New royalties under public consultation: legal and practical implications

GENERAL CONSIDERATIONS

On 23 November 2017, the draft law for mineral, petroleum and hydromineral resources has been released for public consultation (the “Draft Law”).

For the purpose of the present article, only the amendments on the petroleum royalties will be further detailed.

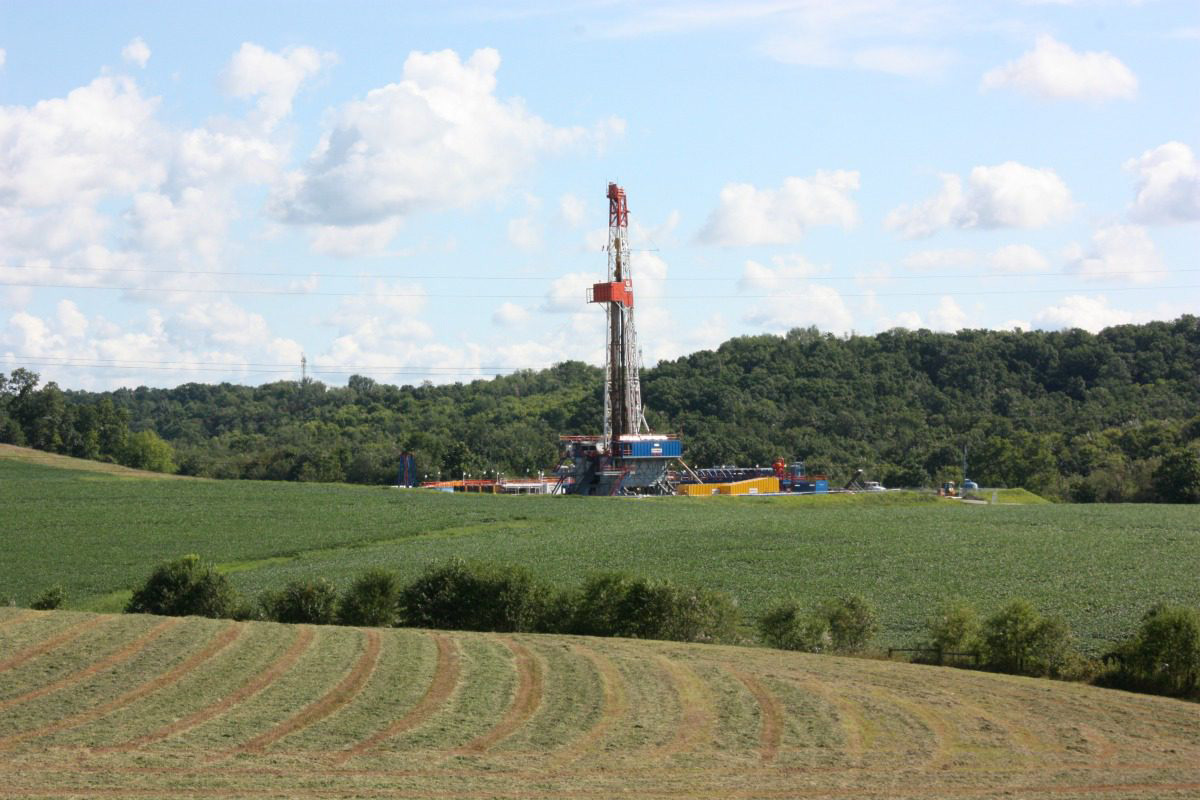

The Draft Law is a perfect example of what one might call “a lot of noise” for rather a minor impact. Historically, the public attention on this topic has been artificially ignited and sustained by a number of politicians with flamboyant statements supporting a spectacular increase in the government take. Yet, the geological, legal and social conditions in Romania (hardly ever understood by such politicians) do not justify such an increase (i.e. the specific geological landscape, the numerous small mature onshore fields, the size of the challenging deep water reservoirs, the lack of private ownership over subsurface resources – as opposed to the US where land owners are entitled to the underground resources; the short distances between social accumulations – i.e. no large available land surfaces, small number of drilling rigs, high mobilization costs for offshore rigs in the Black Sea etc).

APPLICABILITY

The current petroleum concessions will not be impacted (Art 3 para 1 of the Draft Law); only new concession agreements will fall under the scope of the Draft Law.

Yet, should the duration of the current concessions be extended, the new (i.e. then applicable) royalty regime will become applicable (Art 3 para 3 of the Draft Law). Such a provision is extremely important for the development plans to be approved, if an extension of production period is envisaged.

Onshore royalties

The Draft Law does not change neither the royalty quotas, nor the production volumes (to which such percentages are applied) currently referred to under Article 49 of the Petroleum Law no 238/2004.

However, the Draft Law contains an uncomfortable provision enabling the government to “update” the royalty quotas, upon the request of the competent authority – (Such request must be based on an “opportunity economic analysis”).

It is for the first time when specific quotas are proposed for offshore. The offshore system is based on a fixed quota (i.e. 8% for oil & 10% for gas) applied up to a certain production level (i.e. 100.000 tones for oil and 200.000 thousand m3 for gas). If these levels are exceeded, a variable quota will be added on top of the fixed quota. The maximum quotas (summed up: both fixed and variable) are maintained though: 13.5% for oil and 13% for gas.

Although the maximum quotas have been kept, the fixed quota is a newcomer. Practical implications? We see them primarily for smaller fields/ productions: so far, the minimum quotas started from 3,5% (oil) and 3,5% (gas). Under the Draft Law, everything will be charged with 8%, respectively 10%. Will the business cases be robust enough to withstand such higher quotas? Could it be that smaller accumulations remain unexploited because of such higher quotas? We shall see.

Even the larger fields might face this issue towards the end of their life. The fields in their so called “tale” of production (i.e. the final years of production, when the volume is decreasing after the plateau period) will withstand difficultly such fixed higher quotas. As a result, it could be that the production is stopped earlier than under the current regime (when a smaller royalty would not be so burdensome as an 8% or 10% quota). Wouldn’t it be better (from state’s perspective) to cash in a lower royalty than 8% or 10% out of nothing?

COMPUTATION METHOD

The royalty is determined by applying the royalty quota to the value of the gross production; the value of the gross production is determined by multiplying the gross production with the reference price1 to be communicated by the competent authority2. The methodology for computing the reference price is to be adopted.

1 – As such, the Draft Law maintains the system based on revenues. We believe that, considering the Romanian landscape a system based on profit would have been more beneficial (i.e. when the profit is low, the royalty should decrease accordingly – but it would enable continuing production; when the profit is high, royalties should be high). As there is no reference to profit, the government runs the risk that certain producers stop production earlier as their business cases might turn uneconomic due to the revenue based royalty.

Additionally, the computation of the reference price would consider the fluctuations of the Brent oil price/ the OPCOM gas price. This is definitely a positive change (compared to the existing system), but there are a number of other factors that directly impact the profit which will not be considered (and that is why a profit based royalty would have been more advisable than the revenue based model).

2 – The Draft Law provides only for onshore that if the selling price is higher than the reference price established by the competent authority, the selling price will be considered for the computation of the royalty (as per Art 20 para 2 under Annex 2 of the Draft Law).

Keeping the reference price will introduce uncertainty: even if such reference price is to consider the Brent oil price/ OPCOM gas price (as the Draft Law specifies), it allows for “outside the market” / state interventions and, as such, it creates uneasiness among investors.

OTHER ASPECTS

Following the introduction in 2014 under the Petroleum Law of the concept of petroleum areas (Romanian: “zone petroliere”), the Draft Law sets forth, only for offshore, that all production obtained from all petroleum areas will be taken into consideration (i.e. not individually, per petroleum area).

The Draft Law sets forth that the royalty will be paid monthly. If the royalty is not paid for six months, the concession agreement must be cancelled.

CONCLUSIONS

The release of the Draft Law is a step forward towards landing one of the key issues that many existing investors must clarify before sanctioning their development projects. At the same time, putting in place a new royalty regime will open the door for potential investors that are now only prospecting Romanian fields.

The uncertainty revolving around the government take (i.e. royalties, taxes etc) has constantly been mentioned as an indirect obstacle (aside from other reasons) for the 11th NAMR licensing round – investors have justifiably claimed it would be difficult to place bids for a contractual relationship potentially for several decades while the fiscal regime is unclear. If adopted, the Draft Law (although including a number of elements that could be improved), will for sure help removing some of such uncertainty.