Hydrogen Technology: Who Is Investing and Why

The number of hydrogen patents is exploding, and hydrogen-based technologies seem to be subject to an increasingly obvious strategy. In the last ten years, according to a study by the European Patent Office (EPO) and the International Energy Agency (IEA), Europe has concentrated 28% of patent filings in the field of hydrogen technology. However, some technologies are still far from being implemented by energy market participants.

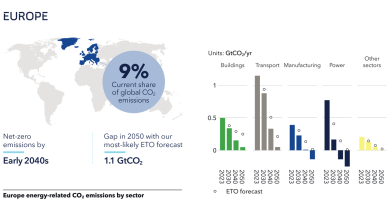

Experts at the European Patent Office estimate that hydrogen production currently remains almost 100% gas-based, but the world of innovation has already moved on to the technologies required for the energy transition. Although the race is far from won, Europe is leading the way in hydrogen. According to a study by the IEA and EPO, EU Member States filed 28% of hydrogen-related patents in the decade 2011-2020, ahead of Japan (24%) and the United States (20%).

The two organisations have identified all patents filed in the energy sector for the period 2011-2020, retaining only ‘international patent families’, i.e., inventions that have been the subject of a patent application in at least two different countries.

Europe is particularly well positioned in hydrogen production and dominates patent filings for electrolysers. Europe is also at the forefront of hydrogen storage and distribution (33% of the total in the last ten years). On the other hand, Japan remains the dominant filer of end-use patents, a position mainly driven by its automotive industry.

Hydrogen as an argument for clean storage

Investors are interested in a credible solution for storing ‘clean’ energy from wind turbines and photovoltaic panels. Hydrogen is entering the race but faces two counterarguments: cost-effectiveness and carbon footprint. Because by far the only feasible hydrogen production today is from methane.

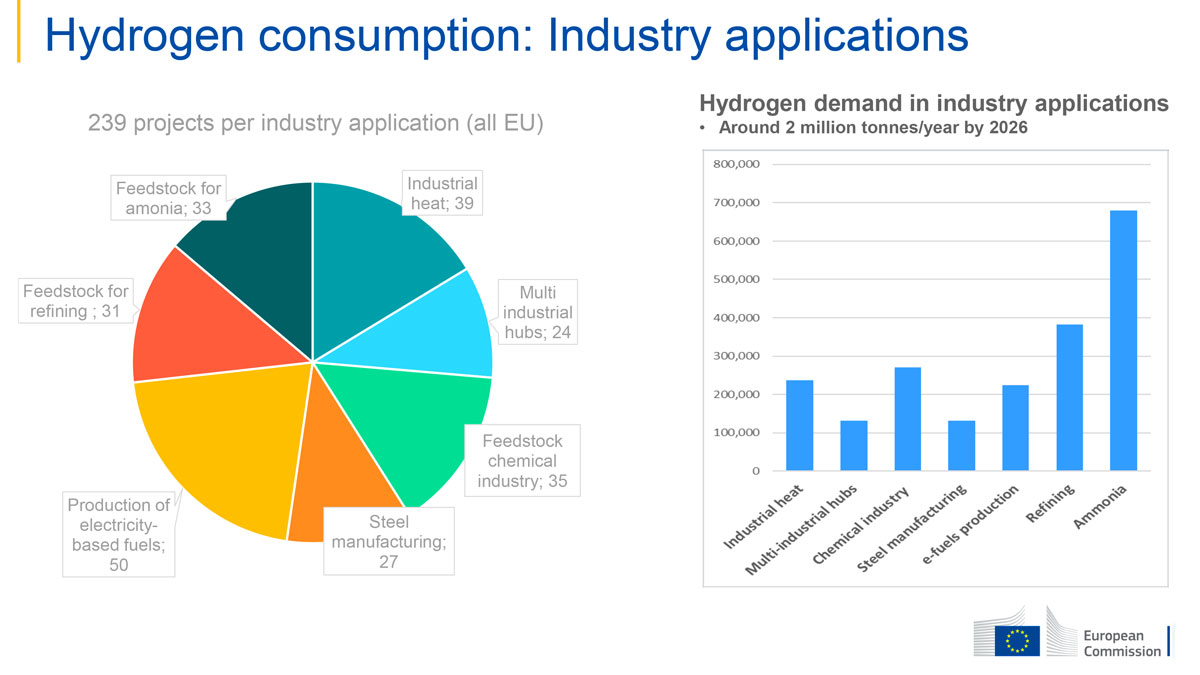

Moreover, the H2 sector, regardless of its mode of production, is associated with low efficiency: the energy ultimately recoverable at the end of the chain will never be more than a small half of that extracted from the source. As proof of this, Europe, thanks to the REPowerEU plan, is aiming for a consumption of 20 million tonnes by 2030. Thus, 30% of European primary steel production should be decarbonised using renewable hydrogen in about fifteen years.

Today, hydrogen production is not so green: for every kilogram of hydrogen produced, between 10 kg and 12 kg of CO2 are emitted. Hydrocarbons are currently used to make it, but we can use a better process, thanks to electrolysers, which make it possible to store electricity from solar or wind power, for example. The only problem is the high price. Experts believe we should focus on low carbon emissions, i.e., less than 3.38 kg of CO2 per kilogram of hydrogen.

Hydrogen is both an alternative resource to the conventional battery for energy storage and power generation, but also a tool that makes it possible to arbitrate between centralised energies and local, intermittent, carbon-free generation. Unfortunately, hydrogen has a low efficiency due to high energy losses. The cleanest way to produce hydrogen is by electrolysis of water, but this process consumes a lot of energy, and its yield is well below 100%.

New rules for renewable hydrogen

The European Commission (EC) proposed on 13 February 2023 detailed rules to define what constitutes renewable hydrogen in the European Union (EU) by adopting two Delegated Acts required under the Renewable Energy Directive. These Acts are part of a broad EU regulatory framework for hydrogen which includes energy infrastructure investments and state aid rules, and legislative targets for renewable hydrogen for the industry and transport sectors. They will ensure that all renewable fuels of non-biological origin (also known as RFNBOs) are produced from renewable electricity. The two Acts are inter-related and both necessary for the fuels to be counted towards Member States’ renewable energy target. They will provide regulatory certainty to investors as the EU aims to reach 10 million tonnes of domestic renewable hydrogen production and 10 million tonnes of imported renewable hydrogen in line with the REPowerEU Plan.

More renewables, less emissions

The first Delegated Act defines under which conditions hydrogen, hydrogen-based fuels or other energy carriers can be considered as an RFNBO. The Act clarifies the principle of ‘additionality’ for hydrogen set out in the EU’s Renewable Energy Directive. Electrolysers to produce hydrogen will have to be connected to new renewable electricity production. This principle aims to ensure that the generation of renewable hydrogen incentivises an increase in the volume of renewable energy available to the grid compared to what exists already. In this way, hydrogen production will be supporting decarbonisation and complementing electrification efforts, while avoiding pressure on power generation.

While initial electricity demand for hydrogen production will be negligible, it will increase towards 2030 with the mass rollout of large-scale electrolysers. The EC estimates that around 500 TWh of renewable electricity is needed to meet the 2030 ambition in REPowerEU of producing 10 million tonnes of RFNBOs. The 10Mt ambition in 2030 corresponds to 14% of total EU electricity consumption. This ambition is reflected in the EC proposal to increase the 2030 target for renewables to 45%.

The Delegated Act sets out different ways in which producers can demonstrate that the renewable electricity used for hydrogen production complies with additionality rules. It further introduces criteria aimed to ensure that renewable hydrogen is only produced when and where sufficient renewable energy is available (known as temporal and geographic correlation).

To consider existing investment commitments and allow the sector to adapt to the new framework, the rules will be phased in gradually, and designed to become more stringent over time. Specifically, the rules foresee a transition phase of the requirements on ‘additionality’ for hydrogen projects that will start operating before 1 January 2028. This transition period corresponds to the period when electrolysers will be scaled up and come onto the market. Furthermore, hydrogen producers will be able to match their hydrogen production with their contracted renewables monthly until the 1 January 2030. However, Member States will have the option of introducing stricter rules about temporal correlation as of 1 July 2027.

The requirements to produce renewable hydrogen will apply to both domestic producers as well as producers from third countries that want to export renewable hydrogen to the EU to count towards the EU renewables targets. A certification scheme relying on voluntary schemes will ensure that producers, whether in the EU or in third countries, can demonstrate in a simple and easy way their compliance with the EU framework and trade renewable hydrogen within the Single Market.

The second Delegated Act provides a methodology for calculating life-cycle greenhouse gas emissions for RFNBOs. The methodology considers greenhouse gas emissions across the full lifecycle of the fuels, including upstream emissions, emissions associated with taking electricity from the grid, from processing, and those associated with transporting these fuels to the end-consumer. The methodology also clarifies how to calculate the greenhouse gas emissions of renewable hydrogen or its derivatives in case it is co-produced in a facility that produces fossil-based fuels.

Renewable hydrogen production

This is the hydrogen production technique, which consists of ‘breaking’ the water molecules using an electric current (via an electrolyser) to extract dihydrogen H2. For this hydrogen to be considered ‘green’ or renewable, the electricity used must itself be carbon-free.

Grey H2 production

Hydrogen is a very rare resource on Earth. It must therefore be produced. A common method of production is to heat hydrocarbons from oil or gas with steam. This requires fossil fuels and releases carbon monoxide as well as a small amount of carbon dioxide. It is therefore not a sustainable production process, which is why the category of hydrogen resulting from this production technique is called grey hydrogen.

Blue and green H2

Another production method is based on electrolysis. Using electricity, water molecules are split into hydrogen and oxygen. The electricity needed for this operation can be produced in different ways. For example, electricity from a gas- or coal-fired power plant can be used. The hydrogen produced in this way is grey hydrogen.

But if the CO2 released during power generation is captured, then we are talking about blue hydrogen. Of course, electricity can also come from sustainable sources, such as solar or wind power. The hydrogen produced in this case is called green hydrogen.

Demand for green H2 on the rise

Today, about 90% of global hydrogen production is still grey hydrogen. However, this situation should change quickly, which is why governments around the world have committed to rapidly reducing CO2 emissions. Extensive investment programmes have been implemented in Europe and the United States to develop new sustainable technologies. China has also named the hydrogen industry as one of the six industries of the future in its latest five-year plan (2021-2025).

Fertiliser producer OCI, for example, is betting big on hydrogen development. The company, listed on the Amsterdam Stock Exchange (Euronext Amsterdam), expects demand for green hydrogen to increase tenfold over the next ten years. At the same time, technological developments should enable the cost and therefore the price of green hydrogen to halve.

Sceptics’ position

“To succeed in making clean hydrogen, it will therefore require the production of green electricity, and many electrolyzers,” says Christelle Werquin, General Delegate of the France Hydrogen Association. “We will need it, but we cannot wait because we must produce massively and lower costs today. We consider that we must focus on low carbon, i.e., less than 3.38 kg of CO2 per kilogram of hydrogen,” claims Christelle Werquin.

“I’ve lived through, I think, five economic bubbles in my professional career, and I’m afraid to say I start to recognise the pattern,” green technology analyst Michael Liebreich told the World Hydrogen Congress in Rotterdam. The analyst first recalled that the vast majority of hydrogen used today (94 million tonnes) is still produced from gas and coal and therefore harmful to climate change.

“Europe won’t be able to produce on its own: there’s not enough space, it’s too expensive and it takes too long. Tomorrow, France’s energy mix will be nuclear, a little local hydrogen and imported renewables in the form of ammonia or hydrogen. Of the 20 million tonnes of hydrogen foreseen in the REPowerEU plan, Brussels expects half to be imported,” said Pierre-Etienne Franc, CEO of Hy24.

H2 engines in mobility and transport

Some hydrogen mobility projects can be successful. The low hydrogen yield can progress, especially at the electrolysis level through waste heat recovery. And hydrogen’s energy density and the fast charging it allows (provided stations are available) can make it stand out for very frequently used vehicles and heavy mobility, say hydrogen advocates, who also point to the risks of reliance on critical metals that batteries pose.

Renault bets on hydrogen-powered fuel cells

Alpine CEO Laurent Rossi has confirmed that the Renault group’s sports brand’s three future production vehicles will be powered by electric motors. The manufacturer will start by launching in 2024 a sports car, described as a ‘supercharged R5’, as part of the ElectriCity pole. Due to be assembled soon, the GT X-Over crossover is expected to be launched in 2025, a year ahead of the launch of the electric A110’s electric offspring produced by Lotus in England.

To drive sustainable mobility, Renault Group is turning to cleaner technology and engines, such as that used on traditional electric cars, but also hydrogen fuel cell cars. By combining fuel cells with ‘green’ hydrogen, Renault Group is ushering in a new era for mobility, a necessary shift for the coming decades. While still relatively small for the time being, it is a market that is constantly growing. There are multiple advantages to running vehicles on hydrogen fuel cells: cars emit only water vapour, run silently, offer a driving range and performance that are on par with current cars, and take only 3 to 5 minutes for a complete refill.

Race against time

Beyond Europe’s borders, the competition for carbon-free hydrogen has already begun across the globe. While Joe Biden is bringing the United States out of the shadows and into the light on hydrogen with his Inflation Reduction Act plan, China and South Korea are already using this energy vector for several thousand vehicles and have the infrastructure to accommodate future imports. Europe is, in theory, well positioned, thanks to strong public support and good cooperation between industry and research decision-makers.

Europe still has to stay in the game and move as fast as other countries. The US is fortunate to be self-producing and will want to export. Europe, South Korea, Singapore will struggle to import cheaply. Therefore, Europe’s major ports must now be equipped to receive hydrogen and redistribute it.

It remains for companies to adapt and integrate hydrogen into industrial processes. “You also have to think about new hydrogen professions, from engineer to technician,” argues Christelle Werquin. Therefore, schools must integrate hydrogen into their subjects.

Investment in hydrogen stocks on the stock market

The potential of hydrogen as an alternative to fossil fuels appears significant. This is why it can be interesting to invest in this sector. There are different ways to invest in shares of hydrogen-related companies on the stock exchange. Several large companies are active in the production of hydrogen or fuel cells that power vehicles. A major advantage of these large companies’ shares is that they also have many other businesses, which helps dilute risk. If developments are slower than expected, these companies are less affected. Here are just a few examples:

- Shell

Energy giant Shell has been studying possible applications for hydrogen for decades. The company thus has all the necessary expertise and believes it can play a leading role in the development of the hydrogen economy. In addition to hydrogen, Shell is investing heavily in other sustainable technologies. Of course, the majority of turnover and profits still depend on oil and gas. Thus, by buying shares in this company, the investment in hydrogen represents only a small part of the amount invested.

- Air Liquide

France’s Air Liquide has long been a major producer of hydrogen. The company has fifty years of experience in this field and a unique knowledge of the entire hydrogen value chain. It wants to make its hydrogen production increasingly sustainable. From 2020, it has increased its investment in hydrogen mobility.

- Toyota

The Japanese group is a pioneer in terms of hydrogen-powered cars. Indeed, in 2014, it was the first manufacturer to produce a hydrogen-powered car, the Toyota Mirai. Just over ten thousand of them have been sold and a second generation of the model was recently launched. Toyota has high hopes for the hydrogen economy. The company is thus behind the construction of Woven City at the foot of Mount Fuji, Japan’s highest mountain, in 2021. It’s a small town that runs entirely on hydrogen and will serve as a proving ground.

- Hyundai

One car manufacturer working hard on hydrogen is Hyundai. The Korean company wants to launch a hydrogen version for all its models from 2028. To achieve this, it is investing billions in developing and selling hydrogen technology.

Investment in hydrogen small caps

Another approach is to invest in small companies that focus exclusively on hydrogen development, as an important part of the energy transition. However, this approach involves several risks. If hydrogen development does not progress as quickly as expected, then it will have a much greater impact on these small companies. The price trend is also more volatile. In recent years, the shares in several small companies have seen strong price increases due to increased interest in hydrogen. However, the price then fell. Examples of these small businesses: Hydrogen Refueling Solutions (HRS), HDF Energy (Hydrogène de France), Powercell Sweden, Ballard Power, Plug Power, NEL Asa, FuelCell Energy.

Investing in H2 on the stock market with ETFs

In addition to investing in individual stocks, you can also invest in a basket of hydrogen stocks through ETFs. In this way, you invest in a single acquisition in many companies that are involved in hydrogen development. An example of an ETF with stocks in the hydrogen sector is L&G Hydrogen Economy. To buy ETFs, you need a broker to place an order.

Conclusion

Global awareness of the importance of sustainable development has put hydrogen in the spotlight. Cars, trucks, and other vehicles could be powered by hydrogen in the future. Hydrogen could even prove a solution for heating buildings. Investment in hydrogen, driven by the imperative of decarbonisation and energy sovereignty, has reached the point where some experts point to the risk of a bubble and remind us of the limits to mobility.

The question that remains is whether investing in hydrogen is a smart move.