COVID-19: The Curious Case of a Green Virus

Months after realizing the outbreak of a new virus, weeks after witnessing disturbing images, in China dropping on the streets, and days after the release of financial data about how this phenomenon is affecting global markets, we are witnessing an unexpected and strange side effect: the reduction of global CO2 emissions.

The effects, implications, action plans and the unfolding of the events bear an earie resemblance with post-apocalyptic scenarios in computer games (Plague Inc. players will understand) and movies, with the difference being that this is not happening in a screen; it is here, now.

We can’t help but wonder about existential questions about us, the humans, the earth, our planet, and our troubled relationship. But let’s rewind and get back to the beginning of this potentially apocalyptic story, where everything started.

The virus

Just before the ending of 2019 Anno Domini, China informed the World Health Organization about an unknown new virus with pneumonia-like symptoms, spreading within its territory. Point zero, where the first incident probably took place, was pinpointed in the city of Wuhan. Chinese scientists came fast to the conclusion that it was a virus of the family of coronaviruses, and that it was rapidly spreading, ravaging the city and the rural areas around Wuhan. Coronaviruses are common in the animal kingdom, and have rarely exhibited capacity to evolve into forms that can be infectious to humans. Since the start of the century, two other coronaviruses have infected humans, causing the SARS outbreak in 2002 and the MERS outbreak in 2012.

Scientists now think that this new virus probably became capable of infecting humans just before 2019 ended. Trying to narrow down point zero, it is believed that this coronavirus and its ‘jump’ to humans originated at a seafood market in Wuhan and started spreading from there. It is well known, and nowadays very well documented, that the notion of hygiene is not the strong point of such markets. Contradictory data has emerged though, indicating that that the first patient to get sick did not have any contact with the market. Experts are still, probably in vain, trying to trace the outbreak back to its source.

Chinese officials have said that they have seen cases where people with the virus infected others before they start showing symptoms, but there isn’t good evidence to say if or how much that is happening. A case has been reported where a woman who didn’t show symptoms appeared to infect others in Germany. This only adds to the uncertainty around the phenomenon and its effects, with hysteria being potentially one of them. Meanwhile the coronavirus continues spreading throughout the globe in a scarce pattern.

The type of animal the virus originated from is also not clear. One team of researchers in China published a report arguing that it came from serpent species, probably snakes, based on the genetic code of the virus. Another study relates them to another species, showcasing that up to 96% the virus is identical to one coronavirus found in bats. Both SARS and MERS originated in bats. This indication, coupled with the fact that bats are considered a delicacy in that part of the world, strengthens the hypothesis.

The interesting part of the plot, adding perhaps to the suspense of this curious story, is the turnaround of the Chinese government in the way they handled the outbreak. Contrary to their past practices, like in the SARS outbreak where the Chinese attempted to conceal cases from WHO inspectors and limit information, this time they announced it quickly. China reported the outbreak of the new virus to the WHO, which praised their quick response and transparency in a press conference. Furthermore, China is also allowing WHO teams to assist Chinese public health officials with the ongoing work, the global organization announced on January. Even the United States have commented on the fact that “China has exhibited a higher level of transparency” comparingly with the past.

The ‘technical’ name of the virus, given by the WHO, is COVID-19. It can be broken down to ‘co’, ‘vi’ for corona-virus, ‘d’ for disease, and ‘19’ for the year the disease emerged.

Researchers are still trying to map and understand the symptoms of COVID-19, which have ranged from mild, like those in a cold, to severe, like in pneumonia. Around 20% of confirmed cases have been severe, according to the WHO. That’s the cases that we are actually aware of, with the potential of infinitely more mild cases of the illness not being flagged, being strong.

So far, the fatality rate for the new illness is around 1%-2%, though it’s too early to be certain and that could change as the outbreak progresses. Accordingly, the fatality rate for SARS was about 15%, with the majority of fatal cases targeting older individuals suffering already by other underlying health issues, like heart disease, hypertension, and diabetes. That’s the same demographic group most being at risk of dying from illnesses like the common flu.

Early evidence suggested that, like other coronaviruses, the virus jumps between people who are in very close contact with each other, and probably spreads when an infected person sneezes or coughs. There is no certain knowledge and complete understanding of the spreading patterns and channels. WHO has reported that there have been sustained chains of people passing the virus along for at least four generations: one person got sick (probably from an animal), passed the virus to another person, who passed it to another person and so on. People in other countries outside of China, like the United States, Germany, Vietnam, seem to have gotten infected not from direct travel to China.

The serious concerns about the containment of the virus, which seems to be far more complicated than anticipated, are about the fact that we still have not detailed the way it is being spread. There’s still only limited evidence that asymptomatic people can spread the virus, but strong indications. According to Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, in a press conference: “Even if there is some asymptomatic transmission, in all the history of respiratory borne illness, asymptomatic transmission has never been the driver of outbreaks. An epidemic is not driven by asymptomatic carriers.”

The WHO says that researchers think each sick person will go on to infect, on average, between 1.4 and 2.5 additional people, though that’s only a rough and preliminary estimate, with other estimations raising the infected up to 3 people. Those estimations are called the virus’s R0. The R0 (naught-zero) is the formula representation of how well an infection might be able to spread. The higher the number, the more potentially spreadable it can be. SARS had up to 5 people, but this formula operates with the assumption that the infected person will actually spread the disease; the person might eventually not – and this is where the whole prevention game is played. If an illness isn’t very severe (and kills only a small percentage of people), but it’s highly transmissible, it can still cause devastating effects; if something affects millions, the small percentage it kills will still be a high number of fatalities.

The death toll from the virus on mainland China reached 2,000 some days ago. There have been more than 72,436 confirmed cases of people infected with Coronavirus in mainland China as of February 17th.

The Chinese and global response

The relationship between China and the WHO seems to be evolving into a complicated one, despite the good omens in the beginning. There are concerns that Chinese officials are undercounting the number of infected and downgrading the cases and many deaths as being from pneumonia and the common flu. Honestly, it is very hard to distinguish. In case anyone forgot, China is a communistic, state-controlled country; indicatively Wuhan police investigated and reprimanded many of its citizens for spreading what it called “rumours online and other malicious content” a few weeks ago. It is also very indicative that one of the first scientists (himself ill) that forced the hand of the Chinese government to proceed to revelations about the outbreak, by streaming himself on the internet, was forced to sign a letter that “he would not disturb the public peace again”; he passed away some days after.

Buildings in affected areas in China are disinfecting elevator buttons, door handles and now, money. The People’s Bank of China announced it would begin deep cleaning cash to prevent further spread. Every bank in the country will disinfect paper money with ultraviolet light and then store it for a period up to two weeks before it’s approved for use.

On January 22nd, Wuhan authorities shut down all transportation in the city, which is home to over 11 million people. They closed buses and subways, and cancelled all flights and trains in and out of the city. The director general of the WHO applauded the decision, saying that it would help control the outbreak and slow the spread into other countries. The construction of whole hospitals to address the emergency has also been witnessed in record times in the city Wuhan. Fifteen other cities, home to a total of around 50 million people, are locked down as well, according to The New York Times.

Dr. Gauden Galea, the World Health Organization’s representative in China, talked to the Associated Press however, regarding the uncertain outcome of such measures: “To my knowledge, trying to contain a city of 11 million people is new to science. It has not been tried before as a public health measure. We cannot at this stage say it will or it will not work.”

Obviously, serious consideration is not only focusing on how to contain the outbreak itself but also the financial impact of it. The leadership in Beijing appears keenly aware of the financial risks. Currently, Beijing is urging local governments to focus on getting the economy back on its feet. President Xi Jinping himself has reportedly said that the coronavirus response outside the epicentre of the outbreak in Hubei province has gone too far, warning of damage to the economy and cautioning against more restrictive measures.

China has been ‘encouraging’ banks to roll over loans and local authorities to cut rents and other costs for firms, as well as on brokerages to hold or buy stocks to keep stock prices from sinking. More financial measures are being designed as these words are being typed, as part of a framework.

Local governments continue to maintain and even tighten controls on movement and are encouraging businesses to stay shut. This suggests they are more worried about getting blamed for a new outbreak than about keeping the economy on ice for a few extra days or weeks.

Beyond the disruptions caused by the measures to combat the virus on construction sites, the real estate sector will receive a mighty blow. Lowered income is likely to prompt builders to slow down and refrain from starting new projects. If financial distress results in disruption to operations, the effect could be more profound and sustained.

The potential for wider financial disruption is clear as firms, local governments – and increasingly households – have high levels of debt. Lack of cashflow during the extended shutdown is likely to make some debt unserviceable, with the country’s leading financial media Caixin calling the virus ‘an existential threat’ to small businesses.

Chinese and global economic effects

The outbreak and subsequently the shutdown of huge parts of China and its industries could impact more than 5 million businesses across the globe, according to studies. Businesses are dealing with lost revenue and disrupted supply chains due to China’s factory shutdowns, tens of millions of people remaining in lockdown in dozens of cities and other countries extending travel restrictions.

A global data analytics firm, Dun & Bradstreet, released recently a report through which analysed the Chinese provinces most impacted by the virus, and found they are intricately linked to the global business network. The affected areas with more than 100 confirmed cases, in the beginning of February, were home to more than 90% of all active businesses in China, according to the report, and 50 thousand of them are in these regions where the branches and subsidiaries of foreign companies are situated; Dun & Bradstreet researchers found that “at least 51,000 companies worldwide, 163 of which are in the Fortune 1000.”

Almost half of the companies with subsidiaries in impacted regions are headquartered in Hong Kong, while the U.S. accounts for 19%, Japan 12% and Germany 5%.

The impact on businesses in China and around the world is already dragging down economic growth forecasts for the year. In a research note, Moody’s downgraded its global growth estimations by 20%, expecting G20 economies to have an aggregated growth rate of 2.4% in 2020 with China going down to 5.2%. Economists polled by Reuters said they expected China’s economic growth to slump to 4.5% in the first quarter of 2020, down from 6% in the previous quarter – the slowest pace since the financial crisis.

This forecast operates with the (wishful?) assumption that the spread of the virus will be contained by the end of Q1, restoring ‘normal economic activity’ within Q2. However, uncertainty about scientific, medical and financial facts could prove this model false, at best. The Chinese economy constitutes one fifth of global GDP and analysts estimated that if containment of the outbreak is delayed beyond the summer, the ‘cascading effect’ might cause a drag of around one percentage point on global GDP growth.

Moody’s Vice President Madhavi Bokil stated that: “There is already evidence albeit anecdotal – that supply chains are being disrupted, including outside China. Furthermore, extended lockdowns in China would have a global impact given the country’s importance and interconnectedness in the global economy.”

The Dun & Bradstreet report identified that the top five major sectors, accounting for more than 80% of businesses within impacted provinces, were services, wholesale trade, manufacturing, retail and financial services. The impacted provinces of, for instance, Guangdong, Jiangsu, Zhejiang, Beijing and Shandong account for almost half of total employment and sales volume for the whole Chinese economy. The report continues: “When (not if) containment and eradication is achieved, factors within the impacted geography are bound to generate economic activity with consumers, satisfying pent-up demand once improved conditions are underway. The sum of the efforts to revitalize the region will place the global economy back on track for sustained growth.”

The Chinese GDP growth target for 2020 will be officially set in the annual session of the National People’s Congress, which normally takes place before the end of Q1, but appears likely to be delayed due to the emergency. One of the GDP components, investment, is by far the most CO2-intensive, due to the energy used to make steel, cement, non-ferrous metals, glass and other basic construction materials. Relaxing the GDP growth target for the year would give more space to reconcile the different objectives, but authorities insist that the country will stick to its targets.

The Political Bureau of the Chinese communist party recently intervened at all levels, including speeding up large construction projects and increasing both bank lending and government spending. A return to debt-fuelled stimulus spending runs counter to the government’s aim of rebalancing the economy towards consumption. Another major uncertainty is that there is no indication on which sectors or what type of expenditure should be targeted, through this stimulus. Targeting clean energy and energy efficiency investments would be a natural way to reconcile the perceived need to prop up economic growth with state-engineered spending and China’s stated ambition to be a contributor to the fight against climate change.

The effects are global and according to the saying: “when China sneezes, the world catches a cold”. Well, now China got a cold and the implications for the rest of the world’s economies could be frightening.

The measures taken globally for the containment of the virus are also having a dramatic impact on aviation. There is a report of reduction of 50-90% in capacity on routes departing mainland China and a 60-70% reduction in domestic flights within the mainland over the past two weeks, compared with the week commencing 20 January. Interestingly, these flights were responsible for 17% of total CO2 emissions from passenger aviation in 2018, implying that that the on-going flight suspensions and cancellations have cut global CO2 emissions from passenger flights by around 11% (3Mt) in the recent past. This is a sneak peak of the next chapter of the article though.

When it comes to global corporate players, Apple – one of the leading corporations on the planet, indicated to investors that it probably won’t meet targets set for the upcoming quarter. Obviously, China is one of the decisive markets they based the assumptions on, and they are ‘taxed’ for it now. Disney, another major player in China, project significant potential loses while its theme parks in the region remain closed and obviously a threat to containment (as public areas attracting high volume – especially of children). Both Shanghai Disneyland and Hong Kong Disneyland are closed indefinitely, and the company said its 2020 earnings will likely suffer as a result. Other major brands such as Starbucks, Nike and Capri Holdings (owning Versace, among other luxury brands), are having their own share of impact due to their thousand closed stores in China due of mandatory lockdowns.

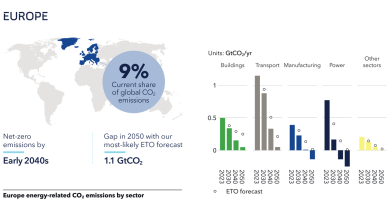

Now when it comes to Europe, the constant economic patient with the frivolous attempts of unified (?) policy, things are more complicated. Europe remains an amalgam of strong, less strong and some other economies which overall does not present a strong unified front, especially in times of crisis. Very soon, reports are going to be released regarding the purchasing managers’ indices (PMI), revealing and consolidating data about the steamrollers of Europe: Germany and France. These will provide a better understanding of how the region’s companies are faring and could offer some indications about the severity of the blow and potentially the domino effects on the ‘other’ economies (Greece is looking the other way).

Until now the readings regarding the economic performance of the Eurozone have been more than optimistic, indicating an upturn, but February’s survey will give a much better picture of the impacts from China’s slow down. With the inflation rates of Germany, and all the rest, remaining low, the European Central Bank last year cut rates and restarted its notorious bond-buying program. This does not come without concerns as to which extent this monetary measure will have much of a positive effect, particularly given how much stimulus the ECB has already injected. Recent industrial production data offered little comfort. It showed a 2% fall in the eurozone in December, and a 4% drop for the previous year.

Environmental effects

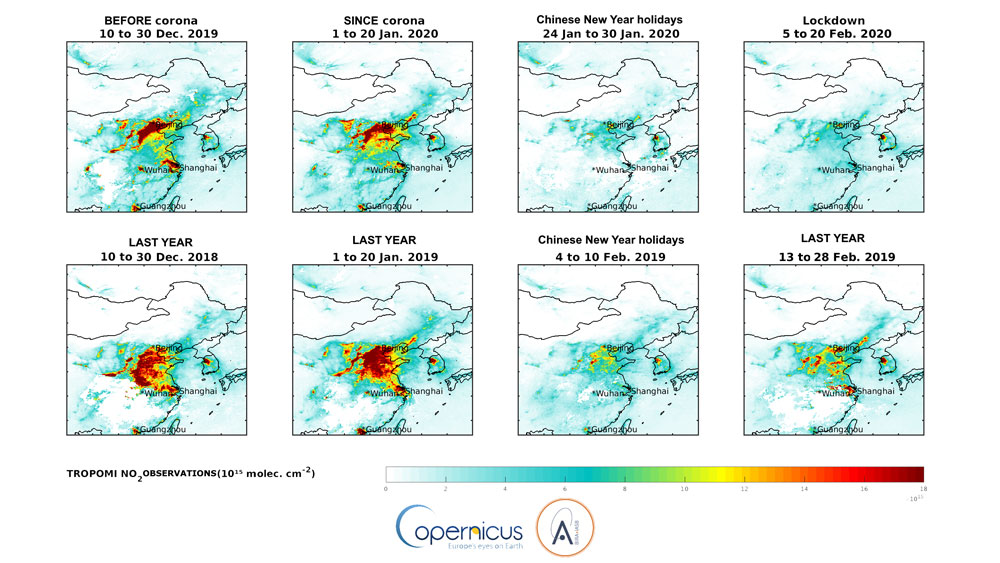

Every winter, during Chinese New Year, the country closes down for a week, with shops and construction sites closing and most industries winding down operations. The holiday has a significant short-term impact on energy demand, industrial output and emissions. A new report delivered by the non-profit organization, Carbon Brief, found that the restrictive and preventive measures due to the virus, like travel restrictions, longer holidays, and the slowdown of production and the economy in general, indicate that China still remains ‘sedated’ and has not recovered from the usual lull around the Chinese New Year, a roughly two-week festival that began this year on January 25.

The report focused on carbon emissions during the two-week period beginning 10 days after the start of the festival and compared that to the same period for each of the previous five years. Over that period in 2019, China emitted 400 million metric tons of carbon dioxide; this year’s figure is likely closer to 300 million metric tons. All told, the measures to contain coronavirus have resulted in reductions of 15% to 40% in output across key industrial sectors. This is likely to have wiped out a quarter or more of the country’s CO2 emissions over the past two weeks, the period when activity would normally have resumed after the Chinese new-year holiday.

Accordingly, the International Energy Agency (IEA) has reported the first quarterly decline in a decade in terms of oil demand. Since the virus has forced factories to close and kept people shut in, the amount of oil needed to keep the global economy running has sharply declined. Global oil demand is expected to drop by 435,000 barrels in the first three months of 2020 compared to the same period last year. It’s really early to predict or project how lower oil demand will affect the global economy, but IEA has states: “Consequences will vary over time, with the initial economic hit on transportation and services, likely followed by Chinese industry, then eventually exports and the broader economy.” Any sustained impact on fossil-fuel use would come from reduced demand, which initial indicators suggest could have a major impact. For example, February car sales are forecast to fall by 30% below last year’s already depressed levels.

If consumer demand is reduced – for example, due to unpaid wages during the crisis cascading through the rest of the economy – then industrial output and fossil-fuel use might not recover, even though capacity is available to do so.

Although pictures of empty city centres and public transport might seem like evidence for the large decline in emissions, the fact is that China’s energy consumption is dominated by industry. The reduction in emissions is mostly a result of lower output from oil refineries and lower coal use for power generation and steel-making, as China’s government struggles to control the epidemic.

Analysis of data from the China Electricity Council shows newly installed wind power capacity fell 4%, solar power capacity by 53%, hydropower by 53% and nuclear by 31% in the first 11 months of the year, while newly added thermal power capacity increased by 13%. After booming in the first half of the 2019, electric vehicle sales fell 32% year on year in the period from July to November. Taken together, the reductions in coal and crude oil use indicate a reduction in CO2 emissions of 25% or more, compared with the same two-week period following the Chinese New Year holiday in 2019.

Strikingly, all indicators of industrial capacity utilization – coal power plants, blast furnaces, coking, steel products, refineries – deteriorated further in the week commencing in the second week of February, when business was officially expected to resume.

All the indications, across the board, are down:

- Coal usage at a four-year low.

- Output of steel production at the lowest level for five years.

- Oil refinery operations in Shandong at the lowest level since 2015.

- Domestic flights are down up to 70% compared to a month ago.

- Levels of NO2 air pollution over China down by a third compared to last year.

Initial analysis from the International Energy Agency (IEA) and Organization of the Petroleum Exporting Countries (OPEC) suggests the repercussions of the outbreak could shave up to half a percent off global oil demand in January-September this year.

However, the Chinese government’s coming stimulus measures in response to the disruption could outweigh these shorter-term impacts on energy and emissions, as it did after the global financial crisis and the 2015 domestic economic downturn. The key factor determining the size of this impact is how fast things return to normal.

Conclusion

The situation is still developing globally and there is no guarantee as to whether it is going to deteriorate, and turn to apocalyptic magnitude, or prove to be just a global sneeze. The Chinese authorities seem to be handling the situation well and, for now, it seems that the global community has exhibited good reflexes also.

The virus is still spreading all over the world and with the projected capacity of 1 infected individual spreading it up to 3 more, the alarming conditions are still far from over.

The global economic effects are yet to be realized in terms of consolidated retrospective manner. We are just now putting together initial reports, trying to scratch the surface, without knowing how deep the waters are. Maybe it will pass, as all the official (and unofficial) indications predict.

Either way, it is pretty clear by now that while human activities are slowing down (or stopping) our carbon footprint drops dramatically. Irrespectively of whether anyone wants to believe, or not, that the planet is experiencing global warming due to our existence as a species, it is definitely true that the same planet was doing just fine without the millions of metric tons of CO2 we are producing. Let’s also keep in mind that there are strong indications that this passing winter will probably be the hottest of all (recorded) time.

All in all, it seems that this halt might soon come to an end, as we predict that business will soon continue as usual; meanwhile the question remains: did humanity really need to face a potentially apocalyptic even to stop polluting?