ArcelorMittal looking for buyers for Galati plant

ArcelorMittal received in early May the European Commission’s approval to purchase Italy’s Ilva plant, the largest steel mill in Europe. The approval was given by the Commission based on the commitment of the company led by Indian magnate Lakshmi Mittal to put up for sale units in Italy, Macedonia, the Czech Republic, Luxembourg, Belgium and Romania. With this approval, the plant in Galati (formerly Sidex), will be prepared for a new sale, after ArcelorMittal had purchased it from the Romanian state in 2001 within a transaction worth USD 70mln, and had invested USD 350mln over the past 10 years.

After receiving the green light from the European Commission to take over Ilva plant, ArcelorMittal hired the US group Bank of America Merrill Lynch to manage the asset sale, thus answering to EU concerns in terms of competition within the transaction through which it will purchase the steel mill in southern Italy, for EUR 1.8bn.

Assurances in a troubled market

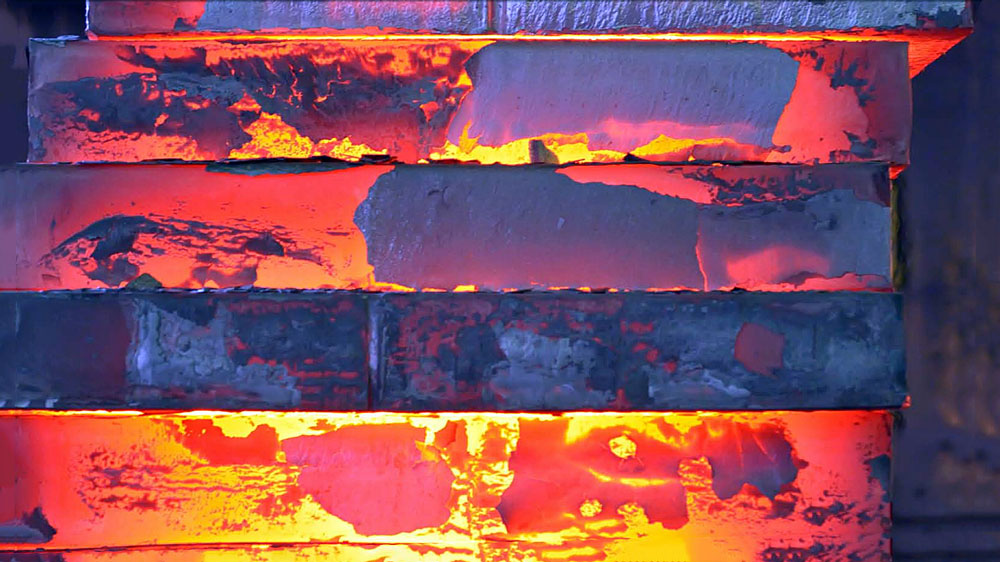

In the recent years, ArcelorMittal Galati plant has recorded an average production of around two million tons of steel per year, after in 1989 it had reached the production peak, eight million tons. Of the six furnaces existing at the time, today only one is standing. While before privatization there were 27,000 people working on plant’s platform, today there are only around 7,000, of which 5,500 belong to the plant and the rest – to contracting companies. For those whose activity is still related to that of the Galati-based plant, the news of putting up for sale the unit has caused the concern that it could be closed and they would lose their jobs. The authorities in Brussels, as well as those in Bucharest, have given assurances however that it would not happen and the plant would even increase its production after the sale.

The European Commission has expressed concern that a transaction on the takeover of the largest steel mill in Europe by the largest steel producer in the world would reduce competition in certain product segments and would generate higher prices for consumers in southern Europe. The industry is experiencing a state of uncertainty amid an extreme global turmoil, with production overcapacity, Chinese dumping and sanctions announced by Donald Trump to protect the US market. In this context, the announcement of India’s ArcelorMittal regarding the intention to sell the steel mill in Galati, one of the largest companies in Romania, sparks even more anxiety.

EC to oversee the sale process

According to the European Commission, ArcelorMittal will be responsible for plant’s sale within an open and non-discriminatory process. The process will be monitored by Brussels and the future owner will need expertise and the desire to ensure a sustainable operation of the unit. Once ArcelorMittal decides on a buyer the company will have the obligation to officially present the respective buyer to the European Commission, which will verify whether the established criteria have been observed. The Commission’s power of decision refers to approval of the buyer, after it is proposed by ArcelorMittal.

Before the sale is completed, ArcelorMittal and the potential buyer will need to provide the Commission with all the relevant information to assess the expertise and capacity of the buyer to operate market assets in a sustainable manner, in competition with ArcelorMittal. ArcelorMittal has also committed to boost investments in order to increase the capacity of the Galati-based plant, which will mean that it will have to provide the buyer with certain funds, and it will have access to this financing only if it uses it as part of an investment to expand the capacities in Galati.

Transfer of shares, only with state approval

Deputy Prime Minister Viorel Stefan has told a press conference that the transfer of shares would be done only with the explicit consent of the Romanian state.

“The transfer can only be done with the explicit consent of the Romanian state. There is a right mentioned in the privatization contract, stating that the transfer can only be done with the seller’s consent, i.e. of the Romanian state,” the official has stated, adding that a European Commission official would monitor the situation in the following five-ten years after the transaction. “Precautionary measures will be taken and all the necessary guarantees will be provided for production in Galati to increase after this transaction, not be restricted, and it will be valid for all production units subject to this transaction,” Deputy Prime Minister Viorel Stefan claims.

Besides the plant in Romania, ArcelorMittal has offered to sell the units ArcelorMittal Piombino, the only galvanizing line in Italy, ArcelorMittal Skopje (Macedonia), ArcelorMittal Ostrava (Czech Republic), ArcelorMittal Dudelange (Luxembourg) and the galvanizing lines number 4 and 5 of Flemalle; the etching, and the cold-rolling and covered metallic packaging lines of Tilleur, all of these from the plant of Liege, Belgium. According to the sources quoted by the international press, the assets package which ArcelorMittal has offered to sell is a lot bigger than the concessions the group was initially willing to make to be able to purchase Ilva plant.

In Romania, ArcelorMittal owns production units in Galati, Iasi, Roman and Hunedoara.

40% of Italy’s steel production

With a bid of EUR 1.8 billion (USD 2.2 billion), ArcelorMittal wants to acquire Ilva, the largest European steel maker, which employs over 14,000 people. Ilva, located in Taranto, southern Italy, manufactures annually nine million tons of steel, approximately 40% of Italy’s steel output, and supplies steel for automotive manufacturers, electrical equipment manufacturers and shipbuilders.

ArcelorMittal has promised to invest here other EUR 2.4 billion in upgrade.

Galati’s steel industry, more and more restricted

In 1988, Sidex Galati was among top ten steel producers in Europe, with an output of around eight million tons of liquid steel achieved by over 50,000 steelworkers.

In 1999, Sidex had halved its staff and production, but was still covering 4% of Romania’s GDP. With Sidex’s takeover by ArcelorMittal, the large investments promised upon takeover translated into the demolition of the coke-chemical plant, cutting five out of six furnaces and two steelworks, resulting in a drop in output of about two million tons per year; plus the layoff of about 20,000 employees.

Growing production, declining investments

Romania’s crude steel production in 2017 stood at 3.37 million tons, up 2.2% compared to the previous year. However, total investment expenses in the steel industry amounted to RON 217.767bn, down 8.5% compared to 2016.

Investments decreased in most metallurgical sectors: steel smelters (- 60%), long products (- 46.7%), rolling mills (- 36.8%), other metallurgical plants (- 31.2%), cold rolling plants (- 27.3%). Gross energy consumption in the steel industry in 2017 stood at 59,143.7 TJ, down 2.8% compared to the previous year.