Go for Growth, or go home

Evolution is part of any business. Whether we go faster or slower in any given direction is due to a multitude of factors and underlying conditions but at the end of the day, it all comes down to our willingness to persevere. And a business that doesn’t go anywhere is a dead business.

That being said, where is your business going? Are you currently facing challenges or obstacles and what may be the difference between the two? Experts say it’s a matter of perspective. But you should be happy either way. The bumpy road is usually less travelled, but the roads that are the least travelled could prove to be the most rewarding. If the business or the industry is not growing then we have an issue. But if due to our own inactivity our business is not growing, then we have a problem.

Let’s take a look at a couple of businesses which are doing well, just to get the ball rolling. One thing all the winners have in common? They set goals and look to the future. And that’s exactly what BP Global is doing with their ‘BP’s view to 2021: five things to know’. They understand that in order to know where you are going, you first have to know where you’ve been. Thus, safe in the understanding that they had great results in 2017, even surpassing the market’s expectations, the investors can turn their eyes to the future.

The first topic that they touch on is safety. No matter the time period, safety, efficiency and reliability will get the job done. Their results show a continued drop in work safety incidents but they say the job is never done. While the recordable injuries remain below their five-year average, BP’s group Chief Executive Bob Dudley insists that progress is still being made in that department.

Growing also means bettering, and BP intends on getting more bang for their buck by improving their portfolio with 35 percent higher margins on average. In their projections this would add up to 900,000 barrels per day from new projects come 2021. With a hefty offering of more than 20 projects, 13 of those already under construction, and six final investment decisions due in 2018, BP aims at focusing on lower costs and higher margins. Major project start-ups are also in the pole position, presently contributing with a 12 percent production increase and further growth expected.

We have to remember that this is still a numbers game. BP’s downstream business expects to deliver upwards of USD 3 billion increase in earnings between 2016 and 2021, with two-thirds due to BP’s marketing business, with the rest owed to manufacturing. This seems very feasible as the results for 2017 were deemed the best on record, growing almost by a quarter compared to 2016.

Counting on the diverse offering the brand presents, Chief Executive for Downstream Tufan Erginbilgic is confident that growth in existing markets and expansion to new material markets in Mexico, India, Indonesia or China is more than likely.

But evolution should not be undertaken chaotically, without control and concern for our future. Nobody wishes for a Pyrrhic victory. Thus, BP targets a two-pronged approach.

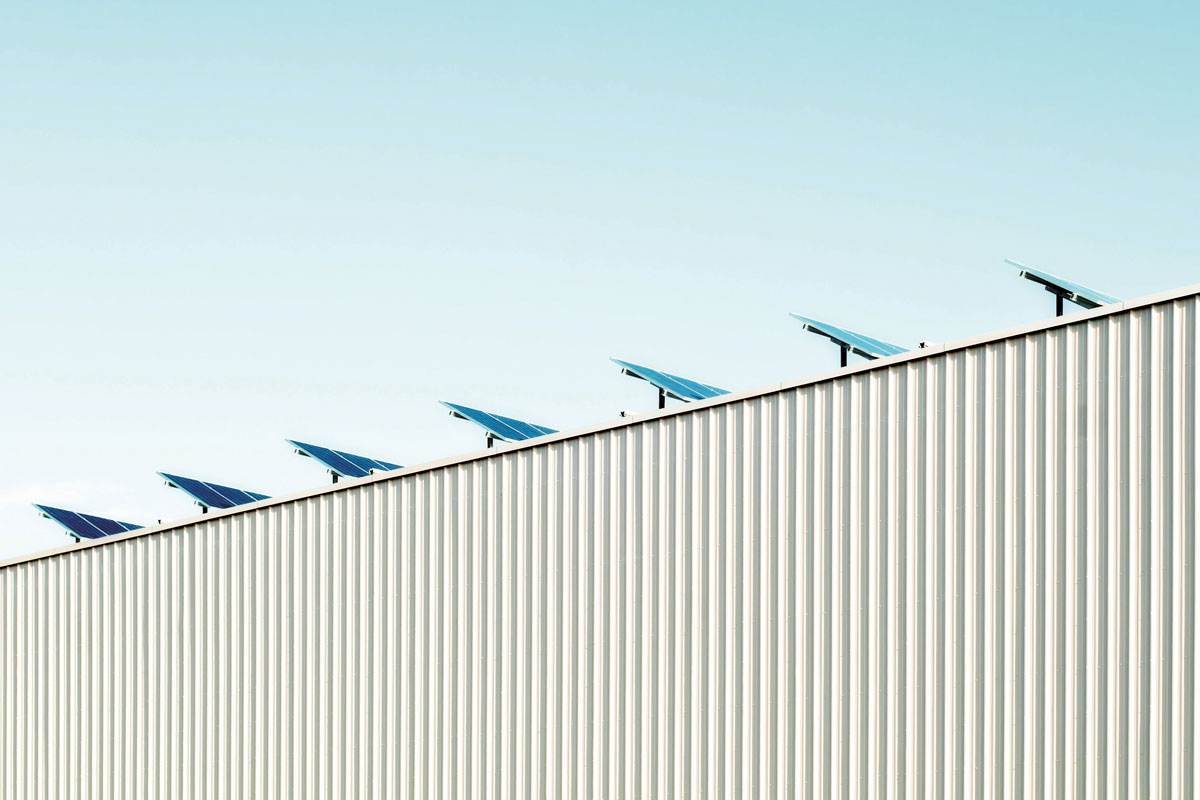

On one hand they keep the focus on expansion, while also investing in smart ways to lower the carbon footprint their big industry steps may inflict. The lower carbon future should not be just a fancy dream we talk about, we should make it into a reality. Judging by the activities undertaken across their business field, BP is committed for real.

The priorities that they have laid out include the reducing of their own operation’s emissions, investing in new thoughtful business and developing products that will enable customers to reduce their own emissions. By investing around USD 500 million annually just on renewables, new technology, exploration and research, BP is set to continue to spearhead the transition of global energy needs towards clean energy.

As Lamar McKay, Deputy Chief executive, states: “At BP, we want to be part of the solution”. This means not only focusing on the future, but also on today, according to him. Solutions seems to be derived from advanced mobility studies and digital transformation, a much-discussed topic.

Bottom line is that if you want to get to see tomorrow, you still have to be around for it. Profit will make or break a business and that’s why BP considers the shareholders’ satisfaction a top priority. When you perform well and deliver, as they did in 2017, the expectations increase. And they seem primed to meet those too.

By investing around USD 500 million annually just on renewables, new technology, exploration and research, BP is set to continue to spearhead the transition of global energy needs towards clean energy.

Another company which has its eyes on growth is Deloitte and they set out to analyse the top strategies of tech companies as they prepare the plans for 2018 in their own ‘2018 Technology Industry Outlook’. The review focuses on opportunities, strategies and risks companies might face this year, in the view of Paul Sallomi, Vice Chairman of Deloitte.

It appears the competitive edge will be gained by way of innovative technologies like cloud, cognitive computing and data analytics. By combining these solutions, companies benefit from more cost control and the ability to drive revenue. As cloud applications and services drastically change the market it is no surprise that they are expected to pass the 50 percent adoption point. Riding the coattails of this change is also the flexible consumption trend which enables consumers to pay on the go.

Even though it is still in its early years, cognitive computing is already proving to be an asset for companies in enhancing services and products, making better and more informed decisions and improving operations. As cloud and cognitive computing go hand in hand, companies have easier access to it and use it to analyse and find patterns in qualitative data. This means that in the near future apps will become real learning tools for most people, with many anticipating new jobs being created on the basis of adopting cognitive technologies.

Speaking about strategies, it seems that the old adage of ‘Buy or build’ has now evolved into ‘buy, build – or partner’.

As partnerships are now only one click away, it wouldn’t be so odd to hear about age old competitors working together in areas where they don’t compete head to head, in order to achieve the new concept of cooperative competition which basically describes the situation where everybody has something to gain from everybody else’s gain. Since no company can truly hold all the answers, these new technological and informational partnerships may very well hold the key to new business models where the best solution is produced together.

Nobody said it was going to be easy, so only the most adept companies will benefit from this new dynamic, provided that the customer experience remains pristine. Of course, for the reserved and cautious, the merger and acquisition system will still provide plenty of options of obtaining the top capabilities. As this will become a diagonal way of climbing the business ladder we should not be surprised by divestitures, a necessary tool when companies have outgrown their past endeavours.

As we know, sacrifice is necessary when growing, but risk does not have to be. Of course, digitalization opens a lot of doors, but it may also allow some uninvited guests.

According to a recent report, 27 percent of connected third party cloud applications which employees brought into enterprise environments present a high cyber security danger. As this may cause losses in the range of millions of dollars, companies will have to use more than one security vendor and product. But the threats will not only be of a digital nature. As every country has a specific data protection policy, the cloud solution builders and users alike will need to carefully navigate the regulatory environment. It seems that the best asset for business will be a sort of sixth sense that will luckily foresee the biggest industry disruptors. Keeping your eyes open and your mind ready for unexpected things, such as industry hopping might be the key.

Speaking of predictions, there is one man who regards them as a team effort. In a LinkedIn article titled ‘Changing for the better… and not going back’, Lorenzo Simonelli, the Chairman and CEO of Baker Hughes, a GE Company, wonders about the success of an energy think tank.

The Florence based Annual Meeting that he is referring to, amounts yearly circa 1,200 industry leaders. This should most likely prove enough brain and financial power for a change and Mr. Simonelli ponders that we’re already seeing it happen.

As the industry is now standing on far more solid ground, some early risers have already taken in the concept of competitive collaboration. Companies will not only have to work with one another, but with customers as well if we are to see a reduction in tenderizing costs and a growth in cost efficiency and high performance.

It seems that all the leaders agreed that the world of tomorrow will be built on sustainable solutions and on the very delicate dynamic of ‘me and you’ not ‘me versus you’. This will allow not only for open communication but also for platform crossing and flexibility. Everybody agreed that the main link here will be the digital revolution.

Just to complete a full circle we will now go back to BP on the subject of global energy trends in their ‘Energy Outlook 2018’ presented by Spencer Dale, Chief Economist. Their outlook proposes that by 2040 the world GDP will more than double, our population will reach approximately 9.2 billion with increased urbanization, we’ll see a 35 percent increase in energy demand with China and India leading it, a more diverse energy mix, rising industrial demand and sadly a carbon emission rise of 10 percent.

As China and India take the lead on energy growth, amounting to approximately 25 percent, there are a number of players bent on making the global energy market more and more competitive.

According to the report, thanks to efficient use of energy, it is possible that by 2040, the EU will have a GDP level that is three times greater than it was in 1975 but the level of energy it will be using will theoretically also be the same as in 1975.

But energy abundance still comes with a price. Granted, 10 percent carbon emission raise is less than expected given the last quarter of a century but still far from the Paris agreement.

Speaking about the energy mix, coal, gas, oil and fossil fuels are still alive and kicking, amounting to 25 percent of global energy by 2040.

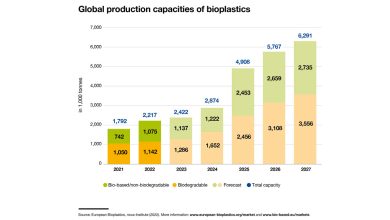

According to the report’s ‘evolving transition’ scenario, renewables will increase five times over, amounting to 14 percent of primary energy. Being compared to nuclear power, renewables are set to flourish being backed by failing costs, increasing competitiveness, technological improvements and government support.

As gas overtakes coal, the demand for oil and liquid fuels is envisioned to continue to grow, eventually reaching peak demand.

In an extreme scenario presented by the report, conventional cars will be banned by 2040, which means oil demand would be reduced by about 10 million barrels on a daily basis. The void would have to be filled by autonomous vehicles which would see a great frequency of use and help replace oil demand with electricity.

It’s really good that these matters attract more and more attention every day, but we should not forget about action. We all know growing is difficult and usually demands sacrifice and a considerable amount of effort. Whether it’s worth it, this is a decision each of us will have to make.

Just take care, the world, industry and business will not cease to grow just because we refuse to grow. If we don’t take the opportunity, somebody else will. It would be a pity to miss out on something that happens naturally anyway.