A new era for Equinor on the UKCS

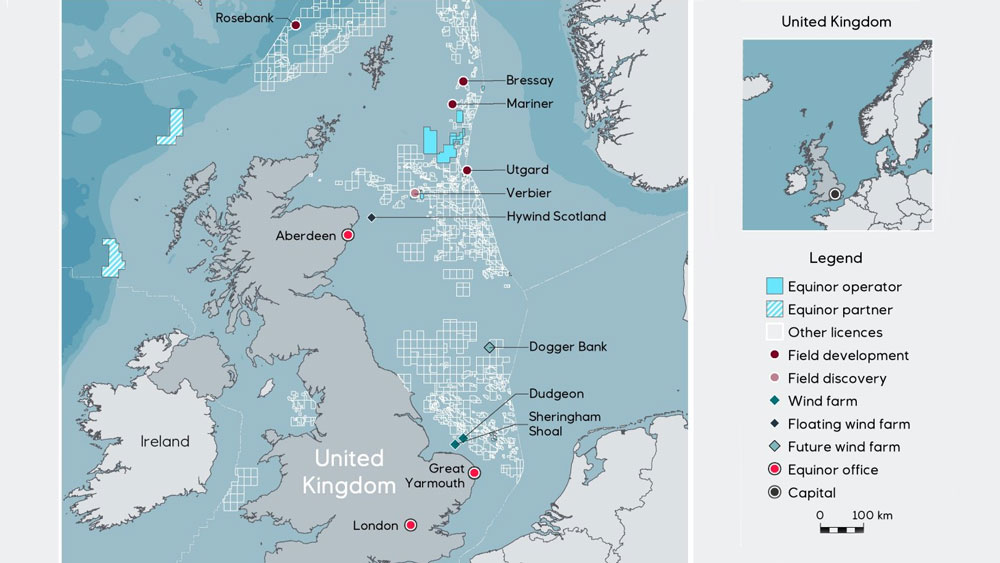

Equinor and Chevron have completed their transaction announced in 2018, whereby Equinor has acquired Chevron’s 40% operated interest in the Rosebank project, one of the largest undeveloped fields on the UK Continental Shelf (UKCS).

Rosebank further strengthens Equinor’s UK upstream portfolio which includes the Mariner development.

Equinor’s UK portfolio also includes attractive exploration opportunities and three producing offshore wind farms. In addition, Equinor is the largest supplier of crude oil and of natural gas to the UK.

Equinor has signed the agreement to acquire Chevron’s 40 percent operated interest in the Rosebank project, on October 1, 2018.

Discovered in 1981 on the East Shetland Platform, approximately 150 kilometres east of the Shetland Islands, the Mariner field is a daunting prospect for oil and gas producers. Mariner is a heavy oil field characterised by dense, viscous oil.

In December 2012, Equinor and its partners decided to take on the challenge and made the investment decision for the Mariner project, which entails a gross investment of more than GBP 4.5 billion. This was the largest capital commitment to the UK Continental Shelf in more than a decade.

The concept chosen includes a production, drilling and quarters (PDQ) platform based on a steel jacket, Mariner A, with a floating storage unit (FSU), Mariner B. Drilling will be carried out from the Mariner A drilling rig, with a jack-up rig assisting for the first 4 years.

The Mariner oil field consists of two shallow reservoir sections: the deeper, Maureen formation at 1492 meters and the shallower Heimdal reservoir at 1227 meters. The oil is heavy with API gravities of 14.2 and 12.1 and viscosities at reservoir conditions of 67 cP and 508 cP, respectively for Maureen and Heimdal.

The development of the Mariner field will contribute more than 300 million barrels of oil with average plateau production of around 55,000 barrels per day. The field will provide a long-term cash-flow over 30 years. Production is expected to commence during the first half of 2019.

The steel jacket was installed in the field during the summer of 2015. The topsides modules are being constructed by Daewoo Shipbuilding & Marine Engineering Co., Ltd. (DSME).

Heavy oil projects have required the development of pioneering technology. Since its discovery in 1981, the Mariner field has been subject to a number of development studies by different operators. Equinor was the first company to put forward a development concept that will fully address the complexities of this field.

Equinor is the operator of the Mariner field with 65.11% equity. Co-venturers are J.X. Nippon (20%), Siccar Point Energy (8.89%) and Dyas (6%).

Equinor has awarded the contract for drilling services on the Mariner platform to UK-based Odfjell Drilling. Noble Corporation is awarded the contract for the additional jack-up rig that will assist the PDQ in the initial years. This rig is currently in operation in the Mariner field.

The Mariner maintenance and modification services contract has been awarded to Aker Solutions UK. The offshore services contract has been awarded to Stork Technical Services Limited, also based in the UK. The helicopter transportation contract for the Mariner field has been awarded to CHC Helicopter in the UK.