Infringement against Romania due to pollution

Currently, Romania is in infringement procedure, triggered by the European Commission for exceeding, for several years, the limit values of the harmful substances present in the air (sulphur dioxide, dioxide nitrogen and nitrogen oxides, suspended particulate matter and lead) in three urban agglomerations in the country – Iasi, Bucharest and Brasov. Although environmental and energy taxes levied by the state are above the European average, the results take time materialize.

The most important environmental tax bases are: energy products, motor vehicles, resource use fees, waste storage fees, the taxation of measured or estimated polluting gases or greenhouse gas emissions. The main four categories of environmental taxes are:

Energy taxes (including transport fuels) – include taxes on energy products used for both transport and stationary purposes (for energy and industrial processes). The most important energy products for transport are gasoline and diesel.

Transport taxes (excluding transport fuels) – mainly include taxes on ownership and use of motor vehicles. Taxes on other transport equipment (e.g. airplanes) and related transport services (e.g. charter or regular flights tax) are also included in this category, if they comply with the general definition of environmental taxes.

Pollution taxes apply to emissions from movable and immovable sources and to the sale of certain goods (batteries, hazardous chemicals, tires, plastic bags, plastic and cardboard packaging). Thus, there are taxes that apply to emissions into the air and water, solid waste and noise. This category does not include taxes of CO2, as they are included in the category of energy taxes.

Resource taxes are the taxes that apply to the exploitation of natural resources (water, minerals, wood etc.) other than those used as energy sources. However, there are differences of opinion whether extraction of natural resources is in itself harmful or not, although there is a general agreement that it can bring environmental issues, such as soil erosion and pollution. The most important effects of air pollution are due to emissions generated by transport and agriculture, as well as electricity production.

Environmental taxes on an upward trend

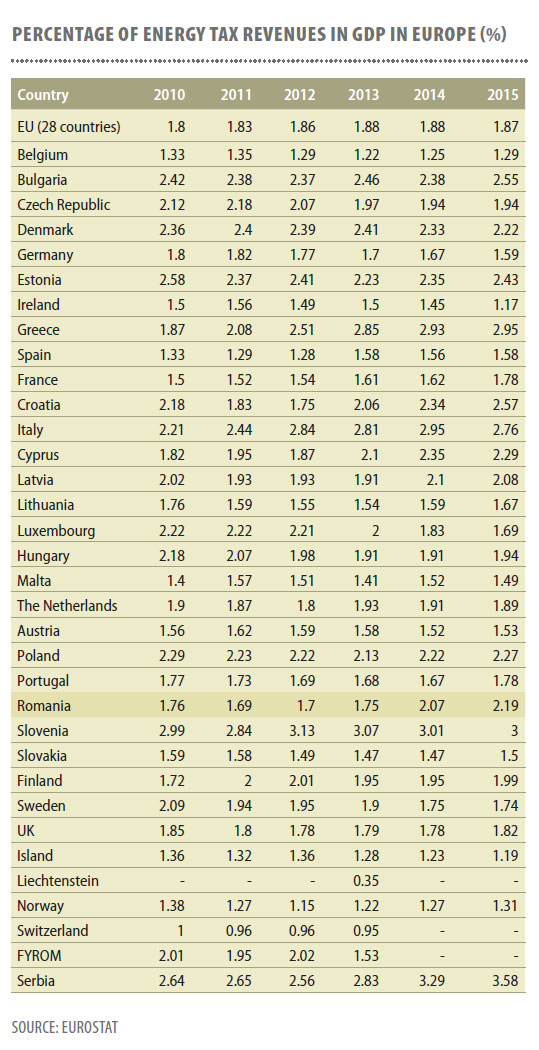

Environmental taxes have recorded an upward trend in Romania over the recent years. While in 2010 they accounted for 2.09% of GDP, in 2015 they represented 2.43% of GDP, according to a report of the Court of Auditors on air quality in Romania. From this point of view, Romania ranks 19th in Europe, on the same footing as Portugal, out of 32 countries. Although there has been a decline in annual average concentrations in recent years, this trend has been driven mainly by the decline in the economy and less by measures taken by authorities. With the rebound in economic activity, pollution has started to increase slightly after 2015, especially with regard to emissions of nitrogen dioxide, lead and particulate matter.

Energy taxes increased by over 60%

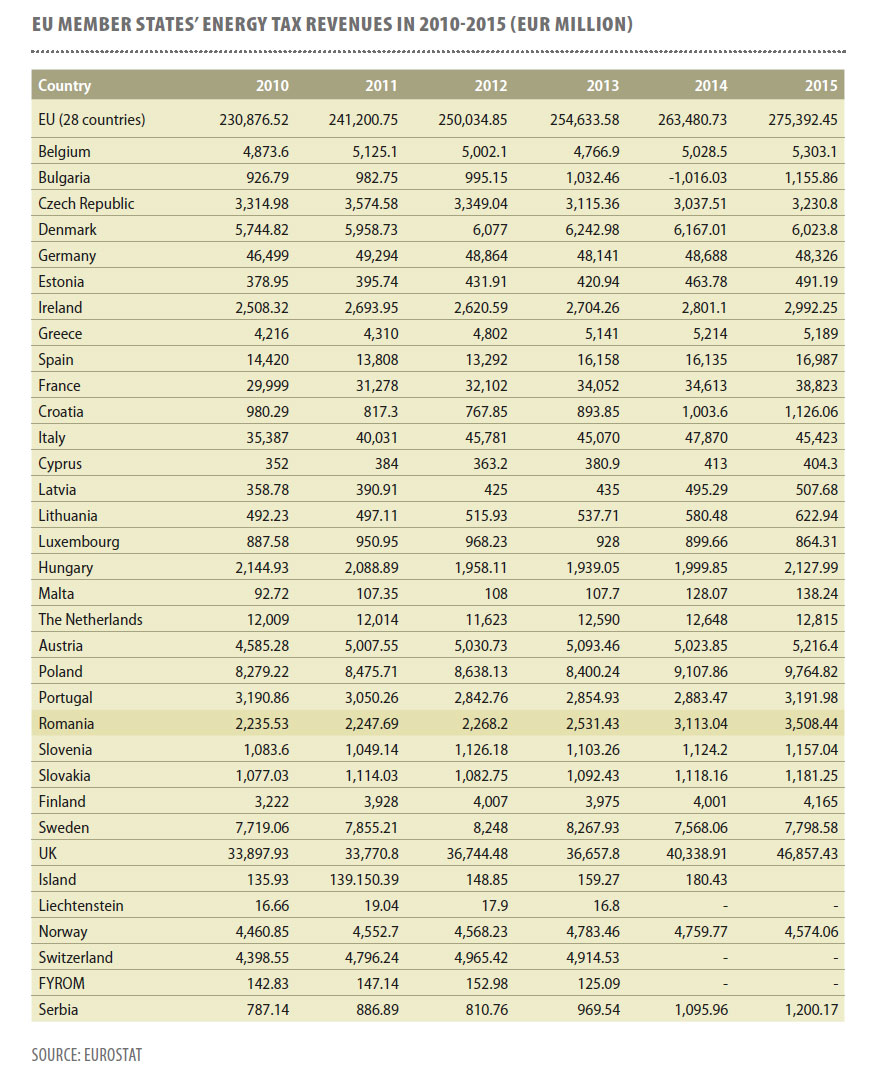

At European Union level, as well as at the level of Romania, energy taxes are the most important source of environmental taxes. Romania is characterized by extremely high primary and final energy intensity compared to the average of the European Union (approximately four times higher). Although Romania has a significant technical potential for the use of renewable energy resources, a very small part is used, except for hydro resources from large hydropower plants. In 2010, the value of energy taxes stood at EUR 2.23bn in Romania, and in 2015 it reached EUR 3.5bn, amount placing our country the sixth in the European Union, after the UK (EUR 46.85bn), Poland (EUR 9.76bn), Sweden (EUR 7.79bn), Denmark (EUR 6.03bn) and Norway (EUR 4.57bn). As percentage of GDP, the weight of energy taxes increased in the mentioned period from 1.76% to 2.19%, finally exceeding the EU average, which was 1.87% in 2015.

Lower revenues from transport

However, Romania is in the last places of the ranking in terms of transport taxes, but this is not due to the existence of a limited or new national car fleet, but to the fact that during the analysed period the legal framework regulating this tax had shortcomings and inaccuracies that led to large amounts of refunds. While in 2010 transport taxes brought to the budget EUR 400mln, in 2015 they value fell to EUR 372mln. Also, as percentage of GDP, they fell from 0.32% to 0.23%. Even with a percentage of 0.23% of GDP, Romania surpassed in terms of these taxes countries such as Luxembourg (0.14%), Belgium (0.7%) and Poland (0.21%).

Broken measuring and control equipment

Although plans for air quality and plans for maintaining air quality for the period 2016-2020 were initiated, they were not completed last year. Following the audit conducted by the auditors of the Court of Auditors, it resulted that many analysers in monitoring stations have been defective for long periods of time and many of the interior and exterior public information panels, which were supposed to show the general daily air quality indices, are rather non-functional than functional, and the funds allocated for equipment maintenance were insufficient. Furthermore, there was a lack of performance indicators to measure the degree of achievement of air quality monitoring objectives.

Air quality plans, delayed

The concern of local authorities for air quality monitoring is proven by the delays recorded. For example, at the end of last year, the Air Quality Plan (AQP) for Iasi Municipality was returned for the third time by the territorial Environmental Protection Agency to the Mayor’s Office of Iasi for additions and restoration. In the agglomeration of Bucharest, the technical assistance contract for the elaboration of the Integrated Air Quality Plan (IAQP) was just under way. Also, in the urban agglomerations Galati, Bacau, Ilfov, Brasov, Braila and Cluj, the plans were not ready and they were still in various stages of elaboration. Moreover, the County Councils of Mehedinti and Harghita hadn’t even initiated these plans.