Shell to Sell Its Non-Core Canadian Shale Assets to Crescent Point

Royal Dutch Shell plc, through its affiliate Shell Canada Energy (Shell), has reached an agreement with publicly listed Canadian energy company Crescent Point Energy Corp. (Crescent Point) to sell its Duvernay shale light oil position in Alberta, Canada for a total consideration of $707 million (C$900 million). The transaction has an effective date of January 1, 2021.

The consideration is comprised of $550 million in cash and 50 million shares (valued at $157 million) in Crescent Point Energy common stock (TSX:CPG). Subject to regulatory approvals, the transaction is expected to close in April 2021.

“Divesting these assets underpins Shell’s effort to focus the Upstream portfolio to deliver cash,” said Wael Sawan, Upstream Director at Shell. “While we believe these assets hold value, the divestment allows us to focus on our core Upstream positions like the Permian Basin, with integrated value chains, thereby building a resilient, lower-risk and less complex portfolio.”

The transaction includes the transfer of approximately 450,000 net acres in the Fox Creek (Kaybob) and Rocky Mountain House (Willesden Green) areas, along with related infrastructure, currently producing around 30,000 barrels of oil equivalent per day (boe/d) from more than 270 wells. Crescent Point Energy will retain the field employees and several technical and commercial roles that support the assets.

Key highlights of the agreement

- Strategic entry into a premier and established liquids rich play with greater than 10 years of high-return, low risk drilling inventory.

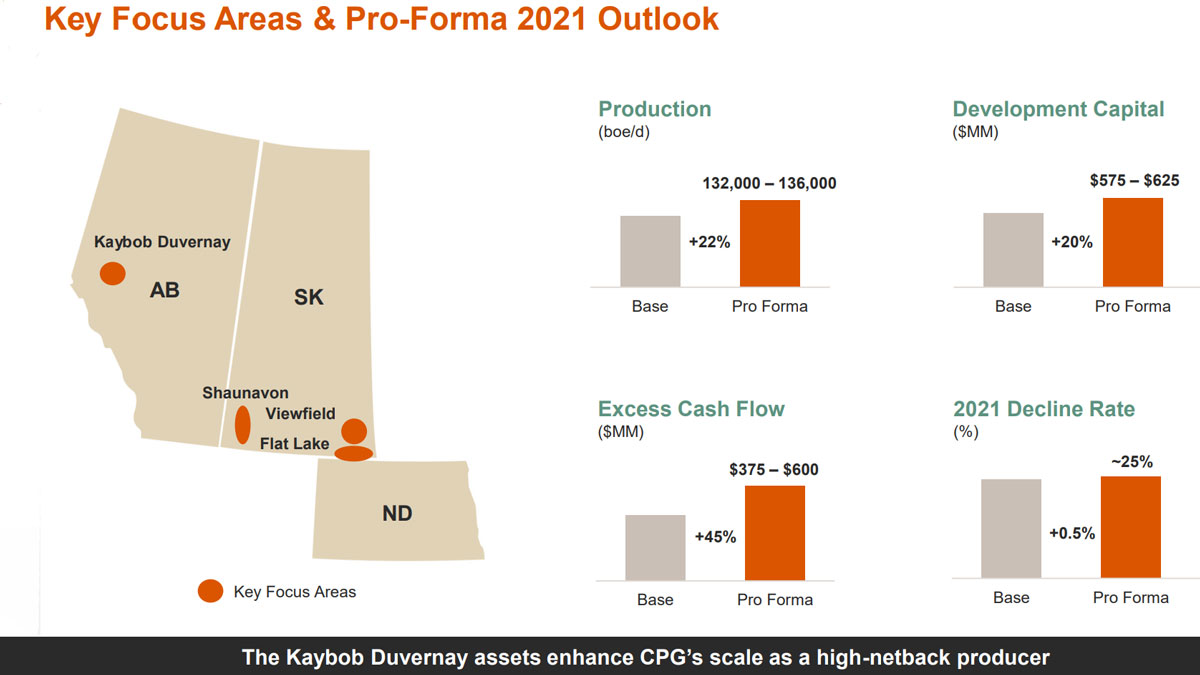

- Strengthens expected 2021 excess cash flow generation to approximately $375 to $600 million, at US$50/bbl to US$60/bbl WTI.

- Pro-forma 2021 guidance production of approximately 134,000 boe/d, primarily comprised of high-margin oil and liquids.

- Improves netback by over seven percent by lowering royalty rates and reducing per boe operating and G&A expenses.

- Lowers expected year-end 2021 leverage to approximately 2.3 to 1.6 times adjusted funds flow, at US$50/bbl to US$60/bbl WTI.

- Enhances ESG profile through Assets with a low standing well count with minimal reclamation and a low emissions intensity.

Strategic rationale and asset overview

“We are excited to add the Kaybob Duvernay asset as a strategic core area to our portfolio, as its significant inventory of high-return locations and free cash flow profile provide an attractive and return enhancing opportunity for our shareholders,” said Craig Bryksa, President and CEO of Crescent Point. “The Acquisition is aligned with our core principles to focus on strategic initiatives that enhance our balance sheet strength and sustainability. It is expected to enhance our free cash flow generation, leverage ratios and ESG profile. The depth of high-return drilling inventory also provides optionality within our capital allocation framework. We view the Kaybob assets as low-risk given that they have been delineated over the past decade and key infrastructure and market access are already in place.”

Key attributes of the acquired assets

- Production of approximately 30,000 boe/d (57% condensate, 8% NGL and 35% shale gas)

- Core of the condensate rich fairway with attractive reservoir characteristics, including higher pressure and pay thickness

- Approximately 500 net sections of contiguous land in the Kaybob area (approximately 325 net sections undeveloped).

- 98 percent Crown land with limited expiry concerns and a high working interest of approximately 100 percent

- Approximately 200 net internally identified drilling locations, based on conservative well spacing of 600 meters, of which only 36 are booked as Proved plus Probable (2P) in the independent evaluators report prepared by McDaniel & Associates Consultants Ltd. These locations are primarily comprised of two-mile horizontal wells.

- High quality type wells with strong liquids rates and competitive full-cycle economics

- Significant owned and third-party infrastructure currently in place, leading to lower expected future capital requirements

- A royalty rate of approximately five percent and expected operating expenses of approximately $7.25 per boe.

Prior to the expected closing of the Acquisition in April 2021, Shell plans to bring a number of drilled and uncompleted wells on stream. As a result, production from the acquired Assets is expected to increase to approximately 35,000 boe/d during second quarter 2021. Crescent Point plans to manage these Assets to target a lower decline rate and longer-term production of approximately 30,000 boe/d. Following the initial period of flush production, Crescent Point’s pro-forma decline rate is expected to remain unchanged at approximately 25 percent.

Crescent Point will also seek opportunities to enhance returns over time through potential operational efficiencies and effective knowledge transfer. Crescent Point will combine its significant expertise in multi-well pad development and field technology, including experience gained from other North American resource plays with similar geology, along with the technical expertise provided by the Shell staff that will be joining the company.

Transaction details, metrics and financial accretion

As part of the agreement, Crescent Point will acquire the Assets for $900 million. The Acquisition will be funded through a combination of $700 million in cash, accessed through the Company’s credit facility, and 50 million Crescent Point common shares. Upon closing, Shell will own approximately 8.6 percent of the outstanding Crescent Point common shares.

With approximately 30,000 boe/d of production and assuming US$50/bbl WTI, the estimated acquisition metrics are as follows: Less than 3.0 times net operating income based on an operating netback of approximately $30 per boe; $30,000 per flowing boe; and $12.87 per boe of 2P reserves of 107.4 MMboe as assigned by the independent evaluator, equating to a recycle ratio of over 2.0 times, including $483 million of undiscounted future development capital.

The acquired Assets are estimated to require approximately $180 million of annual capital to sustain approximately 30,000 boe/d of production, further enhancing the Company’s free cash flow generation.

This Acquisition is expected to be accretive on all per share metrics. In particular, in the 12-month period following the closing of the Acquisition, excess cash flow per share is expected to double with adjusted funds flow per share increasing by greater than 25 percent, compared to Crescent Point’s pre-acquisition expectations. These accretion metrics improve further on a debt-adjusted basis. In addition, the Company’s adjusted funds flow netback is also expected to increase by over seven percent, driven by a lower royalty rate and anticipated per boe operating and general and administrative expense reductions.

The above-mentioned transaction metrics and financial accretion are based on a price forecast of US$50/bbl WTI, CDN$2.50/mcf AECO and a US$/CDN $0.78 exchange rate. The effective date of the Acquisition is January 1, 2021.

Scotiabank and BMO Capital Markets acted as financial advisors to Crescent Point on this transaction. The Acquisition is subject to the satisfaction of customary closing conditions, consents and regulatory approvals.

Shell in Canada

Shell has been operating in Canada for more than 100 years and remains committed to the country’s energy future. Shell’s footprint in Canada includes a 40% interest in LNG Canada; Shale gas positions in British Columbia (Groundbirch) and gas and liquids positions in Alberta (Gold Creek); the Scotford Complex in Alberta, identified as one of Shell’s six high-value energy and chemicals parks; investments in cleaner energy including the first waste-to-low-carbon-fuels plant in Québec; and a growing Retail business with around 1,400 Shell-branded sites across Canada, among others.

Shell has approximately 500 producing wells in the Groundbirch acreage in Northeast British Columbia, of which roughly 75% of those wells have joint venture ownership, and the Gold Creek asset in the wet Montney play where Shell has about 40 wells on-stream, averaging approximately 4,000 boe/d.

Shell’s global Upstream strategy aims for a more focused, competitive and resilient portfolio to deliver cash. It includes nine core positions globally and lean Upstream positions that will either mature into core positions, be repurposed or be monetized through divestment.

In Shales, Shell has built resilient, low break-even positions by focusing on high-margin tight oil positions and low-cost gas assets. In the Permian Shell has a very attractive position. Shell’s acreage lies in areas with the thickest formations and provides more than 50% of total Shales production.