Underpinning the Transition: EC Prefers Green H2

Hydrogen is enjoying unprecedented momentum, is set to underpin EU’s energy transition by 2050 and to support the global effort to implement the Paris Agreement, says the European Commission (EC) in the EU Hydrogen Strategy, released in July 2020.

The EU’s executive body commends the use of hydrogen as having the biggest potential to foster the achievement of the EU’s climate neutrality objectives, given its multiple uses (as feedstock, fuel, energy carrier or for storage) and its various applications across industry, transport, power generation. Similarly, the International Energy Agency (IEA) states that scaling up the use and application of hydrogen in sectors where it is currently not widespread, such as transport, buildings, and power generation seems to be the way forward in ensuring cross-sectoral decarbonisation.

It is fair to reckon that hydrogen plays an important, if not a fundamental role in humanity’s transition towards a cleaner and more secure energy future. While the EU seems intent in placing its long-terms bets on green hydrogen mostly and recommends a gradual transition that favours the use of blue, turquoise and pink hydrogen, the IEA believes that to achieve Paris Climate Agreement goals global blue and turquoise hydrogen production should reach 40 million tons by 2030 from 450000 tons today.

Do you have a favourite colour of hydrogen?

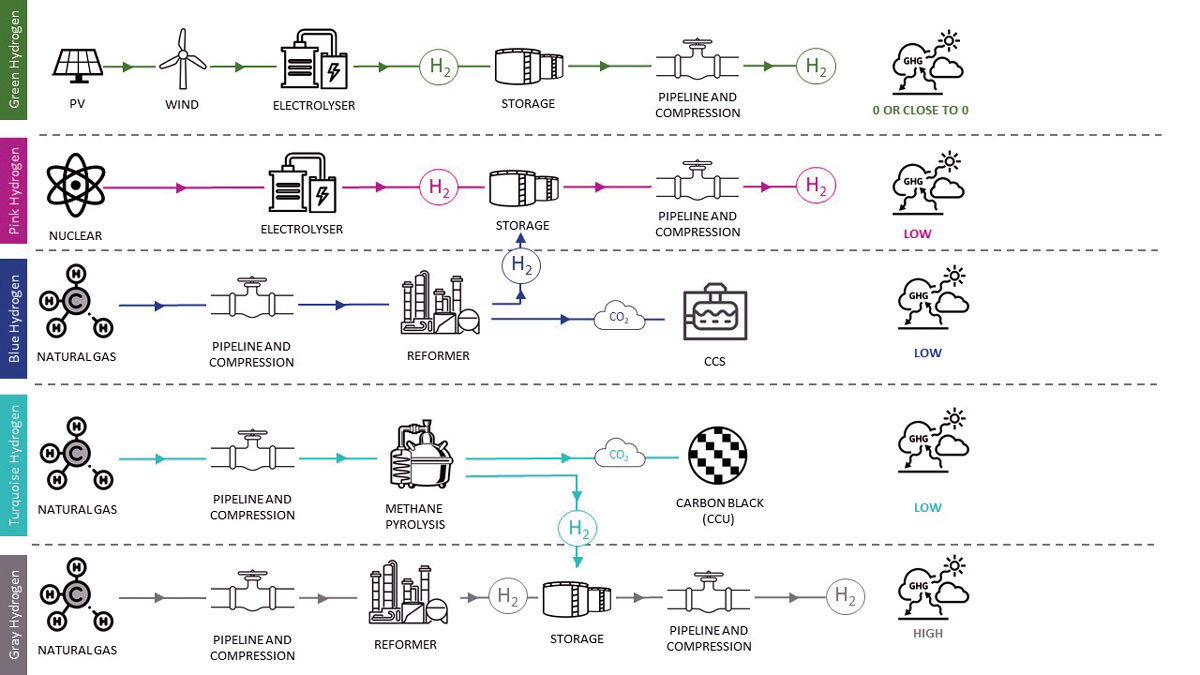

Hydrogen is not an energy source per se, but an energy carrier. Hydrogen cannot be found easily in the nature; it must be produced using various chemical conversion processes and technologies. The specifics of the hydrogen production process and the type of fuel it utilises determine whether hydrogen will be dubbed green, grey, pink, yellow, blue, or turquoise, as shown below.

The most climate friendly type of hydrogen is considered the green hydrogen produced through the electrolysis of water and using electricity from renewable sources. Its GHG emissions are 0 or close to 0. Unsurprisingly, the EU Hydrogen Strategy puts green hydrogen in the spotlight as a priority to reach carbon neutrality by 2050 and for the global effort to implement the Paris Agreement while working towards zero pollution.

Currently, H2 can be extracted from fossil fuels, biomass, water, or a mix of both. However, it is still largely produced from natural gas or coal, accounting for around 6% of the global natural gas use and 2% of global coal. According to the IEA, the production of H2 from fossil fuels is responsible at a global level for CO2 emissions of around 830 million tonnes of CO2 per year, equivalent to the CO2 emissions of UK and Indonesia combined, whereas at EU level it results in the release of 70 to 100 million tonnes CO2.

In addition, the fuel costs are the largest component of hydrogen production and they account for between 45-75% of the production costs. Therefore, green hydrogen is not currently competitive with the fossil-based one (i.e., low gas prices give rise to some of the lowest H2 productions costs). Nonetheless, looking at the future declining costs for renewable electricity, in particular solar PV and wind, the competitiveness of green hydrogen is set to increase. Nowadays, less than 0.1% of global dedicated hydrogen production comes from water electrolysis.

Green hydrogen is at the core of the EU’s Hydrogen Strategy. The clear priority for the EU is to develop green hydrogen in three phases:

- First phase (2020-2024) installs at least 6 GW of electrolysers in the EU and produce 1 million tonnes of green hydrogen.

- Second phase (2025-2030) installs at least 40 GW of electrolysers and produce up to 10 million tonnes of green hydrogen.

- Third phase (2030 onwards and towards 2050) green hydrogen to become mature and be deployed at large scale.

Despite this rampant development pace that the EC envisions for electrolysers, low-carbon hydrogen, such as blue hydrogen with CCS, turquoise hydrogen with CCU and electricity hydrogen (regardless of the way in which electricity is produced) as enablers of the energy transition. For this reason, the NGOs have clamoured that the EU Hydrogen Strategy is a gift to oil and gas companies.

The discussions around hydrogen are important and very actual because even though technologies for its production have been developed, the production capacity is low: in the EU total production capacity of electrolysers is below 1 GW a year. A scaling up in production must be balanced by an upscaling of demand. The interplay between supply and demand will define the infrastructure needs for its transportation. Supply must be transported to the demand, either delivered to final users or included in an integrated energy system. Currently, hydrogen can be transported through pipelines, in trucks or ships. Even though the EC has issued a clear roadmap with ambitious goals of carbon neutrality through the deployment of green hydrogen at a large and mature scale by 2050, the regulatory framework has not been issued yet.

A clear, transparent, and dynamic regulatory framework will allow to assess whether the current conditions applicable to the gas industry may be transposed for hydrogen as well. Particular attention should be paid to the hydrogen infrastructure since this is the backbone of any future hydrogen market.

In its EU Hydrogen Strategy, the EC assesses that for the 1st phase – no need for dedicate hydrogen infrastructure, local decentralized production; second phase – local hydrogen networks would emerge; third phase – repurposing of existing natural gas infrastructure seen as an opportunity for a cost-effective energy transition in combination with newly built hydrogen dedicated infrastructure (limited). For example, it is expected the hydrogen network in Germany and the Netherlands may consist of up to 90% of the repurposed natural gas infrastructure.

Blending of H2 into the natural gas networks

Conversely, when it comes to blending a specific amount of hydrogen into the already existing gas networks, both the EC and the industry see it as enabling the transitional phase and fostering the intake of decentralised green energy production in local networks; however, the EC’s belief that blending is less efficient in the long run has spun reactions from the industry which claims that hydrogen admixtures should be properly recognised within the future EU energy regulatory framework. At the same time, the European Federation of Energy Traders (EFET) agrees that blending or co-transportations and the replacement of natural gas with hydrogen allows the gas system to play an ongoing role in a decarbonised framework and.

Gradual transition implies gradual regulation

The Agency for the Cooperation of Energy Regulators (ACER) and Council of European Energy Regulators (CEER) have expressed views on the implementation of the EU Hydrogen Strategy. The regulators welcome the strategy and emphasise the crucial role of gradual, dynamic, and flexible regulation of hydrogen networks in line with market and infrastructure developments, under the supervision of the regulatory authorities and period market monitoring. At the same time, EFET suggests that the EU Gas Network Codes and other existing regulations should be reviewed and adapted to ensure a harmonised regulatory framework for the future gas market in Europe. The regulation of any future hydrogen market shall locate hydrogen at the core of an integrated energy system and incentivise the development and deployment of hydrogen in the hard-to-abate sectors, such as maritime, aviation, transportation, and certain industrial processes. The EU’s plan is to achieve this by unlocking large investments in clean hydrogen and CCS technologies from the EU’s post-COVID 750 billion EUR recovery package.

Regulating an emerging market is no easy task

The EU is aware that regulating an emerging market beset by various unknowns is no easy task. Utmost attention should be paid to this transition period as a gradual development of the market and dynamic adaptation of the regulatory framework may guarantee the achievement of climate neutrality goal and a decarbonised integrated energy system with green hydrogen and renewable electricity at its centre. But the EC cannot and shall not be left alone in this process. A concerted effort from the member states, industry, civil society, and any other stakeholders is mandatory. That is why, on 26 March, the EC opened a Public Consultation on revising the Gas Directive 2009/73/EC and Gas Regulation 715/2009 as a step for the preparation of legislative proposals for a new hydrogen and gas markets decarbonisation package intended for publication in Q4 2021.

A sudden shift of the market rules coupled with lack in flexibility and dynamism of the regulation may result in failure to decarbonise the gas sector. But what will the EC choose? Will the new gas and hydrogen regulatory frameworks deploy a gradual regulation of the future hydrogen market?

Disclaimer: The views and opinions expressed in this article are those of the author’s and do not reflect the official policy or position of any other agency, organization, employer, or company.

Lavinia Tanase is an EU energy law and regulation specialist, former Research Associate Florence School of Regulation