in other countries have picked up projects. Once the safety of people in Ukraine was ensured, it was possible for them to get back to a stable workload from other European countries. Recently, the Ukrainian experts have been working as an extended team of our other offices.

At this point, we are getting back to the Green Deal again. In this situation, it may sound completely different to the people and industry. Connected with the independence from energy utilities, it gives a very different dimension to the planned projects. Now we are partners of most battery producers or battery component suppliers. Their plans are huge, as they want to be able to meet the recent demand. We are also working with the majority of our global clients on changing their energy master plans for their production facilities such as breweries, tire plants, heating plants and others. It wasn’t so long ago that it would have been difficult to find any partners in the production teams when we proposed energy saving solutions with an impact on the production process. Now, everybody is open to new ideas. That is great.

Is the logistics and industrial sector still attractive for investors, although the rate of growth of demand and supply is lower? What’s next for industrial investors? What are their recent needs and demands?

Pavel Celunda: The recent needs our industrial customers revolve around energy, securing a supply of materials and predicting at least midterm how the market will develop. I would not count on logistics too much. Recently there is too much fluctuation, and it is surely not easy for the company to commit to any big investment. Still, in my view there are some certainties which our investors can hold onto. For new investors in the industrial sector, the recent trends are sustainability, diversification and securing utility sources. Any investment in this direction will be safe and will deliver a return. Also gaining, cleaning, recovering of the new non-ferric materials seems to be the right direction for investment.

Generally, there are clear tendencies towards re-establishing the technology centres within Central Europe to become independent, at least partially, from the knowledge base of the Asian and other foreign licensors. This segment will be strongly supported by the local economies as well, so initial uncertainties and possible inefficiencies will not undermine the business case. The general tendency is that such investments are getting bigger in terms of the project size. Obviously, the investor needs a different approach to invest 2-5 million euros in the start-up project compared to setting up the project of 100-200 million euros, which would still have to be the technology development project.

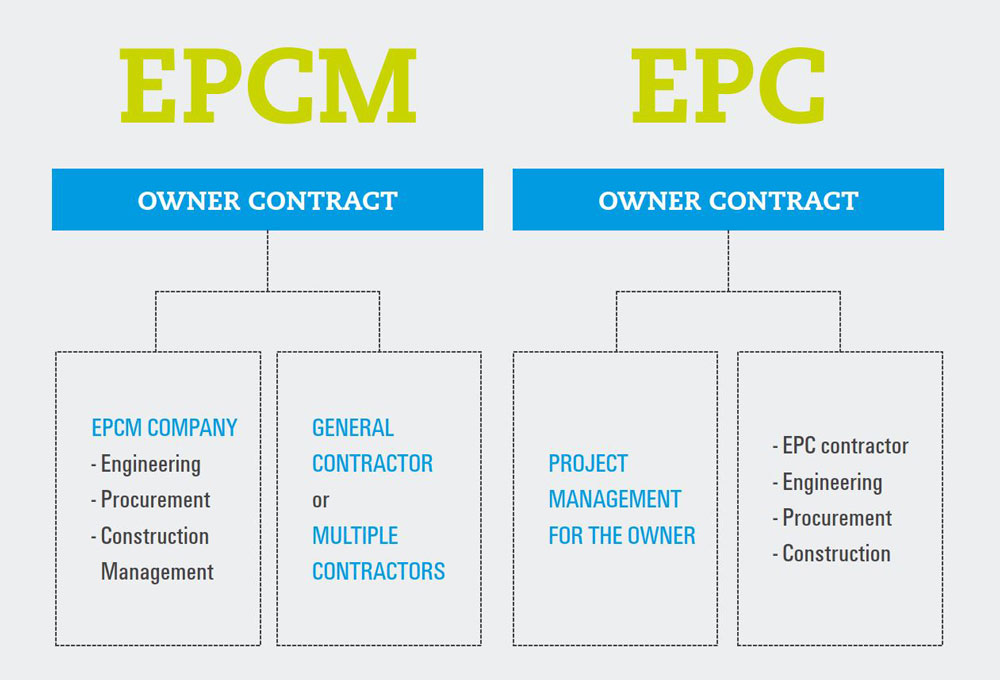

The situation is a little bit different for large established investors in the industrial sector. Oil and gas giants, for example, are very busy with their new strategies and green targets up to 2030. As part of these strategies, there needs to be a restructuring to enable the flexible approach to new investments. In Central Europe, there are not many solution providers, who are ready to work with new technologies and bear the risks for an EPC project. Some of our customers had to learn it the hard way. Still, the tendency is towards flexibility, accepting more process responsibility and independence of their teams.

Currently, we see a significant increase in raw material prices, and also in the costs of energy, logistics and so on. What, in your opinion, would be a proper approach and an effective risk mitigation strategy?

Pavel Celunda: I can reliably respond to this question only with respect to the investments market. With my experience from our ongoing projects, there is only one right solution, which is a logical and pragmatic approach, combined with a high level of flexibility that all projects need now.

Many investors mistakenly assume that a fixed price design-build EPC is the lower-risk approach for them. Today, this is not always the case. The more prices fluctuate, the more investors need to take away the risk of fluctuation from contractors and keep them under their control. What we usually recommend to our clients is to set the project approach in a flexible but clearly described way. Flexibility and adaptability are the keys to success.

Who are your key partners and major projects in the region? Are there any ongoing energy transformation projects – green energy, biochemical, greening of the gas, etc.?

Pavel Celunda: Energy transition and biotechnologies have been our focus for years. During more than 10 years of partnership with the universities in the region, for example, we contributed to some of the first pilot units for second generation bioethanol technologies.

Recently, this market segment has become very attractive and is gaining some strong momentum. In Central Europe, we see quite a large share of energy transition projects. The overall value chain of energy transition projects is very wide, so it generates other investments as well. I like to say that energy transition technologies of various kinds within their overall value chain are actually awakening the chemical market in Central and Eastern Europe. I am proud to say that Bilfinger Tebodin has been a part of the largest investments in this field in our region recently.

We work for all the industries mentioned with both international and locally focused clients. Moreover, energy transition influences all the segments of our market portfolio, because even food and feed, chemical or automotive plants need to react to the energy issue. We are here to support all of them in this journey as a reliable partner.

I would like to add one important market segment that is growing – electromobility. Its supply chain is huge – starting with mining of nonferrous materials, cleaning them, preparing the middle products, assembling them to batteries and later on recycling the batteries. The progress of such projects is very advanced and car manufactures have already travelled quite far along the one-way road toward the electromobility. This market is very active, and those projects are a significant part of our portfolio now with a growing tendency.

More than half of our recent projects are concept studies, economic analyses, and feasibility studies. Still, I see that at least one third of them is already a commitment to build a plant and execute the project.

The ambitious effort to accelerate global clean energy transitions has brought about significant changes in the execution of projects. How does an international engineering company cope with this goal?

Pavel Celunda: You are right, we have been facing significant changes in the execution of projects. For example, the project for the second-generation bioethanol plant required us to combine food-related hygienic standards with pulp and paper, and to pack it into the chemical and oil & gas wrap. Modern energy sources are no longer about the boiler itself. They are about the handling of fuel – mixing it, preparing it, sorting it. When it comes to fumes cleaning and circular economy, we see that greening of gas brings together the chemical and gas industries too. In electromobility, the battery plant always has the specifics of a big scale up from the chemical type of plant, but it is driven by the strong competitiveness of the automotive market, which does not allow pilot plants or half scale operation testing.

Therefore, the impact on a project is significant – it influences the project development approach, the procurement strategy, the expertise needed, the budget and the time control. As I have mentioned before, well-established corporations with well-organized investment departments suddenly struggle to organize a tender for such an innovative new project. This is where I see the strength of our company because we can act as an integrator. Over the years, the greatest expertise we have developed includes what I would call industry insight and integration skills. Now it is indeed being fully utilized.

On top of this, our clients may rely on our international expert centres and the fact that they can offer the transfer of knowledge from one country to another. What this means is that once we have built a similar project in the Czech Republic, for instance, we are able to use the same core team and knowledge we have gained, while executing the new project in Hungary or any other country.

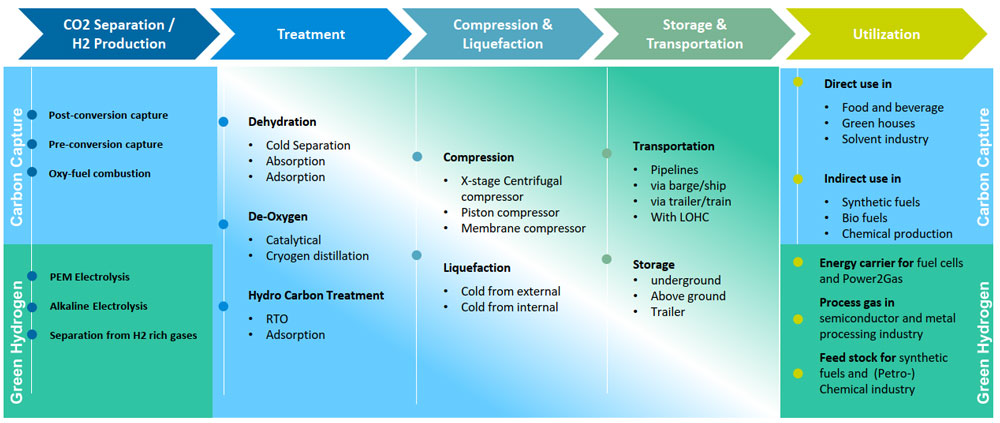

With a growing interest in hydrogen and a low carbon economy comes the need to ensure the sector’s technology. What is Bilfinger Tebodin’s approach in this regard?

Pavel Celunda: Recently, we have been developing several kinds of energy master plans for projects. This means we need to have a complex and independent look at the plant’s utilities consumption, as well as on the way the asset owner runs the plant and its production processes. Hydrogen technologies are one of the focuses of Bilfinger Tebodin. We have a specialized expert centre, a partnership with the world-class electrolysis licensors and the capability to support the investor as an EPC partner. That means we can supply the client as a one-stop shop.

Hydrogen technology is at the beginning of its path, and it needs time to figure out where it is heading. What, for example, is the industry that will use it the most? How will it be transported? Will it be a substitute for natural gas? Will we use centralized or decentralized solutions? There are too many open questions, aren’t there? For now, in our region there are mainly mid-size and pilot projects running so far. As a Group, Bilfinger offers products and services along the entire hydrogen value chain – from production to storage, transport, and utilization.

What I find equally interesting are carbon capture technologies. I can see that here in the Central Europe it is yet an undervalued technology. With the dramatic energy situation on the market today, however, it can be predicted that some kind of a mid-term solution will emerge, the solution that could gain more time for our economics. For instance, a coal plant without a chimney could be something that could be working for the next 20 years.

The expansion of renewable sources may be the key for energy companies on their path to sustainability. How does Bilfinger Tebodin support such endeavours?

Pavel Celunda: For pure energy companies there is only one way forward these days – to get green, or at least blue. Every energy plant has its own specifics, country legislation, and other strings attached. As I mentioned, hydrogen and carbon capture technologies are the potential solutions that do not fit yet for all the purposes. There are also other ways to reduce the carbon footprint.

If I look at an industrial investor – the simplest way is to buy green electric energy from the grid. In today’s dynamic world, I can understand that some industrial clients are simply taking the easiest way. However, I am convinced that this would be only a short-term solution.

I believe that there is always a time to sit down with an investor and develop a proper mid-term energy solution for them. When I look back, it is clear to me that all our successful energy related projects had one thing in common: apart from the new energy mix and new utility sources, the investor was prepared to change his production stereotypes and adjust them to new circumstances. In this case, we can develop an energy master plan that will actually contribute significant value to the company. It is based on a clear vision and defined strategy, which investor would be able to explain to team and get the buy in.

In its 2050 long-term strategy, the EU claims the transition to a climate-neutral society is both an urgent challenge and an opportunity to build a better future for all. What will Bilfinger Tebodin’s next steps of your journey towards a climate-neutral economy be?

Pavel Celunda: The energy transition and climate agreement in Europe are developing at a rapid pace. In addition to the multiple opportunities that it offers, this changing industrial climate poses significant challenges and uncertainties for companies that plan their future investments. It also presents a liability for our customers’ bottom line, with increasing costs for both energy and the emissions that the energy causes. Fortunately, laws and regulations are not the only factors that are changing. The available technologies are continuously improving, with increased efficiency, lower operating costs, and extensive solutions to address engineering challenges. We support industry in its energy transition, providing the best available technologies and services for industrial players. Bilfinger Tebodin helps you turn this transition challenge into an opportunity and shows you how to benefit from it. Our support helps industrial plant operators handle the energy transition by delivering a comprehensive portfolio of products and services. We help our clients focus on the skills that are essential for their business, while taking advantage of the many opportunities presented by the energy transition.