Comparative Study on Specific Taxation of Offshore Gas Production in Europe

Romania Continues to Have the Highest Effective Tax Rate

The latest and most comprehensive comparative study on specific taxation of offshore gas production in Europe, conducted by PwC Romania for the Oil and Gas Employers’ Federation (FPPG), will be launched within a series of events and actions aimed at informing on the technical aspects of regulation of offshore gas production in Romania.

In recent years, the study shows, operators’ revenues from gas (and oil) production have had a constant decline. This trend comes following the great pressure put by declining hydrocarbon prices and decrease in production from fields under exploitation. But the development of offshore production could have a significant contribution to cover gas demand in the future, according to study’s data. Costs and risks related to such projects, especially the deep ones, are high and are made in the long run. Therefore, the study finds, very few global companies have the know-how, the technology, and the financial resources necessary for such projects.

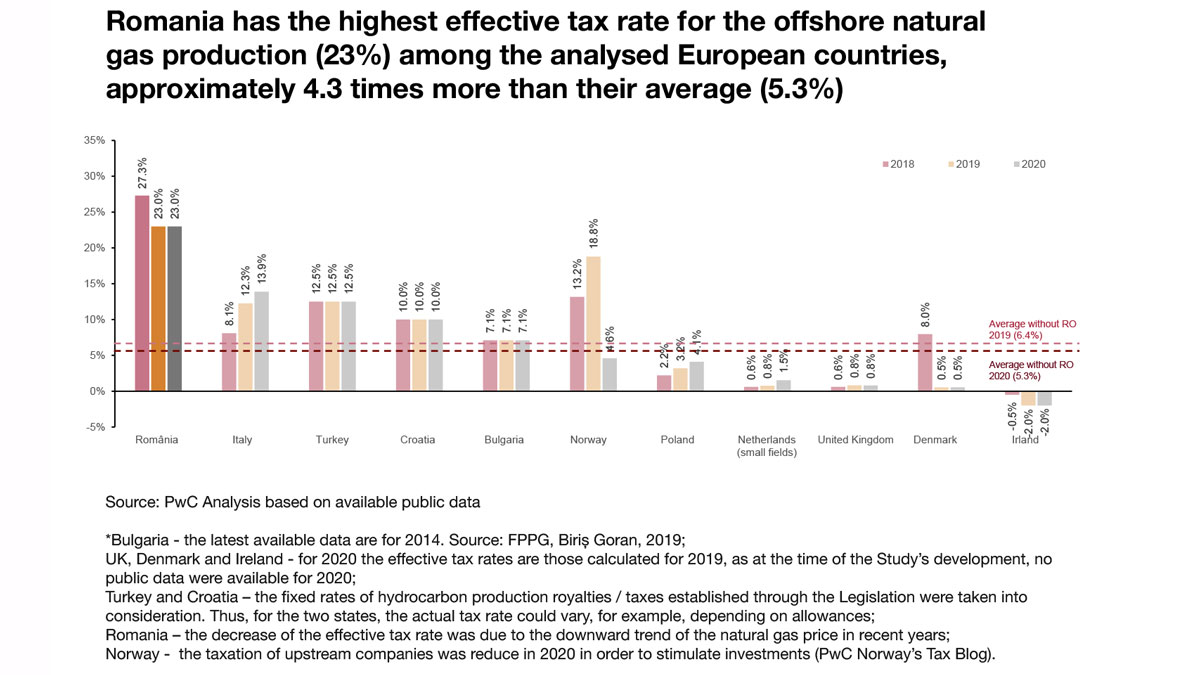

“The results of the comparative analysis show significant differences between the effective tax rates applied to (offshore) gas production. Both in 2020 and 2019, Romania had the highest effective tax rate, of 23%, a level over 4 times higher than the average for the European states considered in the study,” says the coordinator of the study, Andreea Mitirita, Tax Services Partner, PwC Romania.

The study concludes that predictability and stability of the legislative and regulatory framework are a major prerequisite for investment decisions that require high initial costs, high risks, and a long period to recover them, such as those in the offshore gas production. Also, the tax regime must be stable and competitive, in order to retain and attract investors. In this regard, to restore balance and competitiveness of the tax regime applicable to Black Sea gas projects, it is necessary to amend the Offshore Law.

“Dialogue between public policy-makers and the representatives of the sector is essential to develop an optimal framework for investments in offshore gas production, benefiting both the state, citizens and investors,” believes Catalin Nita, Executive Director of FPPG.

FPPG points out once again that the opportunity of the moment on the development of Black Sea gas reserves must be capitalized now, in the context in which natural gas has the chance to be a transition fuel. Otherwise, there is a risk that Romania’s development potential from the perspective of holding this competitive advantage be lost.

The study analysed from a comparative point of view the effective tax rates specific to offshore gas production in European states considered relevant, available as of May 31, 2021, in order to identify an updated image of the tax ‘burden’.

The effective tax rate for each state was calculated by reporting the value of royalties and specific taxes paid by the main players in the industry to revenues obtained from the production and sale of natural gas.

Conclusions and recommendations

Conclusions

- The results of the comparative analysis show significant differences between the effective tax rates of offshore gas production. In 2019, the maximum level is in Romania (23%), and the minimum in Ireland (-2%). Also, in 2020, Romania maintains its position, with the highest rate at 23%.

- Despite the high nominal tax rates in the Nordic countries such as Norway, Denmark, the Netherlands, and Ireland, we note that the effective tax rates (payments to the state as share of total revenues) are very low, even negative (e.g., Ireland) compared to other countries. This is generated by the level of allowances, amid pressure on the sector in recent years and to support an industry that has a major contribution to the economy.

- In recent years there has been a major decrease in the oil and gas operators’ revenues. This trend is due to the high pressure from the falling prices of natural gas and oil.

- The development of offshore production has a significant contribution to meeting future natural gas demand. The costs and risks associated with such projects, especially the Deepwater ones, are high and the investments are characterised by long payback periods. Globally, very few companies have the know-how, technology and financial resources needed for such projects.

Recommendations

- The predictability and stability of the legislative and regulatory framework is a major precondition for investment decisions that require high initial outlay and a long payback period, such as for offshore gas production.

- The tax regime must be stable and competitive in order to retain and attract investors. Therefore, in order to restore the balance and competitiveness of the fiscal regime applicable to natural gas projects in the Black Sea, it is necessary to amend the Offshore Law.

- The natural gas sector is an essential contributor to the development of the Romanian economy, thus, the fiscal regime should be tweaked in order to generate attractiveness for investors, as investments generate a multiplier effect in the economy by driving the development of other sectors.

- The dialogue between policy makers and representatives of the sector is essential in order to develop an optimal framework for investments in offshore natural gas production, on the background of which both the state/citizens and investors should benefit.

- The opportunity of the moment to develop the Black Sea natural gas reserves must be used as soon as possible, as natural gas has the chance to represent the transition fuel. Otherwise, Romania’s development potential from the perspective of owning this resource/this competitive advantage will decrease.