Romania, Europe’s Economic Growth Champion in Q1 2021

According to provisional data reported by Eurostat, Romania is the champion in the European Union, having the highest economic growth in Q1 2021, followed by Cyprus with an increase of 2%, Hungary of 1.9% and Lithuania of 1.8%.

Compared to the same quarter of last year, the Romanian GDP has exactly the same value, which means that the Romanian economy has fully recovered after the COVID19 pandemic and now we are registering a relaunch.

After this advance, analysts believe that there are great chances for the Romanian economy to end the year with an GDP growth of even 7%.

The government had initially estimated an increase of 4.3% for the whole year, recently changed to 5%, a target that will certainly change if it is a good agricultural year as shown, but also an increase beyond industry expectations.

The European Commission indicated in the spring forecast an advance of the Romanian economy of 5.1% this year, while the IMF revised its estimates to 6%.

In 2022, the IMF expects Romania’s economy to grow by 4.8%, the Fund said in the April edition of its World Economic Outlook (WEO) report.

The IMF also said it expects the GDP of Emerging and Developing Europe area comprising Romania, Russia, Turkey, Poland, Ukraine, Hungary, Belarus, Bulgaria, Serbia, and Croatia to grow by 4.4% in 2021 and by 3,9% in 2022.

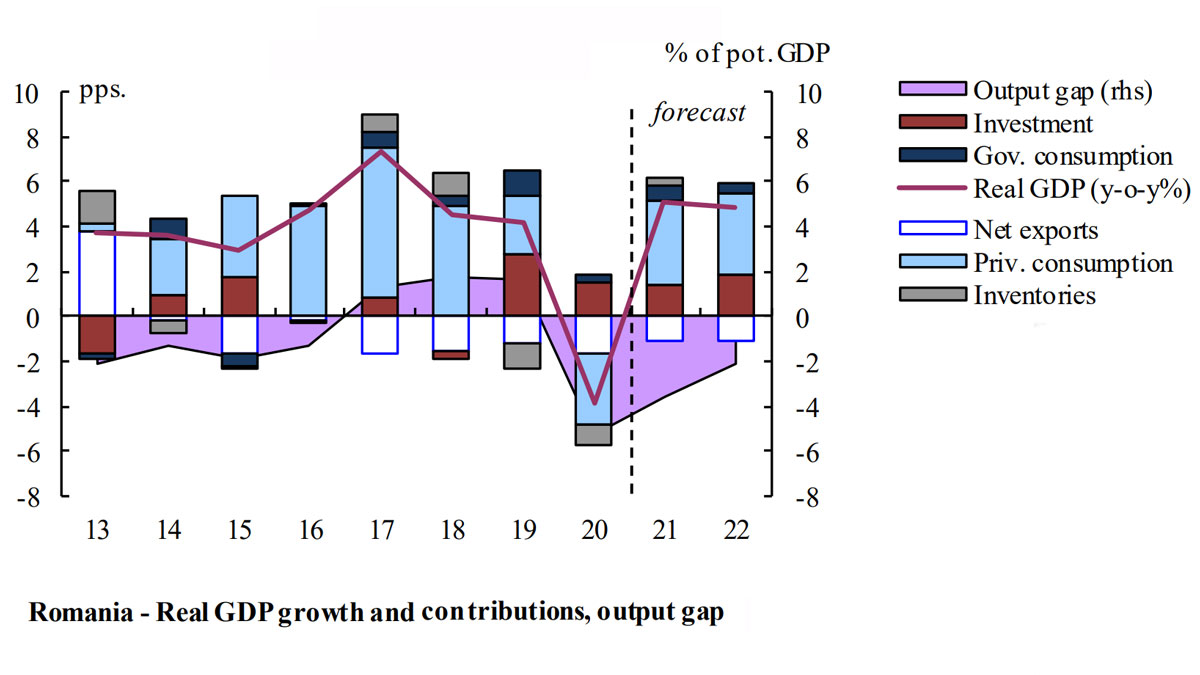

After a milder-than-anticipated decline in 2020, Romania’s economy is set to recover from the COVID19 crisis and return to pre-crisis levels of economic activity before the end of 2021. Nevertheless, uncertainty remains high given the unpredictable evolution of the pandemic and possible disruptions in the supply of vaccines. The budget deficit is projected to decline gradually on account of incipient fiscal consolidation efforts and strong GDP growth.

Strong recovery ahead

According to Eurostat, real GDP is forecast to increase by 5.1 % in 2021 and 4.9% in 2022. Private consumption is expected to recover as the vaccination roll-out progresses and social distancing measures are gradually lifted.

The phasing in of projects under the RRP is set to lend new impetus to investment growth. After a sharp contraction in 2020, exports are expected to rebound in 2021, supported by the gradual recovery of global trade, while higher consumer spending should spur import growth. Overall, the contribution of net exports to growth over the forecast horizon is set to remain negative. The current account deficit is expected to decline slightly to 4.9% in 2021 and 4.6% in 2022.

Policy measures to limit job losses adopted in 2020 helped contain the rise in the unemployment rate to only 5% from 3.9% in 2019.

Unemployment is projected to reach 5.2% in 2021 as headcount employment looks likely to be almost stagnant and because of growth in the labour force.

In 2022, the unemployment rate is expected to decline on the back of a rise in employment.

Nominal wages growth is projected to be relatively steady over the forecast horizon, but clearly lower than the double-digit rates seen in recent years.

HICP inflation declined from 3.9% in 2019 to 2.3% in 2020, largely on account of the sharp drop in oil prices but also due to falling food and services prices. Inflation is projected to increase to 2.9% in 2021, mainly as a result of the recovery in oil prices and the rise in electricity tariffs following market liberalisation. It is subsequently expected to decline to 2.7% in 2022.

Risks to the economic growth forecast

Risks to the economic growth forecast are broadly balanced.

On the one hand, confidence effects and a better than expected progress of projects financed under the RRP could provide an extra boost to domestic demand. However, delays in the implementation of the RRP could result in a more muted recovery.

The forecast follows the authorities’ backloaded projection on the plan’s implementation, according to which only a limited amount of the grant allocation will be used in 2021 and 2022.

Public deficit on a downward trend

The general government deficit was 9.2% of GDP in 2020, almost 5 pps. of GDP higher than in the previous year. This increase was mainly the result of pre-existing expansionary policies, including double-digit increases in pensions, as well as of the impact of temporary measures against the COVID19 pandemic and the overall deterioration in the macroeconomic environment. However, the government avoided an even larger increase in the deficit and in its debt by reversing earlier decisions to increase pensions by 40% and to double the child allowance.

The deficit is forecast to fall to around 8% of GDP in 2021. This improvement is mainly due to a suspension of new increases in pensions and public wages, additional cuts to some bonuses and other expenditure, and the partial withdrawal of emergency measures. Moreover, the fiscal position is forecast to benefit from higher revenues thanks to the recovery of the economy.

As the economic recovery continues in 2022, and crisis-related measures are discontinued the budget deficit is expected to fall further, to 7.1% of GDP.

Moreover, the suspension of increases in public wages is set to continue, while pensions are expected to increase following a standard indexation rule, instead of the faster pace that had previously been planned.

General government debt increased substantially in 2020, to 47.3% of GDP. In 2021, public debt is forecast to increase at 49.7% of GDP and continue increasing in 2022, mainly due to the still high primary deficit.

The fiscal forecast is subject to upside risks as the Romanian government put forward a medium term fiscal policy plan to reduce its deficit to less than 3% of GDP by 2024, which should be accompanied by deficit-reducing measures as of 2022.

https://ec.europa.eu/economy_finance/forecasts/2021/spring/ecfin_forecast_spring_2021_ro_en.pdf