Strategic Materials and Energy Transition: Cobalt

This article deals with the identification of cobalt resources, who produces, who consumes and what is this resource availability until 2050.

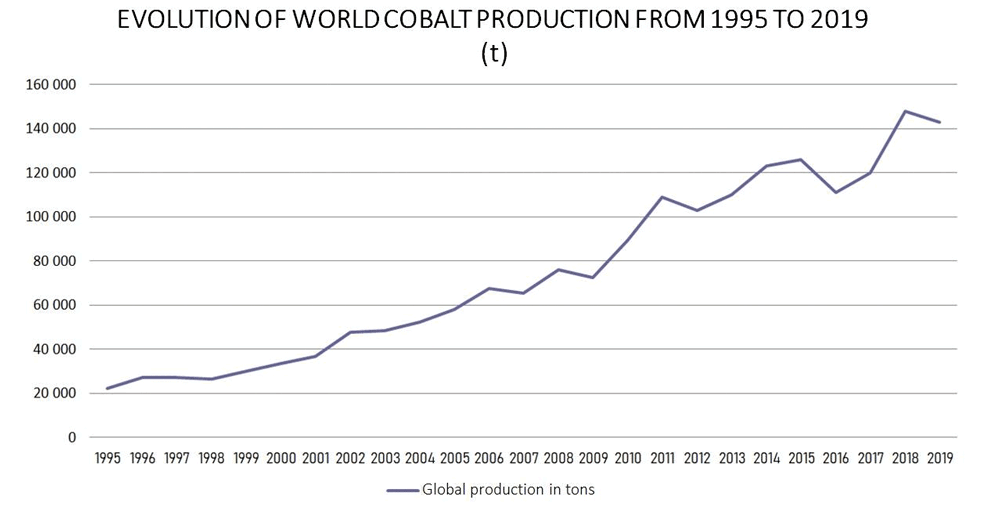

In the following 30 years demand for strategic materials necessary for energy transition is expected to grow 50-fold.

China provides 90% of the global demand for rare earth elements, South Africa 80% of the PGM (Platinum Group Metals) requirements, the Democratic Republic of the Congo 65% of cobalt and Turkey 40% of borates. Europeans depend overwhelmingly on China and other emerging countries for future supplies.

What answer should we expect from Europe?

The European list of critical raw materials continues to evolve in accordance with technological priorities: it has gone from 14 materials in 2011 to 30 critical materials in 2020. Unfortunately, their supply is linked to very concentrated global markets.

The European Union has developed a strategic plan based on 10 different axes and established a European Raw Materials Alliance. The top priority is selective recovery, within Europe’s borders, of an extractive and processing industry by financing sustainable mining projects.

The inventory of European mineral resources indicates germanium and cobalt in Finland, gallium in Germany, strontium in Spain, hafnium, and indium in France. Other metals, such as lithium, could be produced in Europe, but this is not the case for economic reasons.

A second alternative for Europe is to develop a ‘substitution’ strategy, namely, to develop independent substitution technologies for these rare metals. Technological challenge is possible in certain fields. In absence of ‘raw materials’, it will be necessary to concentrate huge research resources, such as research in energy storage.

Even if today, from an economic point of view, the cost of recycling is often higher than the purchase price of certain raw materials, recycling of materials opens up interesting prospects for which new resources have to be mobilized. There is no doubt that for Europe the supply of raw materials will continue to depend on trade agreements, but the old continent’s strategy cannot come down to this form of dependence.

According to the plan of European institutions, exposure to geopolitical risks, to global market shocks must be reduced and resilient supply chains must be built. But the most difficult step remains to be taken, namely operationalization of the strategic plan through priorities and clear decisions. National interests will have to be left behind and cooperation agreements will have to be found between the European institutions, national authorities, and the private sector. Europe’s future will depend on its ability to establish a true alliance for raw materials.

Cobalt or ‘Blood Diamond’, a particularly fragile economic and strategic situation

Cobalt has the particularity of having a high melting point and retains its strength and magnetic properties even when subjected to high temperatures. Therefore, this makes it an essential element for many strategic areas, such as aerospace, defence, chemical industry etc. We also find it as a component of superalloys used in gas turbines and nuclear reactors, but also in radar magnets, missile guidance systems, marine propulsion systems and sensors.

Cobalt increasingly owes its visibility mainly due to its use in low carbon technologies, also called green technologies (renewable energies and rechargeable batteries); it is present mainly in wind turbine magnets, but also in the cathode of lithium-ion batteries and nickel metal hydride batteries used in electric or hybrid vehicles.

Cobalt Resources. Who produces? Who consumes?

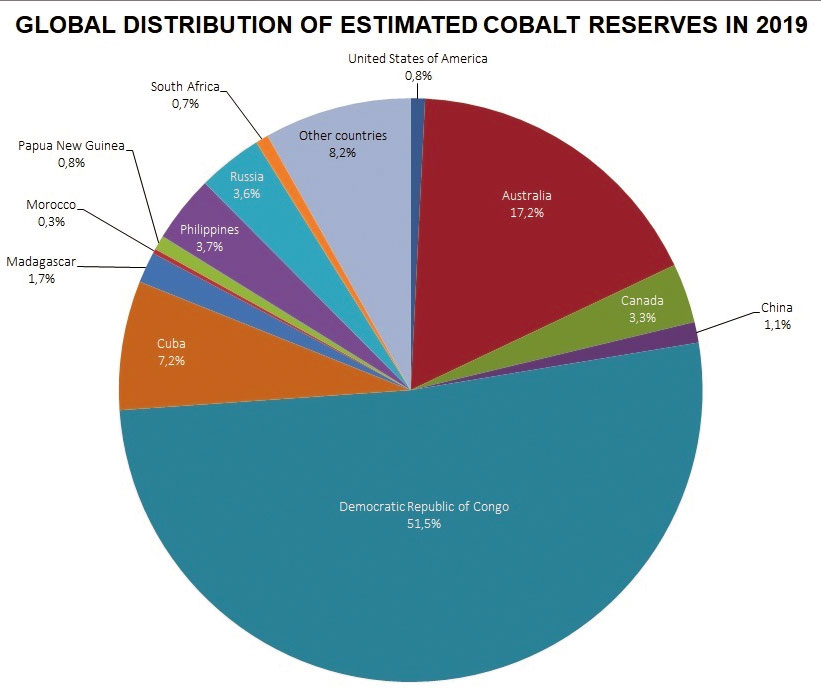

In 2020, according to the USGS (United States Geological Survey), terrestrial resources amount to 25 million tons. Most of these resources are located in the ‘Copperbelt’, a mining area that includes much of the province of Kantanga in the Democratic Republic of Congo (DRC).

The rest of the resources are distributed mainly in Australia, Cuba, Canada, Russia, and the United States. Another 120 million tons of cobalt are believed to be found in the lower Atlantic, Indian and Pacific Oceans. However, their exploitation is not yet relevant due to technological, economic, and legal barriers.

China, Japan and the United States, the world’s largest consumers of cobalt

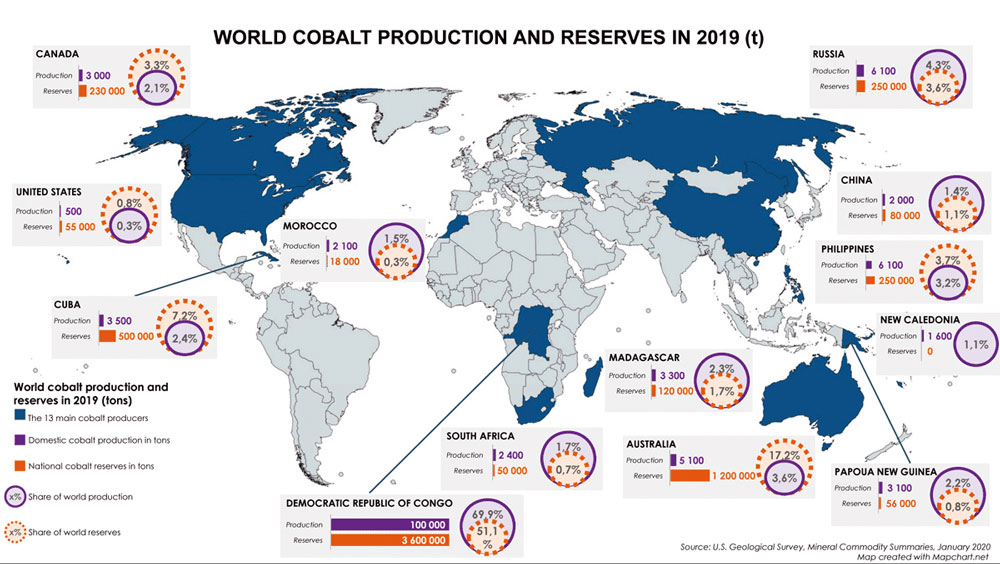

In 2019, almost 70% of the mining production came from the Democratic Republic of Congo, while this country accounted for only 21% of world extraction in 2000. Some of the most important producers include Russia, with 6,100 tons (which means 4.3% of the total); Australia, with 5,100 tons (3.6% of the total). The share of each of the other ‘big’ producing countries – the Philippines, Cuba, Madagascar, Canada, Morocco, China, and New Caledonia – does not exceed 3.2%. Therefore, the extractive activities are extremely concentrated from a geographical point of view.

The same is true for refining, which is 50% controlled, compared to 3% in 2000, by China, the rest taking place mainly in Finland, Belgium, and Canada. China, Japan, and the United States are the world’s largest consumers of cobalt. In 2019, China is at the forefront of the podium and 80% of the cobalt consumed there is used for battery manufacturing (USGS).

Are there cobalt resources available until 2050?

High geological criticality

To assess the availability of cobalt until 2050, the TIAM-IFPEN model was used. Two climate scenarios were used, 2D (2°C) and 4D (4°C), each with two different mobility scenarios:

- Business As Usual (BAU) mobility, i.e., a continuous increase in dependence on cars, property, consumerism

- Sustainable mobility – stronger fiscal and regulatory policies, with priority granted to sustainable modes of mobility, such as public and non-motorized transport.

For each mobility scenario, three trajectories of the chemical mixture of the lithium-ion battery were considered: one with a high cobalt content (10% NCA, 90% NMC622), an intermediate (10% NCA, 40% NMC622) and a low intensity cobalt mixture (10% NCA, 90% NMC811) until 2050.

83.2% of cobalt resources could be consumed between 2013 and 2050

To assess the level of criticality related to cobalt, cumulative demand ratios were calculated until 2050 compared to the resources known at the moment, varying the three groups of parameters previously described. Based on a BAU mobility scenario with a mixture of lithium-ion batteries with high cobalt content, the demand ratio of this metal goes from 64% in the case of a climate scenario to 83.2% in the case of a more ambitious climate scenario. This last ratio means that 83.2% of cobalt resources would be consumed between 2013 and 2050 in such scenario.

If we consider that limiting global heating to 2D will be the chosen target, then two leverages can be mobilized to moderate the pressure exercised on cobalt resources. First of all, promoting battery technologies with reduced cobalt intensity seems the most efficiency way to reduce the level of criticality related to cobalt. Secondly, the results of the modelling activity show the positive impact of implementing a sustainable mobility policy on the level of criticality of the blue metal. Finally, recycling is to play a key role in meeting the strong growth in cobalt demand by 2050.

Cobalt, a by-product of copper and nickel mines

Cobalt demand is not very sensitive to price changes. In the event of a sharp increase in prices, the cobalt market will respond in three ways: by increasing recycled volumes, by leveraging technological innovations to exploit a wider range of resources, and by further mobilizing informal cobalt production in the DRC. In 2015, 98% of the cobalt extracted from the earth was a by-product of copper or nickel mines. Only the Bou-Azzer mine in Morocco made cobalt its main product. This characteristic of cobalt reinforces the supply risk associated with it, as the amount of by-product generated by the extractive activities depends closely on that of the main metals. As a result, the cobalt market’s ability to adapt to growing demand is limited.

According to NGOs, cobalt is the ‘Blood Diamond’. More than 70% of the cobalt mining production was controlled by the Democratic Republic of Congo in 2020, compared to 28% in 2000. However, the country suffers from strong political instability, as well as a worrying security situation, with many conflict areas in the east of the country. Dangerous working conditions, exposure to potentially carcinogenic dust, child labour, and a proliferation of clandestine mines linked to the high market value of cobalt, have earned the latter the nickname ‘Blood Diamond’.

China’s strategy of ensuring supply reduces the cobalt amount available to other consuming states

According to Gulley/2019 Report, Chinese refineries account for 50% of the global volume, compared to only 3% in 2000. The Chinese power has also implemented a strategy of investment abroad to ensure its supply with metals considered strategic. Therefore, while for 2016 the share of foreign cobalt production held by Chinese entities added to domestic production, the Chinese influence will move from 2% to 14% for cobalt extraction and from 11% to 33% to produce cobalt intermediates (Gulley, 2019). These figures highlight the risk that a country that gains importance in the value chain may represent; China’s strategy of securing its supply potentially reduces the amount of cobalt available to other consuming states.

Cobalt extraction contributes to global warming

Although an essential element for certain low-carbon technologies, cobalt – mainly mining and refining activities – has an environmental impact that should be taken into account. For example, cobalt extraction requires energy from fossil resources, which contributes to global warming. These activities also have a significant impact on the health of minors and populations located in the respective areas. It was also proven that cobalt production emits various types of pollution. This metal shows that, far from meaning the end of reliance on raw materials, energy transition and electrification of mobility modes bring new constraints on other types of resources.

States and companies pursue or take into account several paths: first of all, diversification of supply sources; then technological innovation by designing batteries that consume less cobalt (or the use of other types of batteries); and, in the end, electronic waste and battery collection and recycling.

Therefore, while the secondary cobalt sources are still underexploited today, they could be an important resource in the future.