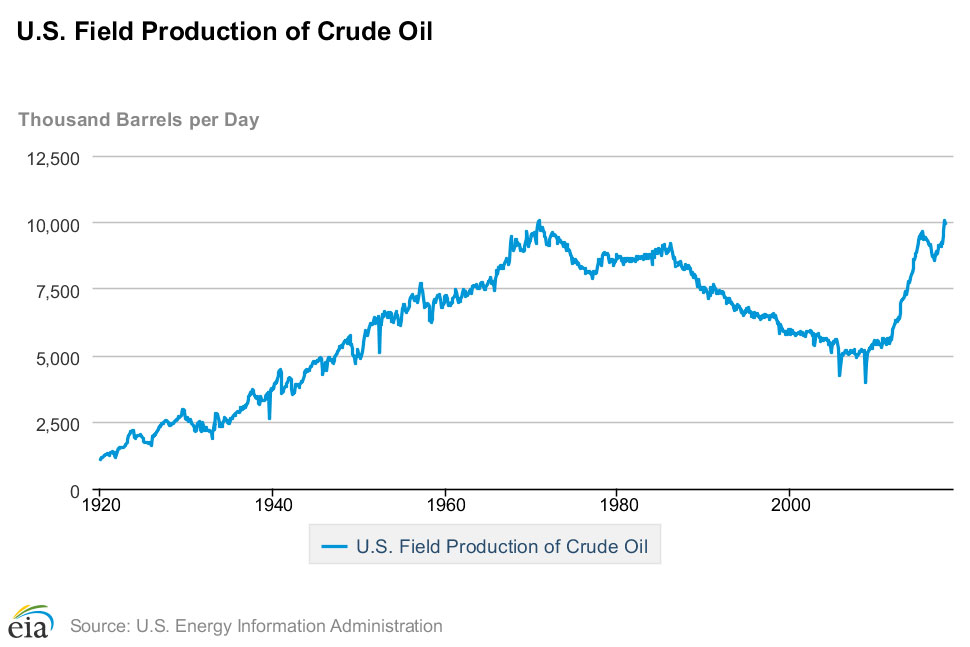

Highest US monthly crude oil production in almost half a century

US crude oil production has increased significantly over the past 10 years, driven mainly by production from tight rock formations including shale and other fine-grained rock using horizontal drilling and hydraulic fracturing to improve efficiency. EIA estimates of crude oil production from tight formations in November 2017 reached 5.09 million b/d, surpassing a previous high of 4.70 million b/d in March 2015. These formations also produce considerable volumes of natural gas associated with the crude oil.

Within the Lower 48 states, November 2017 production reached a record high in Texas at 3.89 million b/d, followed by North Dakota at 1.18 million b/d. Production in the Federal Gulf of Mexico reached 1.67 million b/d, up 14% from the October 2017 level as the region recovered from Hurricane Nate.

Liquid production – both crude oil and condensate – from tight rock currently accounts for about 51% of total production. A decade ago, in November 2008, production from tight formations accounted for only 7% of total U.S. production. Non-tight oil production has been mostly constant over the previous decade.

Tight oil production can be sensitive to changing oil prices. After increasing relatively steadily since 2011, tight oil production began to decline after the West Texas Intermediate (WTI) crude oil price decreased from USD 105 per barrel (b) in June 2014 to a low of USD 30/b in February 2016. WTI prices were about USD 60 a barrel in January 2018.

Production continued to increase through these price fluctuations in three formations in the Permian Basin—the Spraberry, Bone Spring, and Wolfcamp plays that span parts of western Texas and eastern New Mexico – and in the Bakken formation in the Williston Basin in North Dakota and Montana.