Oil & Gas Industry Contribution to Romania’s GDP Growth

A new study entitled ‘The Contribution of the Oil & Gas Industry to the Romanian Economy’ (2nd edition, updated and extended), reflecting the independent assessment of the Consilium Policy Advisors Group (CPAG), shows that the role of the oil & gas sector in Romania has been exponentially increased since the beginning of this decade.

The scientific approach used by Ec. Dr. Laurian Lungu – Economic Adviser, Co-Founder of Consilium Policy Advisors Group, to highlight the direct economic dimension of this sector in the context of the Romanian economy needs no further elaboration and points out how crucial this industry is becoming.

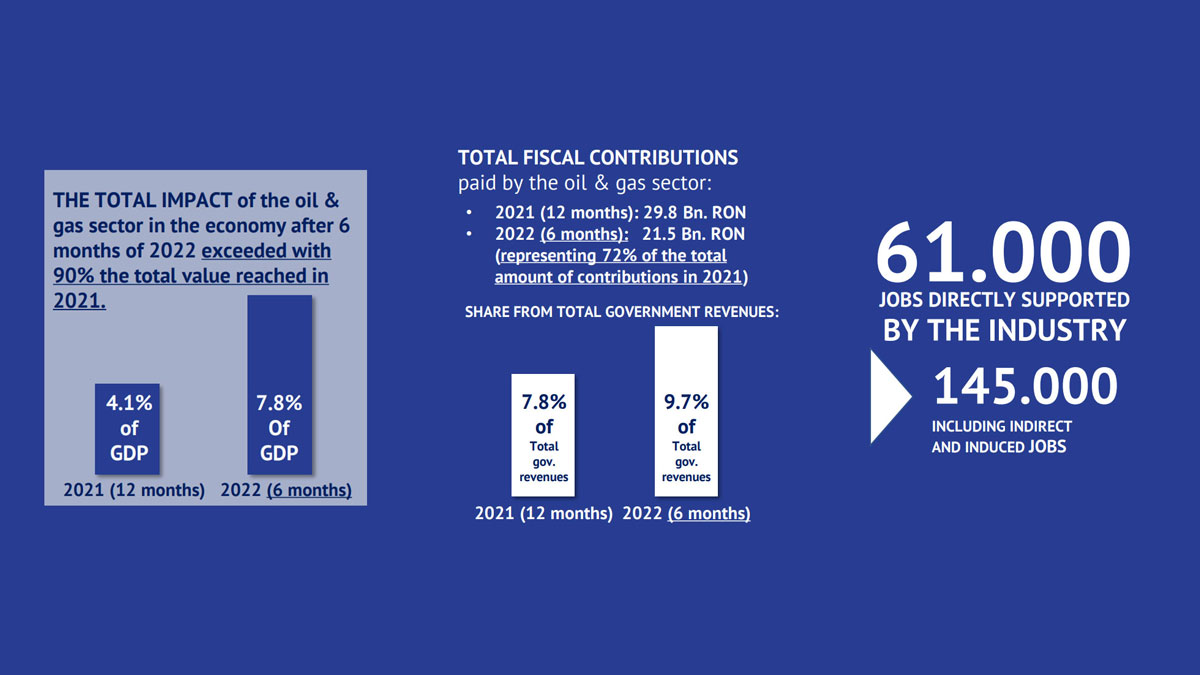

The total impact of the oil and gas industry in the economy (i.e., including direct, indirect, and induced effects) is more than significant, increasing from 3.1% of GDP in 2020 to 4.1% of GDP in 2021 and 7.8% of GDP in the first half of 2022 alone. The above figure underestimates the true impact of the sector in the economy, given that some of the companies were not part of the survey[1].

Apart from the increase due to economic recovery after the pandemic and the effect of sustained investments during the last 10-15 years, a significant part of this gain is attributed to the rise in oil and natural gas prices all over the world. However, the positive impact on the economy of the Romanian oil and gas sector facilitated new instruments built by the state in order to alleviate the numerous symptoms of a complicated decade from multiple perspectives.

The need for this sector in difficult times has been proven with historic recurrence since its beginning. The energy crisis was perceived as a more serious threat than anything else by a significant number of Europeans, while Romanians already had compensation schemes that were financed through the taxation of this sector. The threats to the security of supply and blockages in weak energy mixes are, fortunately, not significant concerns for Romania at this moment due to its local production of oil and, most importantly, natural gas.

Natural gas is arguably the most important energy source now, playing a significant role in maintaining the security of supply for most countries around the world. The popularity of natural gas as a fuel source is due to its clean burning characteristics, affordability, and versatility. Thus, the security of supply of natural gas is critical for ensuring the reliability and availability of the European economy. A secure natural gas supply provides predictability, consistency, and can meet the public and industrial demands of its users without disruptions.

“We hope to see that Romanian production will only increase in the next years, especially through offshore and deep onshore projects that will consolidate this country’s role in the new energy security architecture of its region. Through this industry, Romania has the potential and responsibility to make a greater impact in reshaping eastern European security in all its dimensions and improving the living standards of Romanians. This is mainly done through taxes from major contributors of this industry, which are a vital source of revenue for Romania, providing the resources necessary to fund public services, promote economic growth, reduce income inequality, pay for government debts, and foster social stability,” the Oil and Gas Employers’ Federation (FPPG) Board pointed out.

Key findings

The contribution of the oil & gas sector to Romania’s GDP growth has increased substantially since 2020, when its performance was negatively influenced by the low demand during the pandemic. Apart from the increase coming from higher production volumes, a significant part of this gain is attributed to the rise in oil and natural gas prices. Oil & gas sector represented around 7.8% of GDP in the first half of 2022. In comparative terms, in the referred period, the contribution of the oil & gas sector to GDP represents:

- 249% of the ‘Financial Intermediation & Insurance’ sector contribution to GDP,

- 105% of the contribution to GDP attributable to the ‘Arts, Entertainment and Recreational Activities’ sector, or

- 99% of the ‘Construction’ sector contribution to GDP, or

- 54% of the either the ‘IT & C’ sector or the ‘Real Estate Transactions’ sector contribution to GDP

Employment effects are also considerable. At the end of June 2022, the number of jobs directly supported by the oil & gas sector was almost 61,000. Accounting for the indirect and induced effects, this becomes 145,000, almost 3% of Romania’s total employment.

Total fiscal contributions paid by the oil & gas sector to the government consolidated budget amounted to RON 29.8 billion in 2021 and RON 21.5 billion in the first half of 2022, representing 7.8% and 9.7% respectively of total government revenues.

Following the increase in both quantities and prices, royalties and windfall taxes paid by the oil and gas sector reached a record high in the first half of 2022. Together they amounted to RON 8.1 billion, the equivalent of 3.7% of total government revenues in the first half of 2022.

The oil & gas sector paid VAT and fuel excise duties amounting to RON 17.6 billion in 2020 and RON 20.9 billion in 2021, the equivalent of 19.2% and 18.4% respectively of the revenues the government collected from VAT and excise duties.

Investments made by the oil & gas companies were negatively impacted by the pandemic. Despite this, the sector invested RON 5.6 billion in 2020 and RON 4.4 billion in 2021, the equivalent of 2.2% and 1.4% of total economy investments respectively.

‘The Contribution of the Oil & Gas Industry to the Romanian Economy’ study was prepared with the financial support of the Oil and Gas Employers’ Federation (FPPG).

[1] The term ‘oil & gas industry/sector’ used in the context of this paper comprises the companies included in this analysis. Although these companies together account for a very large share of the sector’s total, there are some other companies operating in the oil & gas sector which were not included in the analysis; for instance, Rompetrol, Lukoil or SLB. Only these three, together, could add an estimated minimum 8% additional impact on direct employment effects, with a potential similar impact to direct GDP effects.