Directly Negotiated PPAs – A New Chance for Renewables in Romania?

The Romanian Government recently enacted the Emergency Government Ordinance No. 74/2020 (‘EGO 74/2020’), which entered in force on 18 May 2020. An expected and necessary piece of legislation, EGO 74/2020 amends the Energy law No. 123/2012 (‘Romanian Energy Law’) by expressly allowing bilateral power purchase agreements (‘PPAs’) to be directly negotiated outside the centralized markets, although not for all electricity generation capacities, as further detailed below. Until now all wholesale electricity transactions had to be concluded exclusively on the centralized markets in a transparent, public, competitive and non-discriminatory manner, with limited exceptions generally for small generators.

EGO 74/2020 should be a major step forward in improving the legislative framework of renewables and allowing this industry to pick up again. But is it enough?

Only new capacities to benefit?

The ban on directly negotiated PPAs came in 2012 in the context of the highly politicized discussions on the directly negotiated PPAs concluded by some state-owned generators with some well positioned traders in rather unfavourable conditions for such generators. Probably in order to avoid any discrimination in the market the ban was general and, as such, it negatively affected the development of renewable projects by damaging their bankability.

EGO 74/2020, however, does not overturn this general ban, but rather extends the exceptions to it so as to cover any new energy production capacities commissioned after 1 June 2020. The permissibility of directly negotiated PPAs applies to any new generation capacities (not only renewables), but it will primarily benefit to renewables in fact because this type of investments in the Romanian power generation sector has prevailed in the past 10 years and should continue to do so.

Hence, EGO 74/2020 keeps the ban on directly negotiated PPAs for existing generation capacities, creating two separate legal regimes for the sale of power by the generators depending on the commissioning date – until or after 1 June 2020. The consequences of such approach should be carefully analysed from two perspectives: (i) possible distortion of free competition between the power generators; and (ii) compliance with EU Regulation No. 943/2019 on the internal market for electricity (‘Regulation 943/2019’ or ‘Regulation’).

As regards point (i), if one would compare a power generator having commissioned its capacity before 1 June 2020 to another one which will commission its capacity after 1 June 2020 – the latter seems in a better competitive position as it may freely secure a long term directly negotiated PPA, while the former could not. This apparent competitive advantage (if there would be deemed so) results exclusively from the change of the applicable legal framework. It is not clear if this effect has been considered or analysed by the Government before enacting EGO 74/2020.

As regards point (ii), Regulation 943/2019 requires Member States, regulatory authorities and system/market operators to ensure that markets are managed in accordance with a number of principles amongst which “long-term electricity supply contracts shall be negotiable over the counter” (the wide definition of the ‘supply contracts’ includes PPAs and the reference to “over the counter” indicates directly negotiated PPAs). There is no distinction made in the Regulation between existing and new generation capacities. Furthermore, the Romanian regulatory authority, ANRE, has issued Order no. 236/2019 at the end of last year, which anticipated the general lifting of the ban on directly negotiated PPAs by expressly allowing electricity transactions to be performed on ‘non-regulated markets’ (Romanian language: ‘piete nereglementate’). Moreover, ANRE has also prepared a draft Order (not yet enacted) which defines ‘long-term electricity supply contracts’ used by the Regulation as the contracts with over 1 (one) year delivery period, again without any distinction between existing and new capacities. Therefore, EGO 74/2020 seems to introduce a restriction to the applicability of Regulation 943/2019 on the matter of freely negotiated PPAs, which is neither provided by the Regulation nor predicted by ANRE’s secondary legislation implementing the Regulation.

It is also noteworthy that Regulation 943/2019 (as any EU regulation) is directly applicable in the Member States as of its entry into force on 1 January 2020 and should prevail on the domestic legislation. However, until now ANRE has rather avoided taking a firm stance on whether the directly negotiated PPAs are allowed as of 1 January 2020 in Romania. This is essentially due to the express ban still surviving in the Romanian Energy Law and on the ground that Regulation 943/2019 does not provide what should be the minimum duration of PPAs in order to qualify as ‘long term supply contracts’ subject to free negotiation as per the Regulation, aspect which ANRE sought to cover/clarify in the above-mentioned draft Order.

Meanwhile, as detailed above, EGO 74/2020 has only partially lifted the ban on directly negotiated PPAs and it remains to be seen if the Parliament will fully align the Romanian Energy Law to the Regulation 943/2019 on this matter as result of the parliamentary procedure for approval of the ordinance (in Romania any emergency ordinance passed by the Government must be discussed and ultimately approved as such, amended, or rejected by the Parliament).

Also, there is a previous bill amending the Romanian Energy Law launched in 2019 and already approved by the Senate, which continues to regulate an express ban on directly negotiated PPAs (hopefully, this too should be corrected by the end of the legislative process by the decisional Chamber of Deputies).

A new support scheme for renewables?

Since the directly negotiated PPAs represent a major bankability factor, the lifting of the ban for the new generation capacities should help them to secure project financing easier. Therefore, this is a much-awaited correction of the regulatory framework.

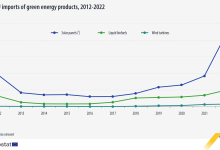

But despite this positive development, currently there is no State-sponsored support scheme applicable in Romania: the previous green certificates scheme has closed at the end of 2016 and for the time being there is no replacement scheme applicable. As a result, the installing of new renewable generation capacities has almost stopped since 2017.

However, nowadays there are opinions arguing that some renewable sources such as solar and, to a lesser extent, wind, could be profitable theoretically even without a State-sponsored support scheme. Nevertheless, this remains rather a speculative assessment, as it may vary depending on the market, technology and ultimately each project specifics.

Therefore, especially in countries with shifting regulations such as Romania, renewables still seem to need a support scheme, also in the general context of the mandatory targets with respect to renewable sources under the EU framework. Romanian Government is willing to undertake a rather ambitious target of 30.7% weight of renewable sources in the total energy consumption for 2030 (compared to 24% in 2020), which should translate in the need to install by 2030 new capacities close to 7,000 MW of renewables, out of which almost 6,000 MW only in wind and solar, as per the current draft National Energy and Climate Plan for 2021 – 2030. A new support scheme would be vital to attract the needed investments towards achieving these targets.

In this context, it seems the Romanian state intends to prepare and implement in the next 2 years a contract for difference (‘CfD’) support mechanism for which it recently launched an advisory selection process through EBRD. In principle, a CfD mechanism guarantees a striking price for each generator depending on the actual project costs – the generator sells at market price but there will be a positive or negative financial adjustment operated by a central counterparty with the difference between the applicable striking price and the reference market price. Realistically and given that the estimated duration of the preparation process of such new support scheme is of 2 years, the earliest date such CfD mechanism could become operational is likely 2022. Nonetheless, this is other good news for investors, who could start already planning or securing projects.

Why renewables should still be a priority for Romania?

There were opposing views in Romania with respect to renewables and shifting attitudes fluctuating from generous support to reserved approach or even open criticism because of grid integration problems of renewable projects or social costs involved by the previously applicable green certificates support scheme. But one thing is certain – the decarbonization is the strategic direction to which Romania and the whole EU is heading under the recent European Green Deal and renewables are instrumental to achieving the very ambitious decarbonization targets set by EU.

Moreover, renewables could compensate for the additional electricity output needed due to the foreseeable increasing consumption, on one hand, and the likely operational shortcomings and eventually decommissioning of the old and outdated conventional energy generation capacities combined with the lack of replacement or new such investments, on the other hand. Thus, it is quite possible that no new conventional (including nuclear) capacities will be commissioned by 2030. Also, certain existing capacities accounted for in the statistics of total capacity installed nationwide might be no longer operational already. According to statements by ANRE officials on mid-2019, out of the 24,000 MW installed energy generation capacity in Romania at that time around 8,000 MW were no longer operational. ANRE has started in 2019 a process of assessing the actual operating capacity at country level and withdrawing the generation license for the capacities that are no longer operational as a matter of fact. As a result, according to official ANRE data, there are currently approx. 20,661 MW installed energy generation capacity in Romania remaining, which may reduce even more in the coming period. The above indicates that it could appear rather sooner than later a potential systemic deficit of generation capacities on the Romanian market (Romania was already a net importer of electricity in 2019).

Finally, the accelerated technological advancement entails a progressive decrease of costs of renewable projects and the planned CfD support mechanism should provide investors/generators certainty and price security/stability while protecting at the same time the consumers in the event of excessive rising of electricity prices (to the extent the amounts refunded by the generators are re-distributed to consumers).

Therefore, renewables might be a win-win for everyone – policy makers, investors and consumers alike.