Equinor acquires Chevron’s stake in Rosebank project

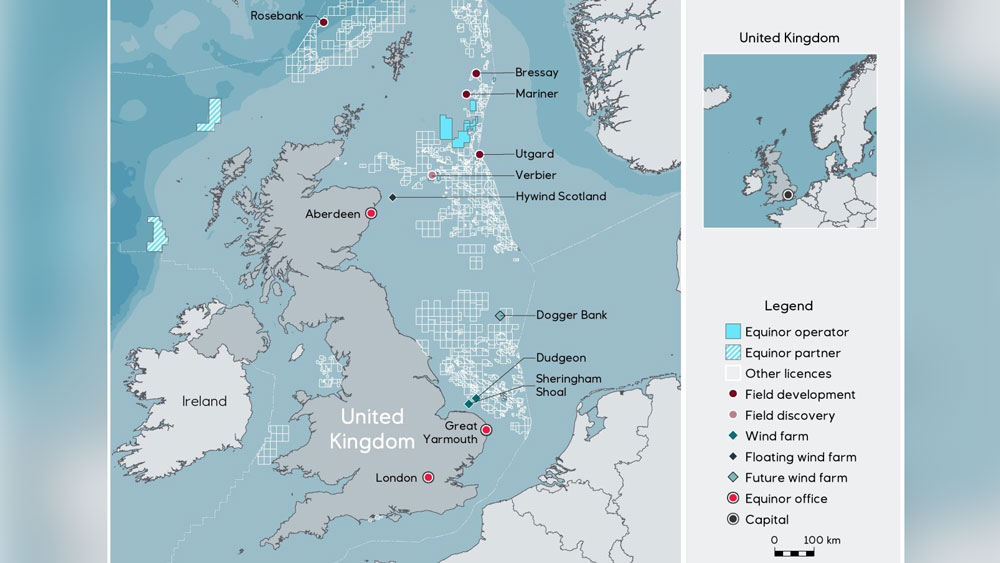

Equinor has signed an agreement to acquire Chevron’s 40% operated interest in the Rosebank project, one of the largest undeveloped fields on the UK Continental Shelf (UKCS). Once concluded, the transaction will strengthen Equinor’s UK portfolio, which includes the Mariner development, attractive exploration opportunities and three producing offshore wind farms.

“We look forward to becoming the operator of the Rosebank project. We have a proven track record of high value field developments across the North Sea and will now be able to deploy this experience on a new project in the UK. Today’s agreement allows us to buy back into an asset in which we previously had a participating interest, demonstrating our strategy of creating value through oil price cycles. The acquisition of Rosebank complements our portfolio of oil, gas and wind assets in this country, in line with our strategy as a broad energy company. This new investment underlines Equinor’s commitment to be a reliable, secure energy partner for the UK,” says Al Cook, Equinor’s Executive Vice President for global strategy & business development and UK country manager.

The Rosebank field was discovered in 2004 and lies about 130 km northwest of the Shetland Islands in water depths of approximately 1,110m. The other partners in the field are Suncor Energy (40%) and Siccar Point Energy (20%).

“With Rosebank, a standalone development in the underexplored West of Shetland region, we strengthen our upstream portfolio, which also includes Mariner, one of the largest investments on the UKCS in over a decade. As we have done with other projects in our portfolio, such as Johan Castberg and Bay du Nord, we intend to leverage our experience and competence to create further value in Rosebank, in alignment with the UK Government’s priority of maximizing the economic recovery of the UKCS,” says Hedda Felin, Equinor’s Senior Vice President for UK & Ireland offshore.

The transaction is subject to customary conditions, including partner and authority approval, with completion targeted as soon as possible.

The parties have agreed not to disclose the commercial terms of the agreement.