Daily round-up of oil and gas news

22 October 2018

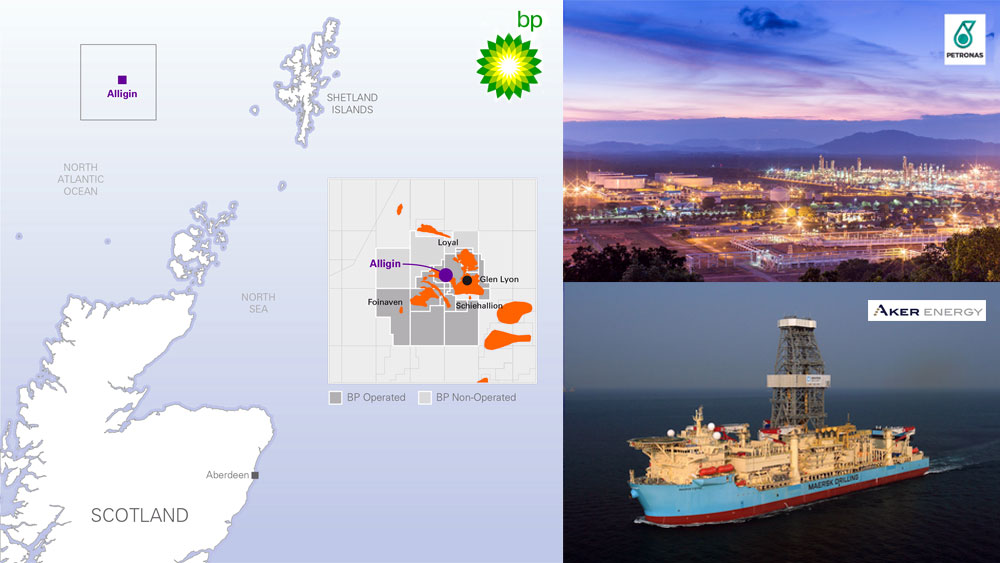

1. BP receives OGA approval to develop Alligin field in North Sea

BP today confirmed it has received approval from the Oil and Gas Authority (OGA) to proceed with the Alligin development west of Shetland, which will target 20 million barrels of oil equivalent, and is expected to produce 12,000 barrels gross of oil equivalent a day at peak.

Alligin is located 140 kilometres west of Shetland in a water depth of 475 metres. It forms part of the Greater Schiehallion Area.

The Alligin development will consist of two wells, which will be tied-back into the existing Schiehallion and Loyal subsea infrastructure, utilising the processing and export facilities of the Glen Lyon floating, production storage, offload (FPSO) vessel.

The development will include new subsea infrastructure, consisting of gas lift and water injection pipeline systems, and a new controls umbilical. The wells will be drilled by the Deepsea Aberdeen rig.

Alligin (BP 50% operator; Shell 50%) is part of a series of infrastructure-led subsea tie-back developments in the North Sea, accessing new production from fields located near to established producing infrastructure.

BP North Sea regional president Ariel Flores said: “We announced our intention to develop Alligin in April and six months later we have achieved regulatory approval. Always maintaining our focus on safety, we are modernising and transforming how we work in the North Sea to fully realise the potential of our portfolio.

“Alligin is part of our advantaged oil story, rescuing stranded reserves and tying them back into existing infrastructure. Developments like this have shorter project cycles, allowing us to bring on new production quicker. These subsea tiebacks complement our major start-ups and underpin BP’s commitment to the North Sea.”

Brenda Wyllie, West of Shetland and Northern North Sea area manager at the Oil and Gas Authority (OGA), said: “The Oil and Gas Authority is pleased to consent to the development of the Alligin field. This fast-tracked project will maximise economic recovery through utilising capacity in the Glen Lyon FPSO and is a good example of the competitive advantage available to operators from the extensive infrastructure installed in the UKCS.”

This is BP’s second North Sea development approval in the past two months. Vorlich, which targets 30 million barrels of oil equivalent, received regulatory approval in September.

BP’s Clair Ridge development is expected to start-up later this year. It is expected to target 640 million barrels of resources and have a peak production of 120,000 barrels of oil a day.

BP also has 32% stake in the North Sea Culzean development, which is expected to supply around 5% of UK gas requirements. First gas is anticipated in 2019.

Earlier this year, BP was awarded seven licences, five as operator and two as partner, in the North Sea’s 30th Offshore Licensing Round.

And in January, BP announced two new discoveries in the North Sea at Capercaillie in the Central North Sea and Achmelvich west of Shetland.

2. Woodside signs agreement with China’s ENN

Australia’s Woodside Petroleum has signed a cooperation agreement with China’s ENN Group under which the two companies will work together to explore a broad range of potential business opportunities.

The deal was signed at a ceremony in Zhoushan on behalf of Woodside by executive vice president Marketing Trading & Shipping Reinhardt Matisons and by ENN Group CEO Cheung Yip Sang.

“Woodside’s aim is to grow our relationship with ENN Group, and we now plan to jointly investigate opportunities for cooperation in LNG marketing, trading and shipping,” Matisons said.

“Other potential areas for cooperation include oil and gas exploration and production, liquefaction and regasification projects.Woodside is planning to add to its existing LNG production portfolio with its proposed developments of the Scarborough and Browse offshore gas resources through the Burrup Hub in Western Australia,” he added.

ENN Group recently commissioned the first phase of the Zhoushan LNG import terminal and is aiming to grow its market share in China’s gas distribution and retailing sector, as well as internationally.

3. Malaysia’s Petronas agrees to buy 10 pct in Oman’s Khazzan

Malaysia’s Petroliam Nasional Berhad (Petronas) said its subsidiary would buy a 10 per cent stake in Oman’s Al Khazzan gas field, following a bidding exercise held by the exploration arm of state-owned Oman Oil Company.

The Petronas unit, PC Oman Ventures Ltd, would acquire the stake from Oman Oil Company Exploration and Production (OOCEP), a subsidiary of Oman Oil Company, in Block 61 of the field, which is expected to produce around 1.5 billion cubic feet of natural gas per day by 2020.

The completion of the transaction is subject to approval from the sultanate’s government and other closing conditions, OOCEP said in a statement.

Petronas is Malaysia’s fully-integrated oil and gas multinational ranked among the largest corporations on Fortune Global 500.

OOCEP, through its subsidiary Makarim Gas Development, currently holds a 40 per cent stake in Block 61, whereas the operator BP Oman holds the remaining 60 per cent.

Block 61, which includes Khazzan and Ghazeer gas fields, is one of the largest unconventional gas projects which is expected to produce around 1.5 billion cubic feet of gas daily by 2020.

“Completion of the transaction is subject to closing conditions,” Petronas said in a statement.

Max Petrov, from Wood Mackenzie’s corporate analysis team, said: “Petronas is no stranger to Oman, having held exploration acreage adjacent to Khazzan until 2014.

“The announcement highlights Petronas’ strong appetite for international business development and gas resource capture, coming less than six months after it joined Shell’s LNG Canada project.

“We believe the company is buying into the project for its strong gas reserves potential. The size of resource on Block 61 means that future phases could be developed, beyond the current expansion, provided the partners can secure a buyer for the additional gas.”

Petrov added that the development would contribute 2 per cent of Petronas’ global output by 2023.

4. Drillship Maersk Viking has arrived Ghanaian Waters

Aker Energy announces the arrival of the Maersk Vikingdrillship at the Deepwater Tano Cape Three Points (DWT/CTP) block offshore Ghana.

“We are proud to announce the arrival of Maersk Viking in Ghanaian waters. The drillship arrival marks an important milestone towards the start of the upcoming drilling campaign. The Maersk Viking will commence drilling of the Pecan-4A appraisal well when all preparations have been completed,” says Country Manager Jan Helge Skogen.

Maersk Viking is an advanced ultra-deep water drillship, capable of drilling in water depths of 3,600 meters. Under its contract with Aker Energy, the rig will perform the drilling of the Pecan-4A appraisal well in a water depth of 2,674 meters, located approx. 70 miles off the coast of Ghana, in addition to two optional wells.

The drilling rig is owned by Maersk Drilling and features a drillship design with a dual derrick and large subsea work and storage areas, allowing for efficient well construction. With its advanced position control system, the ship automatically maintains a fixed position in severe weather conditions with waves up to 11 meters and wind speeds of up to 26 meters per second.