Cleaner energy, the most attractive subject for the next 30 years

We could argue that nothing is constant anymore, but you most likely know that. Humanity has always been looking for something solid, a foundation of sorts on which it may continue to build. This is how we make our way through this existence, always in cycles. We settle down, start growing roots, depleting the resources from one area and then moving on. We’re always on the move, whether we like it or not. Still, amidst all this fluctuation, people crave stability. We prefer tradition to change, even going as far as fearing the latter. Of course, this is also valid for our industries, our markets. We seldom move forward on initiative alone, we prefer waiting until it’s too late. Only select few have the vision of moving on before things go downhill. And there are signs, more than we could stand to acknowledge. That’s why we need someone to look out for these signs. Somebody who understands there is but only one constant in this life: change.

Luckily for us, there will always be people dealing with the business of change. The International Energy Agency (IEA) is hitting the nail on the head with its 2017 World Energy Outlook aptly named “A world in transformation”. They are looking out for the signs you might have missed. Let’s face it: it all starts with cost reduction and the most attractive subject for the next 30 years seems to be cleaner energy. Cheap and easy to deploy, it is set to change the way we see energy production today. Along the same lines we may discover that energy will mostly be electrical in nature in the coming years. China already saw the opportunity and is set to direct its economy towards the service sector as the US is ever resilient in the field of shale gas and tight oil. In a world where it has become harder to tell apart consumer from producer it’s time for the upstarts, the developing countries, to leave their mark.

But all this would not be possible without the star of the show, our ever-present driver of change, to call it by a simpler name – need. Change is usually driven by an incentive, and in this particular scenario we may call it demand, energy demand to be more precise. According to the New Policies Scenario, the global energy demand will expand by 30% come 2040. The arguments are presented in the form of a global economy that is growing at an average rate of 3.4% per year, a population of 9 billion in 2040 and an urbanization process that will see another Shanghai sized urban population emerging every four months. Talking about developing countries, India leads the contribution to demand growth with an 11% energy use increase by 2040. Not far behind we may find Southeast Asia, with their demand growing twice faster than China’s. With Asia taking two-thirds of the global demand pie, the rest will be split between Middle East, Latin-America and Africa.

New needs will require new ways to meet them and this is where natural gas, renewables and energy efficiency come in. Were it not for the efficiency improvements, we would see double the rise in energy use. Somebody has to take the hit, and this time it’s coal’s turn to take one for the team as renewables are set to meet 40% of the increase in primary demand. Their expansive growth in the power sector spells doom for the golden age of coal.

«In the absence of large-scale carbon capture and storage, global coal consumption flatlines»

Good news for oil though, the demand continues to grow to 2040 even if at a rather decreasing pace. Natural gas will target the industrial sector with an expected rise of 45% by 2040. Renewables are set to comprise two thirds of global investments as the cheapest and cleanest source of energy generation, with China and India already on the offensive. Their rapid installation of photovoltaics will spearhead the trend that will transform solar energy into the biggest source of low-carbon energy by 2040.

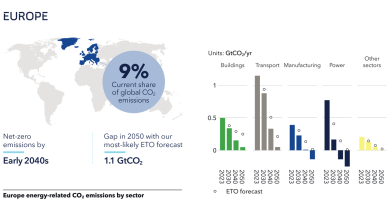

In the European Union it will be wind that leads the change, with great development potential both onshore and offshore, and becomes the leading source of electricity after 2030. As policies regarding the use of renewable electricity are strengthened, it is expected that household use will pitch in and help realize a 40% raise in final consumption by 2040, an effect of rising incomes and desire of better quality of life. Considering all this, it’s actually no surprise that the global investment in electricity has surpassed that of oil and gas and energy security has become a staple on everybody’s policy agenda.

China is well aware of what’s coming and is now starting to act as one of the main drivers of change. The new phase in the country’s development hints towards a greater focus on natural gas, electricity and high efficiency digital technologies. Without this new efficient approach, the end use consumption by 2040 is estimated to be 40% higher.

«Nonetheless, by 2040 per-capita energy consumption in China exceeds that of the European Union»

Even a blind man could see that given China’s role as a major energy player, some nations will likely follow in its footsteps. The future of transitioning to cleaner energy might be in their hands. Albeit China is set to dethrone the US in oil consumption come 2030, their iron fuel efficiency policy and decided shift towards electrical modes of transportation will eventually allow India to take the wheel on oil demand growth. China will continue to reign over coal markets but, according to the report, this market is in its death march. But oil and gas will not give up the fight and they have a serious backer. Based on its ability to unlock new resources in cost effective ways, the US is envisioned to become a net exporter of oil, not only gas by 2030. According to the Deloitte US oil and gas outlook, the US will follow its motto of ‘energy dominance’ as they already envision Mexico as a promising market for natural gas and oil. Apparently, they are still able to keep up with the cost reductions and consolidate at the same time.

Demand will of course follow supply up until 2025, but will decrease afterwards based on efficiency measures and fuel switching. Oil prices will continue to be dwarfed if US tight oil continues to prosper and the switch to electrical cars is happening at an accelerated pace. This would have to be supported by extra policy and infrastructure support but all in all it would keep prices between USD 50 to USD 70 per barrel by 2040. This estimation would be valid only if we assume that major producers will survive the period of lower hydrocarbons revenue.

According to the IEA Outlook, another game changer will be natural gas which will account for one-fourth of the global energy demand and will come second only to oil as the most important fuel. This transition will go rather smoothly, especially in cases where gas could substitute for oil. Developing economies will lead the growth, with significant costs attributed to importing and putting infrastructure in place. Countries in Asia will be at the forefront, as these developments also address familiar air quality policies. The market is set to become more liquid and flexible, US LNG assuring almost 90% of the expected growth by 2040. The offer also doubles, as 2040 will see major diversification in supply mostly coming from new sites in the US, Australia, Russia, Qatar, Canada and Mozambique. Thus, the price will be influenced by availability rather than in relation to oil.

All around access to electricity and clean cooking still seems to be part of a utopian future but there is good news as well. Since 2012, more than 100 million people have gained access to electricity every year with impressive progress being made especially in regions like India, Indonesia and sub-Saharan Africa. Even so, there is still a long way to go according to the New Policies Scenario which states that by 2030 there will still be some 675 million people without access to electricity and 2.3 billion still relying on pollutants for cooking. Yes, the numbers are considerably lower than before but they still herald staggering 2.8 million premature deaths per year.

«Policy attention to air quality is rising and global emissions of all the major pollutants fall in our projections, but their health impacts remain severe»

Premature deaths caused by outdoor air pollution are expected to increase from 3 million to more than 4 million by 2040 and industrialization and urbanization play a big role in that. C02 emissions are also expected to increase by a meagre amount but still prove to have a devastating influence on climate change.

The report would be rather anti-climactic if it didn’t also offer a solution and it comes under the guise of The Sustainable Development Scenario. This strategy works its way back from conclusion to starting point, making sure to carefully underpin the major goals which lead to sustainable economic development: stabilization of climate, cleaner air and universal access to modern energy with a back drop of reduced energy security risks. In order for all this to come to fruition there are a couple of milestones to achieve. The first and apparently most important would be the peak in CO2 emissions and their rapid decline, in line with the Paris Agreement. In this scenario, the low-carbon sources would have to reach 40% of the energy mix by 2040; energy efficiency would be a must, accompanied by a sharp drop in coal demand and a peak in oil consumption. Power generation should be almost carbon free with 60% power generation coming from renewables and the rest from a combination of nuclear power and carbon capture and storage solutions. In this scenario the natural gas would finally surpass oil as the main fuel, but only if action is rapidly taken on minimizing the subsequent methane leaks. This would assure a 20% rise in consumption well beyond 2030. Luckily, according to the report, 40-50% of the methane leaks could be handled for no net cost, given that the value produced by the captured methane covers the abatement solutions.

If we were to heed the Deloitte Outlook we could realize this is also the age of digitalization. Adapting or ignoring this could make or break your business. Innovative ideas are already producing great efficiency gains and demanding serious investments. By now you most likely realize that not everyone will make the cut. As times change, the industry should change as well. The bottom line not only for business, but for our whole way of life should be: If you want to see tomorrow, start investing in today.