DocProcess: RO e-Factura to Bring over EUR 7 bln to the State Budget

DocProcess, the leader in business process automation in Romania, estimates an 80% increase in demand for the implementation of electronic invoicing and compliance with an electronic invoicing system in the context of the national project RO e-Factura. The electronic invoicing system is operational in Romania starting with November 2021, being optional in the first stage and focused only on the Business to Government (B2G) relationship. In the coming months, the system will be extended to cover the Business to Business (B2B) relationship, the goal being to have a compulsory system starting with 2023.

“By implementing electronic invoicing, Romania is taking a major step in integrating digital technologies into companies’ activities and in the direction of aligning with European directives in this field. The elimination of paper invoices can significantly increase the VAT collection as well as bring additionally approximately 35 million euros per year to the Romanian public sector. In 2020 and 2021, we have seen a 25% increase in demand in this direction, with companies looking to outsource the e-invoicing service and adopt the new regulations in place. At DocProcess, we have developed solutions that are compatible and compliant with the national electronic invoicing system, through which companies can operate following its requirements and also have at their disposal instant methods for quick validation, approval, and automatic verification of invoices,” Liviu Apolozan, President and VP Strategy at DocProcess, stated.

In the latest report published by the European Commission in 2021 on the VAT gap in the European Union, Romania ranks last, with the highest VAT gap (34.9%) in 2019, up from 2018 (32.7%). This represents a loss of EUR 7.4 billion in uncollected VAT contributions. The implementation of an electronic invoicing system can help to significantly reduce this gap. Such a system will also help reduce companies’ costs and increase their profits. In addition, e-invoicing has an important sustainability component. It significantly reduces the carbon footprint by eliminating paper, cutting down trees, and reducing the amount of fuel dedicated to sending these types of documents in physical format.

The Romanian government launched the RO e-Factura project in March 2020 and aims to streamline the collection of taxes and contributions, in particular, to improve and consolidate the degree of VAT collection and prevent/combat tax evasion. The model that Romania analysed was the Italian one, where the electronic invoice is used on both the B2G and the B2B relationship. Currently, the legal framework of the electronic invoicing system in Romania is established by GEO 120/2021 and by a series of several orders of the Ministry of Finance and of ANAF, especially by Fiscal Order 12/2022, which provides the elements to be taken into account by companies in terms of B2B relationship. DocProcess, through Liviu Apolozan, has been and is actively involved in the stages of development of this legislative project in Romania. The company expects that with the launch of RO e-Factura and the obligation of using electronic invoices, the demand for such solutions will increase by at least 80% in 2022.

According to the latest edition of the Digital Economy and Society Index (DESI 2021), Romania ranks 25th out of 27 in integrating digital technologies into companies’ activities. The indicator also includes electronic invoicing, and Romania is below the EU average of 32%, with only 17% of companies using this type of invoice in 2020. The percentage was decreasing compared to 2018, when it was 20%. In Italy, a country whose implementation system is a model that Romania follows, according to the DESI 2021 report, in 2020, 95% of companies used electronic invoicing, a significant increase compared to 2018 when only 42% of companies had implemented such a system.

Globally, according to a Billentis report, the e-invoicing market was estimated at EUR 4.3 billion in 2019 and is expected to reach EUR 18 billion by 2025 due to the growing number of governments from various countries that are imposing this type of invoice for both the public and private sector. In France, where DocProcess has been present through a local office since 2019, the electronic invoice is already mandatory from the 1st of January 2020 for the B2G relationship. The plan is to make e-invoicing mandatory in the coming years through various stages. The ultimate goal is that from the 1st of January 2026, e-invoicing is compulsory for all companies, including small and medium-sized enterprises and micro-enterprises.

Outside Europe, Saudi Arabia began adopting the electronic invoice in December 2021 and the process will take place in two stages. In the first stage, companies will be required to issue and store electronic invoices using a system compatible with the local tax authority (ZATCA). At this stage, companies will not be required to distribute details and report invoices to ZATCA. In the second stage, scheduled to start on the 1st of January 2023, companies will need to integrate their electronic invoicing solutions into the ZATCA system to send invoices for verification and validation in this portal. DocProcess participated in implementing the process to support companies in this country.

In June 2021, the Federal Reserve announced the launch of a pilot project in 2022 in the United States, which aims to establish a standard electronic invoicing system for the B2B relationship. In April 2021, DocProcess opened a local office in Austin, Texas, which aims to expand and implement the company’s solutions and products in this market.

DocProcess automation solutions are used by more than 3,500 companies.

About DocProcess

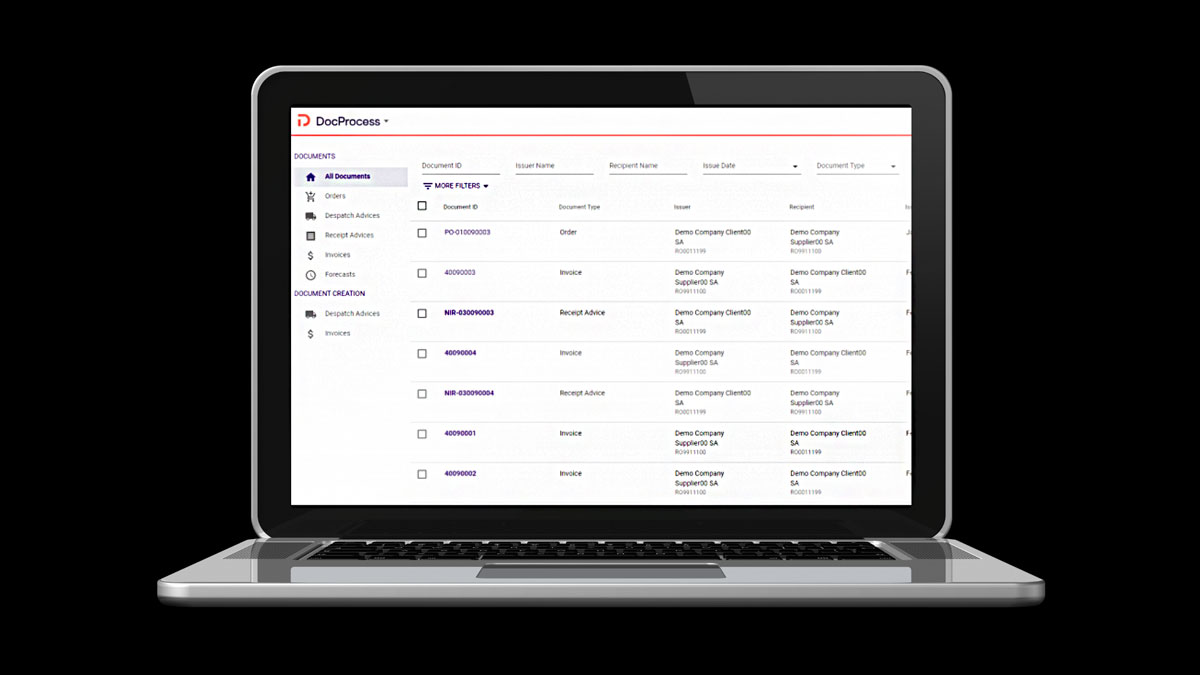

DocProcess offers Business Ecosystem Automation solutions that help companies streamline and automate processes. DocProcess shapes the future of how companies of all sizes run their business by enabling them to take control of processes through their whole business ecosystem and connecting them digitally with their clients, suppliers, or financial and logistics partners. Thanks to the platform’s flexibility, companies can mix solutions to fit their changing business needs and connect all aspects of their business workflows: Purchase-2-Pay, Order-2-Cash, E-invoicing, Logistics, Contract Management, reconciliation processes and more. All cross-referenced against record management and archiving.

Established in 2005 by Liviu Apolozan, DocProcess has a robust global footprint with offices in France (Paris and Grenoble), Romania (Bucharest and Brasov) and the USA (Austin).