First Offshore Wind Energy Tenders in Romania

The Ministry of Development, Public Works and Administration has launched the tender for the preparation of the appropriate assessment study and the environmental report for the ‘Maritime Spatial Planning’ (MSP). Maritime spatial planning aims to organise human activities in these areas to meet various environmental, economic, and social objectives and is regulated by Directive 2014/89/EU. This includes the installation of offshore wind turbines, without affecting other economic activities (shipping, oil rigs, fishing etc.) or the environment.

The launch of this tender is long overdue. The European Commission has launched infringement proceedings against Romania because the adoption of the MSP did not respect the deadline.

The Directive required EU coastal Member States to draw up maritime spatial plans by March 31, 2021, and to submit copies of the plans to the Commission and the other Member States concerned within three months of their publication. The European Commission sent Romania a letter of formal notice in December 2021 for failing to meet this deadline. It was only in February 2022 that the Executive adopted a decision approving the regulation on the organisation, functioning and membership of the Maritime Spatial Planning Committee.

Conclusions of independent estimates

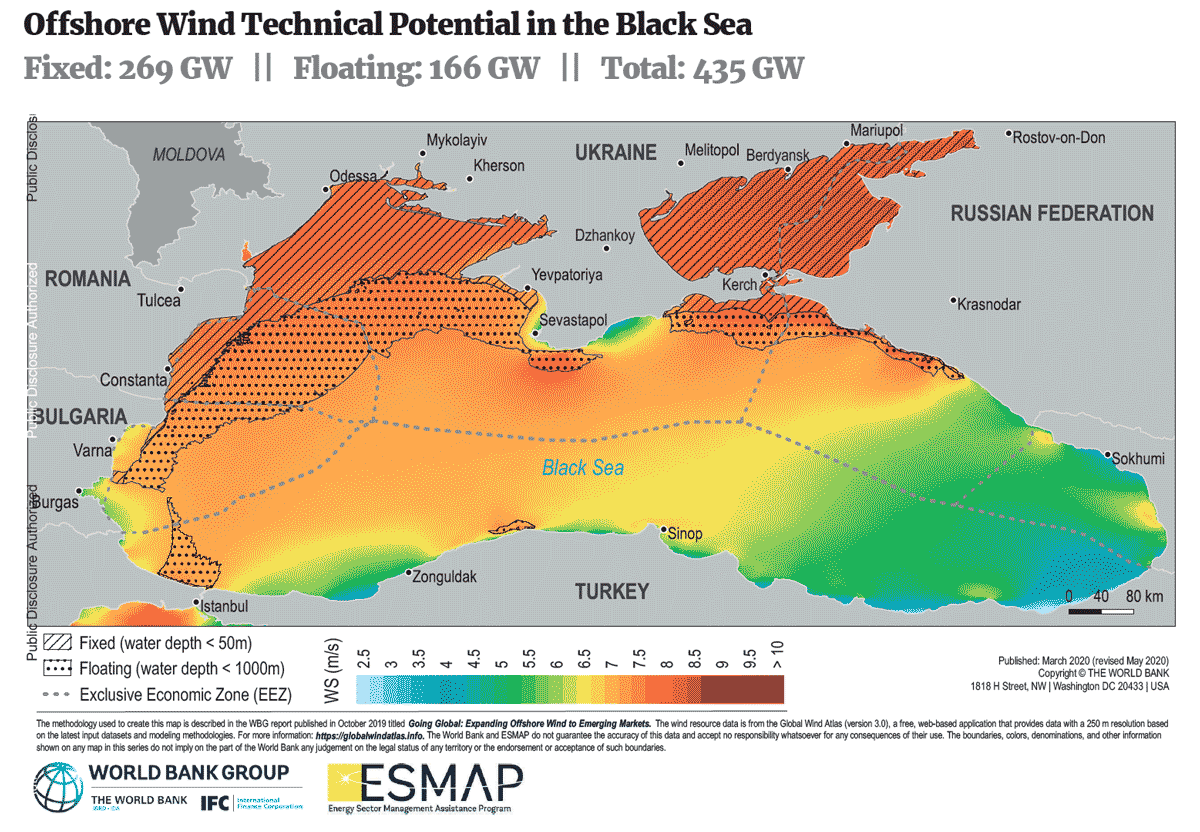

So far, no official study has been carried out by the Romanian state on the wind energy potential of the Romanian Black Sea continental shelf. We can only speak of estimates made by various NGOs. For example, the technical offshore wind potential of the Romanian Black Sea continental shelf was estimated at 76,000 MW, according to a study a few years ago by CEPS, a Brussels-based think-tank specialising in European affairs, which cited a World Bank report on the subject. Of the 76,000 MW, 22,000 MW could, in terms of technical potential, be installed in seabed-mounted wind turbines and 54,000 MW in floating installations, according to the research.

Another study published in 2020 by the Energy Policy Group (EPG) claims that Romania’s offshore wind energy potential has a potential natural capacity of 94 GW, of which 22 GW using fixed turbines. The resulting annual energy production could reach 239 TWh, of which 54.4 TWh would be produced by fixed turbines. This would be a huge amount of energy, considering that a year ago Romania produced 59 TWh from all sources, of which wind energy accounted for 6.5 TWh.

“We are talking about an exploitable wind potential in the Black Sea of 96 GW, of which 22 GW would be in shallow waters, up to 50 m, where fixed wind turbines can be installed. The seabed, even in the shallow Black Sea, differs from north to south. For example, in the area of Constanta South, Tuzla towards Eforie, fixing is increasingly difficult, as well as making foundations in the seabed of the Black Sea. That’s why the wind is also better in the northern area, in the Portita area, of the OMV Petrom offshore rigs. We are talking about wind that can reach 70-80% annual frequency, which means that we are talking about a huge potential in terms of continuous and almost baseload operation of offshore wind energy,” said Energy Minister Virgil Popescu.

Adoption of the legal framework

Government should finalise the draft Offshore Law by the second quarter of 2023 so that the legislative framework is in place to allow turbines to be installed at sea. The deadline is a milestone in the National Recovery and Resilience Plan (NRRP), and Romania is being advised by the World Bank to meet it. There are currently two scenarios proposed by the World Bank, including a hybrid option.

The Energy Minister recently announced that he hoped the first tenders for offshore wind turbines to start by the end of 2023.

Strategic objectives of the European Commission

The European Commission’s Offshore Strategy aims to have an installed capacity of at least 60 GW of offshore wind energy by 2030 and 300 GW by 2050. The strategy was adopted in November 2020 and at that time the installed capacity of offshore wind power plants was around 12 GW.

To reach the 300 GW target, the Offshore Strategy estimated that investments of almost €800 billion would be needed.

40% of energy could come from the Black Sea

Offshore wind could become the country’s largest source of electricity generation, accounting for more than 40% of the total, according to an Energy Policy Group (EPG) analysis published earlier this year. The earliest possible start-up of wind energy production in the Black Sea could change Romania’s status as a net importer of electricity and provide additional clean energy needed to decarbonise industry, transport and the heating and cooling sector.

Offshore wind energy plays a key role in Europe’s journey towards reducing dependence on fossil fuel imports and decarbonisation by 2050, at a time when the EU’s energy security interests and climate goals are fully aligned, the analysis shows. The same is true for Romania, with a modelling exercise indicating that 15 GW of offshore wind capacity needs to be developed in Romania’s exclusive economic zone in the Black Sea (SEE) by 2050 to achieve climate neutrality. It would become the country’s largest source of electricity generation, accounting for more than 40% of the total in some scenarios. Offshore wind farms take five to ten years to develop, compared to the EU average of seven years. This means there is a good chance that Romania will connect its first offshore wind capacity to the grid before 2030. This report is based on the results of the first EPG study that assessed the technical potential of offshore wind energy in the Black Sea, proposing solutions to overcome grid challenges. With the support of EU instruments, joint regional planning and joint development between Romania and Bulgaria, offshore wind energy in the Black Sea can kick-start and achieve the economies of scale needed to make offshore wind energy a major decarbonisation driver in Romania and South-East Europe.

A Romanian-Bulgarian energy island

The report shows that to address the grid-related challenges faced by both Romania and Bulgaria in deploying their offshore wind potential, a Romanian-Bulgarian Energy Island (RO-BG) would be an effective and scalable solution to unlock large-scale offshore wind deployment, as well as bring valuable interconnection capacity with other Black Sea countries (such as Turkey, Georgia, as well as Azerbaijan further east), drastically improving energy security and contributing to regional price stability. This would also strengthen the offshore wind potential of the entire Black Sea basin. Indeed, the recently announced HVDC submarine cable to be built by Romania, Azerbaijan, Georgia, and Hungary will be a step forward in this process.

“In a realistic scenario for 2030, the levelized cost of electricity (LCOE) for fixed offshore wind in the Romanian Black Sea region will be €71/MWh, while for further development of floating offshore wind, the LCOE would be €94/MWh. In the case of a joint project between Romania and Bulgaria, the inclusion in the LCOE of the cost of an HVDC connection to the Constanta South substation, as indicated in the baseline scenario for fixed offshore wind, would bring the total cost to €79/MWh for an installed capacity of 3 GW. The addition of an artificial RO-BG energy island would bring the LCOE to 85 EUR/MWh, assuming that the capital investment for the energy island is shared equally between the two countries. The total CAPEX costs allocated to Romania in an RO-BG energy island project, including 3GW offshore wind farms, would be €8.4 billion (€810 million representing Romania’s share of the RO-BG energy island), while the resulting annual energy production is estimated at 9.8 TWh”, according to EPG calculations.

The authors of the analysis show that, in addition to its importance for energy supply and energy resilience, offshore wind deployment brings socio-economic benefits through job creation in the manufacturing, construction and operation and maintenance (O&M) of projects, with a multiplier effect on other sectors – including a significant concentration in the Port of Constanța. Per GW of installed capacity, offshore wind in Europe generates €2.1 billion. Therefore, 3GW of offshore wind installed in Romania would generate €6.3 billion, 2.6% of GDP (2021). This could also contribute to a total of 22,000 new FTE employees (20,000 in the capital phase and 1,800 for O&M), with 15,500 new direct local jobs, assuming Romania attracts investors in wind turbine component manufacturing and plant construction, installation and balancing respectively.

But there are a number of impediments. Establishing appropriate legislative and fiscal frameworks for offshore wind development is of critical importance, especially now, at the beginning of the massive deployment of offshore wind capacity worldwide, say the study authors. They note that an EU-led discussion on the future of offshore development in the Black Sea would facilitate the process for the two member states (Romania and Bulgaria) as well as for non-EU partners. It would also promote discussion and investment in energy islands and potential long-distance interconnections.

The report proposes a combination of a centralised, state-led model and an open, investor-led site development process, with the aim of capitalising on the advantages mentioned, while reducing the associated disadvantages and risks for investors. As a prerequisite and as a rule for successful planning and development, a consistent and continuous dialogue between state authorities and private investors is essential from the earliest stages.

First wind turbine emerges in the Black Sea

The first floating wind turbine in the Black Sea will be tested in Bulgaria’s territorial waters as part of an EU-funded project. The BLOW (Black Sea fLoating Offshore Wind) project was launched this month with a budget of €21 million, of which over €15 million is the EU contribution.

The project, which brings together 16 participants, including Romanian firms Grup Servicii Petroliere (GSP Offshore) and Beia Consult International, aims to unlock the potential of floating offshore wind in the Black Sea by installing a 5 MW demonstration system off the Bulgarian coast. The floating wind turbine is developed by French engineering company Eolink. According to the company, the pyramid-shaped design reduces stresses on the turbine, providing a competitive weight-to-energy ratio that makes the overall structure more than 30% lighter.

The floating structure will be produced by GSP Offshore at the Constanta shipyard. The company, controlled by Gabriel Comanescu, will also transport the turbine to the anchorage area and will receive about €12.56 million for the services provided, according to data on the project website. The floating turbine will supply electricity to an offshore platform operated by the Bulgarian oil and gas company Petroceltic. The turbine is expected to be operational by 2025.

Beia Consult International, one of Romania’s leading suppliers of telecommunications equipment, and the Maritime University of Constanta (UMC) are also among the project participants.

“The aim of the project is to pursue the concept of uniform exploitation of the marine area by operating wind turbines in the offshore area more than 25 kilometres from the shore. In this area the water depth exceeds 40 m and therefore the solution for mounting the wind turbines cannot be the one fixed in the sea floor but using a moored floating semi-submersible platform. The solution is adapted to the western Black Sea area (Varna-Bulgaria), where the wind potential is medium, and therefore the construction is special,” says UMC.

UMC will install environmental monitoring equipment on the turbine. According to the Centre for European Policy Studies (CEPS), one of BLOW’s partners, the project aims to accelerate the energy transition in the region and stimulate societal acceptance and cross-border policy development.

The BLOW project aims to achieve a Levelized Cost of Electricity (LCOE) of €87/MWh by 2028 and €50/MWh by 2030.

UK, clear leader in installed offshore power

A review of the largest operational offshore wind farms shows that the UK has stormed the North Sea. Of the top five largest offshore farms installed in Europe, four are its own, as follows:

- Hornsea Project 2 was commissioned in August 2022, about 100 kilometres off the coast of England in the North Sea. Its installed capacity is 1,386 MW, making it the largest wind farm in the world. It has 165 turbines and supplies electricity to 1.4 million UK households.

- Hornsea Project 1 is also in the North Sea, next to Hornsea Project 1, also a UK farm. It has an installed capacity of 1,218 MW and 174 turbines.

- Moray East is also located in the North Sea, belongs to Great Britain, and is located off Scotland. It has an installed capacity of 960 MW and 100 turbines.

- Triton Knoll is also in the North Sea, belongs to Great Britain and is located off the coast of England. It has an installed capacity of 857 MW and 90 turbines.

- The 1&2 Borssele is also in the North Sea and belongs to the Netherlands. It has an installed capacity of 752 MW and 94 turbines.