Impact of EU’s EMD Reform on PPA’s

The new EU electricity market design (EMD) reform has been negotiated and adopted by the European Parliament, Member States, and Commission and is due for publication in the Official Journal of the EU – officially becoming EU law in the coming weeks. What does this mean for power purchase agreements (PPAs) and will the reform unlock new investments in renewable wind and solar energy?

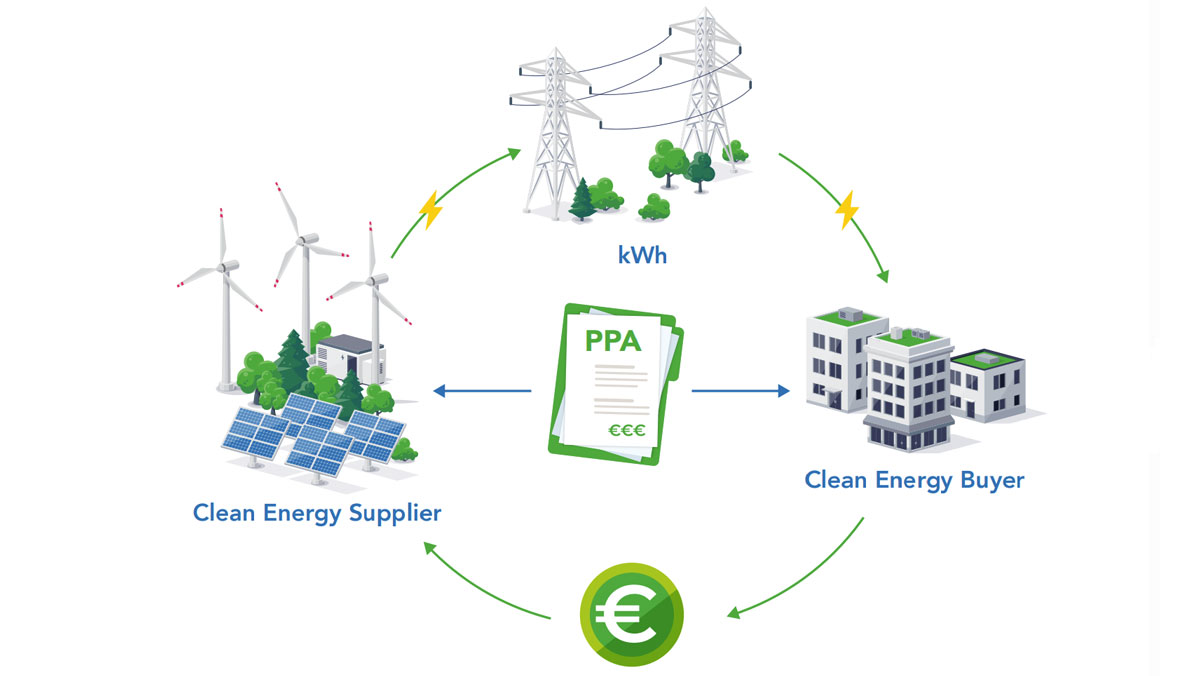

Corporate PPAs are long-term contracts between corporate energy buyers and renewable energy producers. They offer stability for both parties – energy producers receive guaranteed income from their wind or solar asset, and buyers get predictable energy costs and can demonstrate emissions mitigation via green energy certificates or guarantees of origin. This is increasingly important to channel private investment into new renewable energy projects, encouraging the development of new solar and wind farms, and contributing to the EU’s decarbonised energy targets.

The EMD reform aims at providing long-term investment signals in renewable energy while protecting consumers against volatile electricity markets – as was seen in the energy crisis prompted by the war in Ukraine. The new electricity market design rules in the EU rightfully recognise the benefits of PPAs in this regard. What happens next?

Remove barriers

Under the new rules, Member States have a legal obligation to remove unjustified barriers to PPAs with a view to providing energy price predictability. To unlock the full potential of PPAs it is necessary to:

- Speed up permitting: Slow and unpredictable permitting processes delay projects and increase costs. Faster, simpler permitting is essential for the PPA market.

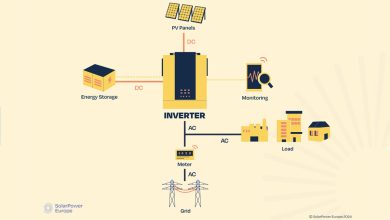

- Modernise grid infrastructure: Energy buyers face the challenge of slow grid connections and uncertain GO delivery if assets are curtailed due to lack of capacity. Upgrading and expanding the power grid is critical to enable wider use of renewable energy sources.

- Preserve regulatory certainty: PPAs are long-term agreements, therefore, clear and stable regulations are needed to create an attractive market for investment in renewable energy where corporates can confidently invest in a PPA.

- Educate new buyers: Many companies lack awareness of the benefits and processes to sign a corporate PPAs. Education and knowledge sharing are needed to unlock wider participation in the PPA market.

Open up the market

PPAs are long term agreements and suppliers are looking for energy buyers which can procure the electricity they produce over, typically, a 5-15-year period. Some energy buyers are not able to prove creditworthiness for such a long period.

The EMD reform encourages Member States to ensure PPA guarantee schemes (state or private) or other financial instruments are in place in response to this challenge. Guarantee schemes are in place in some EU countries, but with limited success. Exploring and developing more accessible derisking instruments can significantly improve the expansion of the PPA market.

Happy coexistence of all routes to market

While PPAs rely on private long-term partnerships, another tool exists to finance the construction of new renewable projects: Contracts for Difference (CfDs). CfDs will continue to play an important role in getting to the EU’s renewable energy targets. EMD obliges 2-sided CfDs, or equivalent schemes with the same impact. These schemes set a strike price, with the energy developer paying back to the state when market prices spike. Poor CfD design can crowd out the PPA market, however. PPAs and CfDs must coexist in order to channel private capital to new wind and solar projects. Open and flexible arrangements in auctions where the winning supplier can set the PPA price and choose the volumes which fall under a PPA, and the volumes under a CfD, will encourage the PPA market.

PPAs: long-term mechanisms for stability

The market design reform has also recognised the ineffectiveness of inframarginal revenue caps as a response to the energy crisis. State interventions in the market, combined with the uneven implementation of price caps across Member States led to significant investor uncertainty in renewables, with a negative impact on the signing of PPAs. Thankfully, the measure has not been included in EMD. This is great news for energy buyers looking to sign a PPA.

Will the EMD reform help energy buyers and unlock new renewable energy power plants via power purchase agreements?

Much of the impact of the reform will be determined by the EU Member States’ implementation.

Successful implementation of the EMD must also happen in parallel with full implementation of the third revision of the EU Renewable Energy Directive and the European Commission’s Action Plan for Grids.

“The RE-Source Platform strongly supports the outcome of the Electricity Market Design revision. It is an opportunity to unlock the full potential of PPAs and pave the way for a thriving renewable energy market in Europe. We look forward to working with national decision-makers and stakeholders as the reform is implemented,” says Annie Scanlan, Policy and Impact Director, at RE-Source Platform.

About RE-Source

RE-Source Platform represents a committed group of corporate renewable energy buyers and energy suppliers driving forward corporate renewable energy sourcing in Europe. Their mission is to make it easier for companies to use more renewable energy.