GFANZ: Private Investors to Drive over USD 130tn in Investment Needed to Reach Net Zero

Through the Glasgow Financial Alliance for Net Zero (GFANZ), over USD 130 trillion of private capital is committed to transforming the economy for net zero. These commitments, from over 450 firms across 45 countries, can deliver the estimated USD 100 trillion of finance needed for net zero over the next three decades.

To support the deployment of this capital, the global financial system is being transformed through 24 major initiatives for COP26 that have been delivered for the summit. This work has significantly strengthened the information, the tools and the markets needed for the financial system to support the transformation of the global economy for net zero.

New analysis, commissioned by the UN High Level Climate Action Champions, finds that the private sector could deliver 70% of total investments needed to meet net zero goals.

In its progress report published on November 3, GFANZ announces that financial sector commitments to net zero now exceed USD 130 trillion, a 25-fold increase under the UK and Italian Presidency.

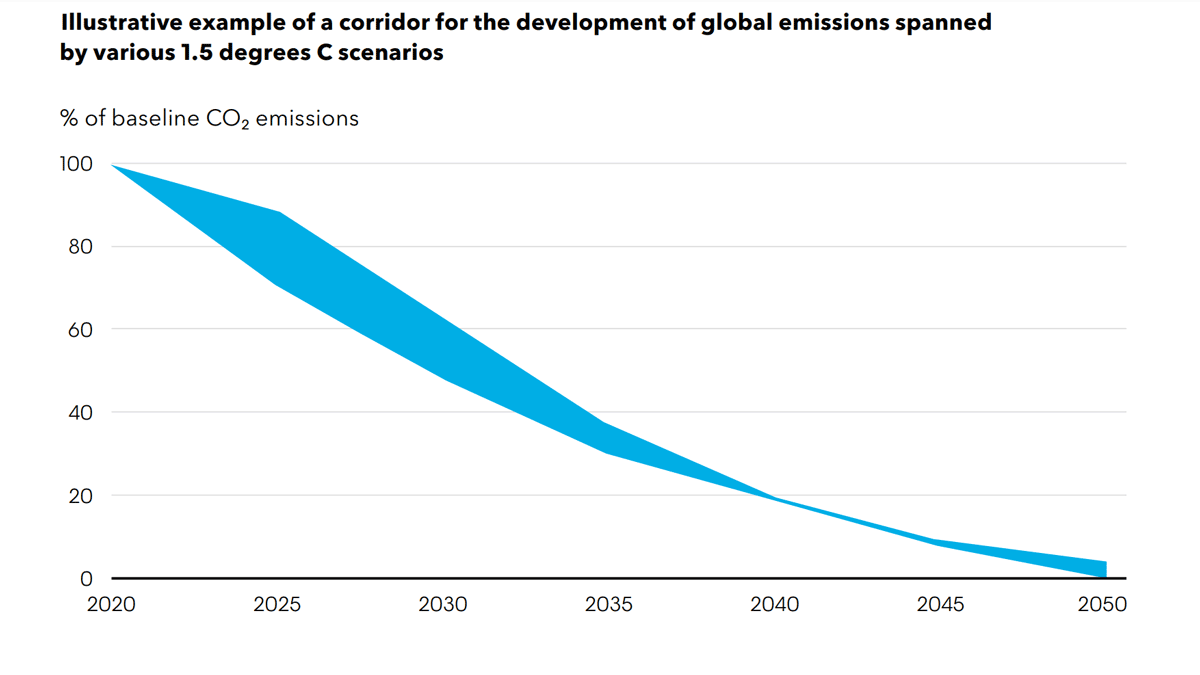

Now firms across the entire financial spectrum – banks, insurers, pension funds, asset managers, export credit agencies, stock exchanges, credit rating agencies, index providers and audit firms – have committed to high ambition, science-based targets, including achieving net zero emissions by 2050 at the latest, delivering their fair share of 50% emission reductions this decade, and reviewing their targets towards this every five years. All firms will report their progress and financed emissions annually.

The progress report also outlines the ambitious body of work underway – led by GFANZ CEOs – to address some of the biggest climate finance challenges, including defining net zero pathways for carbon-intensives sectors, aligning on what constitutes a robust transition plan for corporates and financial institutions, and a sector-wide plan to mobilize capital needed for decarbonization in emerging markets. Collectively, this work will accelerate the implementation of net zero commitments and help to rapidly scale capital flows to support the net zero transition.

It comes as UK Chancellor, Rishi Sunak, announced new requirements for firms to publish net zero transition plans setting out how they will decarbonize through 2050. This follows calls from GFANZ for G20 countries to implement policies to unlock and accelerate capital to support the transition, including mandatory net zero transition plans.

Already, firms are turning ambition into action that will align their portfolios with 1.5°C. Over 90 of the founding institutions of GFANZ have already delivered on setting short-term targets, including 29 asset owners that have committed to reducing portfolio emissions by 25-30% by 2025, as well as 43 asset managers that have published targets for 2030 or sooner. And the first targets have also been published by Net Zero Banking Alliance members.

The 24 other major finance initiatives, led by Mark Carney as part of the private finance priorities for COP26, will help transform the financial architecture by mainstreaming and scaling: climate-related reporting; climate risk management; climate-related investment returns and the mobilization of private finance to emerging and developing economies.

Also, the IFRS Foundation, the international accounting standard body, announced establishment of a new International Sustainability Standards Board to develop globally consistent climate and broader sustainability disclosure standards for the financial markets. This work has been welcomed by Finance Ministers from over 50 countries stretching across 6 continents and follows support from the G7 and others to make climate disclosures mandatory.

Through the work of the Network for Greening the Financial System climate risk management is also being transformed. Thirty-eight central banks, in countries comprising 67% of the world’s emissions, have committed to climate-related stress tests to review the resilience of the world’s largest financial firms in the face of several climate-related risks. And 33 central banks and supervisors, representing 70% of the world’s emissions, have committed to issuing guidance to firms on managing climate-related financial risks.

And to measure more accurately the alignment of lending, investment and underwriting with net zero, the Taskforce on Climate-related Financial Disclosures (TCFD) has published guidance on metrics, targets, and transition plans.

Finally, for COP26, GFANZ Co-Chair Mark Carney is publishing a new plan on how to scale private capital flows to emerging and developing economies. This includes the development of country platforms to connect the now enormous private capital committed to net zero with country projects, scaling blended finance through MDBs and developing high integrity, credible global carbon markets.

GFANZ is supporting these mobilization efforts and has identified an initial set of five catalytic initiatives to accelerate the transition in these countries, based on their scalability and potential impact. In doing so, GFANZ has committed to bring together technical expertise and balance sheets to scale capital commitments ahead of COP27.

GFANZ is taking several measures to accelerate the global transition to net zero beyond COP26 with new leadership, announcing that UN Special Envoy on Climate Ambition and Solutions and Race to Zero Ambassador Michael Bloomberg will join UN Special Envoy Mark Carney as co-chair of GFANZ. Mary Schapiro, Head of the Secretariat for the Taskforce on Climate-related Financial Disclosures and former Chairman of the US Securities and Exchange Commission, will be the vice-chair. They join UN High Level Champion Nigel Topping in the GFANZ leadership team. A new permanent secretariat will have a presence in Europe, the Americas, Africa, and Asia. GFANZ also unveils it will periodically report on its work to the G20’s Financial Stability Board.

“The architecture of the global financial system has been transformed to deliver net zero. We now have the essential plumbing in place to move climate change from the fringes to the forefront of finance so that every financial decision takes climate change into account. Only this mainstream focus can finance the estimated USD 100 trillion of investment needed over the next three decades for a clean energy future,” Mark Carney, UN Special Envoy for Climate Action and Finance and COP26 Private Finance Advisor to PM Johnson said.

“The rapid, and large-scale, increase in capital commitment to net zero, through GFANZ, makes the transition to a 1.5°C world possible. To seize this opportunity, companies must deliver robust transition plans and governments set predictable and credible policies. This will give finance the confidence to invest, pulling forward climate actions and smoothing the transition to net zero, driving growth and jobs upwards, and forcing emissions downwards. Let’s work together to seize this opportunity.”

“Winning the battle against climate change will require vast amounts of new investment and the majority will have to come from the private sector. Leaders in finance have strong incentives to act, and under Mark Carney and Nigel Topping’s leadership, GFANZ has grown to include some of the largest financial institutions in the world. We look forward to building on this progress in the next phase of the alliance’s work, by creating the tools and industry wide coordination we need to turn commitments into action and speed up the transition to a net-zero global economy,” Michael R. Bloomberg, Co-Chair of the Glasgow Financial Alliance for Net Zero, added.

“An orderly transition of the financial sector to meeting net zero commitments supports financial stability. So, we look forward to regular updates to the FSB on the progress of GFANZ, as part of the FSB’s broader outreach in taking forward its roadmap to address financial risks from climate change,” Klaas Knot, Vice Chair of the Financial Stability Board, noted.

Financing Net Zero

Financing the transition: Reaching net-zero emissions by 2050 requires USD 125 trillion of investment, including USD 32 trillion in six sectors over the next decade, according to the new Financing Net Zero Roadmap by Vivid Economics, commissioned by the High-Level Champions.

- Electricity requires USD 16 trillion

- Transport – USD 5.4 trillion

- Buildings – USD 5.2 trillion

- Industry – USD 2.2 trillion

- Low-emission fuels – USD 1.5 trillion

- Agriculture, forestry, and other land use – USD 1.5 trillion

Annual investment must triple to USD 2.6 trillion in 2021-2025 compared to 2016 and 2020. Asia Pacific needs USD 1.1 trillion per year; Europe and North America USD 500 billion each per year. The private sector could provide 70% of that, Vivid Economics found.

About GFANZ

The Glasgow Financial Alliance for Net Zero (GFANZ) is a global coalition of leading financial institutions in the UN’s Race to Zero that is committed to accelerating and mainstreaming the decarbonization of the world economy and reaching net-zero emissions by 2050. It provides a practitioner-led forum for financial firms to collaborate on substantive, crosscutting issues that will accelerate the alignment of financing activities with net zero and support efforts by all companies, organizations, and countries to achieve the goals of the 2015 Paris Agreement. To ensure credibility and consistency, access to GFANZ is grounded in the UN’s Race to Zero campaign, and entry requirements are tailored to the activities of the diverse firms represented.