European Economic Forecasts

Deep and Uneven Recession, Uncertain Recovery

The European Commission publishes two comprehensive forecasts (spring and autumn) and two interim forecasts (winter and summer) each year. The interim forecasts cover annual and quarterly GDP and inflation for the current and following year for all Member States, as well as EU and Eurozone aggregates.

The coronavirus pandemic is a major shock for economies, in the EU and globally, with very serious consequences from a social and economic point of view. Despite the quick and extensive political response, at both EU and national levels, the EU economy will witness this year a recession of historic proportions, the European Commission warns.

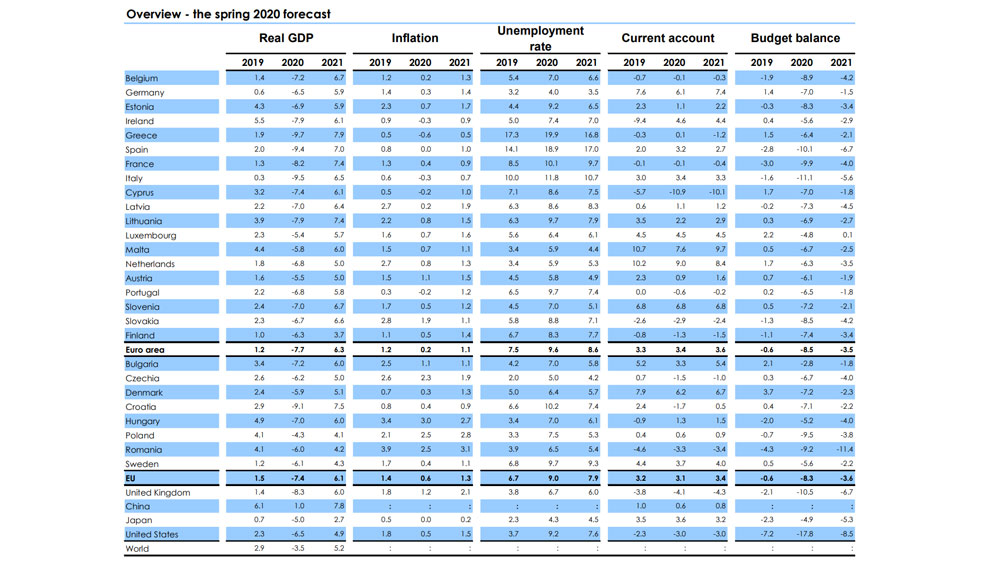

According to the economic forecasts from the spring of 2020, in Romania GDP will drop by 6% in 2020, following to grow by 4.2% in 2021. Inflation will reach the value of 2.5% in 2020, being followed by a 3.1% rate in 2021, while unemployment rate will reach 6.5% in 2020 and 5.4% in 2021.

Also, the Eurozone economy will register a record contraction, of 7¾% in 2020, while in 2021 it will witness a 6¼% growth. EU economy is expected to contract by 7½% in 2020 and grow by approximately 6% in 2021. Forecasts in terms of growth for the EU and the Eurozone have been downgraded by approximately nine percentage points compared to the economic forecasts of the autumn of 2019.

The shock felt by the EU economy is symmetrical by the fact that the pandemic has hit all the Member States, but both the decrease in production in 2020 (from -4¼% in Poland to -9¾% in Greece), and the recovery capacity in 2021 will vary significantly from one country to the other. The economic recovery of each Member State will depend not only on the evolution of the pandemic in the respective country, but also on the structure of the economy and the capacity of reaction through stabilization policies. Given the interdependence of economies in the EU, the dynamics of recovery in each Member State will also affect the capacity for recovery of other Member States.

“At this stage, we can only tentatively map out the scale and gravity of the coronavirus shock to our economies. While the immediate fallout will be far more severe for the global economy than the financial crisis, the depth of the impact will depend on the evolution of the pandemic, our ability to safely restart economic activity and to rebound thereafter. This is a symmetric shock: all EU countries are affected and all are expected to have a recession this year. The EU and member states have already agreed on extraordinary measures to mitigate the impact. Our collective recovery will depend on continued strong and coordinated responses at EU and national level. We are stronger together,” said Valdis Dombrovskis, Executive Vice President for an Economy that works for People.

“Europe is experiencing an economic shock without precedent since the Great Depression. Both the depth of the recession and the strength of recovery will be uneven, conditioned by the speed at which lockdowns can be lifted, the importance of services like tourism in each economy and by each country’s financial resources. Such divergence poses a threat to the single market and the euro area – yet it can be mitigated through decisive, joint European action. We must rise to this challenge,” added Paolo Gentiloni, European Commissioner for the Economy.

A large hit to growth, followed by an incomplete recovery

The coronavirus pandemic has seriously affected consumer spending, industrial output, investment, trade, capital flows and supply chains. The announced progressive relaxation of containment measures should pave the way for recovery. However, no recovery is expected from losses suffered this year by the EU economy before the end of 2021. Investments will remain modest and the labour market will not recover entirely.

Keeping efficient policy measure at EU level and at national level in response to the crisis will be crucial to limit the economic damage and to facilitate a swift, robust recovery to set the economies on the path of sustainable and inclusive growth.

Unemployment is expected to increase, although the measures adopted should limit its growth

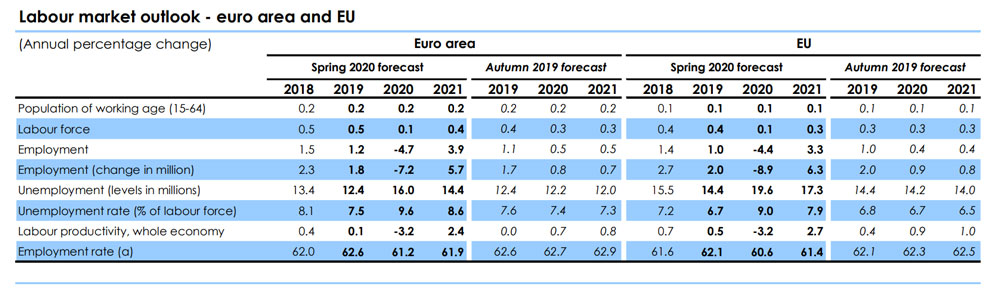

Although the unemployment systems partially, salary subsidies and support granted to enterprises should contribute to limit losses of jobs, the coronavirus pandemic will have serious consequences on the labour market.

In the Eurozone, the unemployment rate is forecast to rise from 7.5% in 2019 to 9½% in 2020 before declining again to 8½% in 2021. In the EU, the unemployment rate is forecast to rise from 6.7% in 2019 to 9% in 2020 and then fall to around 8% in 2021.

Some Member States will see more significant increases in unemployment than others. Those with a high share of works with short-term contracts and those where a large part of the labour force depends on tourism are particularly vulnerable. Young people entering the labour market at this time will also find it harder to secure their first job.

A steep drop in inflation

This year consumer prices are expected to fall significantly amid the drop in demand and the strong decline of oil prices, which, together, should fully offset the isolated increases in prices determined by pandemic-related supply disruptions.

Inflation in the Eurozone, as measured by the Harmonized Index of Consumer Prices (HICP), is now forecast at 0.2% in 2020 and 1.1% in 2021. For the EU, inflation is forecast at 0.6% in 2020 and 1.3% in 2021.

Decisive measures applied will cause public deficits and debt to rise

Member States have reacted decisively through budget measures to limit the economic damages caused by the pandemic. The ‘automatic stabilizers’, including social security benefit payments, together with the discretionary budget measures are set to cause spending to rise. Therefore, the aggregate government deficit of the euro area and the EU is expected to surge from just 0.6% of GDP in 2019 to around 8½% in 2020, before falling back to around 3½% in 2021.

After having been on a declining trend since 2014, the public debt-to-GDP ratio is also set to rise. In the Eurozone, it is forecast to increase from 86% in 2019 to 102¾% in 2020 and to decrease to 98¾% in 2021. In the EU, the debt ratio is forecast to rise from 79.4% in 2019 to around 95% this year before decreasing to 92% next year.

Unusually high uncertainty and risks of negative evolution

Spring forecasts are marked by a greater degree of uncertainty than usual. They are based on a set of assumptions regarding the evolution of the coronavirus pandemic and the related containment measures. The baseline scenario starts from the assumption that, as of May, these measures will be gradually relaxed.

The risks surrounding this forecast are also exceptionally large and concentrated on the downside.

A more severe and longer lasting pandemic than currently expected could cause the GDP to fall much more than assumed in the baseline scenario of this forecast. In absence of a common firm and swift response at EU level, there is a risk that the crisis will cause serious distortions within the Single Market and entrenched economic, financial and social divergences between Eurozone Member States. There is also a risk that the pandemic will trigger more drastic and permanent changes of attitudes towards the global value chains and international cooperation, which would affect the European economy, very open and interconnected. At the same time, the pandemic would leave permanent scars through bankruptcies and long-term damage to the labour market.

Romania – challenges and prospects

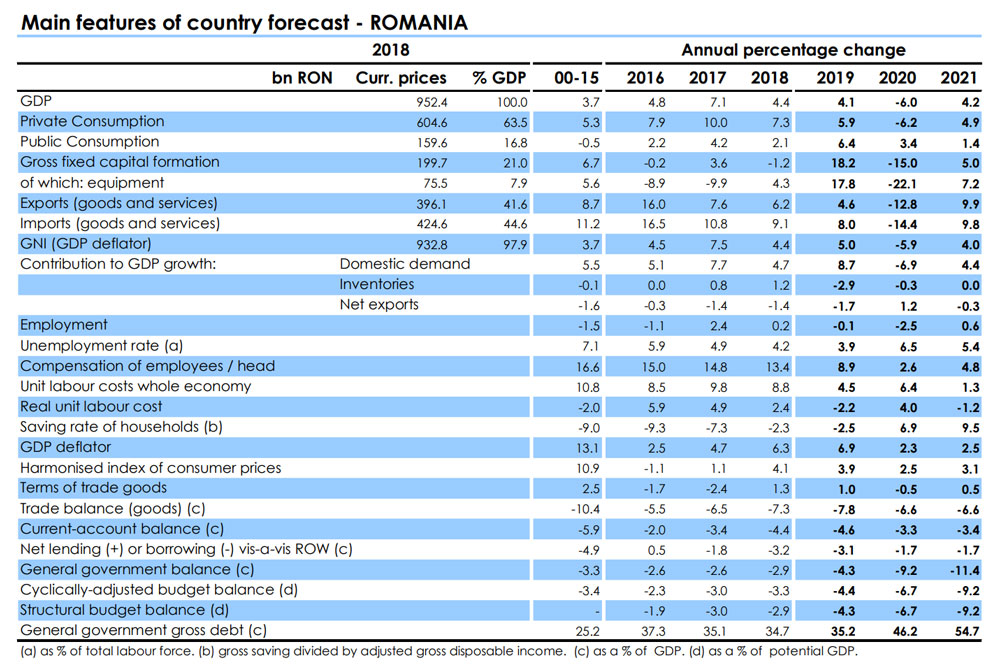

Real GDP is projected to decline sharply in 2020, after several years of robust growth. Private consumption, the main driver of growth in recent years, is expected to be impacted severely by the lockdown measures. Uncertainty is expected to hurt investment decisions, while net exports are projected to contribute positively to growth. Unemployment is set to increase while inflation is forecast to ease due to the drop in oil prices. In 2021, real GDP is projected to rebound, though not to pre-crisis levels. The budget deficit is projected to increase significantly as the fiscal measures required to fight the COVID-19 crisis come on top of past fiscal slippages.

Sharp output drop followed by a moderate recovery

At the onset of the COVID-19 crisis Romania’s economy was growing at an annual rate of around 4%, mainly driven by private consumption.

However, signs of macro-economic imbalances had already emerged, notably in the form of high and growing current account and fiscal deficits.

Romania declared a state of emergency on 16 March and subsequently extended it until mid-May. Containment measures are expected to significantly affect services and manufacturing. To counter the negative impact of the crisis, the government adopted measures aimed at supporting consumers and businesses, such as loan guarantees for SMEs, temporary moratoriums on loan servicing, and technical unemployment schemes.

Real GDP is projected to contract by 6% in 2020 and rebound by 4¼% in 2021. Private consumption, which is expected to be significantly affected by lockdown measures in 2020, should increase gradually as these are lifted and contribute positively to growth in 2021. After a very strong performance in 2019, investment is projected to drop significantly in 2020, as businesses react to the very uncertain environment by postponing or cancelling investment projects. Public investment activity, meanwhile, is projected to be subdued. In 2021, investment is expected to recover only partially amid persistent uncertainty.

Exports are also set to contract in 2020, reflecting the economic contraction in Romania’s main trading partners and supply chain disruptions.

They should resume growth in 2021 as global economic activity gradually picks up. Imports are also set to decline, as domestic demand drops and as production in other countries is affected by lockdowns and supply chain disruptions. Overall, the contribution of net exports to growth in 2020 is set to turn positive and result in a lower current account deficit. However, this positive evolution is expected to start reversing in 2021.

From a record low of 3.9% in 2019, the unemployment rate is projected to increase to 6½% in 2020 as some firms will inevitably close as a result of the COVID-19 crisis, although policy measures are expected to limit job losses. Nominal wages are projected to increase only moderately in 2020 after several years of double-digit growth and remain relatively subdued in 2021.

Inflation is projected to fall to 2.5% in 2020 mainly due to the sharp fall in oil prices. Core inflation is projected to ease somewhat but remain above 3% in 2020 and 2021. In response to the COVID-19 crisis, the National Bank of Romania cut its key monetary policy rate from 2.5% to 2% and started purchasing RON-denominated government securities on the secondary market in order to support the financing of the real economy and the public sector.

Downside risks to the growth forecast

The current projections are subject to a particularly high degree of uncertainty. Beyond the uncertainty that affects all countries related to the evolution of the health crisis, global growth and international trade, for Romania it will be important how the authorities balance the need for support measures with concerns about the medium-term trajectory of public finances which pre-dated the COVID-19 crisis.

Public deficit set to increase

In 2019, the general government deficit rose to 4.3% of GDP from 2.9% in 2018. The increase was driven by higher current expenditure, in particular on public wages. Additionally, public investment rebounded from the very low levels of previous years.

The general government deficit is forecast to increase to around 9¼% of GDP in 2020. The preexisting expansionary trend largely driven by pension increases is set to be reinforced by the impact of the COVID-19 crisis. Expenditure on old-age pensions is set to rise considerably, driven by the full-year effect of the 15% pension increase that came into effect in September 2019 and a further increase of 40% scheduled for September 2020. COVID-19 related measures in the 2020 budget amendment amount to 1.3 pp of GDP of additional spending, out of which 0.4 pp of GDP financed by EU transfers. They include in particular the technical unemployment benefit and emergency spending. Tax revenues are set to be negatively affected by the recession.

The general government deficit is set to further increase in 2021 to around 11½% of GDP under a no-policy-change assumption, despite a projected recovery in tax revenues and phasing out of pandemic-relief related expenditures. This is due to the full-year effect of the 40% increase in pensions in September 2020, an additional upward pension recalculation scheduled for September 2021, and the doubling of child allowance payments.

The debt-to-GDP ratio is forecast to rise from 35.2% in 2019 to around 54¾% in 2022.

Background

The European Commission forecast is based on a set of technical assumptions concerning exchange rates, interest rates and commodity prices, based on information available until April 23. For all other data integrated in forecast, including assumptions about government policies, this forecast takes into consideration information up until and including 22 April. Unless policies are credibly announced and specified in adequate detail, the projections start from the assumption that nothing changes at the level of policies.

The European Commission’s next economic forecast will be the Summer 2020 Interim Economic Forecast which is scheduled to be published in July 2020. This will cover only GDP growth and inflation. The next full forecast will be in November 2020.