New Challenge for O & G in Romania: Curbing Emissions

The European Council recently adopted five laws that will enable the EU to cut greenhouse gas emissions within the main sectors of the economy, while making sure that the most vulnerable citizens and micro-enterprises, as well as the sectors exposed to carbon leakage, are effectively supported in the climate transition.

The laws are part of the ‘Fit for 55’ package, which sets the EU’s policies in line with its commitment to reduce its net greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels and to achieve climate neutrality in 2050. These five laws are: Revision of the ETS Directive; Amendment of the MRV shipping Regulation; Revision of the ETS Aviation Directive; Regulation establishing a Social Climate Fund; Regulation establishing a Carbon Border Adjustment Mechanism.

Also, the European Parliament is due to approve soon the Regulation on methane emissions reduction in the energy sector, which will considerably impact Romania’s oil and gas industry.

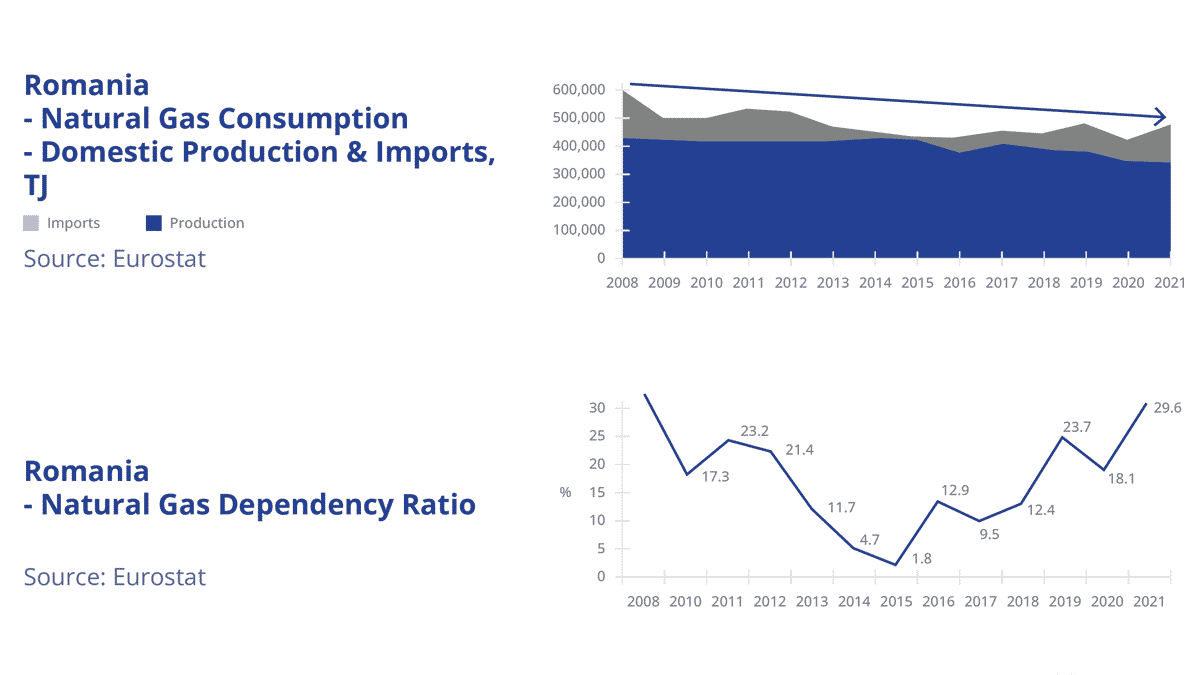

However, any EU country can determine its own energy mix subject to taking into consideration the EU’s climate target goals. This is important because countries that still have oil and gas reserves, like Romania, could set out plans to exploit them, thus ensuring the availability of future production capacities. Moreover, according to the IEA, the demand for fossil fuels is still expected to grow this decade.

According to a study signed by the Consilium Policy Advisors Group (CPAG) – ‘The Contribution of the Oil & Gas Industry to the Romanian Economy’, most companies operating in the oil and gas sector have already put forward plans aimed at meeting climate transition goals. As a consequence, actions directed towards reducing carbon emissions would need to complement investment decisions in both production capacities that support oil and gas production as well as those that use substitute technologies and fuels, especially renewable energy. At the COP 27 meeting, which took place in November 2022, there was a lack of consensus over commitment to phase down fossil fuels; however, parties agreed to keep the 1.5 degrees Celsius alive and thus, on the need to bring down carbon emission.

Regulatory requirements, including the price of CO2 allowances, and the availability of funding would shape the path of future investments in the oil and gas sector. More broadly, funding sources include, among others, the Recovery and Resilience Facility and companies’ own funds, obtained either through borrowing or retained earnings.

In the light of recent developments regarding the evolution of energy prices, especially in Europe, the results of the CPAG study could be used, as before, to aid policy design in the domestic oil and gas sector over the next decade. This should focus on the very large role that oil and gas companies have in contributing to government revenues and how the climate change transition would affect the path of tax contributions cashed in from companies operating in the sector. It could also help to support further work that would address the identification of the necessary policy measures in order to build up/maintain the desired domestic production capacity for natural gas, power and oil in order to ensure an adequate supply-demand energy balance in the medium and long term.

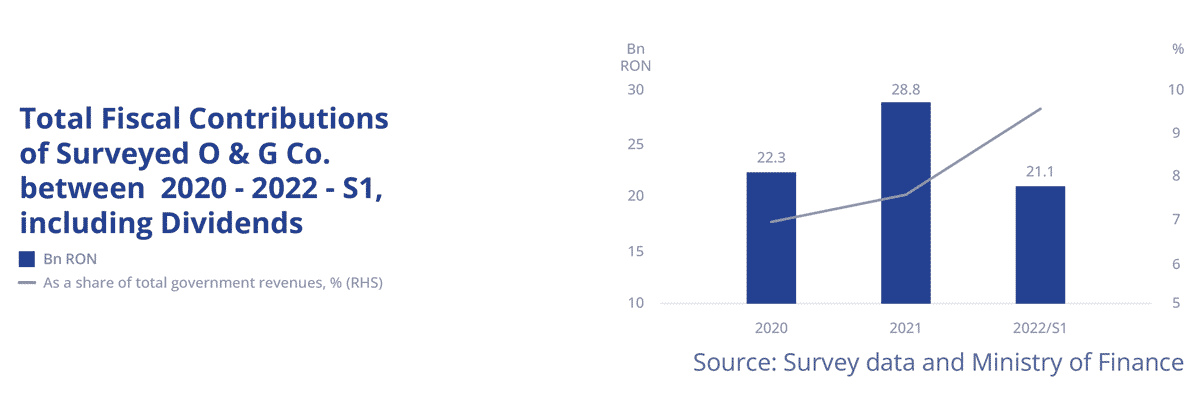

Let’s not forget that total fiscal contributions, including dividends paid to the state, rose by 29% in 2021 compared to 2020 to RON 29.8 Bn., the equivalent of 7.8% of total government revenues.

However, in the first half of 2022 the budgetary impact of O & G Co. was significantly higher, aided to a large extent by higher oil and gas prices. In the first half of 2022 alone, the sector contributed to the government general budget with RON 21.5 Bn., almost the same amount it did for the whole year in 2020.

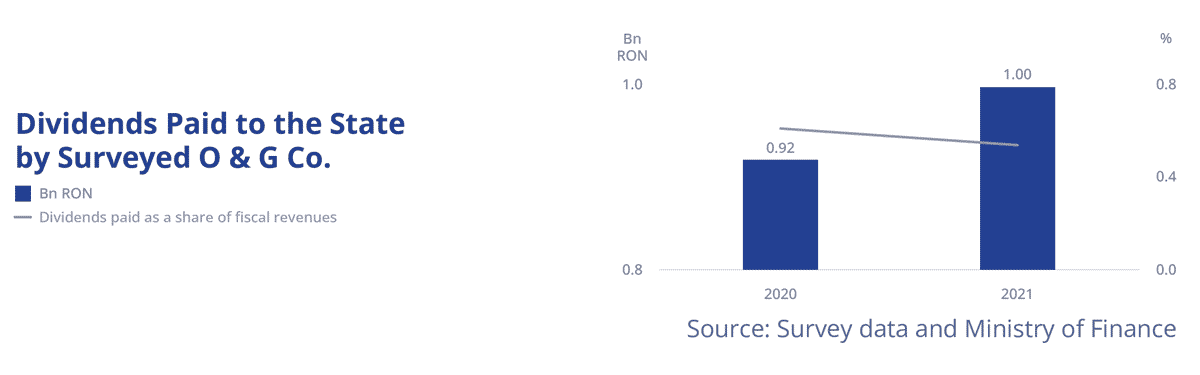

The dividends paid to the state by the surveyed O & G companies averaged close to RON 1 Bn. per year for 2020 and 2021. As a share of fiscal revenues, they were declining slightly from 0.61% in 2020 to 0.54% in 2021.

Data for the first half of 2022 is incomplete for the purpose of this study as the majority of companies where the state has a large stake have not yet provided dividends data for 2022.

O & G effects on investments

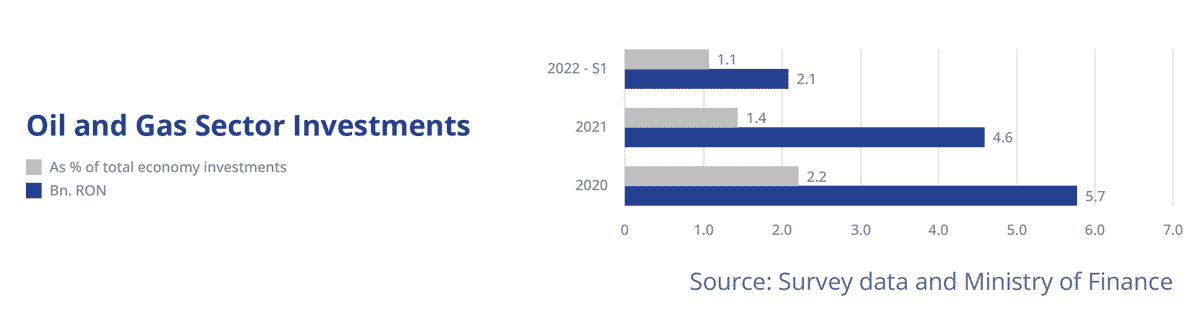

Investment data from the surveyed oil and gas companies revealed a deceleration of investment over the last two years.

This was to be expected since investment decisions in the sector are related to the oil price. Average oil prices were low in 2020, a year when global oil demand collapsed due to the imposition of lockdowns during the pandemic. As a consequence, investments in 2021 – based on decisions made during 2020 – were lower.

Given the current level of oil prices, domestic investments by the oil and gas sector could recover next year. To a certain extent this will also depend on the regulatory framework. But their scope is also important. There are investments that support the green transition and their associated targets, which many companies operating in the oil and gas sector have already committed to.

These will help to decarbonise their operations and their value chains. Other types of investments could be aimed at production capacities that address fossil fuels, notably natural gas, as this is considered to be a transition fuel.

‘The Contribution of the Oil & Gas Industry to the Romanian Economy’ study was prepared with the financial support of the Oil and Gas Employers’ Federation (FPPG).