EUR 7,6mln for The Batteries to Produce Safe Superbatteries

The Batteries, a company supported by EIT InnoEnergy, will mass-produce cheap batteries that will charge a smartphone in less than 15 minutes and last twice as long. Funds from investors will support the commercialisation of the solution.

Breakthrough technology for low-cost production of thin-film batteries with a solid electrolyte has convinced leading investors. The Batteries announces the closing of a Series A with €7,6 million. The funding comes from the existing investor – Aper Ventures fund, January Ciszewski and JR Holding, UAB Electronics System as well as EIT InnoEnergy. The funds will be used to build a production line in the Rzeszów factory in Poland, enabling the sale of safe and ecological batteries on a global scale. The company also wants to increase the team of engineers responsible for developing the breakthrough solid-state technology further. The total amount of support obtained so far is nearly 50 million PLN.

You will forget about charging your smartphone!

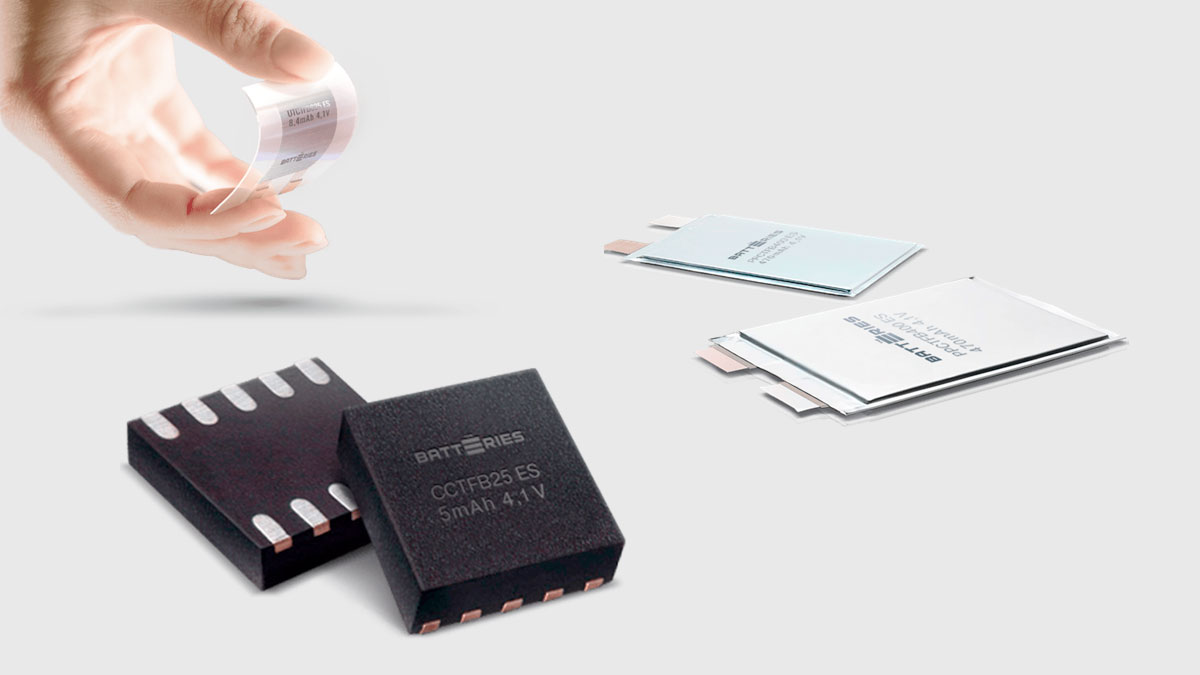

The Batteries is the first company to develop globally unique technology for low-cost production of safe and environmentally friendly solid-state batteries for mass applications in IoT, including industrial sensors, smartwatches, portable medical devices, drones, or smartphones. TFBs (Thin Film Solid State Batteries) will replace traditional lithium-ion batteries, and thanks to their use, the charging time of devices will be significantly reduced, their work efficiency and life span will be extended. Charging a smartphone will take up to 15 minutes, and the battery will work twice as long. It will make electronic devices of mass usage more economical. The originators of the technology also point out the safety of the new batteries, which will no longer explode.

“The Batteries creates a product with an extensive application, and its market potential is vast. The Founders have proven that their patented manufacturing technology can produce safe batteries that are – depending on the industry – up to 10-200 times cheaper than other solid-state battery companies. We believe that each electronics user will have such a battery in their device in the next few years – now, they are still too expensive to use every day,” comments Jacek Błoński, Managing Partner at Aper Ventures.

“As a fund, we support solutions beyond software with global potential and proven competitive advantages. The commercialisation of The Batteries product will allow us to achieve very high rates of return, but above all, it will significantly impact the everyday use of objects,” emphasises Jacek Błoński

The team

Behind the unique technology of The Batteries is a team of founders who have previously worked on the successes of international technology giants such as Apple or Samsung. The partnerships further strengthen the leading position in the global ‘solid-state’ battery market with companies such as Arrow Electronics, Cezamat and Plasma Fusion – acquired by the NASDAQ listed company Meta. At the same time, the technology was given the stamp of approval by Cambridge University experts in the fall of 2021 as revolutionising the consumer electronics battery market.

Investors are betting in the battery race

Batteries have become the most electrifying investment opportunity for VC and Private Equity investors. According to PitchBook and TechCrunch, investments in the industry have totalled nearly $42 billion over the past decade. Three-quarters of that have occurred in the last two years.

“The demand for battery systems – for transport, energy, industrial applications, and consumer products – is growing at an accelerating rate. The European Commission has established the European Battery Alliance to meet these challenges, entrusting EIT InnoEnergy with project management. Its goal is to build a strong and competitive battery industry on the Old Continent. Thanks to the alliance, billions of euros worth of financing and contracts have already been secured by InnoEnergy’s portfolio companies, such as Sweden’s Northvolt or France’s Verkor. The agreement signed last year with the Serbian company ElevenEs assumes strategic cooperation to build Europe’s first gigafactory for lithium-ion batteries in LFP technology. Based on our experience in investing in the battery area, we are convinced that The Batteries company, with its globally unique technology, also has great potential to achieve market success,” says Grzegorz Kandefer, Member of the Board of EIT InnoEnergy Central Europe. Full-scale implementation of this technology will significantly improve the profitability of the production of advanced thin-film batteries for such mass-market applications as smartphones, smartwatches, drones, and similar devices.

Battery market

The bursting lithium-ion battery market is defined by the testing of new materials. Each has its advantages and disadvantages in mass production, depending on the use. The Batteries wants to conquer the consumer electronics, medical devices and IoT (beacons) sector, which is projected to be worth €23.3 billion in 2025. However, there is still a lack of competitors to The Batteries because solid-state batteries face the usual obstacles. They are expensive and difficult to mass-produce, so they have emerged mainly in labs.

“The difficulty with heavy, relatively low capacity and sometimes exploding batteries is a significant barrier to developing many modern sectors of today’s economy. Our latest investment, The Batteries, addresses these challenges. The product, which is already practically ready to be implemented in applications where small but reliable, capacious, and durable batteries are required, is highly demanded on the market. Production launch and commercialisation of the developed solutions will allow us to be ahead of the competition and take our place in this enormous potential market. We constantly invest in ventures with a proven product and a motivated team – we are convinced that this combination, also in the case of The Batteries, will guarantee success to the company and, consequently, to the investors,” said January Ciszewski, main shareholder and President of JR HOLDING ASI S.A.