Post COVID-19 and the Hydrogen Sector

Following the unprecedented Covid-19 outbreak currently unfolding, Hydrogen Europe published its latest paper: ‘Post COVID-19 and the Hydrogen Sector – A Hydrogen Europe Analysis’. The study outlines the need for and rationale behind rapid action as a result of the Covid-19 impact.

The clean hydrogen sector has finally reached the pre-commercialisation phase and is ready to play its essential role in decarbonising our economies. Clean hydrogen is a perfect partner to the European Green Deal, enabling the realisation of its climate, environmental and economic development goals.

The economic crisis following the Covid-19 pandemic may cause a significant delay to the adoption and commercial roll-out of clean hydrogen. It may even permanently endanger the capacity of the clean hydrogen sector to take-up its role as the missing link in the energy transition.

As a result, the clean hydrogen sector faces three major risks:

- In the short term, small, innovative companies which form the backbone of the technology providers are likely to suffer a major shortage of liquidity due to a steep drop in revenues which will result in staff cuts or even bankruptcy;

- Believing that climate and environmental policy commitments will take a backseat in economic recovery plans in Europe and elsewhere large companies which were planning major investments in clean technology are likely to abandon or severely scale-down these plans;

- Investors may, for the reasons as presented above, be less inclined to finance the planned growth of the sector.

A swift, decisive and coordinated action is necessary to address the risks and, at least, dampen the negative impact that they may have on the deployment of clean hydrogen technologies and on our transition to a net carbon, yet powerful and wealthy economy.

To stave off the risks presented above, Hydrogen Europe calls upon the European Commission and all other relevant policy actors to take the following support actions:

- Provide clear and immediate signals that, despite the current crisis, the European climate and environmental objectives will be maintained and even raised. In addition, provide clear policy support signals for the hydrogen industry. The impact of this cannot be overstated and its cost is low.

- Link bailouts/financial support provided in the sectors of energy, transport, energy intensive industries and heating and cooling to strong commitments in terms of decarbonisation in the short and medium term (5-10 years).

- Directly support the hydrogen value chain by compensating for short term revenue loss in value of EUR 450-500 million.

- Provide certainty on the continuation of the European research and innovation partnership on clean hydrogen with increased budget and scope.

- Immediately unlock first commercial markets for green hydrogen through market incentives (e.g. increase renewable energy share quotas in the Renewable Energy Directive (RED II), implement quota for clean/green aviation fuels, etc.), regulation (e.g. enable green power supply through grids) and public funding (e.g. ETS Innovation Fund, Important Projects of Common European Interest (IPCEI), Carbon Contracts for Difference, etc.).

According to Hydrogen Europe, these support actions would help protect thousands of highly skilled jobs and will enable to retain the planned portfolio of investment projects, which have been estimated to be at least EUR 15 billion and as high as EUR 130 billion by 2030.

Is there a need to take action?

At the end of this crisis, companies will look at their results. They will be very bad. It is already clear that many companies will emerge from the crisis with significantly worse balance sheets – with lower assets and high debt levels. As a consequence, they will have to tighten their spending, even when the health crisis is over.

Everything which is not essential for their short-term profitability and core business will be on top of the cuts list. Even if they would like to act differently, company CEOs will not be able to escape that logic due to shareholders pressure.

Unless public authorities are able and willing to convince them to act differently by providing support only on the condition that certain climate/future oriented investments are maintained (i.e. a huge climate targeted recovery plan). Similarly, investors are also already fleeing from any risky assets to the safety of cash, gold and other safe assets which is driving the share market down. As a consequence, long term investors, including pension funds, facing big reduction of their asset valuations will be reluctant to invest in risky projects and risky SMEs.

Furthermore, fears of a global economic recession have brought oil and gas prices to their lowest levels in the last two decades. As the economic fallout of Covid-19 could reduce the world’s oil demand growth for the year ahead, it is feasible that the oil and gas prices will not rapidly recover, further undermining competitiveness of green investments.

The first signs of this happening are already there with Bloomberg NEF cutting its predicted growth in new solar installations by 8%, which would mean a decrease in new additions for the first time since the 1980s, with wind also facing a considerable downside risk.

Another key issue is that 70% of the world’s clean energy investments are still government-driven, either through direct government finance or in response to policies such as subsidies or taxes. With such low oil and gas prices, the importance of government’s role in the energy transition is only going to increase.

Yet, with the economic fallout from the Covid-19 pandemic already predicted to be much more severe as that of the global financial crisis, with energy demand contracting by 6% in 2020, the largest in 70 years in percentage terms and the largest ever in absolute terms, the impact of Covid-19 on the energy demand in 2020 would be more than seven times larger than the impact of the 2008 financial crisis on global energy demand.

Governments worldwide will face an immediate challenge of kick-starting their national economies. As recently announced recovery plans show, the value of fiscal measures undertaken by EU countries varies from 1-2% up to 12% of GDP, with Germany committing up to EUR 156 billion of fiscal measures and a further stabilisation fund worth EUR 600 billion. When combined with a loss of tax revenues, this will substantially increase the level of public deficit and will almost certainly reduce funding and investments in climate change mitigation and adaptation.

The worst risk is associated with the temptation to abandon climate objectives all together: already the Czech Prime Minister has called for the European Green Deal to be scrapped and a Polish Deputy Minister of State Assets has demanded the EU ETS to be abolished from 2021.

Taking all of the above into consideration, it is clear that, if no decisive action is taken, renewable energy and clean technologies industries – with low carbon hydrogen among them – face a considerable downturn risk.

Why should action be taken?

While it’s understandable that in the short term, the measures aimed at fighting the Covid-19 pandemic should take priority, followed up with a focus on propping up the economy, we should not forget that, long term, the climate crisis is still the biggest challenge, and it will still have to be tackled. The International Energy Agency (IEA) estimates that, although global CO2 emissions are expected to decline by 8% in 2020, the rebound in emissions may be larger than the decline, unless the wave of investment to restart the economy is dedicated to a cleaner and more resilient energy infrastructure.

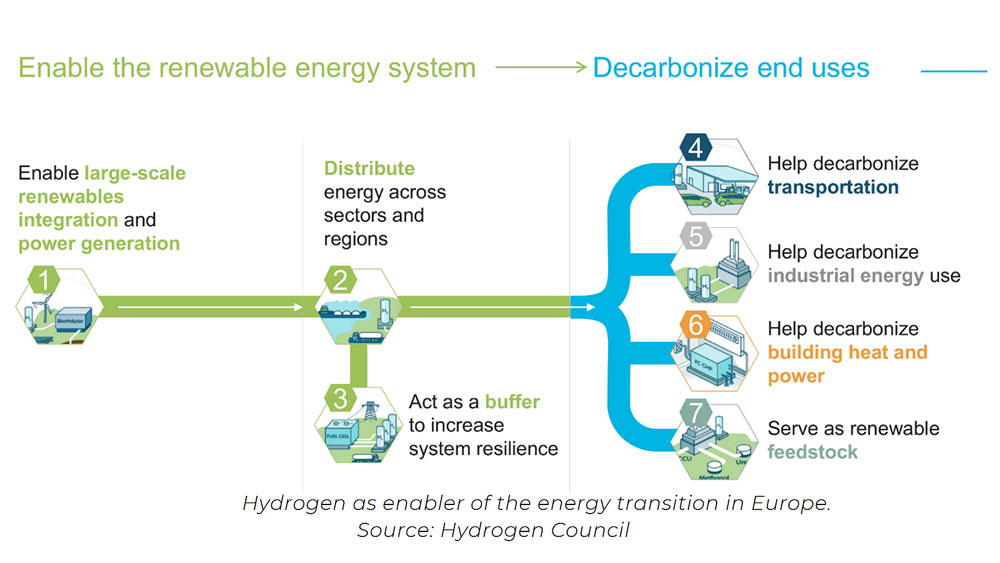

With that in mind, it should be noted that the energy transition in the EU will require hydrogen at large scale. Without it, the EU would miss its decarbonization objectives. Hydrogen represents a versatile, clean, and flexible energy vector.

Hydrogen is not simply a potential contributor to solving the challenges posed by the energy system transition, offering a future solution with a number of advantages, particularly when used in fuel cells but it is a solution without which Europe cannot achieve its 2050 goals on greenhouse gases (GHG) emissions reduction.

The decarbonization of the gas grid that connects Europe’s industry and delivers more than 40% of heating in EU households and 15% of EU power generation requires hydrogen.

In transport, hydrogen and hydrogen made fuels are the most promising decarbonization options for aviation, ships, trains, trucks, buses, large cars, and commercial vehicles, where the lower energy density (hence lower range), weight, high initial costs, and slow recharging performance of batteries are major disadvantages.

Hydrogen is the best (or only) choice for at-scale decarbonization of selected segments in transport, industry, and buildings. Specifically:

- The decarbonization of the gas grid that connects Europe’s industry and delivers more than 40% of heating in EU households and 15% of EU power generation requires hydrogen.

- In transport, hydrogen and hydrogen made fuels are the most promising decarbonization options for aviation, ships, trains, trucks, buses, large cars, and commercial vehicles, where the lower energy density (hence lower range), weight, high initial costs, and slow recharging performance of batteries are major disadvantages.

- Industry can use hydrogen to produce high-grade heat, it can use it directly as a chemical feedstock (for example, in steelmaking, substituting coal-based blast furnaces; ammonia production; hydrotreating in refineries in chemical processes and others) or use it as synthetic methane in order to decrease hard to abate CO2 processes (e.g. in the production of cement).

The potential for hydrogen to essentially replace fossil-based energy while at the same time create jobs and increase long term EU industry global competitiveness, has been recognised by identifying hydrogen technologies and systems as one of several strategic value chains for a future-ready EU industry. None of this will change because of the Covid-19 pandemic.

Furthermore, although the hydrogen sector is still in its early stage of development – it is growing fast. While the current clean hydrogen technology market is not worth more than EUR 2 billion at the moment, our analysis shows that EUR 15 billion of investments that have been planned by the sector in the near term may be in jeopardy.

Over longer term, Hydrogen Europe estimates that there are currently almost 70 projects at varied stage of development that would be at risk if no action is taken.

The total electrolyser capacity planned for installation in those projects is over 22 GW (equivalent of 15 to 20 nuclear reactors). If these projects do not go through, it would equal to a loss of revenues for the EU electrolyser manufacturers of over EUR 13 billion over the next 10 years (taking into account only the end product and dismissing indirect revenues along the supply chain). Considering all additional investments in hydrogen transport, distribution and storage, refuelling stations, vehicles, pipelines, etc. the total value of planned projects that may be affected by the crisis is around EUR 120-130 billion.

What can be done?

As soon as the immediate health crisis caused by the Covid-19 pandemic will subside, the attention should move to ensure that the EU economies are growing again. Yet, only returning to the status quo is not the way forward. We should learn from the 2008 global financial crisis and make sure that clean hydrogen, clean energy, clean transport and smart infrastructure are a central part of any stimulus program. The policies and instruments deployed should ensure that the recovery is durable, i.e. the growth stimulated should be sustainable. Failure to do so might lead only to a temporary recovery in industries that are unsustainable in the long term. This implies integrating long term concerns even in any short-term policy packages.

The immediate actions can include:

- Compensate companies for coronavirus impact (cover salaries while re-skilling, production disruptions, etc.) with special consideration of more vulnerable SMEs.

- Re-orientate manufacturing (investments for competitiveness and up-scaling).

- Strategic ‘investment’ (any kind of financing, loans, guarantees, and even equity) to ensure EU’s capacities along the hydrogen value chain.

- Protect and support the owners/investors against financial distress, and ensure integrity of the EU value chains.

One other immediate action, whose impact cannot be overstated, and one which is cost-free, is an urgent and clear confirmation of the EU’s commitment to its climate goals and to the green deal, accompanied by continued and clear policy support signals for the hydrogen industry. This is essential to support investor confidence.

Over medium term, the actions should also include stronger support for R&D in clean technologies – historically R&D investments in the private sector move in parallel to the GDP growth, hence in times of economic downturn it is crucial for increased public funding to cover the gap and ensure at least continuity in strategic research programmes.

In similar ways to investment in high speed broadband communication networks being part of the economic stimulus packages after previous economic crisis, this time a similar place should be reserved for alternative fuels infrastructure and clean energy systems, accompanied by regulatory frameworks which support open access and competition.

At the same time, with onshore wind and solar power already being cost competitive with fossil fuels (and getting cheaper still), addressing the structural and regulatory issues that are preventing increased renewable energy penetration into grids is more likely to bring about a far greater positive long-term effect.

Investments in energy storage, interconnections as well as accelerating the decarbonisation of heating, transport and industry should be prioritised over direct support of renewable energy projects. Although, having said that, extending existing tax breaks or support mechanisms for renewables is still advisable.

Furthermore, it should be restated that misplacing government subsidies to unsustainable business models may undermine the long-term sustainable growth capacity of the European economy. Even if they would provide short term demand stimulus, they can have a negative effect by postponing needed technology restructuring or fuel switch – thus wasting taxpayer funds in the long run and delaying significantly our fight against climate change. Hence, any bailouts that go to airlines, shipping companies, power, oil and gas or energy intensive industries, should be handed out only on the condition of the public funds recipients agreeing to meeting ambitious decarbonisation goals within the next 5 to 10 years.

There are a number of measures that can be taken without a need for additional direct public spending, including:

- Removing fossil fuel subsidies and tax breaks, thus reducing the funding gap of clean hydrogen projects (and other clean energy projects as well), which is still mostly directly related to the difference versus the fossil fuel benchmark solution.

- Removing unnecessary regulatory barriers and requirements, like proving the additional character of renewable electricity imposed in the RED II.

Relying on existing market-based instruments, i.e. Power Purchase Agreements (PPAs) combined with Guarantees of Origin (GO) for electricity would not only reflect market reality but would help facilitate a number of green hydrogen investment projects.

Both of those measures, while not directly providing any additional funding to companies active in the sector, will go a long way of ensuring the projects that are planned are actually carried out and not put on hold, or cancelled altogether.

Who should be supported?

The hydrogen sector can be split into two groups of companies:

1) SMEs focussed on the hydrogen sector, most as technology providers, some as project developers. These companies usually do not make profit and do not have (yet) a regular business, but they hold a great innovation potential, usually ahead of the game worldwide. They mostly live from the prospect of making money in the future (their current/future/stock value is very much dependent on the vision of the future). Hence their survival is very dependent on:

- The decision of large companies in transport, industry and energy sectors to actually launch and carry out the decarbonisation projects they have announced or planned.

- The willingness of their shareholders to continue bringing equity and let them ‘burn’ cash with the hope of a return in the future.

- The willingness of governments to move forward fast with the policies that will make the hydrogen business viable and inject a level of certainty in their business model and future cash flows projections, therefore reducing risk and easing access capital, including debt.

In the very short term, they may face serious cash flow (liquidity) issues that may lead to bankruptcy. In addition, a number of them are in the middle of very large investments to increase their capacity of production. These investments are usually carried out in phases and, if investors panic (in the absence of strong governmental signals), they may be tempted to stop them.

2) Large companies that will trigger the large deployment in the hydrogen sector, e.g. the big energy companies, the big industry companies, the transport industry. Dozens (if not hundred) projects have been announced but not yet decided. These projects are normally (1) not profitable and (2) a preparation for longer term business cases when policies will be there and costs lower.

First, the companies are likely to cut everything which is not essential for their immediate profitability and, clearly, projects for which no final investment decision was made (all hydrogen projects basically) will be the easiest to cut, reinforcing the need of a recovery plan to escape this logic.

Second, companies will perceive a higher uncertainty about the arrival or not of tougher climate policies. Hence, the need for governments to give them a strong indication that these policies will come and rather sooner.

The situation is slightly different for some transport OEM and for equipment providers that develop hydrogen equipment in addition to a large existing business (e.g. Plastic Omnium, Bosch, etc). They are not developing ‘projects’ with a high visibility like the energy/industry companies. They rather have internal decisions to develop new products (new tank, new test bench, new vehicle models) which are often less visible.

Although the whole hydrogen value chain (including potential users of clean hydrogen) is represented within the membership of Hydrogen Europe, obviously not all European companies active in the sector are also members of the association. In reality, the upstream sector contains a disproportionately large number of SMEs.

A recent European hydrogen and fuel cell supply chain analysis report, identifies a total of 445 actors, of which 246 are research organisations. Out of the 189 industrial actors, the majority (112) are upstream supply chain actors. There are 68 fuel cell and hydrogen system integrators (e.g. fuel cell system, electrolyser system, hydrogen storage system, HRS) and 27 vehicle integrators.

In total Hydrogen Europe estimates that there are at the very least around 280 companies actively developing hydrogen technologies in the Europe currently, out of which around 170 are SMEs. Together the SMEs dedicated to hydrogen and the hydrogen departments of the companies with a broader scope employ around 16.000 people at the moment (with a significant growth potential).

When it comes to taking actions aiming to overcome the negative economic impact of the COVID-19 pandemic, Hydrogen Europe’s position is that the above-mentioned actions should cover the whole value chain.

How much will it cost?

The following estimations have been based on the assumption that the total value of financial support will be gauged in a way as to cover the negative impact of the Covid-19 pandemic – without considering any additional funding, that would be needed to scale-up manufacturing capacity etc.

The estimation has been based on an assessment of the value of lost revenues by industrial actors active in the hydrogen sector. The lost revenues have been estimated using two independent approaches:

- A top-down approach – based on a survey conducted among companies active in the hydrogen sector, during the week of 30.03.2020 – 03.04.2020.

- Bottom-up approach – based on an estimated negative impact, that the economic slowdown will have, on the revenues of companies active in the hydrogen sector. Calculated to be 30% of the value of the 2020 hydrogen market in the EU (considering only technology manufacturing and excluding the sales of hydrogen itself).

On average, without any economic measures being taken, revenues are set to decrease by 50% in 2020, disproportionately affecting SMEs (decrease of 55%) vs 42% decrease for large companies.

Extrapolating the survey results to the whole sector, of estimated 280 companies, the total financial support needed to preserve the workplaces in the hydrogen sector is around EUR 450 million.

Based on experience from previous years and given the current state of the market development, the most conservative estimation made by Hydrogen Europe shows, that, in normal circumstances the total end products market value in 2020 would amount to at least EUR 650 million.

Taking into account the expected duration of the lockdowns in European countries and related slowdown of economic activity, as well as seeing that on average the valuation of stocks of companies active in the hydrogen sector fell by more than 30%, a short-term measure aimed at alleviating the negative impact resulting from the Covid-19 pandemic, should cover at least 25-35% of estimated annual revenues of the sector, i.e. EUR 375-525 million.

It should be also noted that the support plan should be treated as investment rather than cost. As has been demonstrated over the years by the Fuel Cell and Hydrogen Joint Undertaking (FCH JU), the hydrogen sector is willing to follow-up the initial support with its own investments in the field and create EU added value.

Under Horizon 2020 rules, the FCH JU was required to demonstrate a leverage effect of 0.57. This requirement was significantly over-achieved. By the end of 2018, the leverage effect from Hydrogen Europe members alone had reached EUR 1.36. Furthermore certified, reported and planned additional activities over 2014 – 2020 total an amount of EUR 1.218 billion. This means that, taking into account in-kind contributions of private partners, the total leverage effect (in projects and in additional activities) is 2.67.

In other words, for every euro of EU contribution for all signed Horizon 2020 FCH JU grant agreements, private partners (members of Hydrogen Europe and Hydrogen Europe Research) will have committed to spend EUR 2.67 either on FCH JU projects or on additional activities.