Coal’s contribution to the energy mix to decline slightly by 2023

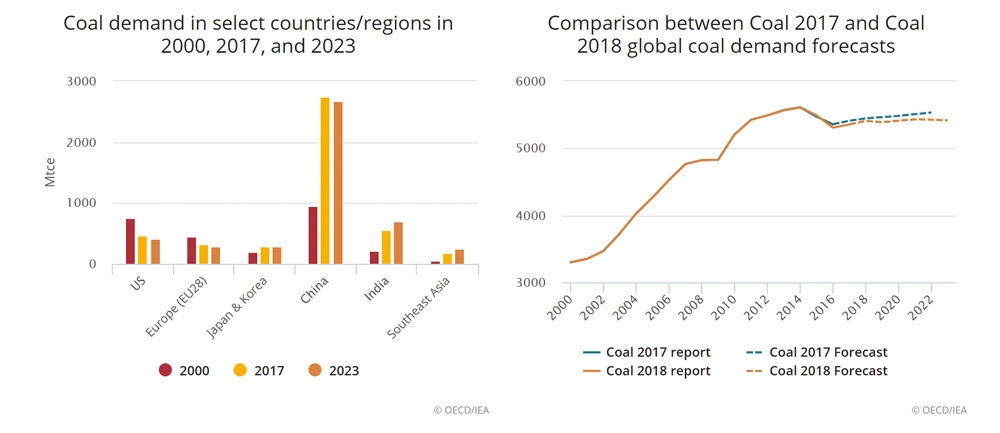

While global coal demand looks set to rise for the second year in a row in 2018, it is forecast to remain stable over the next five years, as declines in Europe and North America are offset by strong growth in India and Southeast Asia, according to the International Energy Agency’s latest coal market report, Coal 2018.

Air quality and climate policies, coal divestment campaigns, phase-out announcements, declining costs of renewables and abundant supplies of natural gas are all putting pressure on coal. As a result, coal’s contribution to the global energy mix is forecast to decline slightly from 27% in 2017 to 25% by 2023.

But coal demand grows across much of Asia due to its affordability and availability. India sees the largest increase of any country, although the rate of growth, at 3.9% per year, is slowing, dampened by a large-scale expansion of renewables and the use of supercritical technology in new coal power plants. Significant increases in coal use are also expected in Indonesia, Vietnam, Philippines, Malaysia and Pakistan.

Coal in China accounts for 14% of global primary energy, the largest around in the world. Developments in the Chinese coal sector have the potential to affect coal, gas and electricity prices across the world, for instance through inter-fuel substitution or regional arbitrage. This puts China’s coal sector at the centre of the global energy stage. While China accounts for nearly half of the world’s coal consumption, its clean-air measures are set to constrain Chinese coal demand going forward. IEA forecasts Chinese coal demand to fall by around 3% over the period.

Meanwhile, in a growing number of countries, the phase out of coal-fired generation is a key policy goal. But market trends are proving resistant to change.

“The story of coal is a tale of two worlds with climate action policies and economic forces leading to closing coal power plants in some countries, while coal continues to play a part in securing access to affordable energy in others,” says Keisuke Sadamori, Director of Energy Markets and Security at the IEA. “For many countries, particularly in South and Southeast Asia, it is looked upon to provide energy security and underpin economic development.”

This is why the IEA sees technologies like Carbon Capture, Utilisation and Storage (CCUS) as essential tools to bridge current and future energy needs with global and national climate ambitions. To help build a new momentum behind the technology, the IEA and the Government of the United Kingdom co-chaired an international summit where ministers, senior governmental officials across the world, CEOs from major energy companies and the financial community came together to identify practical steps to accelerate investment and deployment of CCUS.

“Tackling our long-term climate goals, addressing the urgent health impacts of air pollution and ensuring that more people around the world have access to energy will require an approach that marries strong policies with innovative technologies,” underlines Sadamori. “It must rely on all available options – including more renewables, of course – but also greater energy efficiency, nuclear, CCUS, hydrogen, and more.”

Key findings

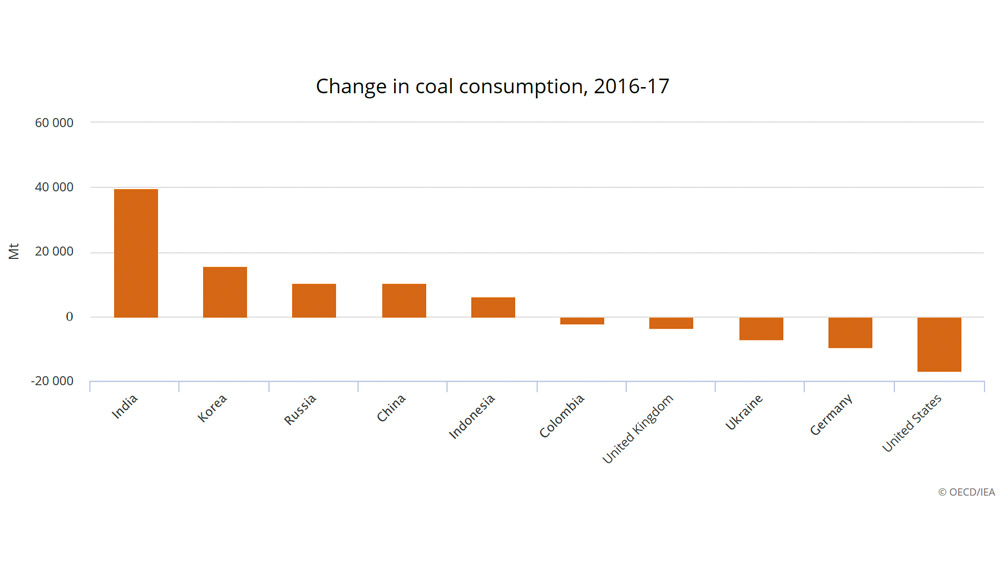

After two years of decline, global coal demand grew by 1% in 2017 to 7585 Mt as stronger global economic growth increased both industrial output and electricity use. Driven by strong coal power generation in China and India, coal demand is expected to grow again in 2018.

- Global coal demand is forecast to be stable through 2023

Global coal demand in the next five years is set to be stable, with declines in United States and Europe offset by growth in India and other Asian countries – though China, the main player in the global coal market, will see a gradual decline in demand. In terms of the total energy mix, coal’s contribution will decline from 27% to 25%, mainly due to growth of renewables and natural gas.

In particular, global coal power generation increased by over 250 TWh, or around 3%, and accounted for about 40% of the additional power generation worldwide. Coal kept its share in the power mix at 38% after some years of decline.

The article continues below the graph.

- The seaborne coal trade experienced a rebound in 2017

Chinese coal imports grew by 15 Mt in 2017, and most other large importers, including Korea, Chinese Taipei, Malaysia, Turkey, Philippines, Brazil, Mexico, Vietnam, Pakistan and Morocco had record imports. Japan, Thailand and Chile were very close to their historical highs. With such sustained demand, prices remain high.

However higher prices aren’t triggering new investments. Risks associated with climate policy, potentially stranded assets, local opposition and the memories of the last downturn have cooled investor appetite to invest in new production.

It appears that banks, insurance companies, hedge funds, utilities and other operators in advanced economies are exiting the coal business.

- A tale of two Europes

Western Europe is accelerating its coal exit – action on climate change and air pollution combined action to specifically phase out coal-fired power generation, are all impacting coal demand. Along with the expansion of renewables, these policy efforts will eventually push coal out of the Western European power mix.

By contrast, most countries in Eastern Europe have not announced phase-out policies and a handful of new coal power plants are under construction in Poland, Greece and in the Balkans. Some countries in Eastern Europe are among the few places in the world where lignite remains the cornerstone of the electricity system.

The article continues below the graph.

- Blue skies in China?

Environmental policies, and in particular clean-air measures, are set to constrain coal demand in China. Yet for now, one out of every four tonnes of coal used in the world is burned to produce electricity in China.

This makes China power sector the largest user of coal in the world by far, and as such, any fluctuation in China’s domestic power system can push global coal demand up or down significantly.

For example, if power demand in China remains stable, global coal demand is set to decline more than 1% per year. But with power demand growth of 10% – similar to the first decade of this century – global coal demand would grow over 3% per year.

Or, with annual growth in hydro output in China of about 1.5%, global coal demand grows at 0.2% per year. But 10% annual growth in hydro output would lead to a decline in global coal demand.

As another example — a shutdown in 2017 of small boilers in China, owing to clean air policies, triggered gas demand in China which in turn pushed up LNG prices in China and around the world.

Given that coal in China is the largest single source of primary energy in the world by far, the interlinkage between fuels and geographies sets Chinese coal in the centre of the energy stage.

- Coal’s engines of growth

Meanwhile, the unmatched period of coal power generation growth in India is set to continue, having grown continuously since 1974. With the Indian economy expected to grow over 8% per year to 2023 and the electrification process continuing, power demand is forecast to rise by more than 5% per year over the period.

Indonesia, Pakistan, Bangladesh, Philippines and Vietnam have more than 800 million people combined, yet their average annual per capita electricity consumption is just one seventh of that in Europe. Increasing coal power generation, supported by new coal plants under construction, will be the main driver of coal demand growth in those countries.

- Uncertainty for future demand

Over the past few years, uncertainty has been a major feature of the import forecast – for example imports to China have been swinging wildly from year to year. Forecasts for India are also uncertain because imports are used to balance a much bigger domestic market, with both coal production and demand growing significantly.

Despite this uncertainty, Colombia and South Africa have proved over the years that exports are more the result of domestic circumstances than the market conditions. Meanwhile, most producers in Australia and Russia are also well placed with expansion in export capacity. In the case of Indonesia and United States, we see many producers on the right side of the supply curve. This is confirmed by the price sensitivity of exports from both countries.

- CCUS: The future of coal

Over the past few years, coal’s shift to Asia has resulted in the emergence of two worlds: one with coal power generation and the other without.

This has made it difficult to build agreements on coal and emission reductions. Some countries have committed to end unabated coal power generation by 2030, while in others, the end of coal generation is unlikely given the role that coal plays for securing access to affordable energy.

Carbon capture, utilisation and storage (CCUS) is the bridge between these two worlds. However, while 2018 brought some good news in terms of policies and projects, the world’s progress with deploying CCUS remains woefully off-track with what is required for a sustainable energy future.

The IEA is committed to continue to build momentum on this crucial technology, as evidenced by 2018 International CCUS Summit, co-hosted by the IEA and the United Kingdom in Edinburgh on 28 November. The Summit contributed to significant new momentum for CCUS and the IEA will continue to support these efforts in 2019 and beyond.