European CCS Bank: A Game-changer for the EU?

To accelerate Carbon Capture and Storage (CCS) project deployment in the EU, the International Association of Oil & Gas Producers Europe (IOGP Europe) calls for the establishment of a “European CCS Bank”, a competitive Carbon Contracts for Difference (CCfD) auctioning mechanism under the Innovation Fund as of 2025.

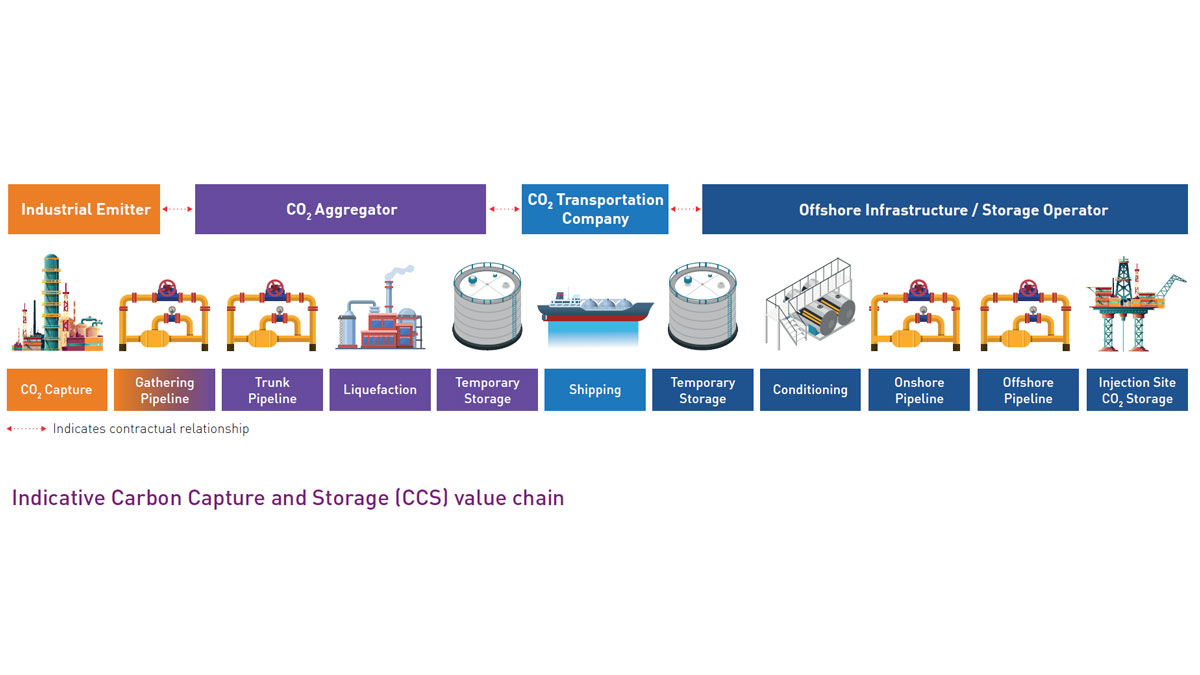

While CCS is now widely recognized as a key technology for industrial decarbonization, project deployment is still too slow. Although a 50 Mt CO₂ annual storage injection capacity target is set for 2030 under the Net Zero Industry Act (NZIA), the disparity between the cost of CO₂ capture and carbon allowance prices under the EU ETS makes capture investments economically unviable for emitters, therefore preventing the conclusion of commercial agreements along the CCUS value chain.

Without a sustainable business case, delayed investments and project deployment prevent the EU from decarbonizing its industry while preserving competitiveness. The Industrial Carbon Management Strategy (ICMS) provides the needed framework for CCUS; it is now time to deliver the tools stemming from it, starting with financial incentives.

The European CCS Bank, a competitive CCfD auctioning mechanism, offers 4 key benefits:

- A transparent market-based instrument that rewards cost-efficiency

- De-risking capture projects by improving financial viability and predictability

- Price discovery and market formation

- Reduced administrative burden.

“If we do not incentivize CO₂ capture for strategic industries, we won’t decarbonize, we will deindustrialize the EU. Contracts for Difference have helped scale up renewables and are now used for hydrogen projects. The European CCS Bank can create the value chain reaction needed to accelerate CCS deployment as of 2025,” said François-Régis Mouton, Managing Director, IOGP Europe.

The key role of Carbon Contracts for Difference (CCfDs)

In Europe today, the main financial trigger for a company to invest in capture technologies as part of the CCS value chain is only provided if it faces full exposure to the costs of the ETS, and the ETS price exceeds the total CCS value chain costs.

However, today, not all industries that will need CCS to decarbonise are fully exposed to the effects of the ETS, and the ETS price is not yet high enough to enable companies to invest in CCS. The EU needs to bridge this gap until the ETS price increases in line with the next phase of the EU’s decarbonisation – otherwise no incentives will be available for emitters to invest in capture technologies and, consequently, pay the cost for transport and storage.

As CCS remains, in its nascent phase, a capital-intensive technology, there is the need to bridge this gap until the ETS price increases in line with the next phase of the EU’s decarbonisation.

IOGP Europe’s analysis based on Rystad data estimates the cost of the full CCS value chain in the EU at a level between 130-230 euro per tonne (€/tonne) of CO2. The capture part typically accounts for more than half of the total (depending on the type of capture technology) and is estimated, for the vast majority of industries, at approximately 90 to 130 €/tonne of CO2.

By covering the cost gap between a stable ‘strike price’ and the fluctuating ETS allowance prices, CCfDs offer a stable, predictable environment for investors, ensuring the economic viability of capture investments (and the related costs of contracting for transport and storage). Those contracts compensate – the entities emitting CO2 and subject to ETS allowances – for the delta between the needed allowance level and the prevailing ETS allowance market price at a given point in time.

National schemes have already successfully been deployed (e.g. SDE++ in the Netherlands) or are currently being implemented (such as in France, Germany and Austria). By providing stability and predictability of future revenue streams, such contracts enable investments in new projects that would otherwise take many years to develop or not come to market at all if they were solely dependent on volatile market prices. It must be noted that other supporting frameworks than CCfDs exist – e.g. stable tax credits, or dedicated funds – and that each one of them aims to provide emitters with long-term certainty on the value of the abated CO2.

It is important to emphasize that European CCfDs should be designed in a way that avoids discriminatory situations and allow for integration with other financing instruments, at the Member State or European level. As the financing gap may vary significantly across different industrial sectors and their respective challenges, this approach can provide support to industries facing greater decarbonisation hurdles due to a larger financing gap. When used in conjunction with other value-chain instruments, as provided for in the EU ETS, CCfDs offer a promising path to a commercially robust future for CCS deployment.

A competitive auctioning scheme for CCfDs dedicated to CCS projects

In its ICM Strategy, the Commission put forward the suggestion of CCfD schemes at the European level to support CCS projects, envisaging the creation of a competitive mechanism under the Innovation Fund.

IOGP Europe strongly supports the Commission’s recommendation and as announced at the last ICM Forum in Pau, encourages starting the development of a CCS Bank for Europe as soon as possible – building on the achievements of the first pilot auction for RFNBO H2 under the Hydrogen Bank.

This new instrument aims to reach similar objectives, with extended scopes:

- The creation of a cost-effective and market-based instrument for financial support. Competitive bidding, in economic theory, is touted as transparent and effective. A constrained budget is allocated to project developers that (can) operate with highest cost-efficiency, whilst achieving maximum greenhouse gas emissions reduction.

- De-risk projects and maximizing leverage of private capital. The large volumes of finance required, coupled with the underlying risk of the nascent carbon market, and often innovative long-term nature of large-scale industrial decarbonization projects, can make CCS projects unattractive to private investors without any financial support. A CCfD mechanism can improve a project’s financial viability, lessen the risk involved, thereby unlocking additional private investment and easing Final Investment Decisions (FIDs).

- Price discovery and market formation. The first Hydrogen Bank pilot auction attracted 132 bids for renewable hydrogen projects between November 2023 and February 2024. The aggregated data revealed unexpectedly lower levelized costs to produce renewable hydrogen and unparalleled insights into geographical variance and market and sectorial willingness-to-pay. Such insights are highly valuable in the absence of a liquid market, offering a way for both market participants and the institutions to glean insights. These insights would be invaluable in a similarly nascent CCS market.

- Reduced administrative burden. Auctions have a lower administrative burden for applicants than other grant processes. Less documentation is required, and the evaluation timeline is shorter. Furthermore, the scheme should be technology-neutral, meaning it would be open to all ETS-related sectors without technology baskets or sectorial prioritization.

To achieve these objectives, key qualification requirements should ensure the highest possible relevance and quality of the projects. Each project should provide (i) a clear strategy for its development, including installations’ procurement, low carbon electricity sourcing and permitting; and (ii) guarantees for the completion of the project (letter of intent).

Furthermore, the scheme should be technology-neutral, meaning it would be open to all ETS-related sectors without technology baskets or sectorial prioritization.

The European CCS Bank would operate through a competitive auction mechanism, similar to the existing European Hydrogen Bank, where project developers submit bids for CCfDs, specifying the financial support needed to bridge the gap between the cost of CCS and carbon market prices. Payments would be tied to verified CO₂ capture and storage, ensuring accountability and incentivizing cost-efficient projects.

About IOGP Europe

The International Association of Oil & Gas Producers Europe (IOGP Europe) is the Brussels-based advocacy arm of IOGP.

IOGP Europe supports the EU’s objective to reach climate neutrality in Europe and calls for an inclusive policy framework to help reach it.

IOGP Europe is registered as an ASBL under Belgian Law. Company number 0759.579.581. EU Transparency Register: 3954187491 70. Registered office: 188A Avenue de Tervueren, B 1150 Brussels, Belgium.