Europe’s Gas Storage: What’s in Store for Winter?

Gas storage in the EU, in particular Underground Gas Storage (UGS), is crucial to guarantee security of supply. Typically, storage supplies 25-30% of gas consumed in the winter season. During the heating season in winter, storage reduces the need to import additional gas and contributes to absorbing supply shocks. Increased geopolitical tensions due to Russia-Ukraine conflict in the beginning of 2022 further amplified uncertainties and consequently the need for well-filled gas storages for future winters.

In its communication on security of supply and affordable energy prices, published on 23 March 2022, the European Commission (EC) proposed measures to address the root causes of the problem in the gas market and ensure security of supply at reasonable prices for next winter and beyond. These include a minimum 80% gas storage level obligation by 1 November 2022, rising to 90% for the following years, with intermediary targets from February to October. Operators of storage sites should report the filling levels to national authorities. EU countries should monitor the filling levels monthly and report to the EC. An important and new element is the burden sharing mechanism. Some EU countries have storages larger than their own national consumption, while others do not have any storage facilities. However, all EU countries benefit from the guaranteed filling levels, so the burden sharing mechanism makes sure that not only EU countries with storage facilities pay for the security of supply costs of the minimum filling target.

On 27 June 2022, the proposed measures were adopted in a new Gas Storage Regulation. Under the new legislation, gas storage facilities will be considered critical infrastructure and all storage operators in the EU will have to go through a new certification process to reduce the risks of outside interference. These rules will contribute to reducing security of supply risks and to support the EU’s competitiveness by ensuring that storages are properly filled.

Gas storage facilities are critical infrastructure to ensure security of supply. A new mandatory certification of all storage system operators will avoid potential risks resulting from third-country influence over critical storage infrastructure, meaning that non-certified operators will have to give up ownership or control of EU gas storage facilities. In addition, for a gas storage facility to close its operations, it would need to have an authorization from the national regulator.

To incentivize the refilling of EU gas storage facilities, the EC is proposing a 100% discount on capacity-based transmission tariffs at entry and exit points of storage facilities.

Does the situation repeat itself?

On 1 January 1974, the United Kingdom switched off the lights. At least for half a week. The Conservative minister at the time, Edward Heath, introduced the three-day week to save energy and help the economy. In the first quarter that year, electricity consumption of enterprises was limited to three consecutive days per week, the television programs stopped at 22:30 and most pubs were closed at the same time. It was a measure, at the time, to fight against inflation and save oil and coal in the face of miners’ strike who were demanding massive increases in salaries due to price hikes.

Almost 50 years later, the history repeats itself. The war in Ukraine has made gas prices to rise and serious supply shortages are expected. Russia has gradually reduced deliveries to Europe. Nord Stream 1 gas pipeline, which runs under the Baltic Sea, ensures only 40% of the capacity and many countries have seen their supply contracts uncertain. Therefore, the concern is rising for the winter ahead. The filling rate of European gas storage units is 55%, compared to a normal average of 57% in this period.

Therefore, old-school solutions are being sought. Not a three-day week yet, but reopening coal-fired power plants. In their turn, Germans wonder whether it is opportune to close the last nuclear power plants, and the Dutch push back the closure of Groningen gas field, the largest in Western Europe. France had promised that it would get rid of coal before the end of the five-year mandate, the Germans must defeat their hate to nuclear energy and the Dutch will have to continue to live with earthquakes caused by Groningen exploitation.

France’s coal-fired power plants restarted ‘when needed’

In 2017, candidate Emmanuel Macron committed to close, for a five-year period, the last French coal-fired power plants, meaning the most polluting fuel. A promise not yet met five years later, to the discontent of environmental protection agencies. According to the version of a future draft law, the government plans to restart the Saint-Avold (Moselle) power plant provisionally for the winter of 2022.

Sources in the Ministry of Ecological Transition confirm the development of a ‘provisional’ measure. The site in Lorraine ceased to operate on March 31. A brief reopening would allow, if necessary, between the end of 2022 and the beginning of 2023, a small additional safety margin to avoid blackouts. In March, the Ministry of Ecological Transition had already announced the possibility of such ‘punctual restart’.

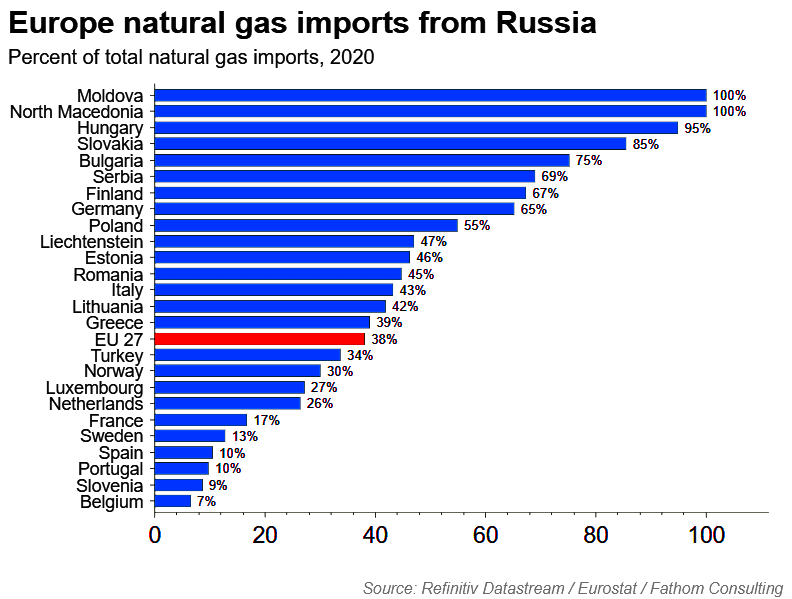

On April 27, for the first time in the history of gas supplies to Europe, Russia decided to unilaterally terminate a supply contract, in response to Western sanctions, and turn off the taps to Poland and Bulgaria. A significant decision for Europe, dependent on Russian gas. Three weeks later, the reductions increased: the interruption of flows to Finland and sudden reductions to Germany, Austria, and Italy. Enough to engage the European Union in a race against time to diversify gas supply, to go through the winter without major problems.

EU Member States are now looking to fill their storage facilities as much as possible, to be able to withdraw gas from them during periods of increased consumption, that is during the colder periods. A strategic safety net, supervised by Brussels, since the European Executive ordered that they be filled at 80% of capacity by November 1, 2022.

Importance of storage for producers and consumers

Gas storage allows to meet the needs of producers and consumers. By storing part of the extracted gas, producers guarantee that they can deliver stable gas volumes throughout the year. For consumers, gas storage guarantees the continuity of supply. Therefore, gas flowing to consumption areas is not necessarily used immediately. It can be stored for reuse once the demand justifies it. Today, gas storage is an essential logistical link to ensure the energy balance of a country.

Whether it comes from the country led by Vladimir Putin or from elsewhere, fossil gas remains necessary for most European countries to heat their buildings, run their industries, or even produce their electricity. Therefore, in 2021, the EU consumed no less than 400 billion cubic meters (approximately 5,000 TWh), of which 90% were imported, mainly from Norway and Russia. However, during winter, gas stocks of Member States covered around 25% of these needs. Stocks were built during summer when lower demand makes possible access to products with lower prices.

Several methods allow storing gas in aboveground or underground facilities.

Aboveground storage

Aboveground storage does not require special geological conditions.

Gas tanks are used to store gas at atmospheric pressure. They have a cylindrical shape, the storage capacity being between 500 and 10,000 cubic meters.

LNG tanks are used to store gas at atmospheric pressure in liquid state. At approximately -161°C, natural gas condenses to become liquefied natural gas (LNG). It occupies a volume almost 600 times lower than in gaseous state. LNG tanks are vertical cylindrical tanks installed near LNG terminals to receive and store LNG transported by LNG carriers. These metal or concrete tanks have a double wall and strong thermal insulation to keep the gas in a liquid state.

Underground storage

Preferred by many countries, when possible, underground storage is the most efficient and economic technical method to respond to gas demand fluctuations. It is also considered a safe method when it comes to public security and respect for the environment.

Aboveground storage, for a similar use, requires facilities on several hectares, with increased risk of accidents. The types of underground storage depend on the geological structures available: depleted reservoirs; aquifers; salt caverns.

Gas storage addresses major challenges

Gas storage plays a strategic role, as it makes possible to offset the technical or political shortcomings of suppliers. This function is particularly important in the case of strong energy dependence of a country on a small number of producers.

Gas storage allows to balance supplies, relatively constant throughout the year, and gas needs, which vary a lot depending on season. Therefore, the facilities are filled during months with low consumption (summer) and are emptied during months with excess consumption (winter). By modulating gas flows in time depending on demand and supply, storage becomes an essential addition to gas transmission and contributes to the optimization of the entire gas exploitation chain.

Gas storage allows producers, transmission, and distribution operators to ensure balance between demand and supply at a more advantageous cost. They can decide to store gas when the price is low and then resell it when the price is higher.

Reaching the storage targets in Europe by winter

Europeans have set the target of replenishing their gas stocks up to 80% before November 1. The European energy regulatory authority provides a framework. But pooling these stocks will not be easy to organize, as five countries alone (Germany, Italy, France, the Netherlands, and Austria) accumulate 75% of the storage capacity. What will the other Member States do? Five Member States have three quarters of the gas storage capacity, while a third of the smallest Member States have none.

Some storage units belong to Gazprom, which, accidentally or not, had only filled them to 25% of capacity, after the winter 2021-2022. In March last year, the European Commission revised gas regulations to impose as a matter of urgency a storage filling rate of at least 80% in 2022 (and 90% in 2023) before winter. As gas storage is the responsibility of Member States within their energy mix, Europe can only regulate from the side-lines (absence of discrimination, transparency etc.).

European countries are on track to reach a gas storage filling target by the start of this winter, but the cost of replenishing stocks will be over 50 billion euros, 10 times more than the historical average of filling up tanks for winter, according to international media.

European governments had been concerned that Russia’s cut in supplies through its main gas pipeline to Germany would leave countries unable to meet goals to refill storage for winter. They have managed to build up gas storage steadily by curbing demand, switching from gas to coal for some power plants and increasing imports of liquefied natural gas (LNG).

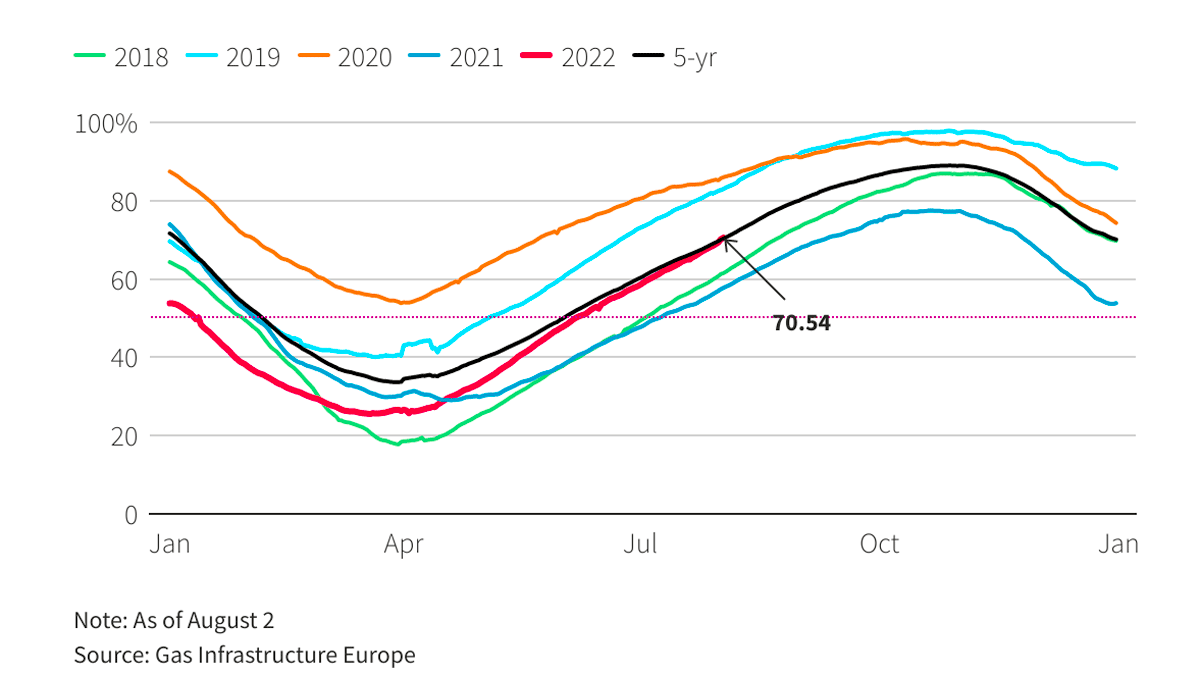

In early August, gas storage facilities in Europe were 70.54% full, exceeding the 5-year average of 70.32%, according to data published by Gas Infrastructure Europe (GIE). Also, the levels were not far from the 10-year average of approximately 71.40%.

Paradox of gas storage

As prices are currently high, there is no incentive to store gas. This cyclical factor exacerbates the storage paradox that repeats itself every year: low stocks at the end of winter lead to an increased demand for gas in the summer to fill the tanks, which makes the price high even in the summer, until the high levels of gas prices during winter are reached. All the economic benefit hoped for by filling the stocks in the summer to sell them (more expensive) in the winter can collapse, storage becomes unprofitable, and the sites are closed!

A rigid 80% fill target will exacerbate this paradox. It should consider not only the storage capacities of each member state, but also local parameters, such as dependence on Russia, the gap between seasons for gas demand (different between northern and southern Europe), gas interconnections between countries, access to LNG terminals. It is necessary to fulfil the targets broken down country by country. The flexibility provided by LNG storage and long-term LNG contracts are other adjustment variables. These are not obvious either, because then we are in competition with Asia, which only has this way of supply, without considering the environmental assessment of the transports.

Real needs of each country

To limit the financial risks and costs related to storage, the real needs per country should be considered, according to energy regulatory authorities, excluding the interruptible consumption and customers that have an alternative to gas and by guaranteeing the provision of essential services including to protected customers. At the national level, storage objectives could be established in the form of an obligation to reserve capacity to be less rigid, adapted to the situation of each market, to its constraints and the financial risk of purchasing gas.

Europe has proposed an additional target of ‘filling trajectory’ for storage capacities, but the filling constraints also risk destroying any incentive to store gas spontaneously. Storage optimization means capitalizing on the opportunities to inject or withdraw gas according to market signals.

Solidarity between Member States

Solidarity is required: if the principle of storage in another member state is recorded for those who do not have this possibility, everything must be thought of to share the financial and industrial burden related to storage. There is a target for Member States that have storage facilities to allocate 15% of them to the Member States that don’t, but ACER (Agency for the Cooperation of Energy Regulators) and CEER (Council of European Energy Regulators) criticize it for its rigidity. The idea of regional stock for several countries and distributing the storage target between the states concerned is preferred. Therefore, the operators present in these countries are provided with the possibility of a better balancing structure of exchanges at the border.

Regulatory authorities don’t want the transmission operator to be the only one responsible for buying and managing the strategic storage capacities. Storage operators themselves, suppliers, or resort, those responsible for balancing can contribute, which gives more diversity for a better operation. Companies could reserve storage capacity pursuant to an obligation set by a member state. It is always more practical to organize cross-border operations by contract rather than by long bureaucratic and financial negotiations between states.

CEER and ACER propose tools to counteract uncertainties, such as auctions on storage prices to force players to rethink the level of risk they estimate for this activity and with assurances in the form state guarantees so that an operator that has stored enough to save its country from going bankrupt.

According to ACER, EU funding may be necessary in the Member States where the costs of implementing the regulation are not accessible.

A fair application of the Regulation would require a review of the national filling targets to have a balanced burden sharing across the Member States. Several Member States are working on the scope and level of storage obligations and the creation of strategic storage. These initiatives and the measures already in place should serve as a starting point for the EU gas. If the national security of supply is ensured by the existing measures in the likely risk context, additional filling requirements aimed at fulfilling the collective target could be subject to dedicated processes and support schemes.

ACER analyses and proposals

For 2022, the 80% filling target is a pragmatic option that helps protect existing contracts.

For 2023 and thereafter, ACER recommends determining the EU filling target and the filling trajectories depending on the expected demand.

In case of regional vulnerability, evaluations should be made to calculate the adequate gas volumes that will be stored on November 1. In any case, the filling rates must be known before storage, starting with 2023.

There should be an adequate monitoring system, covering both volumes (filling levels) and prices in force starting with day 1, to control costs for EU taxpayers.

For 2022, filling trajectories should only be indicative and determined in liaison with national competent authorities for security of supply.

National filling trajectories may not necessarily be applied to individual suppliers but assessed in an aggregated way.

Overly rigid storage products could reduce their value and endanger market players’ ability to effectively fulfil their obligations.

Funding problems and price volatility

High gas prices and uncertainties regarding the future developments, which are now reflected in the negative spreads, lead to extremely high risks for market players. Some suppliers may not have enough financial capacity to store gas and cover deficits from the negative spreads. This situation may endanger the capacity to fill the storage spaces and there should be support measures in place to manage these risks.

The measures that could be implemented to mitigate the difficulty of satisfying market players include:

- Launching descending clock auctions with zero reserve price to reflect the market’s appreciation of the risk of negative spreads, including through negative prices.

- Ascending storage auctions with reserve prices based on seasonal spreads could also be launched. In such a set-up, the reserve price could be negative, helping storage.

- Putting in place insurance measures to reduce the collateral required by the clearing houses. This may involve providing a public guarantee against the failure of players such as covering the risks of losses linked to negative seasonal spreads.

Transmission tariff discount of 100% for storage

Article 9 of the Tariffs network code (TAR NC) already provides for a discount of at least 50% at transmission-storage interconnection points. Although a 100% discount would currently only marginally reduce costs for storing gas, it could be envisaged to set a tariff to zero for security of supply reasons. This measure, applied for the security of supply, should be limited in time, as it may raise contractual problems when the tariffs are already set and be ineffective when the tariffs pose no obstacle in the way of gas storage.

Deadline for certifying gas storage facilities

The period of certification of gas storage facilities should be established evenly to 18 months. The proposed period of 100 working days is too ambitious, given the relatively high number of certificates. Moreover, national laws must be adapted to establish the procedures and rules for certification. The legal provisions of the Regulation (EU) 2017/1938 and (EC) no. 715/2009 on the general rules, deadlines, and other requirements necessary for implementation of the procedure for certification require national legislative transposition. The necessary time to amend the national legislation, standardized period of 18 months would in principle leave open the possibility to carry out an audit significantly faster.

Gas storage in Romania

In July, Secretary of State in the Ministry of Energy Dan-Dragos Dragan participated in the extraordinary meeting of the Energy Council, in Brussels, in the context of the continuation of discussions at the European level regarding the security of natural gas supply for the next winter.

According to the estimates of the European Commission and most of the member states, proactive measures to prepare for the coming winter are more effective than reactive ones in case of supply interruptions, and they send a clear message at the international level regarding the united position of the member states of the European Union in the face of Russia’s blackmail attempts.

Ever since the start of the Russian-Ukrainian conflict and the energy crisis, Romania has supported and continues to support cooperation at the European level, to constructively overcome the challenges, also seeking to protect its strategic interests.

On the side-lines of the Energy Council, the ministers reached a political agreement regarding the proposal of the Council Regulation on coordinated actions to reduce gas consumption for the period August 1, 2022 – March 31, 2023, at the level of the Member States through measures designed to ensure a constant flow of gas to protected consumers and critical industry.

The regulation essentially requires that the volume of gas consumed on March 31, 2023, be 15% lower than the average volume consumed in the similar period of the last 5 years to ensure our security of gas supply in the winter of 2022-2023, as well as an adequate level of gas in storage in the second quarter of 2023.

The savings measures will be VOLUNTARY at the level of the Member States, with the Commission providing a set of instruments that the countries can consider depending on their national specificities. To the extent that the risk of a complete interruption or reduction in the supply of natural gas from Russia materializes, through the implementation decision of the Council, it will be possible to approve the entry into a state of alert at the EU level, through which coordinated measures will be taken to reduce consumption, until reaching a decrease by 15%.

The reductions prior to the entry into force of the state of alert compared to the similar period of the last 5 years are also reflected in the reduction target, which makes national efforts easier. During the reduction of consumption, a series of flexibilities negotiated in the text of the regulation will be considered. For example, gas used for non-electrical purposes can be deducted from the savings target, as well as the volumes of natural gas stored that exceed the intermediate storage targets established in the regulation regarding the gas storage obligation. In the case of Romania, the current storage level is 55%, above the mandatory level of 46% for August 1, 2022.

Romania, through its consumption profile, but also through the availability of domestic gas sources, is well positioned to face the winter of 2022-2023. If additional measures to reduce gas consumption are necessary, household consumers, SMEs, social services, or critical industry will not be included in the scope. Also, at Romania’s proposal, the critical role of the district heating sector in security of supply was recognized, by guaranteeing the constant volumes of gas required for this sector.

The measures adopted by the member states to prepare for winter aim at increasing energy efficiency, the use of renewable energy sources and those with low carbon emissions and baseload production, the consolidation of interconnection at the level of the gas network, the adoption of measures to protect the population and industry in the context of the increase in energy prices.

“Romania supported the importance of indigenous energy sources, since the extraction of Black Sea gas has already started, which covers approximately 10% of the country’s annual consumption. By making the investment in the Neptun Deep Block, Romania will become independent from natural gas imports, being at the same time a factor of stability in the region. Nuclear energy and, to some extent, coal, through their baseload production, represent an additional element for balancing the network. Romania is interested in completing the interconnections related to the Vertical Corridor and the Trans-Balkan Gas Corridor to streamline supply from new sources in the region. Also, the operationalization of the EU Energy Platform for the joint purchase of natural gas is a necessary requirement to ensure the distribution of additional gas flows from third countries, at stable prices,” reads a press release of the Ministry of Energy.

Increased energy prices are still a subject that is in the attention of the European Commission and Energy ministers. The analysis of the different possibilities to optimize the current design of the energy market is of interest for Romania to ensure an affordable price for consumers. To this end, Romania continues to support the analysis of the possibility to uncouple electricity prices from gas prices, an architecture that would allow limiting the contagion effect of the increase in the price of natural gas on the price of energy. The European Commission has indicated that it would conduct an impact study on various measures to optimize the design of the electricity market.