Renewable Hydrogen: Driver of Green Revolution in Europe?

With more and more countries pledging climate neutrality, the world needs to find solutions to decarbonise every part of our economy. Because of its multifaceted and versatile nature, renewable hydrogen can play a key role in addressing the challenges ahead.

Over the past 10 years, activities around green hydrogen have gathered pace in Europe. On this occasion, experts from Delta-EE specializing in energy transition conducted an unprecedented study to make a first inventory of this growing market. According to analyzes, green hydrogen should reach 50 times the production capacity created in recent years. However, this growth is way below the European Union’s targets, established at 6 GW for 2024.

A center dedicated to studying green hydrogen in Europe

It’s about Delta-EE, which has interviewed a sample of over 50 companies over the past 12 months to store information and visions on the green hydrogen market. “As hydrogen appears as a key component of decarbonization efforts around the world, it makes senses to centralize and formalize this expertise through a complete service. From now one, all players in the hydrogen market could benefit from strategic data and personalized assistance, to invest the best this energy for the future,” said Arthur Jouannic, director of the French office of Delta-EE.

A year ago, interest in green hydrogen exploded following the ambitious national and European strategies. As a result, many projects were announced around Europe, claiming that hundreds of megawatts or even gigawatts of green hydrogen production capacity would be installed in the next few years. Delta-EE decided to identify the green hydrogen projects that are currently operational and those that will probably start by 2025.

Germany provides half of the European renewable hydrogen production

According to the study, Europe can currently produce 56 MW, i.e., approximately 4,700 tons of green hydrogen per year. Half of this production is consumed by the transportation industry and approximately one third is used to decarbonize industrial applications, such as petrochemical refining. Germany is the leading state as far as hydrogen is concerned. The country provides almost half of the European production, while no other country produces individually 10 MW. However, the sector is in full swing and large projects are planned this year in Spain, the Netherlands and Denmark, where 10 MW of green hydrogen will be produced by 2020 and 100 MW by 2025.

To support this growth, large producers, such as Nel Hydrogen, ITM Power, Cummins and McPhy, they all build new plants able to produce hundreds of MW or even GW per year. Nevertheless, very little time remains to plan, build, and commission the necessary tens of projects of 10 MW and 100 MW.

Pioneering the use of green hydrogen

The continuous exponential demand for green hydrogen, as well as the states subject to pressure can make funding for environmentally friendly hydrogen projects to continue to boost growth in the energy sector. However, it would be strategic to focus on larger-scale projects (more than 10 MW) intended for mixed industrial applications, rather than smaller transmission applications, which are more frequent today, Delta-EE specialists believe.

As regards renewable hydrogen, the results are therefore mixed. Even if there is a rapid growth of this key technology for reaching the zero carbon targets, we are still quite far from the established national and European targets, extremely ambitious. Today, the green hydrogen market is like an embryo. Ongoing projects are almost entirely funded by the European Union or by national funds, and stakeholders target the sectors in which public support is the greatest. At this stage, the market depends entirely on the huge capital made available by Green Deal and on the various national strategies on hydrogen. Hydrogen is a solution for the future and there are good reasons for this. Through its multidimensional and versatile nature, hydrogen can play a key part in solving future challenges. On the one hand, it can serve as an energy carrier or as a raw material. On the other hand, it can be used to store seasonal renewable electricity. Hydrogen has the great potential of facilitating decarbonization of industrial sectors ‘difficult to decarbonize’ and energy-intensive, such as the steel industry. Moreover, it can be used as green fuel for heavy transport, for which the current electric battery technologies are not practicable.

As the EU is moving away from its reliance on fossil fuels, hydrogen will play a key role in the future energy systems and in achieving the EU’s carbon neutrality target by 2050. Due to a combination of renewable energy, smart storage, energy efficiency and flexible grids, the latest models estimate that clean and sustainable energy can be delivered at a large scale and at the necessary speed. Many experts predict that hydrogen will be at the heart of this transition.

What form of hydrogen is the most suitable for reaching our climate ambition?

Hydrogen is the most abundant element in our universe but represents only a small fraction of the global energy mix in the EU. Today, less than 2% of energy consumption in Europe comes from hydrogen, which is mainly used to manufacture chemicals such as plastics and fertilizers. Moreover, 96% is produced from natural gas, and the production process emits significant amounts of CO2. But how can hydrogen production be decarbonized?

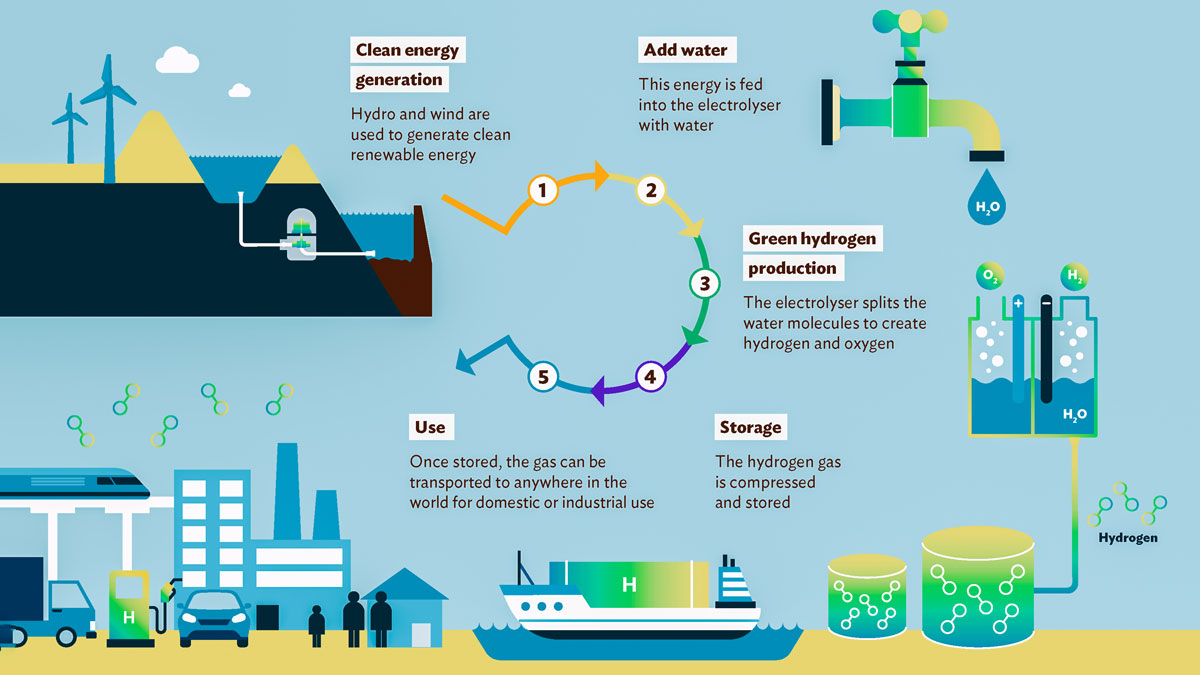

The most important is the primary energy source to produce hydrogen. This source and the process used determine the degree of cleanliness or pollution of the finished product. Fossil hydrogen from natural gas is often named gray hydrogen and is the most common type of hydrogen used today. Low-carbon hydrogen, often called blue hydrogen, is also made from natural gas, but CO2 emitted during its production is captured and stored underground, making it a cleaner, lower-emission option.

Low-carbon hydrogen can play a transitional role to replace gray hydrogen. The cleaner option, however, is renewable hydrogen, i.e., that… green hydrogen. It is obtained from renewable energy sources (wind and solar power, through an electrolyzer). Because the only by-product is water, production is almost zero-emission, which is why it is the form of production that attracts the most interest – from policy makers to scientists and investors.

Having defined the recommended type of hydrogen, the European Union is studying how to increase the production, transport, and profitable consumption of renewable hydrogen to use the flexibility and versatility offered by this energy source. Energy-intensive industrial sectors that are unable to decarbonize by direct electrification are looking for greener, carbon-neutral energy carriers. Renewable hydrogen therefore offers a realistic and promising prospect for environmentally friendly steel or fertilizer production by 2030. The transport sector, given the limitations and costs of batteries, the aviation, maritime and road transport sectors are all looking for solutions to use carbon-neutral fuels for long-distance travel.

With the EU’s commitment to increasing the use of renewable energy sources globally, hydrogen contributes to their long-term and large-scale storage and offers immediate flexibility to the energy system. The storage potential of hydrogen, especially in salt mines currently used for natural gas storage, is particularly beneficial for electricity grids, as it helps to balance the supply and demand of electricity when there is too much or insufficient renewable energy.

EU hydrogen strategy and long-term investment

The European Green Deal combines a double effort for reducing emissions of greenhouse gases and preparing the European industry for a climate-neutral economy. In this context, hydrogen is seen as a centerpiece in solving these two problems and in the evolution of our energy systems.

The European Commission launched two different initiatives in July 2021: a strategy for the integration of energy systems and a separate strategy for hydrogen.

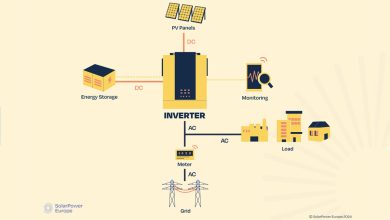

The first strategy describes how the energy system can be made more flexible. This system would allow the exchange of energy between consumers and producers and between different end-use sectors. It would stimulate the use of new technologies by integrating them more easily into the energy market, by promoting a climate-neutral energy system, focused on renewable electricity, circularity, and renewable and low-intensity fuels.

The second strategy looks more closely at the measures needed to make renewable, low-carbon hydrogen a central product of the energy system.

The EU is committed to increasing the share of renewable energy sources, a commitment that reflects a growing share of renewable energy in the energy mix. Moreover, the costs of these energy resources are expected to decrease in the coming years. In this context, the Hydrogen Strategy explores the potential of renewable hydrogen to help decarbonize the EU economy in a cost-effective way. Due to Europe’s industrial power in the production of electrolyzers, new jobs will also be created that can generate economic growth in the EU, which will be key to recovering from the COVID-19 crisis.

Immediate and long-term investments are a first fundamental step for renewable hydrogen to fully take off and provide the European industry with a good starting point on an increasingly competitive global market. In the future budget of the EU, the European Commission highlights the need to unlock investments in essential and clean technologies and value chains, including clean hydrogen. This was strengthened by the additional measures to support European recovery following the COVID-19 pandemic, which points out that recovery can go hand in hand with the decarbonization ambitions. To this end, the EC has developed a Power Up initiative, aimed to encourage EU countries to use their European incentive funds to invest more in renewable energy and renewable hydrogen production. In addition to measures to stimulate investments, Fit for 55 Package of the European Commission includes proposals for reducing greenhouse gas emissions by at least 55% by 2030. It also includes proposals to create a well-functioning European hydrogen market.

Projects, research, and innovation in the hydrogen field

In addition to defining the political and strategic guidelines for hydrogen, the EU also supports many projects and initiatives in this area. These include the European Clean Hydrogen Alliance, announced in March 2020 as part of the New Industrial Strategy for Europe and launched on July 8, 2020, together with the EU Hydrogen Strategy.

This initiative brings together industry, national and local governments, civil society, and other stakeholders. It aims to use hydrogen technologies in an ambitious way by 2030, bringing together actors in renewable and low-carbon hydrogen production, industry demand, mobility, and other sectors, as well as hydrogen transport and distribution. Over 1,000 stakeholders have already joined the alliance and can now present their projects and stimulate the adoption of hydrogen investment projects.

Projects of the Horizon program: Djewels, STORE & GO, Hybrit, H2

The EU is also promoting more hydrogen research and innovation projects under the Horizon 2020 program. These projects are managed through the program (FCH JU) and represent a common public-private partnership supported by the European Commission. These include the EU-funded Djewels project, which will build a 20 MW electrolyzer to guarantee customers low-cost green hydrogen, and the STORE & GO project, which supports new technologies to supply the renewable methane gas network, thus ensuring sustainable energy supply in Europe. Moreover, Hybrit project, in northern Sweden, is a good example of how hydrogen can help green the industries, as it uses renewable hydrogen rather than coal to produce fossil-free iron and steel. On a similar note, a 6 MW electrolyzer developed under the EU-funded H2 project supplies green hydrogen to a steel plant in Linz, Austria, and also provides power grid services due to its flexible electricity consumption.

According to data published by researchers from Delta-EE, the green hydrogen market in Europe will reach 2.7 GW in 2025, i.e., 50 times the production capacity created in recent years. However, this is “far from being sufficient to reach the European Union’s targets of 6 GW in 2024,” the experts report.

67 clean hydrogen projects are operational in Europe, with electrolyzers in 13 countries. Therefore, “56 MW can be produced, i.e., approximately 4,700 tons of green hydrogen per year”. The transportation industry is leader, consuming half of this production. Approximately one third is used “to decarbonize industrial applications, such as petrochemical refining”.

Romania does not have yet a strategy for obtaining and using renewable hydrogen

Are the hydrogen projects included in the National Recovery and Resilience Plan (NRRP) feasible? Can the gas network be adapted to hydrogen transport?

Hidroelectrica wants to produce green hydrogen together with Verbund-Austria and carry it on the Danube across Europe. Green hydrogen will be obtained by large-scale water electrolysis, using a green energy mi (offgrid wind power and ongrid hydro power) and the resulting hydrogen will be incorporated into a mineral oil and transported on the Danube to countries in the Danube Transnational Program (Austria, Bulgaria, Czech Republic, Germany, Hungary, Slovakia, Montenegro, Serbia).

“In an integrated system of the future, hydrogen will play a very important role along with electrification from renewable sources and a more efficient use of resources, as well as the implementation of digitization. The financing part for the elaboration of a strategy is included in NRRP and in the first part of 2022 we will present a strategy that will offer us the main directions of action and which we will submit to public debate. The market is already moving in this direction. Funds will be allocated through various programs supporting the development of hydrogen production from renewable sources and from low-carbon sources (blue hydrogen). We will consult and inspire from the strategies of other European countries,” says Dan Dragos Dragan, Secretary of State in the Ministry of Energy.

Low-carbon hydrogen, a chance for Romania

“The most correct, at this point, is to discuss about a low-carbon hydrogen. It is a better card to play for Romania, as it includes nuclear hydrogen. Although dangerous, nuclear power has no CO2 emissions. The start is given by Germany and the northern countries towards «green», but hydrogen has no color and we, Romanians, must anchor ourselves in our reality. We cannot afford to create a strategy only based on «good behavior» points given by international organizations. I don’t urge to isolation, but the other countries in the European space do not produce hydrogen for the sake of others but pursue their legitimate national interests. Romania has a certain energy mix, which is based on an evolution of the energy sector in the last 60 years, so we cannot take the example of other countries that have an entirely different energy mix. The French mix is dominated by nuclear power, northern countries want to introduce more wind and solar power. The Romanian mix is well balanced: in addition to the part of solid and gaseous fossil fuels, which will be phased out, we have the two nuclear reactors, gaseous fuels (which are not as polluting as hydrocarbons or coal) and which must be capitalized on within reasonable limits until the moment we have a technical maturity of other technologies,” believes Ioan Iordache, Executive Director of the Romanian Association for Hydrogen Energy.

The only study on hydrogen injection into the gas transmission and distribution networks in Romania, conducted by the Intelligent Energy Association (AEI) and publicly presented on May 18, 2021, showed that a Romania with mainly green energy can be achieved using hydrogen as an Energy Vector. The use of hydrogen brings reductions in the bills to end-consumers and makes this goal possible. Experts say that there is a wrong approach, visible today in Romania, to place hydrogen as the exclusive fuel of the future, as it that can bring costs by up to five times higher at the level of the end-consumer.

The study conducted by AEI has brought to light elements of technical, organizational structure of hydrogen transport and distribution and it was found that it cannot be an element that can solve all the future energy problems, but together with other elements it can ensure energy transition. But we cannot achieve anything without a strategy to guide us how and where we are heading. The strategy is important, but it is more important to have a legislative framework that helps us solve the fiscal problems that will accompany this new form of energy. Moreover, this new form of energy is more expensive than others, currently amortized, which involves financial incentives and optimization. “Regarding the strategy made with the help of foreign consultants, I believe that no one can come in your home and tell you what you have to do. The important problem is how we manage to enter the existing systems to produce hydrogen. Beyond what others want, a form of energy must be accepted by the consumer. Consumers were not consulted or asked how they feel about this substance that is more dangerous than others they currently use,” claims Dumitru Chisalita, President of the Intelligent Energy Association.

Romania, the fourth European state in terms of hydrogen production potential

According to energy specialists, Romania has several strengths in terms of green hydrogen production. The huge potential in renewable energy, but also the domestic gas production, the second largest at European level, together with the around 50,000 kilometers of pipelines are the aces up Romania’ sleeve in the field of hydrogen. Romania could attract long-term investments of EUR 775 million in hydrogen electrolysis units with a capacity of 1,500 MW, being the fourth European state in terms of potential in this field. The data are estimates of Hydrogen Europe, a Brussels-based association that represents more than 260 companies in Europe.