Trilemma and Transition: Energy Industry Insights 2023

- Energy professionals are prioritizing secure energy in the trilemma, followed by clean and then affordable energy

- Less than half the industry is confident in meeting decarbonization and climate targets, despite transition progress

- Majority in renewables believe energy security concerns will lead to increased investment

- The power sector overwhelmingly points to an urgent need for greater grid investment

- Half of oil & gas professionals expect increased investment in gas in the year ahead

Energy security concerns outweigh clean and affordable energy on the list of priorities for energy companies globally, as the industry says the energy system will not resolve the energy trilemma in the next decade, according to DNV’s research analysing the views of more than 1,300 senior energy professionals, based on a timely survey conducted during December 2022 and January 2023.

Energy security will take centre stage for oil & gas and power sectors in the year ahead. Renewables players are maintaining their clean energy focus, while the priorities of industrial energy consumers contrast with their suppliers and partners, as they prioritize accessible and affordable energy.

Just 39% of energy professionals are confident about meeting decarbonization and climate targets, yet progress in the energy transition is the greatest driver of confidence among energy professionals for the year ahead, and a majority believe the energy transition is accelerating.

Resolving the energy trilemma – delivering secure, clean, and affordable energy – is viewed by the energy industry as a long-term goal, according to Trilemma and Transition: The momentum to break barriers, the latest edition of DNV’s annual research on the outlook for the energy industry.

Few in the industry (17%) believe the transition will deliver secure, clean, and affordable energy in the next decade, to all parts of the energy system in their country.

Most (41%) see this being achieved in 10-20 years, while a sizable group (32%) believe this crucial outcome of the energy transition will not be realized until well into the 2040s.

There is general agreement on this outlook across regions, with only energy professionals in North America being slightly more conservative on the timeline.

“The energy trilemma is in focus in 2023 as the energy system struggles on all three aspects. Russia’s invasion of Ukraine has reminded the world how fragile energy security can be; coal plants are being fired up while renewables projects come under pressure; and energy consumers are being pressed on the cost of energy,” says Ditlev Engel, CEO, Energy Systems at DNV. “The trilemma is also in transition. In a complex and difficult year for the energy industry, we see the trilemma leading to competing priorities. But in a decarbonized energy system, energy sustainability, affordability, and security actually all pull in the same direction, and the public and private sector can resolve the trilemma through a new approach to scaling and implementation.”

Some 80% of professionals in the renewables sector believe energy security concerns will lead to increased investment in renewables in the year ahead, while a majority (61%) from across the energy industry say their company can become more profitable by improving sustainability.

In contrast, a record year of profits for the oil and gas industry has redefined what acceptable profits look like for the sector.

In 2022, 52% of oil and gas executives said that their organization would make acceptable profits if the oil price averaged USD40 to USD50 per barrel.

For the year ahead, just 39% feel the same. Half of respondents from the oil and gas industry (53%) say that their organization will increase investment in gas in 2023, up eight percentage points year-on-year.

Some 43% of the oil and gas industry expect to increase investment in oil, up nine percentage points. Oil and gas companies are slowing their shift into areas outside of core hydrocarbons businesses and holding back their focus on decarbonization compared to 2022.

In 2023, the energy industry as a whole expects to increase investment in clean energy sources and carriers. Half of energy professionals expect their organization to invest in low-carbon hydrogen/ammonia (52%), and similar proportions in wind (49%) and solar (46%).

Over a third expect their organization to increase investment in carbon capture and storage.

In enabling technologies, six in 10 say their organization is increasing investment in energy efficiency and digitalization, and half the industry is investing in energy storage technologies.

“The energy transition has accelerated through both a pandemic and an energy crisis, and this has left markets striving to keep up, across transmission and distribution systems, supply chains, permitting and licensing, financing, infrastructure, and the workforce,” says Engel. “In the year ahead, we may see a slowing in the scale-down of fossil fuels, but potentially also a slowing in the scale-up of clean energy – if barriers aren’t overcome. Governments and policymakers must step up and remove barriers to implementation, and everyone in the energy industry must push forward in the transition.”

Breaking the barriers

DNV’s research finds signs that barriers could slow the pace of the energy transition in the year ahead, but momentum is building to break these barriers as societies increasingly feel the effects of climate and energy crises, and as bottlenecks become more acute in holding back progress.

There is strong agreement in the power sector about an urgent need for greater investment in the grid, while just a fifth in the renewables sector say current transmission capacity planning is sufficient to enable the expansion of renewables.

Three quarters of the energy industry says that supply chain issues are slowing down the transition, while less than half the industry (44%) expects a significant improvement in the availability of goods in 2023.

For the renewables sector, lack of policy/government support and permitting/licensing issues are the greatest barriers to growth, and a strong majority (88%) say accelerating permitting and licensing is critical to meeting climate goals.

Some 40% of energy companies globally are finding it increasingly difficult to secure reasonably priced finance for projects. Regionally, finance is easier to access for organizations in North America and Europe. By sector, almost half of power companies (47%) are finding it increasingly difficult to secure financing, and 62% of industrial energy consumers.

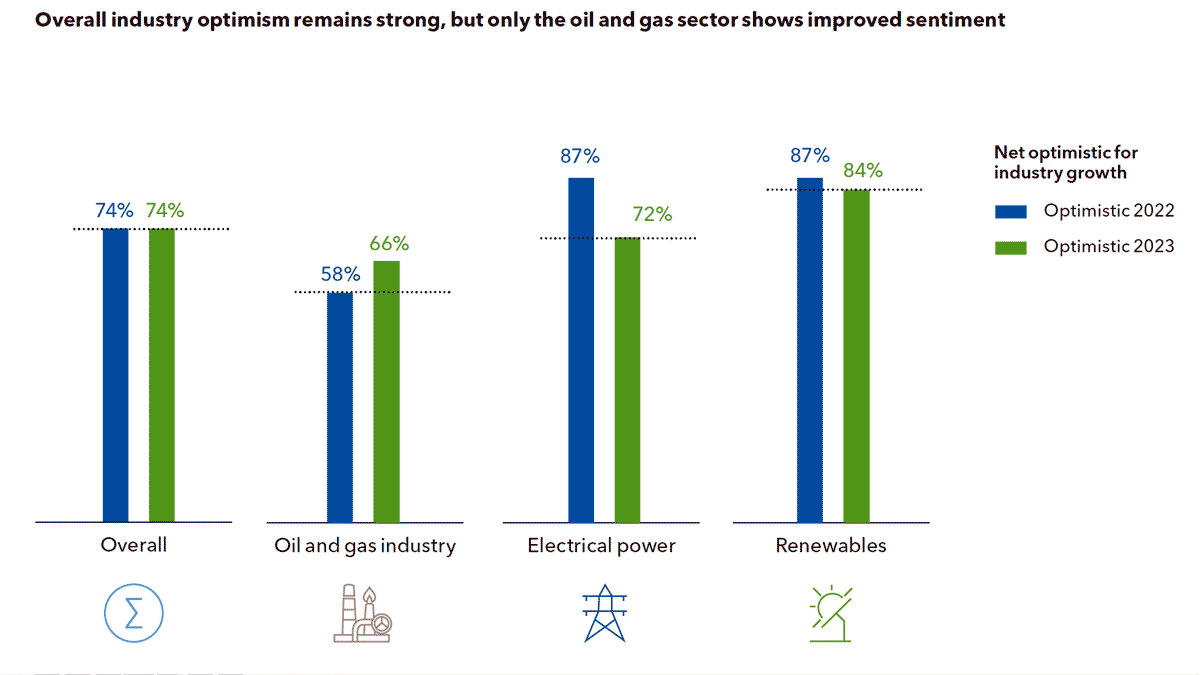

Peak profits (perhaps) for oil and gas

Among oil and gas respondents, growth prospects have improved in the year, rising from 58% to 66%. This is perhaps a modest jump considering the record-shattering profits that many oil and gas companies have posted for 2022. For instance, nearly $200bn in (adjusted basis) profits were made by the five supermajors: ExxonMobil ($55.7bn), Chevron ($35.5bn), TotalEnergies ($36.2bn), BP ($27.7bn) and Shell ($39.9bn) – while several state-owned oil and gas giants did even better.

It was arguably the most profitable year in the whole history of oil and gas, and it will, for a short time at least, redefine what acceptable profits look like.

Foto: Oil and gas industry in 2023: slowing the pivot into areas outside of core hydrocarbons, reduced pace of decarbonization, and redefining acceptable profits.

A way to win in the new world

Many factors support respondents’ optimism for their organization in the year ahead, with emphasis differing by sector. For example, sentiment among oil and gas industry respondents remains tied to market cycles, with oil and gas prices and global economic conditions being much more important drivers than for other parts of the energy industry.

However, “progress in the energy transition” was the stand-out, top driver of optimism – the leading factor for electrical power, renewables and even for industrial energy consumers, and the second highest among oil and gas respondents. This is a remarkable result, given that organizations have typically derived confidence from things like market positioning, new investment, or conventional growth strategies.

Foto: Energy transition progress has become a driver of business confidence

Energy security, the energy trilemma priority

If you have ever shopped for a mountain bike you may have heard the decisions you face summarised with the maxim: light, strong, and cheap – pick two. It reflects the impossibility of getting everything you want, and the need to compromise in at least one area. Beginners typically leave the store with a heavy bike, while enthusiasts leave with a light wallet.

For years, many in the energy industry have viewed the energy trilemma as a similar scenario, implying a need to prioritise between: secure, clean, and affordable. The difference, which events in 2022 demonstrated, is that we cannot – for any extended period – have a strategy that compromises on any aspect of the energy trilemma.

Perspectives on the trilemma change over time. For example, in recent years renewables have become more secure and affordable than in the past. Russia’s invasion of Ukraine, and the pandemic before it, have reminded us of how fragile energy security can be, and how it can impact affordability and clean energy – compromises have been needed across all areas. In 2022, this was especially the case in Europe, as consumers saw their energy bills rocket, coal plants were fired up, and there was a real threat of a gas supply shortfall (relieved only by LNG imports and an unusually mild winter).

Different trilemma priorities

Across the energy industry, secure and reliable energy is the greatest priority in the trilemma for 2023, followed by clean and sustainable energy, with accessible and affordable energy in third place.

However, the different sectors have varying biases.

Energy security takes centre stage for oil and gas and electrical power, renewables respondents make clean energy the top priority, while industrial energy consumers prioritise accessible and affordable energy much more than the energy industry sectors.

“We need an orderly transition,” says Michael Cohen at BP, “so if supply-related pressure results in disruption or price spikes, we lose one foundation of the three-legged stool of the energy trilemma. As a result, we need to see more focus on policies, societal behaviours, and preferences that help to reduce the demand for carbon-intensive fuels, so that we do not get misaligned in terms of supply and demand.”

It is not a simple case that energy strategies and projects have to prioritize one or two aspects over another. In the future, a renewables-based energy system – supplying both green electrons and molecules – has the potential to address all aspects of the transition, such as through greater electrification, energy storage, and grid capacity, or through large-scale low-carbon hydrogen, both combined with low-cost renewable generation.

Indeed, 80% of renewables respondents believe energy security concerns will lead to increased investment in renewables in the year ahead.

But will energy security concerns not also lead to increased investment in natural gas and LNG? “One of the big things for us is ensuring energy security,” says Daniel Toppin, Head of Data at National Gas, the operator of Britain’s gas transmission network. Recent world events have certainly highlighted just how essential gas is across the world. This put gas back in the spotlight, because it shows how gas supply will become a major problem in future if we don’t do something different.”

National Gas ultimately sees hydrogen as the answer, but the extent to which this will (or should) scale is another area of debate.