ENTSOG’s Winter Supply Outlook 2021/22 and Winter Supply Review 2020/21

In this report, ENTSOG has assessed the capability of the European natural gas system to cope with both normal and cold winter conditions, and high demand situations such as a peak day or a two-week cold spell. Likewise, it is complemented by the assessment of high demand situations such as those caused by main supply route disruptions, as required by the Security of Supply EU Regulation (EU) 2017/1938.

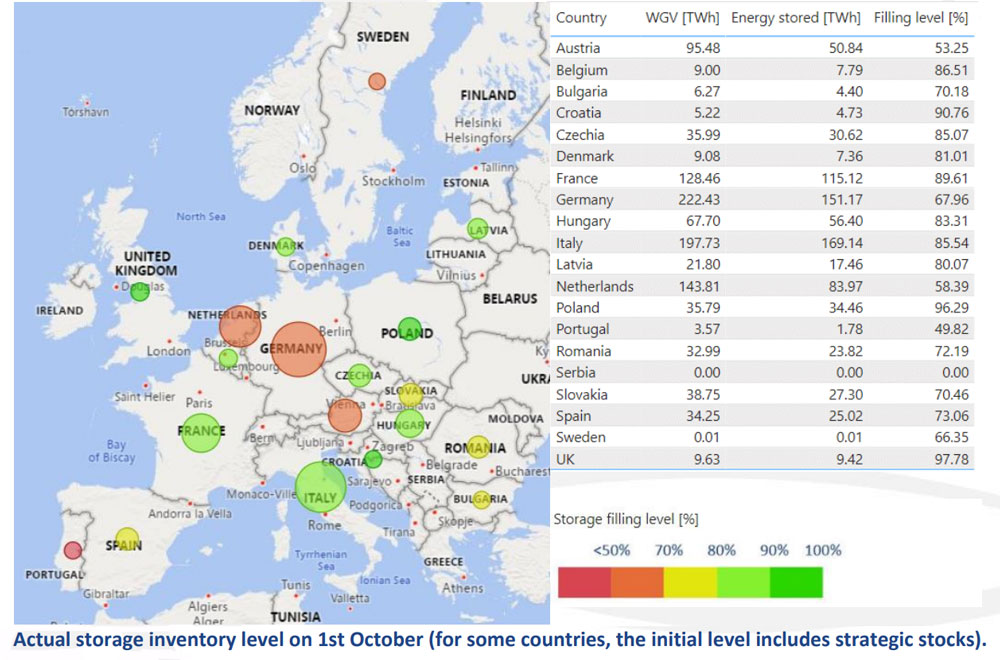

Low storage levels have been observed in Europe this year while observing high gas prices in the summer season. Consequently, ENTSOG’s Winter Supply Outlook gives special attention to the sensitivity of the gas system with respect to possible low storage levels at the end of winter. The storage levels are the results of the decisions made by the market participants.

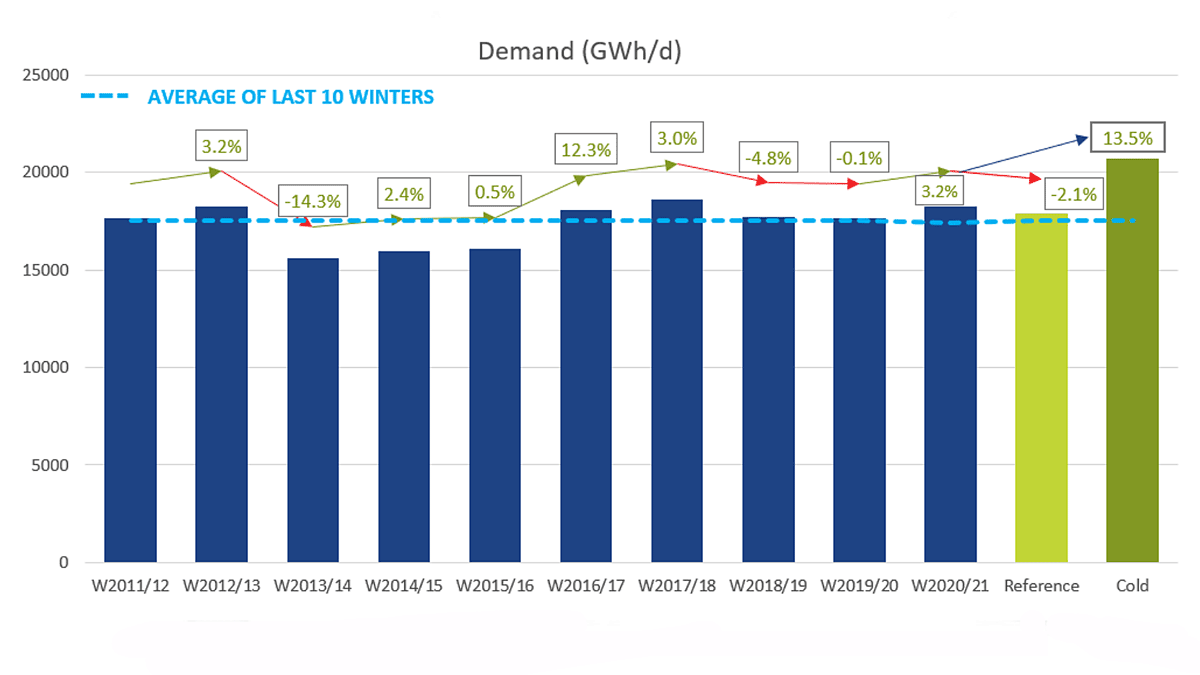

The Winter Supply Outlook report finds that the European gas infrastructure offers sufficient flexibility to the market across the winter season in Europe, even in a situation of high demand during an extremely cold winter. However, in case of a cold winter, the analysis suggests that the exceptionally low storage level combined with the decreasing indigenous production would require an increase of imports by about 5% to 10% higher than the maximum volumes observed in recent years.

The report also indicates that market decisions regarding utilisation of the storages can influence the withdrawal capacities of the storages at the end of a winter. Storage levels that are too low could impact the flexibility of the gas system, in case of supply disruption during high demand situations at the end of the winter season.

Jan Ingwersen, ENTSOG General Director, commented, “The analysis undertaken in the report shows the important role of the gas market players and sufficient gas imports in high demand situations and in a situation with low storage levels, as can be seen exceptionally this year. Importantly, the report confirms the robustness and flexibility of the European gas infrastructure.”

To complement the Supply Outlook report, ENTSOG also carried out a review of the previous winter to increase knowledge of seasonal dynamics of supply and demand.

Main findings of the Winter Supply Outlook

- The European indigenous production continues to decrease year-on-year

- On 1October 2021, the EU storage level (75%) is one of the lowest in any ENTSOG Winter Supply Outlook (831 TWh), with different situations among countries, for two main reasons: Record high use of storage flexibility during winter 2020/2021, resulting in a low level of storage (336 TWh) at the beginning of the injection season, and Low injection during Summer while observing unusual high gas prices

- The European gas infrastructure offers sufficient flexibility to ensure security of gas supply in Europe, provided gas is imported by the market on similar volumes as in recent years

- It can be noted that the EU gas infrastructure has been fully operational and functioning during the Summer season and this status is expected to be maintained for the Winter season 2021/22

- However, in case of a cold Winter, the gas market would need to increase gas imports from pipelines and/or LNG from 5% to 10% higher than the maximum volumes observed in the recent years

- It is important to emphasize that an early and significant withdrawal from storages will result in low storage levels at the end of the Winter season. This will have negative impact on the flexibility of the gas system – and can increase the exposure to demand curtailment in the later part of the Winter season

- South-Eastern Europe has significantly reduced its exposure to demand curtailment following the commissioning of new infrastructure

- However, countries within the risk groups of Ukraine and Baltic States/Finland can be exposed to demand curtailment in case of extreme temperatures combined with import route disruptions from Ukraine or Russia

- The European gas system is also capable of supplying Energy Community Contracting Parties and other EU neighbouring countries with significant volumes of gas

- ENTSOG will monitor the evolution of the storage levels and import volumes throughout the Winter and report on the situation on regular basis.

Winter Supply Review 2020/21: Russian gas supplies to Europe slightly increased

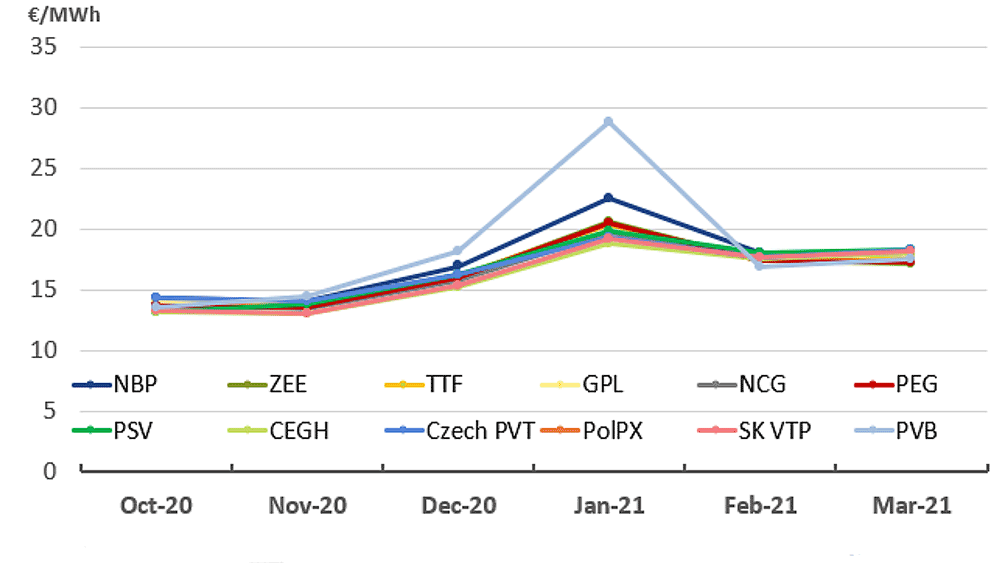

Compared with winter 2019/2020 Russian gas supplies to Europe had a slight increase of more than 1%. Russian deliveries in the fourth quarter were significantly higher than the rest of 2020 as market conditions normalized following the European gas price crash in the summer. A combination of factors — including a second consecutive mild winter at the start of 2020, high gas storage stocks, and low prices and weak demand in the first half — affected total Russian exports in 2020. In October 2020 the main reason for the increase of Russian gas supplies to Europe was the end of the heavy use of virtual reverse flow at the Velke Kapusany interconnection point between Ukraine and Slovakia, which had capped the volume of Russian gas entering Europe through the summer.

Moreover, annual Norwegian (plus 15% in absolute terms) and Algerian (plus 79% in absolute terms) pipeline gas supplies to Europe slightly increased their share in the supply mix (plus 3% both) during the winter season compared with previous season. Skyrocketing Asian spot LNG prices made global LNG market conditions less favourable for export to Europe. Following the low trend of LNG regasification activity observed during winter 2020/21, imports necessary to meet demand for the season would have to come from sources other than LNG.

Algerian flows to Italy have revised strongly upward in winter 2020/2021. The increased flows at Mazara del Vallo are probably connected with oil-linked contracts being competitive with hub TTF in winter 2020/2021 season.

Additionally, heavy maintenance on the Trans Tunisian Pipeline in September 2020 imposes an upper limit on Algerian flows during the month. However, in winter 2020/2021 a share of the Libyan flows at Gela remain unchanged comparing with the previous season.

Moreover, as Azerbaijan has started commercial natural-gas supplies from Shah Deniz 2 field in the Caspian Sea to the European Union (into Italy, Greece, and Bulgaria) via the Trans Adriatic Pipeline (TAP) as of 31 December 2020, a new supply route has been introduced. The share in the supply mix of the new AZ gas source just started in January 2021 is marginal.

LNG share in supplies faced a remarkable decrease of 8% compared with previous winter. The rest of the supply sources share remained at similar levels compared to the ones from 2019/2020 with slight increase in Algeria, Norway (+3%), Russia (+1%) and decrease in European indigenous production (-3%).