Transgaz Ranks 4th Among EU TSOs

Thanks to its strategic investments, Transgaz is today the fourth largest transmission system operator (TSO) in the European Union in terms of the number of kilometres of network managed (about 14,000 km).

The war in Ukraine is redrawing Europe’s energy supply map. The new energy projects, especially those aimed at gas supply, find the national gas transmission company Transgaz involved in the development of several strategic investments, consisting in the construction of gas pipelines, investments that confirm the regional scale of the company with majority state capital.

Transgaz’s management, selected in accordance with the provisions of GEO No. 109/2011 on corporate governance of public enterprises, has undertaken an ambitious investment plan, estimated at EUR 9.1 billion, so that in the next 10 years, the National Gas Transmission System (NTS) will meet the requirements of the European Green Deal to modernize and adapt the existing gas transmission infrastructure.

Transgaz actively contributes to maintaining Romania’s energy security through the investments it has carried out and continues to carry out. They have allowed Romania to increase the level of interconnection with neighbouring countries, the development of the natural gas transmission network, and, equally importantly, they have facilitated the development of strategic regional projects, such as the Ungheni – Chisinau gas pipeline, the development, consolidation and diversification of national and international relations of collaboration and cooperation.

Transgaz’s market value grew by over 33% in 2024

Thanks to these investments, Transgaz is currently the fourth largest transmission and system operator (TSO) in the European Union, according to the number of km of network managed. According to its plans, the company will continue to invest in investment projects with high added value, in line with the commitments made to shareholders, the Romanian State, the European Commission and external institutional partners. This pro-active and responsible, transparent and upright behaviour, together with the managerial performance that characterizes the company’s actions, contribute significantly to the increase in its market value. From the beginning of 2024 until mid-July, the market capitalization increased by 33.7%, (approx. EUR 236 million) respectively from EUR 712.1 million to EUR 947.6 million, which contributed to strengthening the company’s public and investment profile, increasing the prestige and image capital of the company’s management, both domestically and internationally.

EBRD has become a shareholder in Vestmoldtransgaz

The strategic nature of the investments made by Transgaz, the first multinational company in the energy sector with majority state capital, is appreciated by institutional financial partners, as demonstrated by the EBRD’s decision to acquire a significant stake in Vestmoldtransgaz, a subsidiary of Transgaz.

In September 2023, Transgaz, through its Moldovan subsidiary Vestmoldtransgaz, took over from Moldovatransgaz the activity of operation of the 1,450 km of gas transmission network, as well as the activities of gas dispatching and transmission in the Republic of Moldova. The investment effort made by Transgaz on the territory of Romania and the Republic of Moldova, investments implemented to ensure the security of gas supply to the Republic of Moldova, including Transnistria, amounts to EUR 466 million.

Main investments carried out by Transgaz

Thus, the institutional confidence that investors have in Transgaz, in the company’s management, has increased, and the company’s capital of trust has also grown. Beyond the figures, the projects that Transgaz develops and implements bring added value to the company and lead to greater confidence of stakeholders and shareholders in the company’s management’s ability and capacity to develop and implement viable investment projects for the sustainable development of the gas transmission infrastructure in Romania. As presented in the company’s reports to shareholders, investors and all other stakeholders, the performance of Transgaz management bears the imprint of the investments made, investments of strategic importance for increasing the energy security of Romania and of the European Union, among which we mention:

- Completion of BRUA project Phase 1, a project of strategic interest for Romania and Europe, investment budgeted at EUR 479 million, of which EUR 179.32 million represented a grant from the European Commission and realized with EUR 397 million, which means savings of 17%, respectively EUR 82 million. This project was completed in November 2020 and allows the business environment and local communities access to natural gas necessary for economic development and to increase the quality of life of the inhabitants, in conditions of predictability, while ensuring the maximum capacity available to users of the gas transmission network from Romania to Hungary and Bulgaria. By implementing the BRUA phase I project, Transgaz has fulfilled its commitments to the European Commission.

- Completion of the Ungheni – Chisinau gas pipeline (120 km) one month earlier than provided in the privatization contract of Vestmoldtransgaz.

- Construction and commissioning in the period 2019-2023, in a complex and difficult socio-political and economic context, aggravated by the need to manage the negative impact of the SARS-CoV-2 pandemic, of approximately 1,000 km of natural gas transmission pipeline, i.e. an average of 200 km/year, whereas the average km built and commissioned in the last 20 years was 113 km/year.

- Completion of the project ‘Developments of the NTS in the North-East area of Romania in order to improve the natural gas supply for the area and to ensure transmission capacities to the Republic of Moldova’.

- Completion of the project ‘New developments of the NTS in order to take over gas from the Black Sea coast (Vadu – T1)’.

- Replacement of the gas metering station GMS Isaccea 1.

- Completion of the project ‘NTS interconnection with the international transmission system and reverse flow at Isaccea’ – Stage 2 – Works in Sendreni Technological node (NT) – electrical installations and automation.

- Completion of the project to consolidate the transmission system in Romania, between Onesti – Isaccea and reverse flow at Isaccea – Phase 2 (interconnection of the National Transmission System with the international system and reverse flow at Isaccea) – Phase 2 – modernization of Onesti GCS (gas compressor station) and modernization of Silistea GCS.

- Transgaz, through effective operational measures, has also achieved the technical performance to reduce in the period 2013-2023 the technological consumption from 160 million cubic meters to 57.69 million cubic meters, a reduction by 64%, the share of technological consumption in the gas transported in the NTS being today at 0.44%, below the European average of 0.50% recorded by the main TSOs in the European Union.

The value of Transgaz’s investment expenditure for the period 2013-2023 amounts to RON 5.42 billion (EUR 1.08 billion).

142% higher profit in the period 2017-2023 compared to the assumed one

The data published by the company between 2017-2023, according to the financial reports, shows that the level of realizations on revenues, expenses and profit are above those assumed in the Management Plan. The company’s revenues for the period 2017-2023, totalling RON 10,890,844 thousand, are higher by 7%, i.e. RON 757,841 thousand, than the RON 10,133,003 thousand assumed in the Management Plan for 2017-2023. The effort of the management’s intervention in managing and reducing the company’s expenses is visible, the expenses incurred by the company in the period 2017-2023, amounting to RON 8,752,078 thousand, being reduced by 6.5%, i.e. RON 608,866 thousand, compared to the level assumed under the Management Plan for the same period, RON 9,360,944 thousand. These aspects led to a 143% higher gross profit (RON 1,646 million) and a 142% higher net profit (RON 1,363 million) in 2017-2023 compared to the level assumed in the 2017-2023 Cumulative Management Plan.

Romania is in a very privileged position today because Transgaz has invested a lot in the gas transmission infrastructure. We can see the results of investments in the gas infrastructure and Romania’s role in the region as an important hub that can ensure energy security and gas supply from diversified sources for the mentioned countries. Through the proposed projects for the development and modernization of the gas transmission infrastructure, by implementing smart control, automation, communication and network management systems, Transgaz aims both to maximize energy efficiency across the entire chain of activities, as well as to create a smart, efficient, reliable and flexible gas transmission system. In addition to the major projects included in the TYNDP 2024-2033, the Investment Modernization and Development Program for the period 2024-2025 also includes investments in NTS developments in accordance with the provisions of Law 123/2012 updated, investments that ensure the expansion of the National Transmission System in areas with newly established distribution systems.

Diversification of supply sources

After the BRUA and Onesti – Ungheni – Chisinau gas pipelines, the Tuzla – Podior gas pipeline, with a length of 308 km and a value of about EUR 500 million, is the most important gas infrastructure project that Transgaz is building, being a strategic, vital project for energy security, its consolidation and the sustainable development of the national economy. The operationalization of the pipeline is important in the context of an expected increase in demand for natural gas in the coming years, given the decarbonization policies, i.e. transition from coal-fired to gas-fired power plants, but also taking into account the completion of investments in the industrial and energy sectors and investments in the development and expansion of the NTS to allow all localities to be connected to the gas infrastructure.

After the construction of the Turkish Stream 2 pipeline in Bulgaria and Serbia, the pipelines on the Trans-Balkan Corridor became inoperable. Then, Transgaz started the transformation of these pipelines from one-way to bi-directional pipelines, by investing its own forces, thus creating the prerequisites for natural gas transmission on the Southern Corridor and through the T2 pipeline, with a capacity of 14 billion cubic meters/year, from Azerbaijan, as well as LNG from terminals in Turkey and Greece.

The fact that Romania is interconnected in reverse-flow regime allows the import of natural gas from different corridors. Until five years ago there was only the option of importing Russian gas from the T1 transit pipeline. Things are radically different now. Romania can import gas from Hungary, from Bulgaria, from the Caspian Sea, through the TANAP and then TAP pipelines, through the Vertical Corridor, and liquefied natural gas from Greek or Turkish terminals, Turkey having 6 LNG terminals with a capacity of 60 billion cubic meters.

The Vertical Corridor, another important project, is a component of the 3 Seas Initiative’s (3SI) South – North Corridor and will contribute to the diversification of natural gas sources and increase the security of gas supply to Central and Eastern European and Balkan countries.

The Vertical Corridor is an initiative of Transgaz’s CEO, who has been promoting and supporting the concept since 2016. The integration of BRUA into the Vertical Corridor transforms Romania into a major player on the regional gas market. This demonstrates two important aspects: first, that Romania is a country with vision and courage to act in the gas sector, which is important for the present and the future; and second, that Transgaz is a leader in the regional energy sector.

How the management of TSOs is paid in the EU

For more than 16 years, SNTGN Transgaz SA has been a company listed on the Bucharest Stock Exchange, Premium category, in which the corporate governance model is successfully functioning and in which sustainability is at the core of the business strategy, the company being rated by Fitch Rating Agency with ‘BBB- with stable outlook’.

Measuring the performance of companies’ management is a process of optimizing the management of the activities carried out and the use of resources used, in order to effectively meet the strategic objectives assumed by directors and executives through the Company Management Plan, which includes the administration component, the management component and the financial and non-financial key performance indicators. The management of the operator of the National Gas Transmission System has always achieved over 100% of all financial and non-financial key performance indicators approved by shareholders.

Transgaz management remuneration

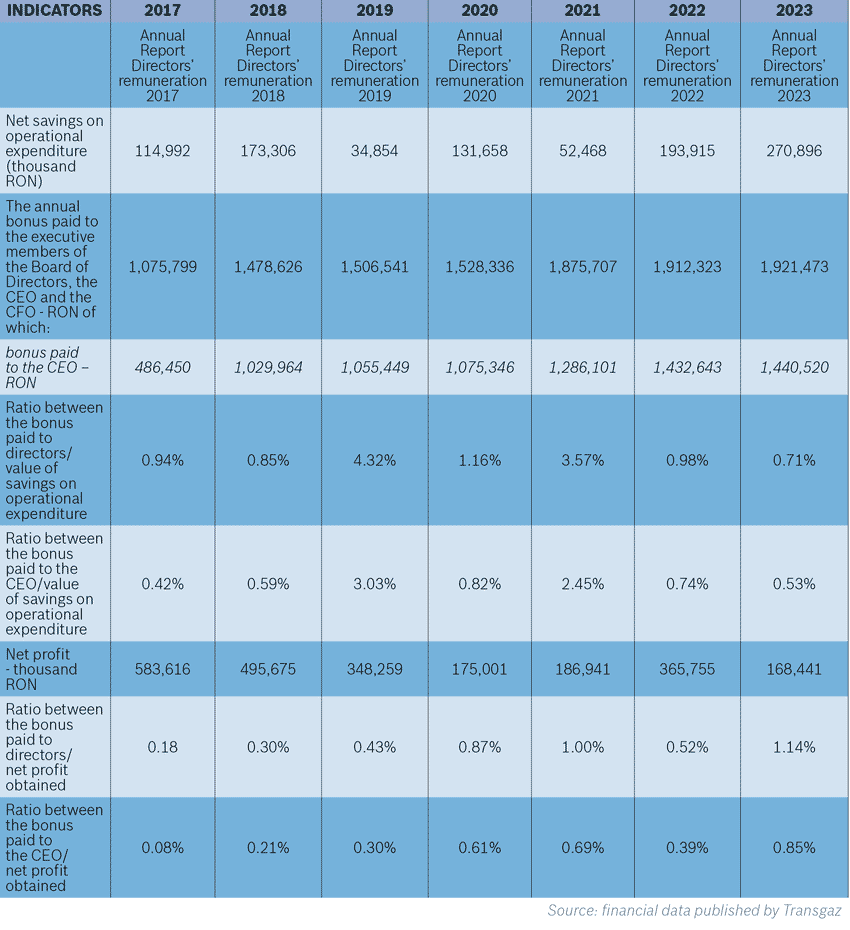

Weighing, on the one hand, the results of the measures undertaken by the company’s management in the period 2017-2023, materialized in the economic-financial performance achieved, and on the other hand, the remuneration received by the company’s management, as provided for in the Management Plan and the Mandate Contract, the balance is as follows:

Official company data shows that:

- The bonus paid to directors for the year 2023 is less than 1% in relation to the amount of net savings realized on operating expenses (0.71%) and 1.14% in relation to the net profit recorded.

- Relative to the net profit realized as a result of the execution of the assumed mandate, the bonus paid to the CEO is less than 1%.

- Relative to the amount of net savings achieved on operational expenditure, as a result of the execution of the mandate assumed, the bonus granted to the CEO ranges between 0.42% in 2017 and 0.53% in 2023.

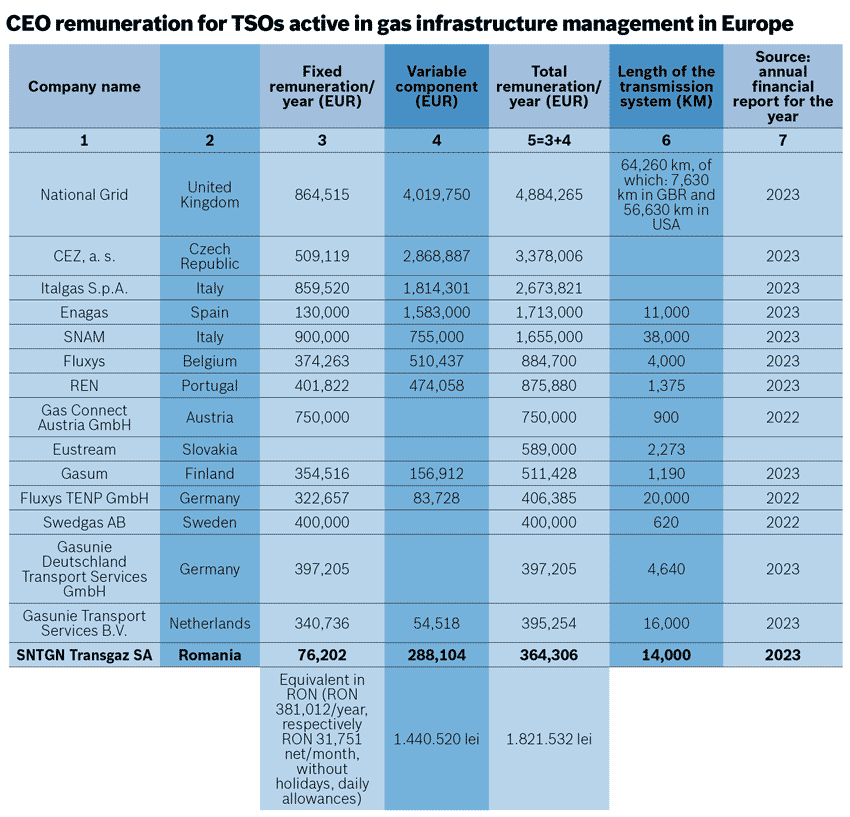

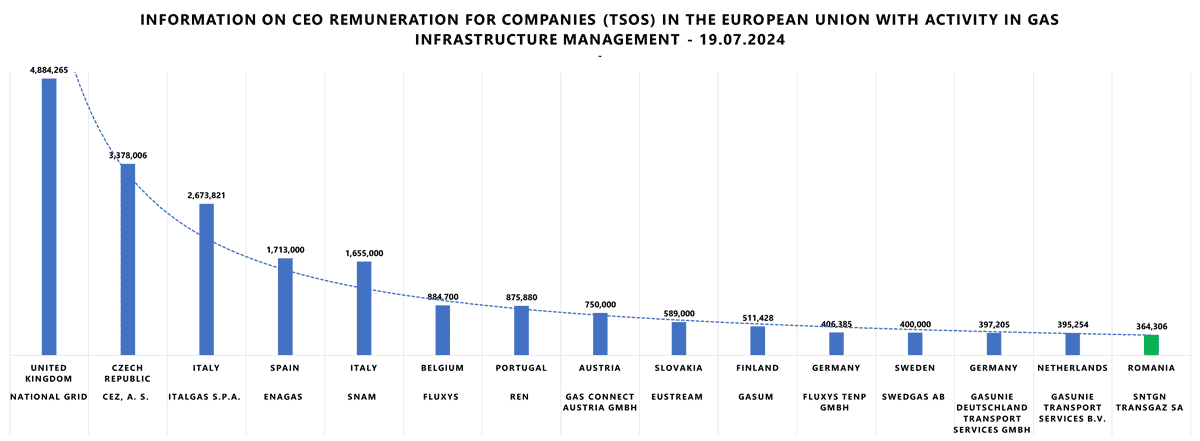

How the CEOs of Europe’s peer companies are paid

Thanks to the investments made in recent years, Transgaz is today in a position to manage some 14,000 km of network, making it the fourth largest company in the EU in this respect. Only France – 37,627 km, Germany – 34,580 km and Italy – 34,500 km are ahead of it.

In terms of CEO remuneration in gas transmission companies, it is noticeable that there are very large differences between the length of the managed transmission network and the level of remuneration.

For example, the CEO of the Swedish gas transmission company Swedgas AB, which manages only 600 km of network, was paid EUR 400,000, the CEO of Fluxys Belgium, which manages a 4,000 km network, 3.5 times smaller than Transgaz’s, was paid EUR 884,700, far above that of his counterparts in many countries that manage much larger networks.

As for Transgaz, according to the remuneration report for 2023, the remuneration of the company’s CEO Ion Sterian totalled EUR 364,306 (RON 1,821,532), of which the fixed remuneration amounted to EUR 76,202 (RON 381,012) and the variable component to EUR 288,104 (RON 1,440,520).