10 trends on the Climate and Energy Agenda

Does your winter seem a little bit cooler than average? Or maybe you’re expecting an overly hot summer. You don’t feel the water actually rising, or the species which can’t adapt quickly enough slowly disappearing, not yet anyway. Not until your own kind is in danger. Let’s be honest here, the majority of the population does not live in a constant fear of climate change. We take it as a possibility, not a probability. When sadly enough it’s starting to look like a dead certainty. Anyhow, most people just think they will be dead by the time actual dramatic changes will occur so that’s done and dusted. Not quite so, though. Wildfires, floods, droughts are very real and are happening now with dire consequences and actual loss of human life. Still think it can’t happen to you? Think again… And now you’re going to ask, what!? We just stop? We forsake modern life and go back to caves? No, nothing so dramatic is required. We just start considering things, thinking and acting with perspective. Putting things in balance, this should be the strategy for the coming years. Energy and climate don’t have to exclude each other.

Luckily enough, the powers that be, namely in this instance the European Commission, are not just sitting pretty waiting for a solution to fall from the sky. By way of the European Political Strategy Centre, they have devised a set of 10 trends that may hopefully alter our view on the flimsy balancing act between energy and climate.

Here and Now

The First trend is actually about realizing that what we are currently discussing is not a matter of coming to terms with what will happen, because it already did. Climate change is the present; it is days of our lives stuff. The rhetoric of “we’ll see when we get there” should be abandoned for the more realistic Here and Now. Well, ‘here’ is a decisively relative term but yes, I am talking about Europe. Let me throw some numbers at you: according to the European Political Strategy Centre report, the cities of Europe are already on average 1°C warmer than in the 20th century. It may seem like a silly number now, but take into account the fact that this is 1°C above preindustrial levels and it’s increasing at an alarming rate: 0.2°C per decade. And we’re already paying for it by way of mitigating wildfires, hurricanes, floods and so on. And wouldn’t you have guessed it; it’s only going to get worse. The record breaking 290 billion euro spent in 2017 on climate adaptation strategies and climate mitigation might seem like pocket change compared with what it may cost us if we don’t pump the breaks now. The loss of human life already is in the hundreds, just this past summer. Not to mention the impact on agriculture, with a reported 50% loss in Europe due to late frost or drought. If you thought migration was a problem before, let’s see what happens when millions of people suddenly realize their living areas can’t sustain proper existence anymore. And this is all due to short term and fast active consequences. But traditional energy production will hurt the environment and also slowly kill you. While disasters like fires and floods quickly wipe out a smaller number of people, air pollution causes about 400,000 Europeans’ premature deaths year in, year out. If this wasn’t enough, climate change is also set to play around with the map of mosquito borne diseases and may cause the over-acidification of oceans by 2100 which will neutralize the entirety of ecosystems based on underwater plants as food sources.

Fact of the matter is that although we’re bound to see some benefits from reducing climate change, we’re still dangerously far from limiting global warming below the agreed 2°C mark. 16 out of 197 participants at the December 2015 Paris Agreement have actual definitive plans to meet their commitment to climate change. The Intergovernmental Panel on Climate Change warns us that we have 12 years left to get our act together or face the worst effects of climate change come 2060 with a 2°C and rising global average temperature increase. Optimists argue that the cost of climate-related damages will average around 120 billion euro per year if we hit 2°C and 190 billion euro for 3°C. Bureaucracy seems to stunt the movement even more, so organizations like the C40 Global Leadership on Climate Change (a network of world cities) is trying to take the initiative at ground level. Even with court cases centred on human rights to hold greenhouse gas emitters and governments accountable it still sounds like too little too late.

A Diverse Energy Mix

But we should at least try to focus on the bright side. The so-called new hope might come from a Diverse Energy Mix (2nd trend). The EU looks ahead and continues to promote renewable energy which now represents 17% of the final energy consumption in Europe, which is right on track if we want to achieve 20% by 2020. With a reduction in the overall share of fossil fuels by almost 10% since 1995, renewables might actually hold 32% of the energy market in Europe by 2030. Globally though we have a different story with the total energy demand being split 10.4% – 81% in favour of fossil fuels. Hopefully the power sector will spearhead the global change towards 12.4% by 2023, with China envisioned to overtake the EU and US in terms or renewable power over the next two decades. But there is still a lot more to be accomplished. Surplus energy currently goes to waste, but one major factor is set to be battery storage, even if it is in its early days. The best approach for renewables is indeed a centred one; most companies are small and slowly growing without massive capital investments. A major change in approach will be required if they are to even think about competing with fossil, not to mention the adoption rates which are certainly affected by the agricultural and urban sectors. The balance seems to be brought about by solar and wind energy, which are becoming more and more competitive seeing a cost reduction by 70% since 2010. While the power sector is advancing quickly as we already mentioned, some sectors are dragging their feet: renewables in transport are still down at 3.4% and not going anywhere due to the sector’s reliance on fossil fuel. And is this a surprise seeing as approximately 112 billion euro have been allocated to the production and consumption of fossil fuels between 2014 and 2016 in Europe?

Markets following business

Is it all a money business though? As we rightly know, Markets follow business (3rd trend). New and exciting technologies also mean new opportunities for investors and industry alike, and the capital markets will eventually follow suit, keyword here being sustainability. Public finance continues to be a major factor, but companies start discovering that the bottom line might benefit from climate friendly business models and technologies, as global markets have already grown to almost one trillion euro annually. Only the European battery market will be worth approximately 250 billion euro by 2025. Also, there are huge untapped resources and market in Africa. Another major trade commodity will most certainly be low-carbon technology, based on the fact that between 2012 and 2015 Europe exported clean energy amounting to 71 billion euro, thus exceeding imports by 11 billion euro.

While the financial sector is still getting its feet wet, there seem to be some movements being made. One of the fast growers is the green bond market which reached 151 billion euro in 2017, supporting a large slice of financing for further clean energy investment. But and there is a big but, these bonds represent a meagre fraction: less than 1% of the whole bond market. The EU is indeed trying to clarify standards and definitions in what pertains to green loans and green securitisation but it will take time. While most large institutional actors like insurance companies, pension funds and sovereign wealth funds are yet to commit, France’s AXA was the first to divest from the coal sector in 2015 and most of the leading EU insurance companies followed them. Another notable endeavour is the Climate Action 100+ group which saw many other global investors advocating for improved climate change governance, emissions reduction and transparency on climate risks.

We are not all moving at the same speed

The 4th trend was always going to be a certainty: We’re not all moving at the same speed. As President Macron argued before quite soundly, even to the discontent or Romanian overzealous patriots, Europe has indeed different speeds. Just compare our economy or roads to German ones. It’s a given then that different countries will adopt a clean economy at varied speeds. Good news though for the Planet as a whole: the number of people employed in the renewable energy industry worldwide surpassed 10 million for the first time in 2017. There had to be a drawback though, the fossil fuel industry is expected to lose about 8.6 billion jobs come 2050. The shift to electrical cars will of course also affect carmakers and garages alike with some jobs becoming unnecessary, thus retraining and lifelong learning will become a must in nearly all sectors. While some jobs will be relevant moving forward, Europe’s job market is already facing a shortage of trained professionals in the wind and solar energy industry. Ironically enough, the public will be one of the drivers against climate change. People who do not realize what’s at stake will protest against rising fuel taxes and retiring old vehicles. Policymakers will have to juggle with sustainable transition measures, all the while taking into account solutions that are manageable for low income groups as well, so as to avoid situations like the ‘yellow vests’. Stricter regulations could also drive business away and further throw an already crooked playing field out of balance. Apparently, it’s high time that we found a global carbon pricing initiative that works… 53 sounds like quite a lot.

Consumers transforming the Energy Demand

Another important trend will be Consumers transforming the Energy Demand (5th trend). As the world economy grows, so shall our need for energy, but apparently consumption is expected to grow at a slower pace than in the past: 1.3% per year over 2015-2035 as opposed to 2.2% per year in 1995-2015. The math does really have an explanation this time: energy intensity is picking up speed which of course leads to improved carbon intensity. Translation – economic growth is no longer intertwined with greenhouse gas emissions at least in Europe (total emissions decreased by 22% between 1990 and 2017, as EU’s combined GDP grew by 57.5%). This was also reflected by a shift in policy making as a third of the world’s energy consumption is neatly covered by mandatory standards and regulations. Things were indeed far more hectic in 2000 when only 11% was regulated. And these actually help the average Joe, especially if he has been living in precarious conditions or is a victim of energy poverty. A key factor in all this going forward will be reusability and recycling, with producers already aligning to this trend with costs noticeably declining. One example of how waste and biomass can help the industry shift comes from the cement industry: the share of fossil wastes and biomass has gone to 28% presently and 14.8% in 2015 from absolutely nothing in 1990. But this does not mean that new solutions alleviate responsibility of consciously making sustainable choices. We should remember that consumers and their appetites continue to rule the market.

Go Digital or go home

The next commandment is pretty clear in what pertains to connectivity: Go Digital or go home (6th trend). Sounds good yes, but it will only work if done carefully. While many were surprised that robots were used in industry as far back as the 80’s, digital technologies were used in the energy sector since the 70’s and are currently picking up speed at an amazing pace. Only in 2016 digital grids amounted to 40 billion euro. That’s almost 40% higher than investment in gas fired power generation around the globe. Energy tech start-ups are springing up like mushrooms after the rain as well, attracting a whopping 5 billion euro in corporate capital and growth equity in 2017. Logically enough, since 2015 this increase was mostly driven by IT companies, not energy, transport or utility ones. And since digital platforms are also in on the action, society’s energy consumption will be optimized as well as cutting costs and reducing the carbon footprint by way of ingenious apps and services at our fingertips. This increased accessibility will not only grant us the capacity to cut our costs, but also use predictive capabilities to address asset malfunction. Mobility is indeed a service nowadays as car sharing and ride-hailing apps take on the urban dweller and not only. We’ve already discussed the various goodies the Internet of Things will provide us with, combined with big data and Artificial Intelligence but the ‘digital twin’ deserves a special mention – power plants and several other installations will benefit from virtual copies that can run predictive maintenance and training simulations. The not so nice part comes now. Being connected means being easier to hack and some companies have had their fair share of grief due to unrelenting hackers. There’s no telling what amount of panic and chaos a cyber-attack may inflict on a fully connected city. Since hackers only need physical access to one entry point in the network in order to paralyze an entire mainframe (one hacked turbine means an entire wind farm being shut down) the cascading principle might affect several countries in a rather horrifying domino effect. In these conditions data privacy and information protection seems to be the frosting on the cake really. And the ever-present conundrum – new technologies, especially digital ones also increase the energy demand.

Electrification breeding Democratization and Fragmentation

All these changes will of course have consequences of their own as Electrification breeds Democratization and Fragmentation (7th trend). This new trend means that the consumer can be a hands-on participant in the energy trend – see solar panels. Unlike coal, gas and nuclear plants, you can now own your energy. This is a holy grail for investors and will obviously create a more competitive energy market. Thus, we are now faced with a new entity, the prosumer – a consumer that produces his own energy and can sell any surplus back to the grid. It is estimated that by 2030, 17% of installed wind capacity and 21% of solar could be owned by energy communities. By 2050 it’s plausible that almost half of the whole EU households, which amount to approximately 113 million, could be an active part of producing renewable energy. We’re far from that idyllic future though. Nowadays, Europe has only some 3,000 energy communities which are limited to just a few countries with the majority located in Denmark, Germany and Austria. According to the German Agency of Renewable Energy, German citizens own approximately one third of the country’s full renewable energy capacity. But all these little prosumers may overthrow and short-circuit a system that was not installed with them in mind. It’s hard to regulate off the grid assets and harder still to integrate them. Seeing as power and electricity don’t come from only one valve anymore this raises some security risks again. Some say it’s worth the risk, companies on the old continent starting to expand to the US. This trend seems to also breathe new life into Blockchain in order to facilitate and secure a transparent transaction environment for independent energy trading platforms. Start-ups concerned with blockchain energy have multiplied and raised more than 265 million euro for technology applications in 2017.

Look to the East

If you’ve been paying attention so far, the next trend which is Look to the East (8th trend), won’t surprise you at all. And you are not the only one; the world has high hopes and has set high expectations for Asia as these fast-growing economies mean fast growing consumption rates. Having already surpassed the US as the largest crude oil importer in the world, China is primed to become the biggest oil consumer in the world by early 2030s. Also, it is expected to account for one fourth of the global growth of gas consumption between 2015 and 2040. Conversely, China is also the biggest greenhouse gas emitter surpassing both the US and the EU. The whole Asia Pacific region could be held accountable for almost 50% of the global carbon dioxide emissions. But fast growth also means furious investment in renewables and energy efficiency as China and neighbours have to contend with surplus energy bills and citizens demanding cleaner air. Between 2015 and 2021, China and India are envisioned to amount to 46% of the projected growth in renewable energy markets. Thus, it’s no surprise that China is the current go-to for companies interested in manufacturing clean tech such as: photovoltaic, electric vehicles and battery cells soon enough. But they don’t just keep their business at home, China being a massive investor in energy infrastructure and resources abroad through its Belt and Road initiative as well as in Africa. Another target they fancy is indeed Europe which accounted for 77% of the total Chinese stock between 2010 and 2017.

New Supplies means new risks

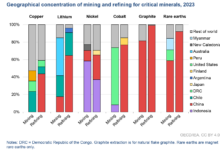

This is what the players in the energy industry need to remember (9th trend). Traditionally, the supply of oil and gas was a concern, mainly because of security issues and pipeline diplomacy but now it seems it won’t be the only one. Sure, gas markets going global and the rise of shares of liquefied natural gas mean diverse sources of import, but the increase of renewable energy means that production is going to be decidedly local, so no more imports required. This change however will not happen overnight and might even create additional dependencies that Europe will have to manage in its external and trade relations. For the production of clean tech solutions to run smoothly, rare earths and cobalt and other such special materials will have to be supplied continuously, and you can’t find most of them at the European corner market. Some will have to be imported from other countries, countries that might not benefit from the most stable political regimes. Seeing as this obstacle can’t be overcome in-house, the key here will be strong trade partnerships and recycling and reuse of materials at every turn. Sadly, EU’s import dependency increased from 46.7% to 53.6% from 2000 to 2016 but Member States have pledged to enhance their cooperation on lowering the exploitation of gas and oil fields in Europe and phasing out coal. Friendly neighbour Russia remains the EU’s main supplier of oil, gas, coal and nuclear fuel, albeit EU imposed sanctions have affected its energy sector. The fact that the US has shifted from an energy importer to an exporter bodes well for Europe’s security supply, but it could also leave it in an exposed geopolitical position vis-à-vis global oil markets should the US turn their back on the Middle East. Foresight will be the name of the game in order to navigate this intricate web of connections between sectors and actors and finally facilitate political steering and be prepared for alternative unexpected scenarios.

Net-zero emissions are possible

Last but not least we need to make clear that Net-zero emissions are possible (10th trend) thanks to innovation. Counting on existing technologies like solar, wind and hydropower, the EU is primed to reduce its carbon footprint by up to a staggering 90% by 2050. But it’s not so simple. In order to actually realize the net-zero scenario, other technologies will have to be implemented as well such as carbon capture and storage, precision farming, advanced biofuels and more. Credit should be given where credit is due, in this case to the private sector which accounts roughly for more than 75% of EU investment in clean energy research and innovation. Despite this, the EU still ranks last among major economies in terms of investment per GDP. It seems that money is short and bureaucracy dramatically slows down the process of actually bringing research to the market. Even though the EU was an early bird in what pertains to this whole innovation game, it still might lag behind on account of being one upped by Asia on the number of low carbon inventions. And this poses a new question: Can carbon be effectively used as a resource? The answer seems to be ‘yes’ in the case of chemical feedstock, fuels and building materials with a goal of reaching net-zero GHG emission if and only if they are powered by renewable energy. If you can’t use it, at least stock it right. This seems to be the motto of Carbon Capture and Storage technologies, but until now they haven’t penetrated Europe on account of negative perception by the public, regulatory constraints and no successful demonstration project. Aspects such as the price for the two mentioned technologies still remain blurred at best.

These trends are in no way definitive and, as you’ve certainly seen, speculate a lot on what might be. Best case scenario, everyone pulls together and humanity collectively overcomes this hurdle which to be honest we brought on ourselves. But with some people deciding that climate change is just a hoax or a tool of manipulation, it might prove to be difficult. These are not the Ten Commandments and should not be regarded as such. But a little moderation and common sense might come in handy, especially for the coming years.