Alexandra Damascan-Armegioiu: Serinus Energy Romania President on Long-term Plans in Romania

Alexandra Damascan-Armegioiu, President of Serinus Energy Romania, discusses with us about the recent developments of the Moftinu gas project as well as the future steps to achieve the company’s objectives in Romania.

During the first quarter of 2019, Serinus Energy finalised the construction of the Moftinu gas plant in Romania and brought the Moftinu gas field on production in April 2019. The Group was granted a twelve-month extension on the third exploration phase of the Satu Mare Concession in Romania until 28 October 2020 with the sole commitment to complete a 3D seismic acquisition program. Prior to the year’s-end, Serinus completed the permitting required to perform the 148km2 3D seismic acquisition program, which was expected to be completed in Q2 2020. Due to the unprecedented disruptions caused by the COVID-19 outbreak the Group is unable to estimate a completion date at this time.

Dear Mrs. Damascan, you have been with Serinus Energy Romania since 2008 and you have abundant technical and commercial expertise in developing the Moftinu gas project from exploration to production. What are the key challenges of this process?

Alexandra Damascan-Armegioiu: Looking back, it is hard to believe that when the Company made the decision in early 2017 to proceed with the Moftinu Gas Project, the Serinus Romania Office staff consisted of only myself and my assistant. It was an exciting time with many challenges. We needed to staff up the Romania office with both technical and financial experts, complete the project design, hire an EPC Contractor, procure all the equipment, receive all regulatory approvals, plan for operations, negotiate a gas marketing contract and receive approval to access the Transgaz system. It was a tremendous team effort and I am very proud of what we have accomplished in that short period of time.

How do you manage to overcome these challenges? Is there still any exploration/development risk?

Alexandra Damascan-Armegioiu: The most important thing was hiring the right people and empowering them to use their knowledge and expertise to work through all the challenges. Like most projects, it never goes according to plan. You have to be ready to deal with all the challenges as they come and work through the problems and come up with solutions. Risk is inherent in our industry and a Company’s success is all about how these risks are managed. The Moftinu Gas Project has been on production for over a year and we now have a very good idea of what the risks of the project are going forward. Obviously, we want to undertake more exploration in order to find another Moftinu field and all the risks this entails.

What do work commitments include?

Alexandra Damascan-Armegioiu: Work commitments always are the tools of an Operator who wants to learn more about his Concession Area, understand the sub-surface, explore more the acreage, so that in the end, a sustainable profit can be achieved. Whether it is drilling new wells, work-overs, seismic acquisition programs, reinterpretation of old historical well and seismic lines, commitments have the outcome of allowing the Operator, as well as the Country, to benefit by creating more work, more jobs, revenue and of course more taxes for the Country.

What is the current situation of the Moftinu gas project? What are the wells and facilities on production today? What is the capacity of the Moftinu gas plant?

Alexandra Damascan-Armegioiu: Moftinu Gas Plant is running on normal parameters, as expected. Our team in Mofinu is doing a fantastic job in running the Plant. We currently have 3 wells producing in the Gas Plant (Moftinu 1003, Moftinu 1004 and Moftinu 1007). The Plant’s capacity is 450,000 m3/day, designed to accommodate 6 flowlines.

What trajectory do you see resulting from the start-up of this project in April 2019? What is the estimated production (boe/d) for this gas field?

Alexandra Damascan-Armegioiu: In Romania, the Company successfully drilled, completed and tested the M-1004 well in February which flowed at 6.0 MMscf/d (approximately 1,000 boe/d). Subsequent to the production tests the well was tied in to the Moftinu Gas Plant and began producing gas into the plant. This well is the third producing well in the Moftinu field and further increases the utilization of the Moftinu Gas Plant. The Company has begun the permitting process for the M-1008 well which is a proposed production well that was anticipated to be drilled late 2020 or early 2021. Drilling plans have been postponed for the duration of the COVID-19 crisis. The Company has permitted a 148 km2 3D seismic acquisition programme in the Berveni area just north of the Moftinu Gas Plant and reached land access agreements with all landowners within the seismic acquisition area. The Company had ordered the mobilization of the seismic equipment and staff to begin the programme, however, due to uncertainty regarding the COVID-19 pandemic and the impacts on travel and services in Romania and the Satu Mare County, the Company and its seismic contractor have postponed the programme. The Company is in discussions with the Romanian regulatory authorities to agree an extension to the concession area.

In Romania, the Group invested USD 2.1 million (2019 – USD 1.1 million) in the three months ended 31 March 2020 primarily to drill, complete, and tie in the M-1004 well. Romania remained a significant cash flow generating business unit during the period as production increased from the addition of M-1004. The field generated a netback per boe of USD 21.66 for the first quarter. 3.61/mcf

In Romania, the Group is subject to a windfall tax on its natural gas production which is applied to supplemental income once natural gas prices exceed 47.53 RON/Mwh (approximately $3.45 per mcf). This supplemental income is taxed at a rate of 60% between 47.53 RON/Mwh and 85.00 RON/Mwh and at a rate of 80% above 85.00 RON/Mwh. Expenses deductible in the calculation of the windfall tax include royalties and capital expenditures are limited to 30% of the supplemental income. For the three months ended 31 March 2020, the Group incurred windfall taxes of $1.0 million) which equates to USD$6.50 per boe (USD1.08/mcf) of Romanian gas production volumes.

During 2019 Serinus started well site preparations for the M-1004 well in Romania. In February 2020, this well was successfully drilled, completed, and tested at a rate of 6.0 MMscf/d (approximately 1,000 boe/d) from three perforated zones and then brought onto production. What are the next steps?

Alexandra Damascan-Armegioiu: M-1004 has five gas-bearing zones that appeared on logs: A2 sand; A2.2 sand; A3 sand; B1 sand; and B3 sand. The three deeper zones were completed, being A2 sand, A2.2 sand, and A3 sand. The two shallower zones had gas pay on logs but were not completed. These zones may be exploited later in the life of the well. After completing the perforation and well completion operations, the Company initiated a flow test whereby all three deeper zones were tested comingled. The well testing procedure and results are as follows: • Moftinu-1004 was flowed on a 20/64” choke for 4 hours followed by a 4 hour build up, then flowed on a 32/64” choke for 4 hours followed by a 4 hour build up, then flowed on a 40/64” choke for 4 hours followed by a 4 hour build up, and then lastly flowed on a 36/64” choke for 15 hours; • On the largest choke size (40/64”), the well flowed at an average rate of 6.0 MMscf/d with no progressive pressure decrease throughout the test; • During the final flow period (15 hours) on a reduced choke size (36/64”), the well flowed at 5.5 MMscf/d with no progressive pressure decrease throughout the test.

What’s next? Well, I can definitely say we are not stopping here. We have the knowledge, we have the expertise, we have the right people and where is a will there is a way. We always think about the next project. Our CEO, Mr. Jeffrey Auld believes in the prospectivity of the Satu Mare Block, he believes in the citizens and the authorities from Romania. For him, there will always be “what can we do next?”

What is the stage of the 3D seismic acquisition program for the future explorations within the Satu Mare concession?

Alexandra Damascan-Armegioiu: At the start of March 2020, we were preparing to provide the mobilization order to our seismic acquisition contractor. Unfortunately, the coronavirus pandemic has forced us to put this project on hold until it is possible to bring in the 100 workers to complete the program. We are in constant discussions with NAMR about the program and when it will be safe for us to proceed. Given this, we are very excited to get this project completed. It is the future growth of the Company to develop additional shallow gas discoveries and to bring them onto production.

What prospects to sell domestic gas production do you see? What effects of lower Romanian gas production may we expect?

Alexandra Damascan-Armegioiu: It is so disappointing to see that Romania still imports gas to meet the country’s gas needs. This fact is mostly due to government policies and interventions in the market that have created tremendous uncertainty for producers that increases the risks to investments. For example, the 2019 gas price in Romania was the highest in Europe. A big factor that caused this was the introduction of GEO 14 in December of 2018. The government tried to roll back all the progress that was made in the creation of a viable gas market in Romania. This interference in the functioning of the market created tremendous uncertainty for producers and consumers alike. I realize that a portion of domestic households may need assistance to cover their heating and electricity costs, but the best role for the government would be to provide direct assistance to these households instead of intervening in the market and creating unnecessary uncertainties for producers beyond the everyday risks we face in delivering gas to Romanian consumers. And as I said, these uncertainties caused the 2019 Romanian gas price to become much higher than prices paid in the rest of Europe. Another ill-conceived government policy is the Windfall tax. This is a very onerous tax on onshore gas producers in Romania. Using Serinus as an example, we only began our production last year and the Windfall tax has taken approximately 22% of our revenue in that time. A windfall tax by definition should allow for the investor to recover all of its investment as well as earning a return on this investment before the government should consider taking a larger share of economic rent. It applies to all gas production ranging from fields that have been producing for decades and have earned back their investment and a return to new gas fields like ours that have only just started producing. We are a Company committed to growing our gas production in Romania. As a small Company currently producing from only one field, we have a high cost of capital making it imperative that we grow our production through our cash flow. The windfall tax takes away money that we would invest in new projects. This would mean more employment, more business for our vendors and over time, more revenue for the government, and increased gas production for the Country’s consumers. With this, I would very much like to see the Windfall tax eliminated, or at the very least, it should be redesigned and should not apply to new gas projects.

You have mentioned that the windfall tax has a negative impact on investment with consequences on the development of the gas. Please elaborate your statement.

Alexandra Damascan-Armegioiu: Yes, indeed it has a negative impact. Both domestic and foreign investments are not encouraged, there is a negative impact on the overall economy of the country, on the stability and predictability of the legislative framework. Overall, the energy security of the country is affected and domestic gas production is at a disadvantage to imports as imports are not subject to the windfall tax. There is a strong correlation of the taxation with the recovery of the investment: we are talking here about a complete deduction of the investments made so that the additional taxes (such as windfall tax) are due from the period of total recovery of the investment by the gas producer.

As you are aware the Government of Romanian instituted a windfall profits tax on a permanent basis on 01 April 2018. This tax burden increases significantly as gas prices increase. Whilst we respect the rights of a national government to conduct its fiscal policies in the best interest of the Country, we believe that this tax has the effect of limiting future developments of gas projects in Romania. The tax does not allow businesses that are advancing gas production in the State of Romania to recover its investment prior to having the windfall tax apply. This has the effect of significantly reducing the economic returns available to the project sponsors and in many cases renders prospective gas developments uneconomic. The alteration or elimination of this tax should be undertaken such that companies like Serinus, are able to recover their investments prior to having this tax apply. This tax is also having a very negative impact on the Romanian gas market and will diminish the future potential for growing Romanian onshore gas production. The Company believes that the Satu Mare Concession holds a significant amount of shallow gas deposits in which the Company would like to exploit to grow our business. The alteration or elimination of the tax would provide the Company with a significant amount of free cash flow that would be reinvested in exploring and production activities for the long-term economic and security benefit of the State of Romania and the European Union, create more employment in the oilfield service industry, and encourage production so that Romania is no longer a net importer of natural gas.

I am a proud citizen of Romania and the European Union. In speaking with European Commission on Romania gas, they are very much supportive for Romania to increase gas production as it helps to increase the energy security in eastern Europe. For Romania, we have the goal of joining the Euro zone someday and adopt the Euro as our currency. To do so with the highest benefit to the country, the government needs to institute policies that help industries for which Romania has a competitive advantage and encourage these industries to invest, grow and export beyond Romania’s borders. Natural gas is one instance of Romanian competitive advantage. Encouraging our competitive industries to grow and export will create significant wealth for the country, improve our balance of payments and strengthen the value of the Lei so that when we are ready to join the Euro zone we do so from a position of strength.

Besides the windfall tax, speaking about the financial constraints, I would like to take this opportunity to highlight our increasing concern regarding the reimbursement of VAT. As you can image, Serinus pays for many of its goods and services in Romania inclusive of VAT. The Company agrees with ANAF, the Romanian tax authority, to schedule a review and audit those VAT payments and ultimately receive a rebate of VAT paid. There are statutory timelines for this process. These timelines have not been honoured by ANAF and the recovery of VAT paid is increasingly being delayed. The current accumulated VAT receivable for Serinus is USD 2.6 million, and it continues to accrue at a significant rate. This has a very real cashflow effect on the business as the VAT rebates continue to accumulate, restricting the Company from having access to that cash to progress the business. The Company has repeatedly requested a time for the VAT audits and have been repeatedly refused even though the statutory limit to schedule such an audit has been exceeded.

What are Serinus Energy’s plans in Romania for the upcoming years?

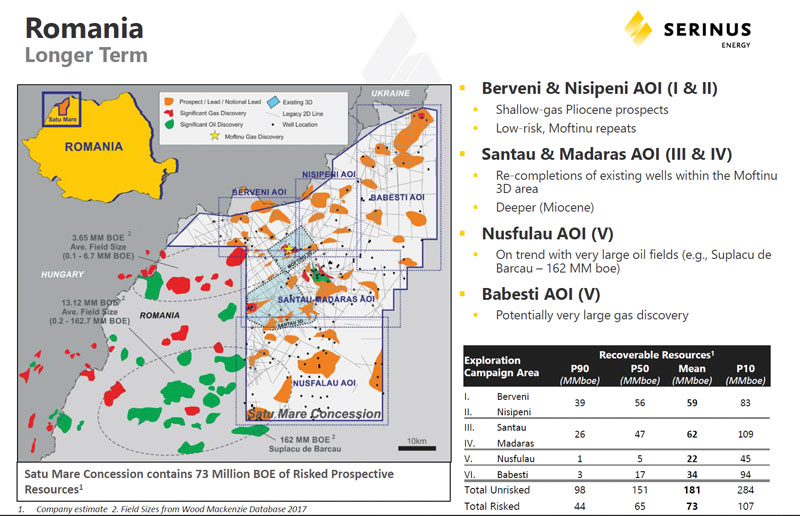

Alexandra Damascan-Armegioiu: As I have stated above, we are looking to invest our profits to find new gas fields in which we can grow our Company. We are looking into new fields within our Block, where we can drill more wells, new leads to cover with 2D and 3D seismic lines, we are constantly re-interpreting the old well files and re-processing old 2D lines. Serinus Energy Romania wants to grow in Romania and depending on the Berveni prospects identified by the future 3D, we would be drilling additional exploration wells into these prospects. With exploration well success, we can drill Berveni development wells and construct gas plant for new fields.

Are there any additional well locations identified for future drilling? What about new potential shallow gas fields?

Alexandra Damascan-Armegioiu: From a corporate perspective, here are the long-term plans for Serinus in Romania.

How does the COVID-19 crisis impact the Moftinu gas project? What follows?

Alexandra Damascan-Armegioiu: The Company’s top priority is the health, safety and wellbeing of all our staff throughout this difficult time. All Group offices are temporarily closed as all staff are working remotely, in line with all local regulations. Operations have not been affected by the outbreak, as the Moftinu field is currently operating as normal. The Company has implemented policies and monitoring such as social distancing to ensure a safe work environment for our staff. The Group continues to monitor each jurisdiction and will implement recommendations and continue to abide by local rules pertaining to all offices.

All capital plans in Romania have been postponed as well as the scheduled maintenance programme at the Moftinu Gas Plant that was set for May 2020. Our teams have designed an incremental maintenance programme considering the postponed gas plant turn-around and does not anticipate this change to have any negative impacts to the safety or performance of the gas plant. The Company had previously announced that it had fully permitted and was preparing to commence a 3D seismic acquisition programme in the Berveni area. This programme has been delayed by the inability to move manpower and equipment during this period. The Company has agreed with its seismic contractor to extend the existing contracts by one year to allow for the future completion of this programme. Subject to the ongoing uncertainty regarding the COVID-19 crisis the Company hopes to recommence this programme in early 2021. The M-1008 production well has been permitted and was expected to be drilled in late 2020 or early 2021, however due to the COVID-19 crisis, it is uncertain when any further work may be completed for the drilling of this well.