Recent developments in the crude oil and gold markets

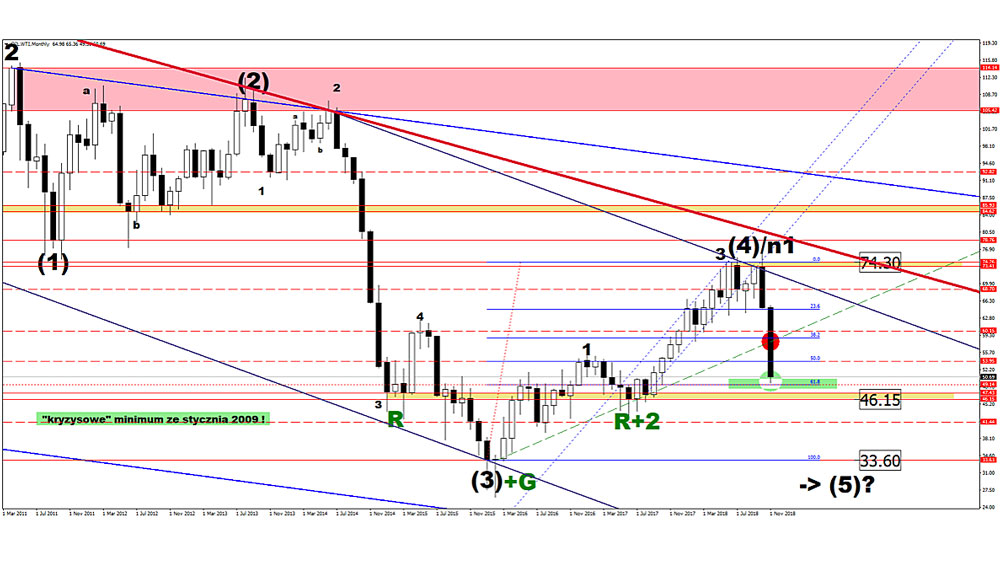

The decline of the crude oil price in November indicates signs of a crash. Taking a look at the evolution and the patterns for crude oil, we can see that since mid-2008, when the oil market has reached the level of USD140 we are dealing with a persistent downward trend. November was definitely one of the worst months for crude oil evolution as the price of black gold has dived deeply.

Taking into consideration the persistent downward trend, as indicated on the graph by the thick red line, the drop from November is clearly in line with this downward pattern. Therefore, there is a high probability that the price of crude oil will reach the level of USD33.60, or even lower.

There is a chance for the downward trend to be interrupted but for that to happen, the price of crude oil would have to be maintained at the level of USD49.15. This level would be a sign of a correction in the market, indicating stopping the development of the 5th downward wave.

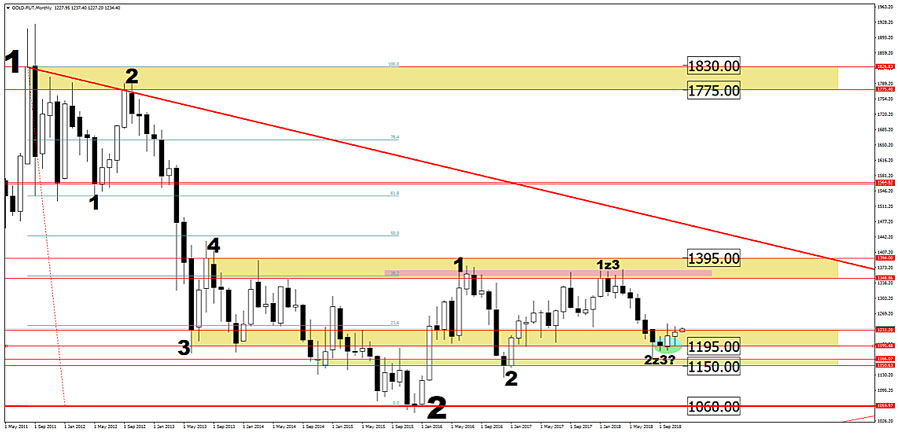

The price of gold remains very low; however, it can be seen that the price level of 1195 – 1230 USD has been maintained for almost half a year and is now expected to end with a stronger move.

Taking into account that the ‘minimums’ in the subsequent waves has been higher and higher as well as the fact that the price has stayed around the level of 1200 USD, it is probably that the market is in the process of creating the third wave of growth. This means that there are higher chances for growth rather than decreases for gold prices.

If there will be consistent movement above the area of USD1230, then it can be expected that the price level of USD1350 – 1395 will be approached in the next upward movement.