Rising Energy Prices: European Solutions

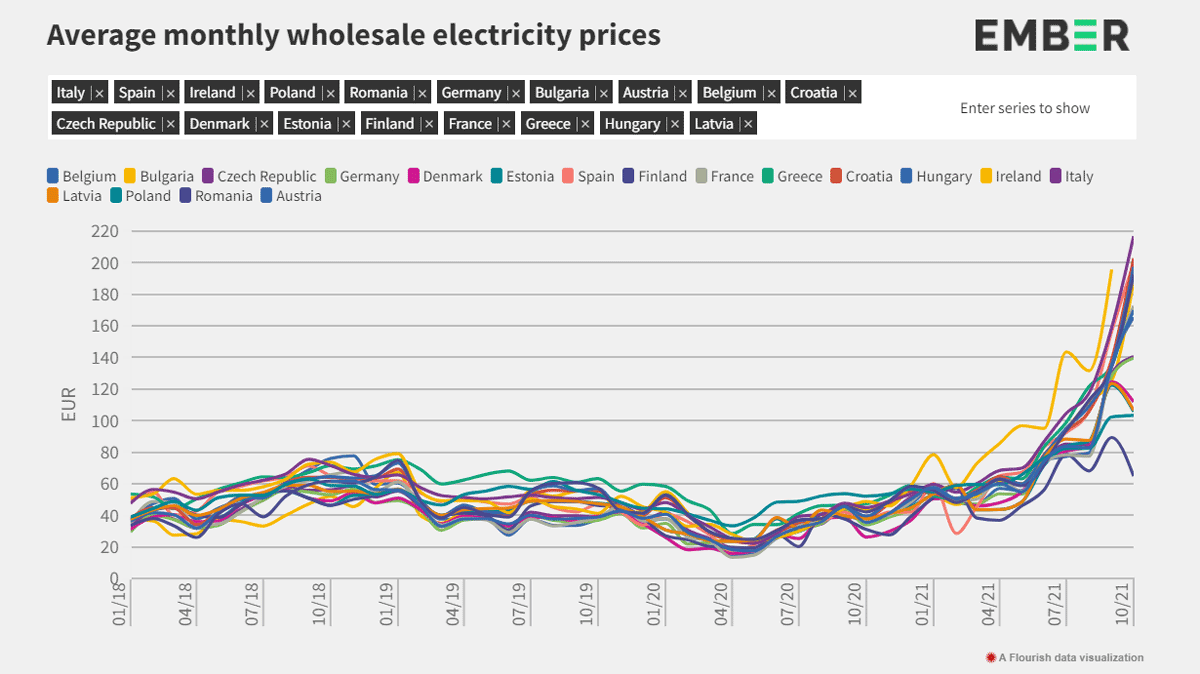

As energy prices are rising around the world, amid the post-Covid economic recovery, what are the measures taken by Europe to reduce pressure on consumers?

The increase in prices is explained by a particular international context and concerns all countries: China is facing an electricity shortage in several provinces, due to insufficient coal supply and, in the United States, gas prices have risen by over 150% since the beginning of 2021.

European competences in energy

Article 194 on the Treaty on the Functioning of the European Union (TFEU) establishes a legal ground that empowers the Union in the energy field in three areas:

- Ensuring the proper functioning of the energy market

- Ensuring security of energy supply

- Promoting energy efficiency and network interconnection

The European energy policy pursues five objectives:

- Diversification of the Union’s energy sources and ensuring energy security

- Ensuring the free movement of energy through adequate infrastructure and the removal of technical or regulatory barriers

- Improving energy efficiency and reducing import dependency, lowering emissions, and boosting jobs and growth

- Decarbonizing the economy and moving towards a low-carbon economy, in line with the Paris Agreement

- Promoting research into low-carbon and clean energy technologies and prioritizing research and innovation to drive the energy transition and improve competition

While Article 194 of the TFEU considers that certain elements of the energy policy are a common competence, which is an evolution to a common energy policy, each member state keeps however the right to determine the conditions of functioning of its energy resources, its choice between the various forms of energy and the sources and the general structure of each state’s supply with energy. Member States establish their energy mix as they see fit, considering however their climate commitments according to the objectives decided at European level: reducing greenhouse gas emissions by 55% by 2030 and carbon neutrality by 2050.

Energy mix and security of supply

At European level, the energy mix remains dominated by fossil fuels, as 38% of the energy consumption comes from oil, 23% from natural gas and 13% from coal. Nuclear energy accounts for only 11%. Although in sharp increase, renewable energy represents a small part of the European Union’s energy consumption.

The own options of the Member States regarding the energy mix, which combines strategic priorities, national and/or social arguments (protection of certain industrial sectors, protection of jobs, phase-out of nuclear energy) may create fragile balance. The energy dependence of the Union’s Member States has increased significantly over the past few years. For example, a year ago, 43.5% of coal, 26.8% of unrefined oil and 34.3% of natural gas imported into Europe was of Russian origin. Let’s remember, in this context, the words of Ursula von der Leyen: “While Gazprom has honoured its long-term contract with us, it has not responded to the increase in demand as it did in previous years. And this is driving prices up. The energy issue is geopolitical par excellence, and Russia knows this only too well”.

Differences between Member States are considerable. For example, with more than half of its gross final energy consumption coming from renewable sources, Sweden (56.4%) had by far the highest share among Member States in 2019, ahead of Finland (43.1%), Latvia (41%), Denmark (37.2%) and Austria (33.6%). At the other end of the scale, the lowest percentages of renewable energy were recorded in Luxembourg (7%), Malta (8.5%), the Netherlands (8.8%) and Belgium (9.9%).

The increase in electricity generated from renewables in the last 10 years has been largely due to the development of three main sources: wind and solar power and solid biofuels. A year ago, renewable energy accounted for 34% of the gross electricity consumption in the European Union. Wind and hydro power accounted for two thirds of the electricity generated from renewable sources (35% each). The remaining third came from solar energy (13%), solid biofuels (8%) and other renewable sources (9%). It should be noted that solar power grows the fastest, in 2010 accounting for only 1% of the mix. The increase in electricity produced from solar power was spectacular, increasing from 7.4 TWh in 2010 to 125.7 TWh in 2020.

The energy mix of the countries in Central and Eastern Europe remains dominated by fossil fuels (almost 80% of the electricity produced in Poland comes from coal) and nuclear energy (46% of the electricity produced in Hungary and 18.20% in Romania).

Natural gas and nuclear energy, compromise energies?

This increase in prices comes at a time when the issue of nuclear energy and natural gas in Europe’s energy transition is a source of division between the Member States. Natural gas, the least polluting fossil fuel (its combustion emitting no dust, just little sulphur dioxide (SO2), little nitrogen oxide (NO2) and less carbon dioxide (CO2) than other fossil fuels) is the compromise energy for many states, including Romania. Nuclear energy does not emit CO2, but waste treatment and, in general, its control raises concerns. Several countries, such as Romania, Poland, Hungary, Finland, and France rely on the possibility to accelerate their transition, partly due to nuclear energy.

The role of nuclear energy in transition is subject to intense confrontations within the definition of ‘green taxonomy’, which aims at making a standardized classification of economic activities based on their contribution in the fight against climate change and which could therefore have a decisive role in investments.

European electricity market

In this context of generalized increase in electricity prices, the functioning of the single European electricity market is at the heart of debates. Authorities in the economic field in France say that it is “not working” and that its mechanisms should be thoroughly reviewed, so that electricity prices are not determined depending on the production cost, but on the marginal production cost.

The marginal production cost operates by putting power plants on the market in order of price, starting with the cheapest, up to the last plant needed to meet consumer demand. The latter is the one that sets the overall price and is often one that is (at times of high demand) gas or coal fired power plant, which makes all electricity producers have the same electricity price. The European electricity market has ensured for consumers cheap prices, over the past decades and, for the time being, the Commission has no plans to review it. However, it expects the Agency for the Cooperation of Energy Regulators to come with several recommendations in the following months.

36 million Europeans affected by the increase in energy prices

Emergency measures have been implemented at the level of each state, to ease the pressure on consumers. We recall immediate aids such as ‘energy vouchers’ worth EUR 100 distributed in France to 5.8 million households. In Italy, a few measures have been taken (EUR 3 billion), including the elimination of ‘gas infrastructure costs’. In Spain, after the measures adopted at the end of July 2021, which aimed especially at a temporary reduction of VAT for electricity (from 21% to 10%) and suspension of the tax on the sale of electricity production, a temporary reduction in the special tax on electricity from 5.11% to 0.5% was also decided. The Polish Government explores the implementation of compensation measures for households whose energy costs represent more than 10% of their income. In the UK, the Government announced a GBP 500mln fund to help the poorest people pay their energy bills, including for heating.

At the same time, several proposals have been submitted to the European Commission by Member States such as France, Greece, Czechia, and Romania calling on European partners to coordinate on the subject, suggesting joint gas acquisitions to obtain more advantageous tariffs or envisaging the withdrawal of gas from the marginal pricing system if prices remain high. Moreover, countries like Luxembourg and the Netherlands, considering that the increase in prices is related to post-Covid recovery, prefer to allow the market to regulate itself.

On October 13, 2021, the European Commission announced temporary measures that the Member States could implement to deal with the rising prices, also remaining within the European legislation, notably in terms of the competition policy. Among the proposed solutions, the Member States could “mitigate the impact of rising prices through price caps and temporary tax reductions for vulnerable energy consumers, or vouchers and subsidies for consumers”.

In terms of medium-term responses, the Commission emphasizes an intensification of the climate transition as the best way to avoid further energy price increases in the future. Meaning:

- Strengthening investments in renewable energy, retrofitting and energy efficiency and speeding up auctioning and authorization procedures for renewable energy

- Development of energy storage capacity, including batteries and hydrogen

- Audit by the European Energy Regulator (ACER) to study the advantages and disadvantages of the current electricity market organization

- Possible revision of the Security of Supply Regulation to ensure better use and functioning of gas storage in Europe

- Study of the likely benefits of voluntary joint procurement of gas stocks by Member States

- Establishment of new cross-border regional gas risk groups to analyse risks and advise Member States on the design of their national prevention and emergency action plans

- Strengthening the role of consumers in the energy market by empowering them to choose and switch suppliers, generate their own electricity, and join energy communities.

Effect of the European Green Deal on prices

What will be the impact of the measures announced within the European Green Deal on energy prices? Decarbonization basically resumes to putting a price tag on a resource that was previously free. This price can be explicit (by taxation) or implicit (by regulation). To give an order of magnitude, carbon prices at the beginning of 2021 were around EUR 30 in Europe. We can take as an example the recommendations of the Stiglitz-Stern Commission, which concluded that the price of carbon should be between USD 40 and USD 80 in 2020, and then between USD 50 and USD 100 in 2030, if we want to contribute to reducing emissions.

Within the European Green Deal, the carbon price holds a central place and involves, as it is presented in the ‘Fit for 55’ draft, a reform of the emission quotas exchange system (EU-ETS) and an update of the Directive on energy taxation, ‘Fit for 55’ provides for a revision of the system to consider the target of a 55% reduction in emissions by 2030.

Following the rising energy prices, which encourage the quest for diversification of sources and therefore, in some cases, the restarting of coal-fired power plants, the price per ton of CO2 in Europe doubled during the year, exceeding EUR 65. The effects of rising carbon prices should be offset in the end by setting up a social climate fund, funded from revenues obtained from the carbon market for road transport and constructions. Moreover, to prevent the relocation of carbon emissions, an adjustment of carbon emissions at the borders should accompany these transformations.

Reforming European energy markets. Positions and oppositions

At the latest meeting of energy ministers in EU Member States, at the beginning of December 2021, they affirmed their positions on reforming European energy markets. Therefore, Germany, Denmark, the Netherlands and other six Member States opposed to requests coming from the governments of other states aimed at reforming the European energy markets. According to them, price cap or switching to a different national pricing system for electricity could discourage electricity transactions between the Member States and undermine the incentives for adding renewable energy in the system.

In reply, Spain, France, and Poland are among the countries that favour the reformation of the European energy market, proposing measures such as restricting the participation of financial speculators on the European market of pollution allowances or joint gas acquisitions by EU states to form strategic reserves.

Regional aids for Romania in 2022-2027, approved by the EC

The European Commission has approved the map based on which regional aids will be granted in Romania during January 1, 2022 – December 31, 2027, within the revised Regional State Aid Guidelines (RAG).

RAG allow Member States to help the most disadvantaged European regions close the gaps and reduce disparities regarding economic welfare, income, and unemployment – cohesion targets that are at the heart of Union’s policies. The Guidelines also provide Member States with more possibilities to support the regions that face structural or transition-related challenges, such as depopulation, to fully contribute to the green transition and digital transition.

Reduced carbon and methane emissions. Establishing a hydrogen market

Also, the legislative proposals adopted by the EC represent a set of measures to facilitate the introduction of gas from renewable sources and with low carbon emissions. The Commissions monitors in this period the EU Methane Strategy, as well as its international commitments on proposals to reduce methane emissions in the energy sector in Europe and in the global supply chain.

One of the main goals is to establish a hydrogen market, to create an investment-friendly environment and allow the development of an infrastructure dedicated to energy from non-polluting sources. The market rules will be applied in two stages, before and after 2030, and will cover especially access to hydrogen infrastructure, unbundling of hydrogen production and transport activities and pricing.

Also, a new governance structure will be created, in the form of the European Network of Network Operators for Hydrogen (ENNOH), to promote an infrastructure dedicated to hydrogen, cross-border coordination and the construction of interconnection networks, as well as the development of specific technical rules. These will facilitate access for gas from renewable sources and with low carbon emissions to the existing gas network, by eliminating tariffs for cross-border interconnections and by reducing tariffs at the injection points.