Electric Vehicles and Robotics for Mining 2020-2030

The new IDTechEx report, ‘Electric Vehicles and Robotics for Mining 2020-2030’ shows how electric vehicles and robotics progress to the newly-arrived unmanned electrical mines. Many mining vehicles are among the most power-hungry EVs, yet they are located where pressure for zero-emission local electricity supply is strengthening. It is therefore futile to analyse mining electrification without addressing where that zero-emission electricity will come from, so IDTechEx does that too – zero-emission microgrids on-site, increasingly multi-mode and transportable.

Mine operators must improve safety, environmental and financial aspects while tackling mining that is often more remote, dangerous and hot making staffing more problematical. The new IDTechEx report, ‘Electric Vehicles and Robotics for Mining 2020-2030’ shows how electric vehicles and increasingly unmanned mines tick the boxes in addressing all these challenges from sea floor to mountain, deep mine and open pit work.

The report provides uniquely up-to-date, penetrating analysis and forecasts of the technology and markets globally. It is for all in the mining vehicle value chain from investors, researchers and materials suppliers to vehicle and component manufacturers, operators, system integrators, mining operators and legislators. Many mining vehicles are among the most power-hungry EVs, yet they are located where pressure for zero-emission local electricity supply is strengthening.

Electrics and robotics square the circle of seeking a wider variety of depleting materials in nastier, more remote places from the seafloor to four kilometres underground, up remote mountains and later outer space. Zero-emission microgrids on-site, sensors everywhere and new information and communications technology lubricate the process. Mining embraces about 1500 large mines yielding metal-bearing material, diamonds and coal, down to tens of thousands of smaller sites such as gravel pits and marble quarries. Despite these greater challenges, mine operators must improve safety, environmental and financial aspects. The man working a tool and the static processor are replaced by vehicles but those vehicle suppliers pushing only diesel-alone vehicles with diesel gensets as a side-line are starting to look retro and rejected.

The new IDTechEx report has an ‘Executive Summary and Conclusions’ sufficient in itself because it gives ten-year forecasts in five categories, six key market drivers in detail and info-grams of the mines of the future and the many new challenges. Here are 20 key conclusions grouped by industry, regional and technological. Mining CapEx content and trend is clarified by new info-grams. Development timeline, patent trend and progress 2020-2040 to price parity with diesel by vehicle type are graphed. The introduction then scopes mining basics, leading miners and new challenges, threats and incentives, the mining equipment market and what is and is not an electric vehicle.

Future of quarrying

The team at Volvo Construction Equipment (CE) is steadfast continuing towards an all-electric future – at least for the quarrying and aggregates industry.

As part of a project to develop an electric site solution that aims to create an accident-free quarry without any unplanned stops and with zero emissions, Volvo CE is building a fleet of eight HX2 autonomous, battery-electric load carriers.

Volvo CE worked in partnership with Skanska Sweden to incorporate the machines into operations at a Swedish quarry for a demonstration at the end of 2018.

The transport stage – from excavation to primary crushing and transport to secondary crushing – has been be electrified.

Surveying is radically improved with drones. In 2019, using the Skycatch-powered Everyday Drone solution, Komatsu Australia was able to survey all six quarries in only five days, with the point clouds for each quarry processed and delivered in less than 24 hours – a huge boost in survey productivity. Surveying six quarries would have normally taken more than a month for a single surveyor, and might have resulted in a less detailed deliverable.

ABB’s optimized e-drivetrain combines a motor, drive and vehicle control unit to enable heavy special and commercial vehicles to transition to fully-electric operation. Manufacturer of underground mining and infrastructure equipment, Epiroc, has already adopted the new concept for its second-generation battery-powered vehicles. ABB has launched an optimized e-drivetrain platform to help manufacturers of heavy duty special and commercial vehicles make a smooth, fast-track transition from diesel to zero-emission electric operations. “Our goal is zero-emission mining. This is a power change that changes everything,” Epiroc says.

Anglo American experimental mining truck now trialling. This ultra-class vehicle is larger than possible as a battery-only truck as yet. Its 800kW fuel cell produces around 800kW of waste heat that could be cost effectively converted to a useful few kW of electricity by thermo-electrics in later versions. Its large battery at 1MWh also runs hot but it enables tens of kW of regenerative braking because fuel cells cannot store electricity.

BEVs are now considered proven. Include cable-fed vehicles with large batteries for BEV mode when needed.

Kirkland Lake Gold bought its first BEV scoop for its Macassa mine in Ontario in 2012. Now many are going BEV including the world’s first unmanned deep mine completing in 2020. Main focus is trucks, utility, loaders inc. LHD.

Nouveau Monde is going BEV its all-electric Matawinie graphite surface mine in Quebec, “to make it the world’s first all-electric mine”. 2020 sees a flood of new mining BEVs on sale. ABB is best in class as independent supplier of mine BEV and hybrid powertrains and chargers without making the vehicles. 8hr endurance is common as is charging using existing power supplies in mines.

Consolidation. There is scope for consolidation in the mining vehicle industry. Shrewd recent purchases include Sandvik buying Artisan in April 2019. Sandvik Artisan 50-ton mining truck is 100 ton fully loaded. 100% battery electric powered. Zero emissions and 3x more power than a diesel. Powers up downhill: at this particular site the operator had been moving material downhill for 8 hours without recharge.

Equipment definitions: market player landscape

Electrification of mobile equipment in heavy industries is a profitable opportunity.

Atlas Copco’s outlined their focus of future development of underground mining equipment will now be zero-emission and battery-driven machinery. The company already offers battery operated scoops (Scooptram ST7), Electric Boomer M2C and smaller truck models, looking to add larger vehicles to their fleet in the near future.

The emerging market landscape puts companies such as Caterpillar, Volvo Group, John Deere, CNH Industrial and Komatsu in a good position to benefit from cross industry synergies.

Drivers will have an impact on whole of the supply chain: OEMs – Increased product variety; Suppliers – System integration – powertrain incl. hybridisation; Dealers/Rental Companies – supply productivity and energy not machines and fuel; Fuel Companies – diversification of fuel types; Service Providers – Managing digitalisation across brands and systems.

Goldcorp Chapleau unmanned electric mine 2020

In mining, 2018 saw the beginning of unmanned deep mining, though the prediction by Komatsu that it will take only three people to run a large open pit mine remains just that – something into the future. Goldcorp Inc (G.TO) (GG.N), the world’s largest gold miner, is building the world’s first new all electric mine using a rough-hewn tunnel, 260 meters underground, completion being in 2020.

In Chapleau Ontario Canada, near-silent, battery-powered machines are tunnelling toward gold in a multimillion-dollar mining experiment to ditch diesel and even people in regular attendance underground. The rock chewing machine weighs 60,000 pounds and runs non-stop on a giant cord. It has a 75-kwh sodium nickel chloride battery to buffer power demands and to move the drill from one part of the mine to another – that is the electric vehicle mode.

“Goldcorp expects to save 7,000t/y of carbon by using an all-electric fleet. That’s the equivalent of 10 roundtrips for a fully booked Boeing 777 between London, UK and New York, US, every year,” Marc Lauzier, mine general manager at Borden Lake, said.

Seven key EV enabling technologies for mining EVs

Important in the electrification of industrial vehicles is not just the vehicles themselves, but also the associated technologies and infrastructure. A suitable electric drivetrain can power tools such as grab arms and even recover dropping or rotational braking energy as electricity back into the battery. The bucket truck shown right is working from the hybrid powertrain of the vehicle. In effect, a hybrid vehicle becomes a genset for operations on arrival. Amongst these new capabilities are the following:

- Electric motors – Electric motors work inversely as generators and transform mechanical energy into electric energy, both for hybrid and full electric. Electric traction is more even, controllable, faster responding and stronger from start. Motors are key to achieving long range/endurance and best performance.

- Traction battery systems including and battery charging and swapping.

- Supercapacitors for energy recovery and storage, the energy recovered or generated in the vehicle can be stored in either batteries or supercapacitors. Given the high-power capabilities of supercapacitors they can recover up to 80% of the kinetic energy of the energy as opposed to 30% in batteries when braking the vehicle and its swinging, digging and lifting tools. Supercapacitors are also called ultracapacitors.

- Power electronics. This will sometimes overtake batteries as the largest percentage of vehicle cost and capability. It adds more and more functions such as regenerative suspension, V2G and solar power handling. Solar bodywork. Photovoltaic bodywork providing 10-100% of the electricity.

- Zero emission transportable microgrids for charging

- Autonomy technology

Overview of electrics in mining vehicles

Hydraulics and diesel engines are being replaced by electrics for zero emission, reliability, long life, precision, performance. CAM vehicles need to be more rugged and work at wider temperature ranges and in more slippery conditions than on-road/indoor vehicles. They grab and deliver stronger surges of energy so motors on or in all wheels, supercapacitors and exceptionally large batteries are more likely to be used. Autonomy is achieved with electric motors responding in one tenth of the time of diesel.

However, currently most mining robotics uses internal combustion engines because, for now, battery electric costs more and needs ‘refuelling’ more often. Hybrid electric is the transitional option. Uniquely, electrification in mining is strongly driven by cost saving in air delivery and cleaning and the severe hazards of sending people underground or to the ocean floor.

On the other hand, the mining environment is often simpler and more controllable. Mining autonomy is usually easier to achieve that say for a car in a city and done earlier. The supercapacitor captures electricity generated from braking when the vehicle is going along, swing braking and tool dropping. It releases electricity to the swing, lift and propulsion motors. Bigger surges are managed in and out than the battery can provide but the battery stores more electricity. The inverter switches between the two types of electricity (AC-DC, one voltage to another) as it travels to and from the supercapacitor and battery and the swing motor and the generator motor. In hybrid electric mining vehicles there may be no battery sometimes. Compact motors and other parts can mean a smaller, more manoeuvrable vehicle. Many motors instead of one can mean the vehicle never fails and it manages slippery conditions better and does not damage public roads by skid steering.

Making the electricity

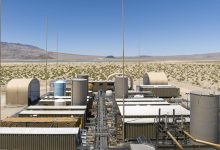

The trend is to off-grid because many CAM locations are remote, national grids are vulnerable to weather and cybercrime and 949 metric tonnes of carbon dioxide equivalent is caused by grid losses (Source: Sarah Jordaan, Kavita Surana).

To create off-grid electricity, we are headed for modular, zero emission diesel genset and grid replacement – potentially a USD 100Bn+ ‘Zero Genset’ market.

CAM industry action arising

Many CAM vehicle manufacturers make diesel gensets. They should sell or shut those activities and make ‘zero gensets’ instead, selling them as systems with their vehicles and alone.