Coal Mines in Europe

A Reality We Still Need to Accept

Coal mines are not just images from ‘Germinal’, Émile Zola’s famous novel. Although doomed to disappear due to the catastrophic impact on the environment, coal mines remain a reality in many European countries.

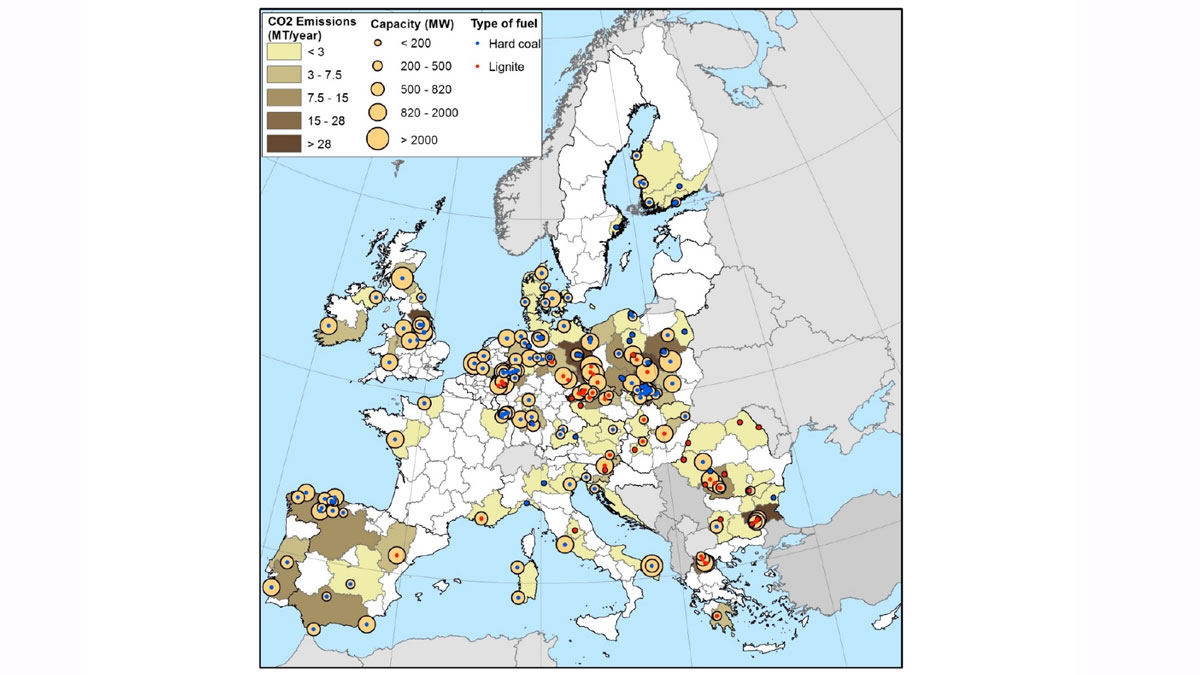

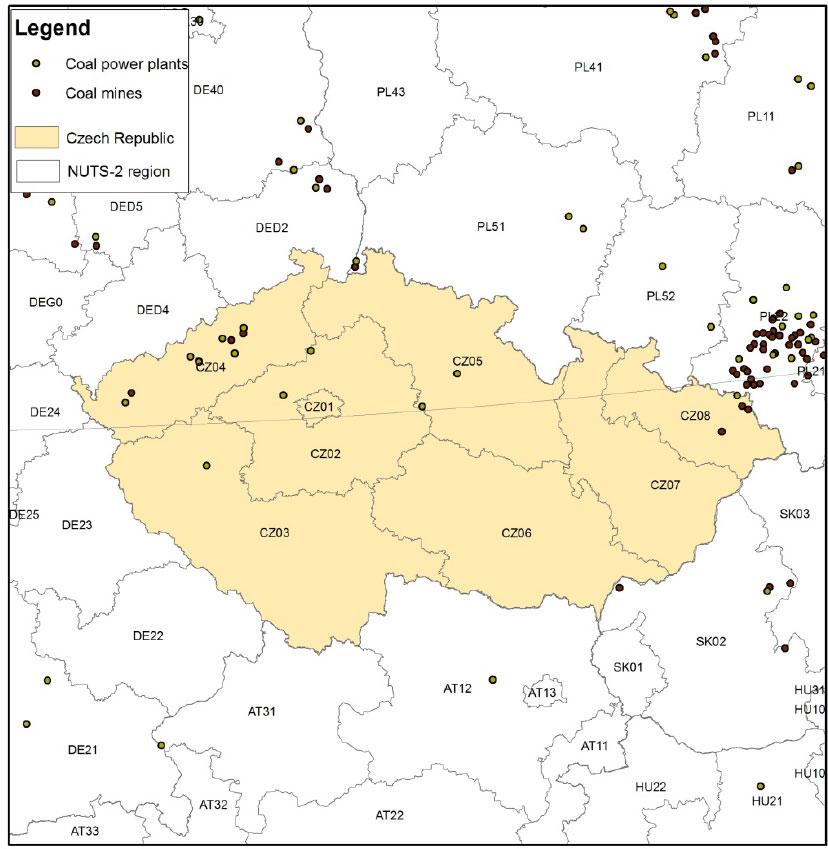

However, coal accounts for only 15% of European Union’s energy production. In the 27 Member States, 53,000 persons are working in thermal power plants and in mines – 185.000, according to the European Commission. Mines in Germany and Poland are the most active, these being supported by modern technologies and improved working conditions. And yet, according to European institutions, two thirds of coal-fired power plants must cease operations by 2030. Even if the European Union manages to spare the black ore, it will remain widely used on the continent, even only for the fact that Russia is one of the main global producers.

At European level, Green Deal provides for financial support measures through the just transition facility: in the following seven years, approximately EUR 40bn will represent public and private funds to help the regions characterized by coal mining.

Most desired transition path in Eastern Europe: natural gas

Eight EU countries, mainly from the former communist bloc, have defended the use of natural gas and support for investments in this energy during energy transition.

However, the place of natural gas in EU’s energy transition remains controversial. The European Investment Bank has decided to cease, as of 2022, financing for any projects related to fossil fuels, including gas. The EU hasn’t regulated yet the draft legislation on green investments. In discussions aimed to establish a classification of investments, depending on their contribution to green transition, the role of gas hasn’t been determined. Therefore, this production was not explicitly excluded from the regulation.

Eight European countries advocate for natural gas

Almost a year ago, Bulgaria, Czechia, Greece, Hungary, Lithuania, Poland, Romania, and Slovakia signed together a 2-page text, which they submitted to the European Commission and Council, advocating for the integration of gas and other gaseous fuels (biomethane and carbon-free gas) in the strategy to a carbon-neutral Europe by 2050.

The countries signatory of the document consider that natural gas can be “an important backup and balance source”, giving time to the development of renewable energy. “It is essential to maintain the support and financial assistance of the EU for the development of gas infrastructure through a favourable framework, structural funds and investment loans,” the signatories claim.

Transition from coal to renewable energy sources through natural gas in Romania

Romania is preparing to mark its permanent elimination of coal. A transformation far from easy, as Romania prides itself with a long and rich mining tradition and continues to use coal, turning it into electricity in its power plants and therefore ensuring its electricity demand. Two electricity production capacities, located in Oltenia and Hunedoara regions, continue to produce coal-fired electricity. While before 1989 the Romanian mining sector employed almost 100,000 people in 450 mines, its current situation is far from encouraging. Indeed, most mines had to be closed, including the oldest mining exploitation, in Petrila, which was opened in 1859. The poor economic performance of coal today is a consequence of several factors, including the lack of investments in operation technologies, costs generated by obsolete technologies, lack of investments necessary to make the production efficient and to comply with environmental standards and, in the end, the lower demand for coal.

On April 21, 2021, Energy Minister Virgil Popescu stated: “Today we completed a memorandum through which we are building a package of social protection for absolutely all those who are working in the mineral resources sector, in the sector related to electricity production: social protection will be directed to those who work underground at Complexul Energetic Hunedoara, to those who work at Mintia Thermal Power Plant and those in Paroseni, if necessary. We are talking about the same social protection for those working at Complexul Energetic Oltenia, where there are surface lignite quarries. The memorandum obviously includes a package of social protection for miners in Crucea mine, which will close because it has no deposits left”.

At the same time, Virgil Popescu insisted to reassure that the Ministry of Energy, Nuclearelectrica, and the current management of CNU make extensive efforts so that following the closure of Crucea mine and by opening the uranium mine in Tulghes-Grinties, Romania will continue to have the integrated nuclear circuit ensured.

European Commission Vice-President Frans Timmermans mentions that Bucharest should propose as soon as possible to the European Commission its plan for the permanent elimination of coal.

“This could become an opportunity for creating new jobs, made available to redundant miners. Romania has funds to do it,” Timmermans mentioned.

According to Green Peace, the Ministry of Energy has to pursue the following objectives to comply with the European climate targets:

- To stop unsustainable support for coal-fired energy production (too polluting and too expensive) and communicate a clear date and a realistic plan to phase out coal from the national energy mix and replace it with new renewable energy capacities; the first step is the urgent establishment of the coal phase-out committee, a committee which would have a mixed composition and would find solutions for the social and economic impact in the area.

- To correlate these efforts with the financial support program announced by the European Commission, the Just Transition Fund, a program dedicated to mining areas that will undergo an extensive decarbonization program. It aims to maintain the economic production and increase the level of employment for those affected by coal elimination (EUR 2.2 billion will be allocated for Romania).

- To amend the Restructuring and Decarbonization Plan of Complexul Energetic Oltenia, so as to be in line with the principles of granting European funds, to pursue and access the existing opportunities of funding for investments in the development of technologies and infrastructures for clean energy.

In Romania, a sensitive project is Jiu Valley. Mihai Melczer, expert in the mining industry and former CEO of Complexul Energetic Hunedoara, has recently stated for RRI (Radio Romania International) that: “When you see that coal mining is no longer profitable and exploitation costs are rising, exploitation must be stopped. There is a need for a reorientation towards industries that offer a margin, which allow to reduce operating costs and increase profits. Coal from Jiu Valley is difficult to extract, does not allow the use of advanced technologies. We are not in Poland. Here, coal deposits are more difficult to exploit. And stubbornly pursuing mining activities is just throwing money out the window.”

Also, the former CEO of Complexul Energetic Hunedoara highlights the social consequences generated by the plan to restructure mining activities. Among projects that should help the affected industrial regions, we can note the creation, in Petrosani, of an institution that develops training courses, and which should train former miners for jobs in the field of green energy. The project should open to the inhabitants of this mono-industrial region other professional prospects and not only mining careers. Another project, which should provide professional alternatives to the inhabitants of the mining region of Jiu Valley, aims to take advantage of properties of hydrogen, which some see as the energy of the future.

“It is crucial to take coal regions along in the European energy transition – we need a just transition. In practice this means that new jobs need to be created for fossil fuel workers – and they need to be trained to fill these jobs. This is the only way for coal regions to go through a successful transition along with the rest of Europe,” WindEurope warns.

The Romanian Wind Energy Association (RWEA) has been working on this issue over the past years and has now been able to fully establish a reskilling project for miners.

It all started with the Renewable Energy School of Skills in Constanta, where 4,500 technicians have been schooled who now take care of O&M of wind farms in Romania and abroad. But starting in July the School’s facilities will be expanded to the Jiu Valley – a former coal region. This facility will train 400 miners per year who will be able to work in the wind industry afterwards.

It is highly critical for these regions to be offered help in their transition. Just like many European coal regions, the Jiu Valley used to have a strong economy. But after the closure of all its mines, its communities were left behind and almost half of the region’s population has left ever since.

These local initiatives can be a big support in reawakening the local economy. Wind energy has grown a lot in Romania recently. It now provides about 12% of Romania’s electricity but is expected to provide up to 35% of Romania’s electricity by 2030.

The closing of mines does not have to mean the downfall of these regions. New opportunities will arise, and the wind industry can make its contribution here by creating jobs for locals.

No new coal-fired power plant will be built in Romania

Energy Minister Virgil Daniel Popescu confirms that no new coal-fired power plant will be built in Romania. Romania will receive no less than EUR 4.4bn within the European Just Transition Facility. “Romania is one of the largest gas producers and reserve owners in Europe. We aim that energy transition from coal to renewable energy be made with natural gas.”

Despite its efforts to develop renewable sources, Romania depends for energy supply with over 60% on fossil fuels, mainly related to coal extraction. But the rising costs and global heating force a transition. The challenge appears especially for Jiu Valley, the famous coal basin of the country. This landscape marked by industrial decline raises the question: what will be the fate of mining regions in Europe; how about in Romania?

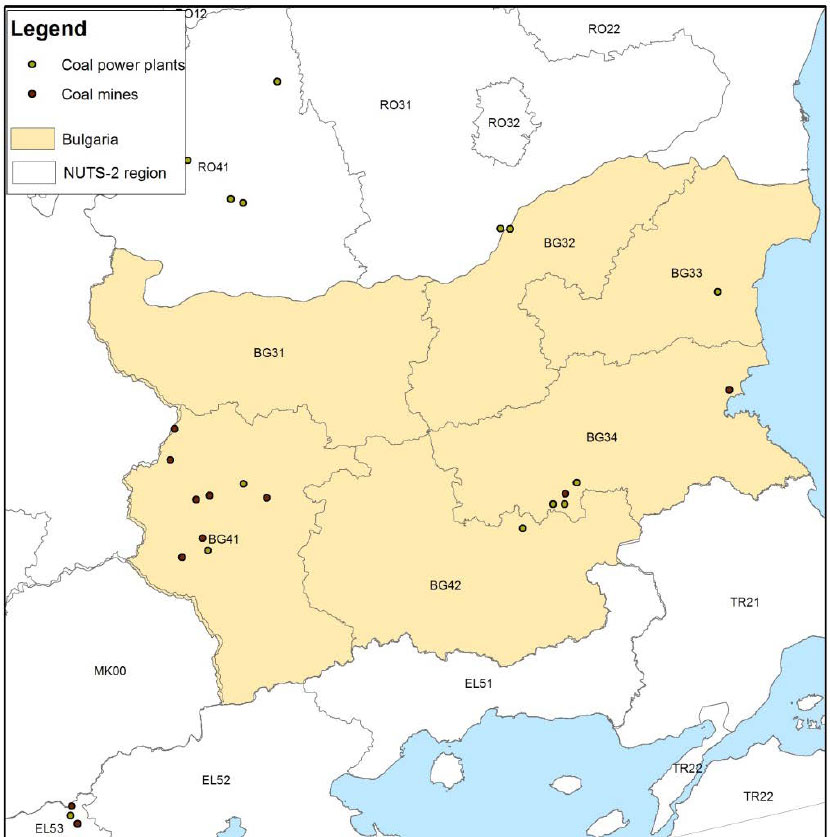

Bulgaria. Extremely costly transition

Countries in Eastern Europe rely to a great extent on fossil fuels. In Bulgaria, almost half of national energy is produced by coal-fired power plants. A very polluting energy, in terms of CO2 emissions, but also due to the production of sulphur dioxide, a toxic gas that irritates the airways and produces acid rain. Therefore, the country is trying to produce less polluting coal, due to new infrastructure. But this transition is very expensive. Completed in 2011, the new power plant that uses flue gas desulphurization technology cost EUR 1.3 billion. “Our efficiency coefficient for these emissions sometimes reaches from 98% to 99%. So, you can imagine the quantity of sulphur dioxide we capture in our plant. Captured sulphur dioxide reacts with limestone and forms industrial gypsum,” said Ivan Tzankov, CEO of AES Bulgaria.

Following Bulgaria’s accession to the EU in 2007, sulphur dioxide emissions have been significantly reduced, from 800,000 tons per year to less than 100,000 tons today. But this remains insufficient in the eyes of the European Commission, which referred Bulgaria to the EU Court of Justice in 2019.

According to several experts, Bulgaria will not be able to comply with new European rules on pollution, due to its aging coal plants. Some of the most recent plants are less than 20 years old. The others are power plants of 50, 60, 70 years, which are reaching the end of their life. In 2018, prices increased from EUR 5 to EUR 25 per ton of coal, as old coal-fired power plants had to comply with EU system of emission quotas. An example is the public power plant Martiza Iztok 2, for which the situation is particularly difficult, as it has accumulated hundreds of millions of euros in debts and produces expensive electricity, which is difficult to sell. The power plant is even more important as it generates up to half of the entire electricity in Bulgaria during the cold season. This is why its closure or upgrade is such a sensitive topic in the country. According to trade unions, over 100,000 people depend economically on this power plant. The Ministry of Energy is trying to expand its life at least until 2050.

Poland – ‘coal country’, a nice history chapter that must be closed

In September last year, under pressure from the European Union, Warsaw decided to begin energy transition. The first measure: closing all coal mines by 2049. A decision with serious consequences, as electricity production relies 80% on this fuel. Artur Sobon, minister responsible for state assets, acknowledges that there is no future for coal in Poland. “We have to do deeper and deeper extractions; it is hard work that will be done less and less. It is a nice chapter in Poland’s history, which must be closed,” said the minister in February this year.

To reduce coal share in electricity production from 80% to 32% by 2040, the Government wants to build, by then, six reactors, of which the first in 2026. Also, Poland undertakes to develop renewable energy, especially solar power, and offshore wind power, in the Baltic Sea. The Minister detailed the problems of heat production, especially to decarbonize the chemical industry. The country is interested in the technology of high-temperature gas reactors (HTGR). Discussions continue with the Japanese Atomic Agency (JAEA) on this technology and the 30 MW high temperature test reactor (HTTR) also received the green light from the Japanese Safety Authority (NRA) to bring the reactor in line with the new safety standards in order to restart it. Poland wants to make sure that the model of financing these reactors will ensure competitiveness of nuclear power.

Czechia: Construction of new reactors in Temelin and Dukovany

While for several years Czechia has expressed its desire to focus more on nuclear power, today, with the strong support of the state, Czechia is turning to the national energy company CEZ.

In 2015, Czechia adopted a strategic plan for 2040-2050, in line both with the national objective of keeping energy security and the European decarbonization objective. This plan provided for the construction of an additional reactor, on each of the two sites, Temelin and Dukovany, with the goal of reaching 50% of nuclear power production by 2050, instead of 35% at the moment. The new nuclear construction project was confirmed by government resolution on July 8, 2019 and it was decided to begin work at Dukovany site. Czechia currently has two nuclear power plants: Temelin and Dukovany.

In May 2020, Czech state officials and players in the nuclear sector, including CEZ, agreed on a financial plan articulated around a state loan for the renewal of Dukovany nuclear power plant, including the estimated cost of the following reactor: EUR 5.80 billion. This orientation takes shape to help lower electricity bills. Waiting for the approval requested from the European Commission on the main conditions of this project, the Czech state has held for long-time discussions with CEZ (the majority shareholder, 70%) about the project’s options to renew its nuclear park, to anticipate the shutdown of its first reactors in the following decades. The country’s priority is to guarantee its energy independence and its related status of net electricity exporter. Moreover, it’s about a drastic decrease in the share of fossil fuels, starting with coal, which accounts for 50% of the electricity mix.

At European level, Czechia defends the objective of nuclear power, considered a source with reduced carbon emissions, in accordance with the European Union rules. According to Karel Havlicek, Minister of Industry and Commerce, it would also contribute to the reduction of its financing costs.

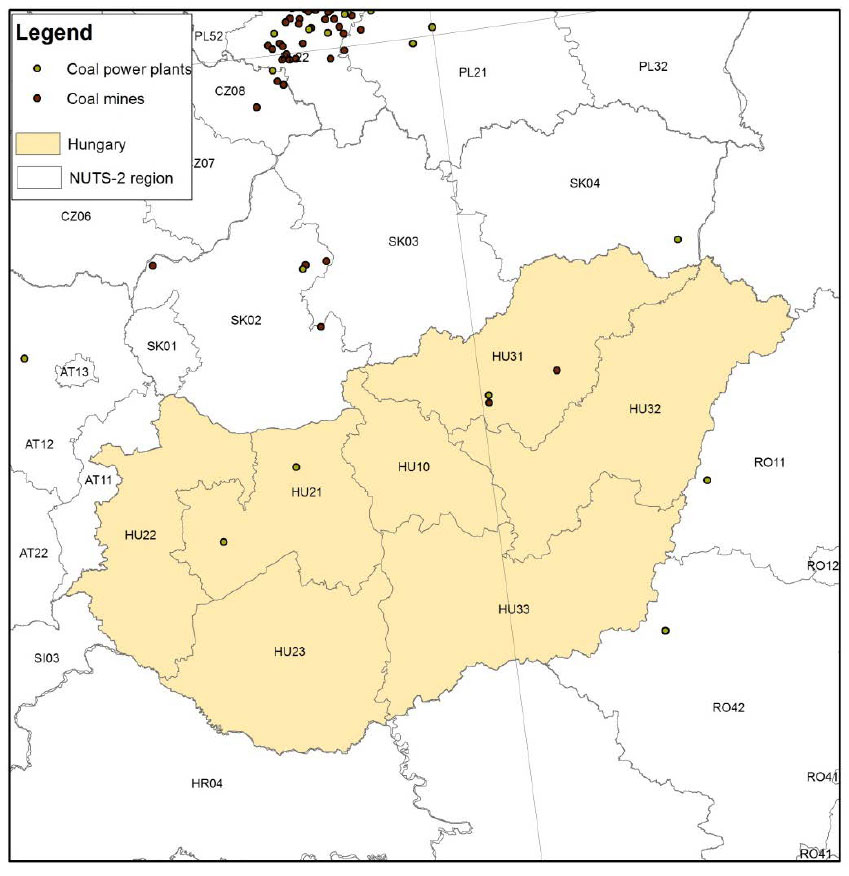

Hungary. Coal phase-out by 2025

“The last coal-fired power plant of the country will be closed in 2025, not in 2030,” said Hungary’s Secretary of State for European Affairs, Attila Steiner, at the annual summit ‘Powering Past Coal Alliance (PPCA)’, on March 2, 2021.

“We want to achieve 90% carbon neutral electricity production by 2030, and to do this, Budapest intends to maintain existing nuclear power production and increase photovoltaic production to 6 GW – three times more than the existing nuclear capacity of the country,” said Attila Steiner.

The Secretary of State added that he wanted the closure of the last major lignite-fired thermal power plant of the country, in Mátra, by 2025, as through this closure Hungary would benefit from European funding to support the affected works in the coal industry.

Greece 2.0. Energy transition in Greece, lagging behind other European countries

The European Investment Bank (EIB) agreed to help manage up to EUR 5 billion as part of implementation in Greece of the National Recovery and Resilience Plan, known as ‘Greece 2.0’. Technical, financial, and environmental experts of EIB will identify high-impact projects, priority sectors and efficient financial structures to ensure the best use of the new European support and loan subsidies for Greece to mitigate the social and economic impact of the coronavirus pandemic. It seems that Greece has breached the European Commission rules on electricity market liberalization. Some still request a fair and real competition by breaking the monopoly of Public Power Corporation S.A. (PPC); therefore, the Greek energy transition is lagging behind other European countries. And as in Europe discussions focus on gradual elimination of coal and lignite, while ensuring a smooth transition for regions that have depended for years on coal extraction and electricity production, in Greece lenders have put pressure to sell 40% of PPC lignite stations to ‘upgrade’ the electricity market, as part of the rescue agreement.

For WWF Greece, the decision to sell a large part of coal assets could be a disaster for consumers and the sustainability of the energy model of the country. A study on Greece’s long-term energy plan, published by the National Observatory in Athens and WWF Greece, showed that electricity costs would be significantly higher if the country’s dependence on lignite were extended. “While the rest of Europe is focused on decarbonization, the claim by Athens officials that the Greek market will become competitive by selling one or two PPC lignite plants is simply a lie,” said in 2019 Nick Keramidas, European director for metallurgy and industrial businesses.

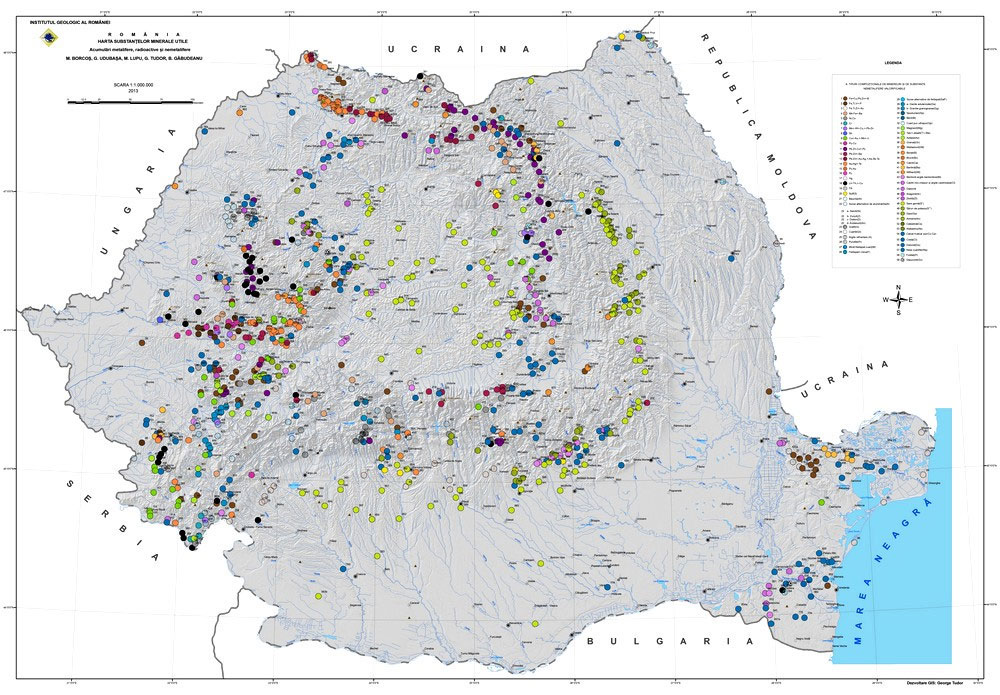

The new European industrial strategy proposes the creation of new alliances

Weaknesses in EU capacities of extraction, processing, recycling, refining and separation (e.g., for lithium) reflect a lack of resilience and a high dependence on sources of supply in other parts of the world. Some materials extracted in Europe (such as lithium) must currently leave the continent to be processed elsewhere. The technologies, capacities and abilities of refining and metallurgy are a key link in the value chain. Thanks to the European Battery Alliance, public and private funds have been widely mobilized and should, for example, make it possible to meet 80% of European demand for lithium from European sources by 2025.

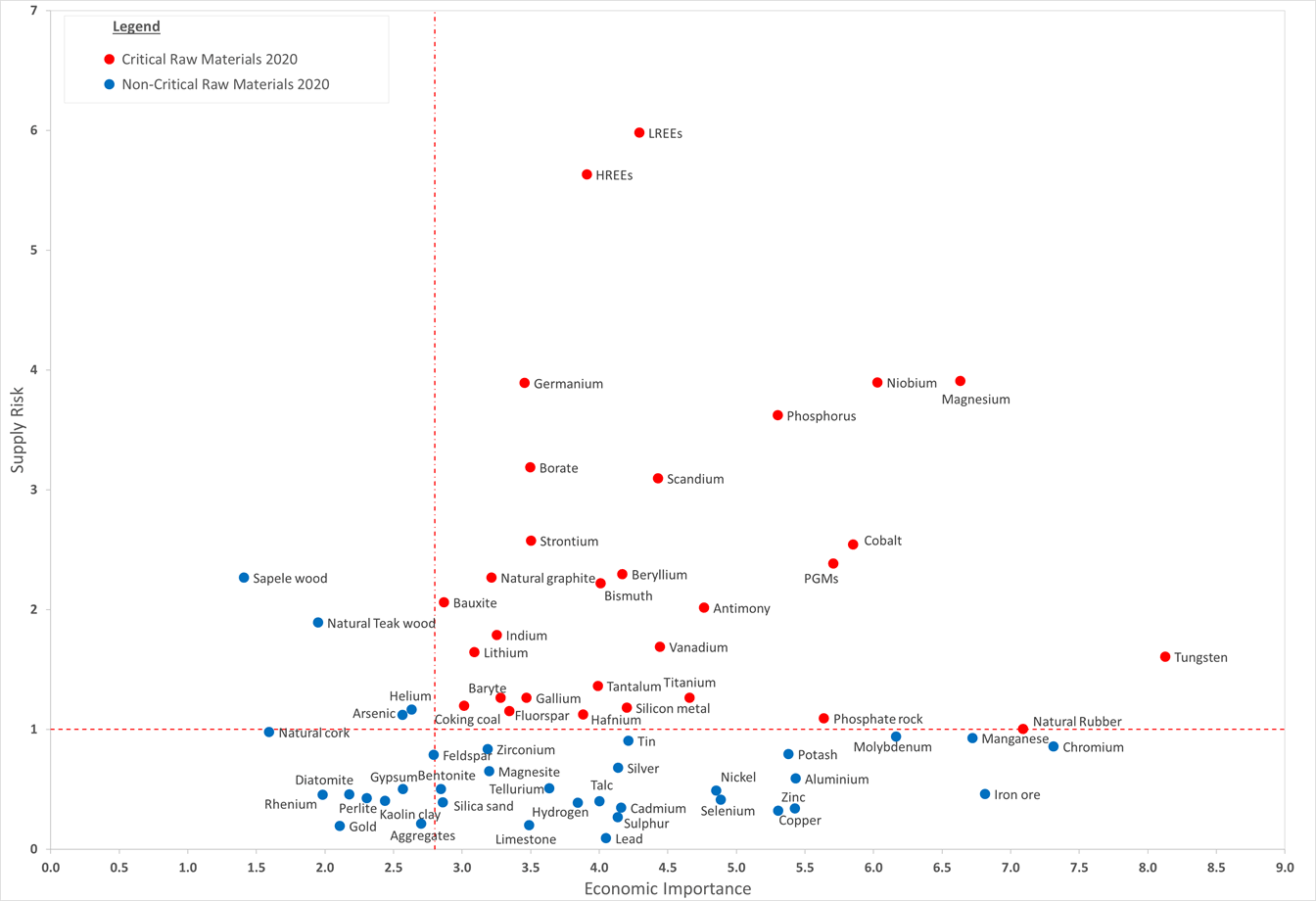

The European Commission has presented its action plan on critical raw materials defined as “raw materials that are the most important from an economic point of view and that present a high risk of lack of supply.” For example, 75 to 100% of metals extracted in Europe come from third countries. In order to overcome this excessive dependence and materialize its green deal, the European Commission is implementing a strategy to secure supplies to the EU.

The Commission Communication to the European Parliament, the Council, the Economic and Social Committee and the Committee of the Regions is structured in two directions. It first provides the list of critical raw materials for the EU and sets out the measures to be taken to strengthen the Union’s resilience and strategic autonomy. The Commission reviews the list every three years, the first being published in 2011 and containing only 11 substances compared to 30 in 2020. Bauxite, lithium, titanium, and strontium appear for the first time in the new list. Helium and nickel are not listed but remain under surveillance due to growing demand.

This list is used to support the development of EU policies, to play a role in negotiating international agreements and to identify investment needs for different programs (Horizon 2020, Horizon Europe).

The criticality assessment method could be revised for the next list (2023) to incorporate the latest knowledge. The EU will contribute to global efforts for better resource management and cooperate with relevant international organizations. This knowledge base should enable strategic planning and forecasting, reflecting the EU’s goal of creating a climate-neutral digital economy by 2050 and strengthening its influence on the world stage. The geopolitical aspect should also be an integral part of this forecasting exercise, thus enabling Europe to anticipate and meet its future needs.

The EU Action Plan for critical raw materials will pursue objectives such as:

- Establishing resilient value chains for industrial ecosystems in the European Union;

- Reducing dependence on primary and critical raw materials through a circular use of resources and the design of sustainable and innovation products;

- Strengthening supply and sustainable and responsible processing of raw materials in the EU;

- Diversification of supply sources through sustainable supply to third countries, by consolidating open and regulated trade in raw materials and eliminating international trade distortions.