European Solar Inverter Industry Bids for IPCEI

The European solar industry has launched their initiative to deliver an Important Project of Common European Interest (IPCEI) for solar inverters. At the launch of the paper ‘Inverters 2.0: Strengthening Europe’s inverter industry’, representatives from the inverter industry presented the IPCEI concept to Kerstin Jorna, the European Commission’s Director-General for Internal Market, Industry, Entrepreneurship and SMEs.

European inverters have a critical opportunity to further tap into the technological advancements needed for the electrification and digitalisation of the energy system. The IPCEI aims to ensure that the EU inverter ecosystem maintains an innovation edge, globally.

European inverter manufacturers are facing pressure and growing competition. A quickly implemented IPCEI will stimulate an innovative and sustainable investment leap forward, empowering Europe to keep pace with the rest of the world.

“We need to build on the success story of European inverters. The electrification wave is a critical opportunity for Europe’s inverters to seize the innovation edge and establish a competitive global market share. An IPCEI is the foundation for Europe to entrench its world-leading spot in inverters that go the extra mile – supporting the grid, securing cyber-preparedness, and strengthening digital interoperability,” Dries Acke, Deputy CEO and Policy Director at SolarPower Europe, said.

The key opportunities and objectives of the IPCEI would target improvements in:

- The technical capacity of power electronics.

- Access to critical components of inverters, and a decrease in material requirements.

- Grid forming abilities, to support greater, smoother, solar integration into the grid.

- Enhanced cybersecurity capacity and strengthened digitalisation, which would include a roadmap for cyber-preparedness in solar inverters and ensuring interoperability between European inverters and the energy system.

Three key projects under the IPCEI would focus respectively on better hardware, smarter software, and a ‘disruptive’ technological breakthrough. With Germany, Austria, Spain, and Italy currently hosting the most inverter manufacturing capacity, the proposal identifies the countries as the potential Member State leaders of the project.

The next meetings of the Joint European Forum for IPCEI (JEF-IPCEI) will take place in Q4 2024. These meetings evaluate candidate technologies and decide on which are suitable for the IPCEI procedure.

What are inverters and why do they matter?

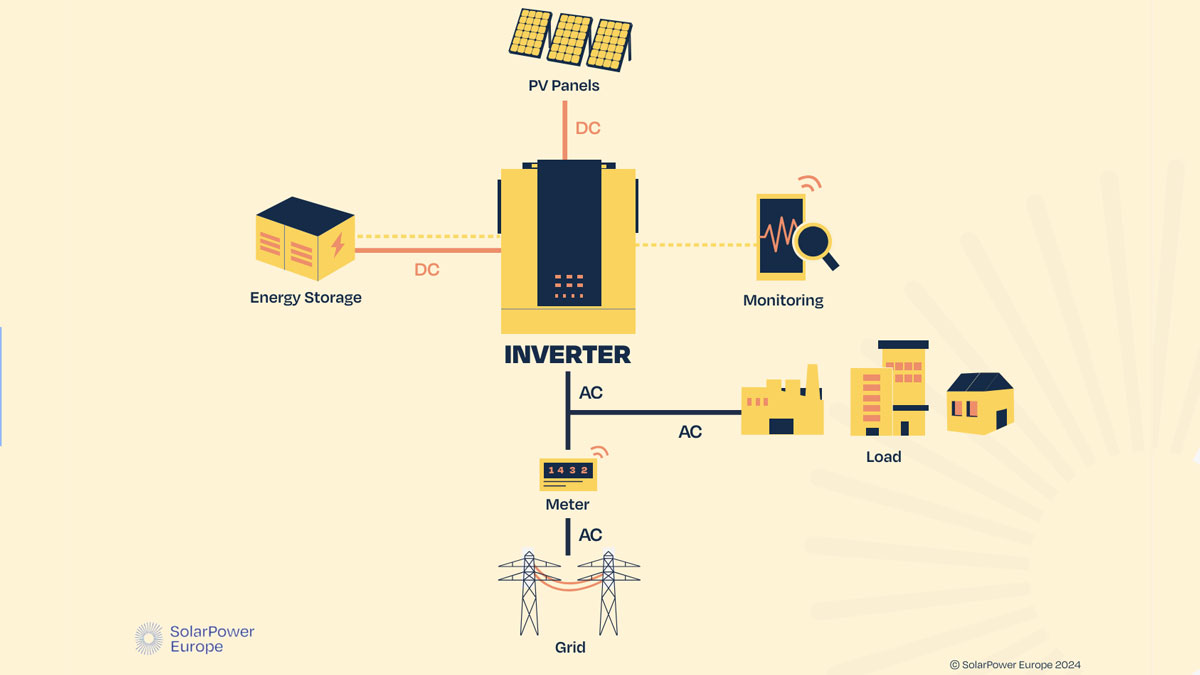

Aside from modules, the solar inverter is the most important component of a grid connected solar photovoltaic (PV) system. Its first function is to convert the direct current (DC) produced by solar panels into alternating current (AC), without which the electricity produced by solar PV would not be useable in electric appliances or the grid.

The second role of inverters is to generate data and control the quality of produced electricity. They are therefore indispensable for grid stability, as they hold information on electricity demand and communicate with the grid within a network of millions of installed PV inverters. In large-scale solar power plants, they serve to stabilise the grid and provide the flexibility needed in our complex energy systems. Some inverters also include important physical (electrical) safety features.

Inverters are also key for smart energy management solutions and sector-coupling in PV-powered systems (households, commercial buildings, or large-scale applications), as they connect renewable electricity production and storage with EV charging, electric heating/cooling, and the grid. They are therefore the backbone of the future European energy system based on renewables.

EU market dynamics

Despite this rich landscape of EU based companies, there is a growing entry of non-EU product manufacturers on the European market. Although this has been supporting the growth of the EU inverter market, it is now leading to a massive displacement of inverters produced in Western countries away from the EU market.

The EU market for inverters is increasingly dominated by companies based in Asia. During the boom phase in 2021-23, European production capacities for inverters could not be fully utilised due to severe supply bottlenecks for components from Asia.

Inverter manufacturers from China (established and new) were significantly less affected; combined with their comparatively lower costs per watt, they were thus able to take over large market shares in Europe.

S&P Commodity Insights estimates that, in terms of MW shipped, European headquartered solar inverter suppliers only shipped 20% of all solar inverters in the European market in 2023. The remaining share was mostly dominated by Chinese companies.

These companies have extremely low-priced products on the EU market. The reasons for lower manufacturing costs and product prices of non-EU producers include the ease of doing manufacturing business outside of Europe, larger economies of scale, the availability of lower labour and energy costs than in Europe, and an industrial strategy in support of domestic manufacturers.

Some EU producers are concerned that inverter prices are decreasing due to these distortions of the level playing field.

In the face of this price pressure from outside competitors, EU companies often advance data security, durability, product sustainability, service quality including after-sale, avoidance of remote controllability of European power supply by foreign entities, and the importance of European manufacturing and suppliers for jobs and future innovation potential, as key added value for their products. However, product price is still the primary decision factor for buyers.

The price pressure is particularly challenging for EU producers with high added manufacturing value in the EU. There is a growing risk of deindustrialisation in the EU on the inverter front as some producers are already facing utilisation rates of 50% and lower in their EU production facilities. Investment decisions for new inverter production capacities are increasingly being made in favour of non-EU locations.

Outside players who recently started producing in Europe are faced with the same challenging conditions: in December 2023, the California-based leading microinverter manufacturer Enphase Energy announced it will stop manufacturing at their production facility in Timisoara, Romania, run by contract manufacturer Flex, and laid off 10% of its workforce, after only 12 months of production. Enphase cited deteriorating market conditions and higher inventories in Europe as the key reason for this closure.

An EU energy policy for inverters should combine measures to support manufacturing with measures to support a thriving solar and inverter market – clear regulatory frameworks that enable and value inverter technologies.

Inverter market key facts

Inverters Explained 2.0 also includes up to date market data.

- In 2023, there was equivalent of 82.1 GW of solar inverter manufacturing capacity in the EU (compared to around 60 GW of solar installed in the same period).

- While some EU inverter companies keep growing and announcing reinvestment plans, their relative market share in Europe is shrinking.

- As of 2023, around 35,000 jobs were employed in the EU by the inverter industry.

- There are at least 14 inverter companies operating in the EU.

- The top countries for inverter production are Spain and Germany, with Spain providing almost half the total EU manufacturing capacity from 4 companies, while Germany hosts almost a third of EU manufacturing capacity, from at least 8 inverter producers.

About IPCEI

IPCEIs are Member State-led ambitious cross-border breakthrough innovation and infrastructure projects that can contribute significantly to the achievement of EU strategies, including the European Green Deal and the Digital strategy, while generating positive spill-over effects benefiting the EU economy and its citizens at large beyond the participating Member States.

Since IPCEIs are funded from national budgets, Member States are in the driving seat to identify the scope of the project, to select (preferably following open calls) participating companies, and to agree on project governance. The public support by Member States to the projects and companies participating under the IPCEI, which constitutes State aid under EU rules, has to be notified to the Commission for assessment and approval. The Commission stands ready to support plans by Member States and the industry, provide guidance and coordinate efforts, where necessary, and is committed to a swift assessment of the relevant projects as soon as notified. Once formally notified, the Commission assesses proposed projects under the IPCEI Communication.