Toshiba’s Strategic Reorganization to Enhance Shareholder Value

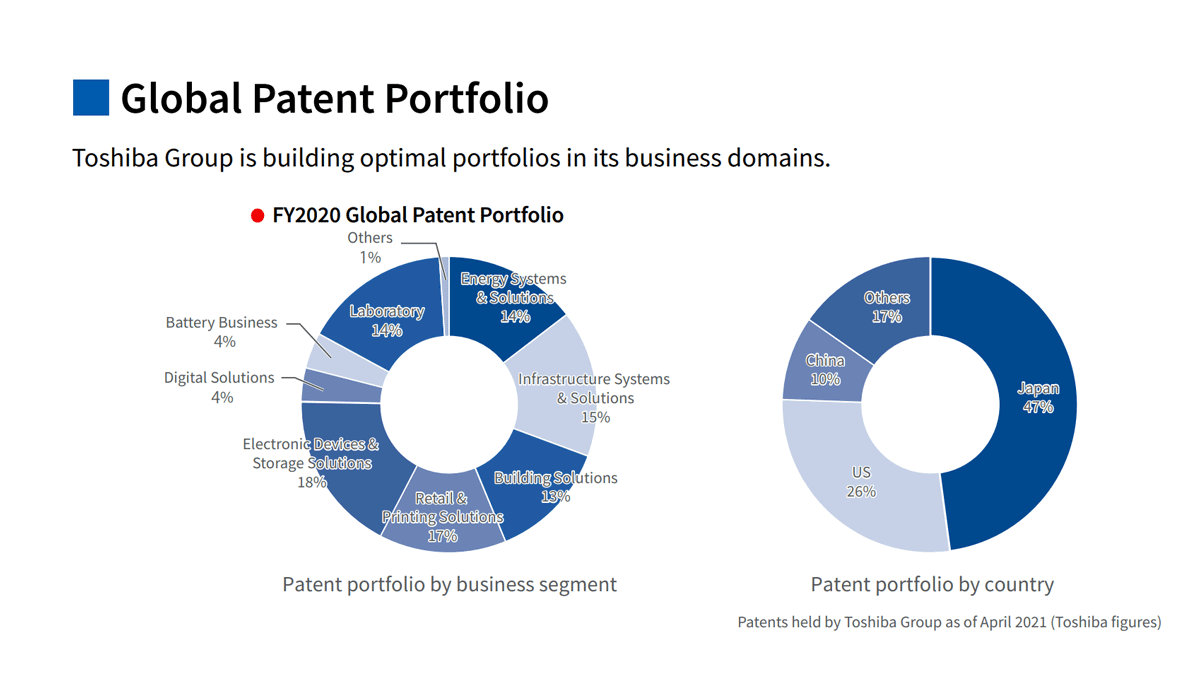

Toshiba will separate into three standalone companies to enhance shareholder value:

- Infrastructure Service Co., consisting of Toshiba’s Energy Systems & Solutions, Infrastructure Systems & Solutions, Building Solutions, Digital Solutions and Battery businesses;

- Device Co., comprising Toshiba’s Electronic Devices & Storage Solutions business;

- Toshiba, holding its shares in Kioxia Holdings Corporation (KHC) and Toshiba Tec Corporation (TOKYO: 6588).

The separation will create two distinctive companies with unique business characteristics leading their respective industries in realizing carbon neutrality and infrastructure resilience (Infrastructure Service Co.) and supporting the evolution of social and IT infrastructure (Device Co.). The separation allows each business to significantly increase its focus and facilitate more agile decision-making and leaner cost structures. As such, both companies will be much better positioned to capitalize on their distinct market positions, priorities, and growth drivers to deliver sustainable profitable growth and enhanced shareholder value. At the same time, Toshiba intends to monetize shares in Kioxia while maximizing shareholder value and return the net proceeds in full to shareholders as soon as practicable to the extent that doing so does not interfere with the smooth implementation of the intended spin-off.

The Company will utilize the tax-qualified spin-off structure via the recent tax reform legislation in Japan, in a first for a company of Toshiba’s size. Toshiba is taking a bold step to unlock substantial value, creating more focused investment opportunities for shareholders, and delivering additional benefits for customers, business partners employees, and its broader stakeholder community.

This separation plan, which has been unanimously approved by Toshiba’s Board, follows a review of a wide range of strategic options by the Board’s Strategic Review Committee (SRC), comprising five Independent Outside Directors. During its review, the SRC sought input from shareholders on the Company’s strategic direction and held discussions with several potential partners.

Based on the thoroughness of the nearly five months review, Toshiba’s management team and Board of Directors are confident that the intended separation into three standalone companies is the best path to enhance shareholder value.

Satoshi Tsunakawa, Interim Chairperson, President and Chief Executive Officer of Toshiba, said: “Over our more than 140-year history, Toshiba has constantly evolved to stay ahead of the times. Today’s announcement is no different. In order to enhance our competitive positioning, each business now needs greater flexibility to address its own market opportunities and challenges. We are convinced that the business separation is attractive and compelling: it will unlock immense value by removing complexity, it enables the businesses to have much more focused management, facilitating agile decision making, and the separation naturally enhances choices for shareholders. Our Board and management team firmly believe that this strategic reorganization is the right step for sustainable profitable growth of each business and the best path to create additional value for our stakeholders. We are grateful for the Strategic Review Committee’s thorough evaluation and recommendation on our best path forward.”

“We are pleased to share this bold and ambitious plan to deliver enhanced value for Toshiba’s shareholders and other important stakeholders. The SRC recommended to the Board that separating the Company into focused businesses is the best path forward for Toshiba and its shareholders following a thorough evaluation of value-enhancing options over nearly five months,” Paul J. Brough, Independent Director, Chairperson of Toshiba’s Strategic Review Committee, added.

New Structure: Overview of Three Companies

Infrastructure Service Co.

Infrastructure Service Co. will consist of Toshiba’s Energy Systems & Solutions, Infrastructure Systems & Solutions, Building Solutions, Digital Solutions and Battery businesses. Its products and services will include power generation, transmission and distribution, renewable energy, energy management, systems solutions for public infrastructure, railways, and industry, building energy-saving solutions, and IT solutions for government agencies and private companies. The Company’s increased focus, combined with its innovative technological solutions, will enable it to play a leading role in driving the transition to renewable energy to meet ambitious global carbon neutrality goals and advancing infrastructure resilience.

Infrastructure Service Co. is expected to have net sales of ¥2.090 trillion in FY32021 and is projected to grow at a 3.3% compound annual growth rate (“CAGR”), reaching ¥2.230 trillion by FY2023. It also expects to improve operating income margins from 5.1% to 5.2% over the same period, which we expect to be higher after the separation.

Device Co.

Device Co. will comprise Toshiba’s Electronic Devices & Storage Solutions business. Its products will include power semiconductors (silicon, compounds), optical semiconductors, analog integrated circuits, high-capacity hard disk drives (“HDD”) for data centers (nearline HDDs) and semiconductor manufacturing equipment. It will be a leader in supporting the evolution of social and IT infrastructure.

Device Co. is expected to have ¥870 billion in net sales in FY2021 and is projected – when excluding the memory resale portion – to grow at a CAGR of 3.3%, reaching ¥880 billion by FY2023. Power semiconductor net sales are expected to grow at an 13% CAGR, increasing from ¥95 billion in FY2021 to ¥120 billion by FY2023. Nearline HDD net sales are expected to grow at a 18% CAGR, increasing from ¥200 billion in FY2021 to ¥280 billion by FY2023. Device Co. expects operating income margins to change from 7.1% in FY2021 to 6.1% by FY2023.

Toshiba

Toshiba will hold the Company’s ownership stake in Kioxia Holdings Corporation (KHC) and Toshiba Tec Corporation (TOKYO: 6588). In connection with the separation of the businesses, Toshiba will seek to convert the shares of KHC into cash as soon as practicable while maximizing shareholder value. As part of this process, Toshiba intends to return the net proceeds of Kioxia shares to shareholders in full to the extent that doing so does not interfere with the smooth implementation of the spin-off.

Improved Governance and Management Structure

Toshiba is committed to pursuing best-in-class governance and each of the newly created businesses will be led by a separate Board of Directors and management team. The Boards of the new companies are expected to be majority independent and comprised of a diverse set of directors with the skills and experience to set strategy and hold management accountable. Separation of the leadership structures for these businesses will facilitate more agile decision-making, with greater focus and knowledge of the company’s customers and employees and create optionality for both new companies to make their own separate and informed decisions regarding potential strategic partners. In addition, the respective companies will be better positioned to tailor capital allocation and shareholder return policies to the optimal leverage and cash flow profiles.

Transaction Details and Timeline

Infrastructure Service Co. and Device Co. will be spun off from Toshiba and company stock of each of the two new companies will be distributed to Toshiba shareholders at the time of the spin-off record date. Toshiba is working with relevant authorities and our advisors to determine the best and the most effective and efficient way to spin off the businesses with an intention of effecting the transaction in a tax-qualified spin-off structure via the recent tax reform legislation in Japan.

The reorganization is expected to be completed in the second half of fiscal year 2023, subject to the completion of necessary procedures, including the approval of Toshiba’s general shareholder meeting and fulfillment of all review requirement of the relevant authorities.

The SRC will continue to oversee the preparation of the separation plan until Toshiba shareholders vote on it at the proposed extraordinary general meeting of shareholders (EGM) expected in the first quarter of the next calendar year, at which point it is expected that a board Steering Committee will be formed.

Commitment to Delivering Shareholder Value and Improving Governance

The separation represents a transformational milestone in Toshiba’s history and the continuation of a renewed commitment by Toshiba’s leadership to create and return value to shareholders. In June 2021, the Board announced a total of ¥150 billion of additional shareholder returns on top of the Company’s ordinary dividend, consisting of a ¥100 billion share repurchase program, which was completed in September, and a ¥110 per share special dividend.

Capital in excess of the appropriate level of capital will be used to provide shareholder returns, including share repurchases in FY22 and FY23, to the extent that it would not interfere with the smooth execution of the business separation.

Toshiba is committed to improving its corporate governance and regaining trust of its shareholders. The Board, which oversaw and approved the announcement is comprised of 75% Independent Outside Directors, all of whom were appointed in the past two and a half years. The Board has also undertaken several initiatives to strengthen Toshiba’s corporate governance, including establishing a Governance Enhancement Committee and initiating a review of Toshiba’s compensation program. Earlier this year, the Nomination Committee engaged an executive search firm to identify a new Chairperson and CEO, a task that will become more efficient following this decision to separate into three distinctive and strong standalone companies. All these efforts build on Toshiba’s commitment to bring its corporate governance practices in line with both global standards and the expectations of Japanese and international investors.