Upcoming Competition Over Rare Earths: Economic and Strategic Impact

Is Romania Still in the Game?

Rare earths are not quite that rare, but usually they are found in very small volumes, arranged over large areas, and require complicated post-processing, which makes most existing deposits too expensive to exploit. Found in the Earth’s crust, rare earths are critical elements used in cars, consumer electronics, computers, communications, clean energy and defense systems.

Wind energy, solar energy, electric vehicles: so many carbon-free energy projects! But let’s not forget, renewable energy requires the use of rare earths on a global scale. Even the digitization processes need rare earths, but their extraction is very polluting. The coming shift to electric vehicles and greater reliance on renewable energy will drive up competition over rare earths, which are crucial to manufacturing everything from mobile phones to batteries for electric cars and wind turbines.

Classification of rare metals

- Main rare metals (with own deposits): Be beryllium, Ge germanium, Li lithium, Nb niobium, PR earths (Rare Earths – TR), Sr strontium, Ta tantalum, Cs cesium, Zr zirconium.

- Secondary rare metals: V vanadium, Bi bismuth, Ga gallium, Hf hafnium, In indium, Cd cadmium, Re rhenium, Rb rubidium, Se selenium, Sc scandium, Te tellurium, Tl thallium.

- The group of rare earths (PR) includes a group of extremely important elements considered critical: scandium, yttrium, lanthanum, cerium, praseodymium, neodymium, promising, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, lutetium.

Fields of application

- Telecommunications (Ga, Ge, In)

- Ultra-light and high temperature resistant alloys (Re, Nb, Ta, V, Y, Ce, Li and others)

- Hybrid vehicles (Li, TR)

- Televisions and personal computer monitors (TR, In, Sc, Sr etc.)

- Military-industrial sector, metallurgy, aerospace industry, energy, electrical and electronic technology

Rubidium, lithium, strontium, beryllium, cesium, gallium, indium, thallium, rhenium, zirconium, tantalum, niobium, vanadium are some of the 36 chemical elements that found their wide application in the world industry in the second half of the twentieth century. Given the growth rate, in some areas that are developing rapidly, their demand has increased by 15-25% per year.

Precious properties of rare metals

Rare metals have exceptional chemical, optical or catalytic properties. They allow the use of LEDs (light emitting diodes) in lighting and turn the exhaust pipes into particle traps. But their electromagnetic properties are the most important for the energy sector. When an electric current passes through the magnetic field of two properly oriented magnets, it generates a force that causes them to rotate relative to each other. This is the principle of the electric motor. The properties of rare metals now make it possible to produce very strong magnets (the largest, 132 t, is at the Saclay Nuclear Research Center, France) or, at equal power, reduce the size of the magnets, for example, to make an electric brush. Without such magnets, Solar Impulse – a Swiss long-range experimental solar-powered aircraft project – would never have taken off.

Rare metal magnets are auxiliaries of electric motors that invade our daily lives and make the energy transition plausible. But these motors are powered by batteries, themselves dependent on rare metals. In order to charge these batteries, it is necessary to use wind turbines, so large magnets, or solar panels that use gallium, selenium and indium.

By 2035, the demand for tantalum is expected to increase fourfold and that for cobalt – twenty-fourfold. This is one of the limits of energy transition. Supporting the change of our energy model already requires doubling the rare metal production every fifteen years, warn experts, who also point out that by 2040 three times more rare earth will be exploited than at present, and sixteen times more lithium.

The production of phones and laptops uses 19% palladium and 23% cobalt

According to professional calculations, the production of a solar panel generates over 70 kilograms of CO2. If we rely on forecasts (an increase by 23% per year in solar panel production), solar plants will therefore generate 2.7 billion tons of carbon every year, or the equivalent of pollution generated during a year by 600,000 vehicles. According to Californian researchers, manufacturing an electric vehicle requires three to four times more energy than that of a conventional vehicle. The production of phones and laptops uses 19% of the world’s palladium, 23% of cobalt, and the operation of this equipment consumes a lot of energy.

ADEME – French Environment and Energy Management Agency has shown that sending an e-mail with attachment represents the energy consumption of an energy-saving light bulb for one hour. Globally, ICT (information and communications technology) consumes 10% of the world’s electricity and produces 50% more greenhouse gases than air transport. The verdict is terrible. “A world of 7.5 billion people will consume more metals in the next 30 years than the two thousand five hundred generations before us.”

Experts say that even more energy is consumed than in the mining process, because you literally have to break mountains to get a few kilograms of precious metal. Then, the ore is treated with chemicals that remain in the treatment water (200 m³ for 1 t of rare earths). To obtain a single kilogram of metal, it is necessary to purify 16 t for cerium, 50 t for gallium and 2200 t for lutetium, because there is only 0.8 mg of lutetium in one kilogram of ore.

Therefore, the extraction of rare metals translates into a high price for humans and the environment; for example, in countries such as Congo, which produces half of the world’s cobalt, for lithium batteries, or in Kazakhstan, which supplies 14% of chromium.

Pollution, which can be radioactive (when metals are combined with thorium or uranium), goes hand in hand with working conditions worthy of another era. Especially in China, where thousands of mines are exploited, with China being the largest consumer of industrial metals on the planet.

Germany, whose machine tool industry swallows up a lot of tungsten, preferred to pay more for the resource, so as to perpetuate alternative mines and save its industrial independence.

Rare metals have no replacements, they are not recycled

While each inhabitant of the planet uses, in various forms, only 17 grams of rare earths per year, consumption will explode in the following years. As rare metals are at the heart of renewable energy and digitization. Therefore, the energy transition has a dark side: new dependence, production that destroys the environment, contaminated populations, and CO2-emitting techniques.

Rare metals have no replacements, they are not recycled, and their distribution often places the owners in a state of monopoly. With the possibility to influence prices or close the tap.

Romania, one of the few countries in Europe that owns natural resources of titanium and zirconium

According to data held by the Romanian National Agency for Mineral Resources (NAMR), Romania’s untapped reserves of mineral resources amount to 20 billion tons (which includes both ferrous and non-ferrous ores and salt, sand, gravel, or ornamental rocks). Therefore, Romania could produce around 20 million tons of ore per year (15% of the European Union’s needs), provided that these resources are exploited in conditions of efficiency and using advanced technologies in the field. Early this year, the European Commission prepared a 10-action plan to secure supply of critical raw materials for EU economies, on which occasion it supplemented the list, with new substances necessary for strategic technologies and sectors.

The list of critical raw materials has 30 positions, and among the newly added is lithium, which is essential for batteries needed to switch to electric mobility, as well as for energy storage.

During the communist regime, Romania extracted and processed titanium and zirconium for military and nuclear purposes. Titanium was used in the aviation industry. The capsules in which radioactive uranium is stored, i.e., the nuclear fuel for the Cernavoda power plant, were made of zirconium. The ore was extracted from the coastal sand from Grindu Chituc and from the Merisani and Glogova quarries. Romania was the sixth country in the world, after the US, the USSR, China, Japan, and France, capable of producing zirconium for nuclear power plants.

After the ‘90s, due to authorities’ lack of interest, the heavy metals industry declined. Therefore, at the moment, Romania imports titanium and zirconium worth millions of euros. Geologists have discovered that the Danube Delta sands are rich in titanium and zirconium ores. The ores have been carried, over time, by the coastal currents and in time have formed sand banks.

The most valuable rare metals in the region are arsenic, gallium, germanium, molybdenum, titanium, vanadium, and tungsten, by the exploitation of which considerable profits could be obtained.

Arsenic is used in the production of alloys, increasing their strength, as well as in electronics, to produce semiconductors, but also in the fireworks industry, in the production of pigments etc.

Gallium is used almost entirely in the electronics industry and also in the production of medicines.

Germanium is a metal that is found in fairly small quantities in nature and has good conductivity, being used in the production of semiconductors.

Molybdenum is generally used in alloys, to increase the strength of steel, and in the chemical industry. It is also a fertilizer for certain plants and finds applications in the petrochemical industry as a catalyst for sulfur removal, in the production of halogen lamps and in the aeronautical industry.

Titanium can be used in alloys, medicine and the defense industry. It also plays a role in industrial processes (chemistry, petrochemistry, desalination), in the production of jewelry and mobile phones.

Vanadium, along with tungsten, chromium, molybdenum and/or cobalt, is used to make high-speed tool steel or as a catalyst to produce sulfuric acid.

Wolfram – also known as tungsten, is used in the production of light bulbs, electrodes, and X-ray tubes.

Rare metals in Rosia Montana

Specialists such as Eng. Doru Apostol, Eng. Aurel Santimbrean, University Lecturer Calin Gabriel Tamas, as well as several NGOs have proven that Rosia Montana holds a real treasure. Following the research carried out by the Romanian Research Institutes (ICECHIM Bucharest, IC Baia Mare) in the Rosia Montana deposit, a series of metals were identified as: gold – 1.5 gr/t; silver – 11.7 gr/t; arsenic – 5000 gr/t; titanium – 1000 gr/t; molybdenum – gr/t; vanadium – 2500 gr/t; nickel – 30 gr/t; chromium – 50 gr/t; – 30 gr/t, gallium – 300 gr/t.

Based on estimates and calculations of working groups, it was proved that the value of the elements extracted from a ton of ore reaches USD 28,973.91. Of this, the total value of gold and silver means only USD 95.10.

The specialists of the Research Institute for Rare Metals claim that Romania could become an important provider of resources at European level.

The European Union imports more than 200 million tons of metal ores annually, the financial effort exceeding EUR 12 billion. The European list of critical raw materials continues to evolve in accordance with technological priorities: it has gone from 14 materials in 2011 to 30 critical materials in 2021, materials whose supply is linked to very concentrated global markets.

Europe, strategies for the ‘substitution’ of rare metals

An alternative for Europe is to develop a ‘substitution’ strategy, namely, to develop independent substitution technologies for these rare metals. The technological challenge is enormous, but ‘selectively’ possible in some areas. In the absence of ‘raw materials’, ‘gray matter’ and the concentration of enormous research resources on selective topics will be needed. The development of the asynchronous electric motor, without rare metals, is an example. Research on energy storage must favor batteries whose materials and components are available within European borders.

Recycling of materials also opens up interesting perspectives for which new resources need to be mobilized, but let’s not forget that the price of recycling is often higher than the purchase price of certain raw materials.

However, the operationalization of the strategic plan through priorities and clear decisions remains the most difficult step. National interests must be left behind and the creation of cooperation agreements between the European institutions, national authorities and the private sector must be pursued. Europe’s future will depend on its ability to establish a true alliance for raw materials.

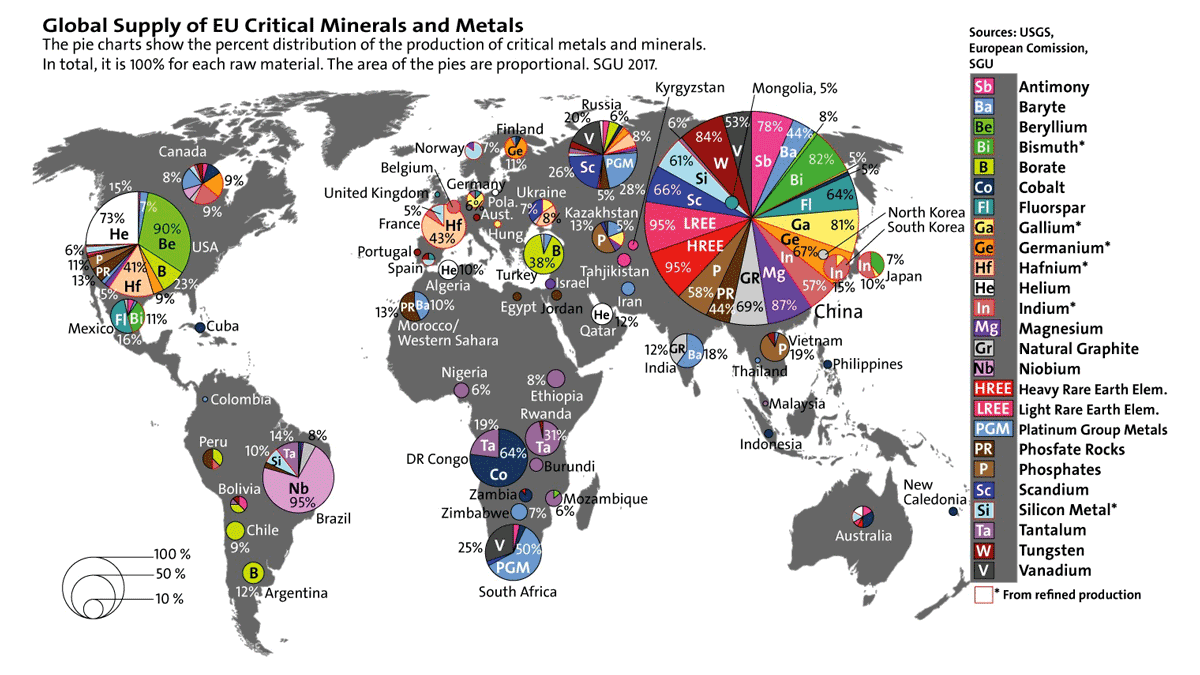

China, global superpower

At present, China accounts for about 70% of the exploitation of rare metals globally and between 85% and 90% of their processing. For the EU, China delivers 98% of its supply needs. This is a matter of concern within the European Union, which relies too much on a single country to supply materials such as neodymium, praseodymium, dysprosium, and terbium.

China, for reasons obviously related to uncompetitive production costs in the rest of the world, has a monopoly on production and supply, which has led to the closure of many rare earth quarries in Western countries. In 2017, China produced 105,000 tons of rare metals, the equivalent of 81% of global production. The other two main producing countries are Australia and Russia (second in the world in terms of rare earth reserves), with 20,000 and 3,000 tons, respectively.

With its vast natural reserves, China will continue to dominate world supply and demand for rare earths. Experts estimate that the monopoly allows Beijing to use rare metals as a geopolitical lever to strengthen its negotiating position at a diplomatic table, and also increase its own military capabilities. The crisis of rare metals has become a central part of China’s economic policy for the rise to the superpower status.

United States starting to get worried

Once a leader in the production and trading of rare earths, the United States relinquished the reins to China in the 1990s. China declared rare earths “protected and strategic materials” and proceeded to control production and processing, introduced export quotas, and sought to dominate the supply chain for crucial applications. Since then, China created a higher market value for the elements, developed technical knowhow, and attracted high-tech companies using rare earths to manufacture final products inside the country. China continued to consolidate and strengthen its dominance over the rare earths industry. This resulted in the United States giving up their position as the leading researcher in the field. The erosion of technical expertise was viewed as even more serious than the issue of resumption of production in the United States, because China dominates all the rest of the steps in the rare earths supply chain.

Just to mention, in 2020, China produced 140,000 tons of rare earths elements, whereas the United States produced just 38,000 tons.

In this context, on February 24, 2021, President Joe Biden signed an executive order intended to boost manufacturing jobs by strengthening U.S. supply chains for advanced batteries, pharmaceuticals, critical minerals, and semiconductors.

The Department of Defense (DOD) announced an investment in the expansion of the largest rare earth element mining and processing company outside of China to provide the raw materials necessary to help combat the climate crisis.

The Administration released findings from the comprehensive 100-day supply chain assessments for four critical products: semiconductor manufacturing and advanced packaging; large capacity batteries, like those for electric vehicles; critical minerals and materials; and pharmaceuticals and active pharmaceutical ingredients (APIs).

It was also decided the establishment of a working group composed of agencies such as the Department of Agriculture (USDA) and the Environmental Protection Agency (EPA) to identify sites where critical minerals could be produced and processed in the United States while adhering to the highest environmental, labor, and sustainability standards. The scope of the working group is to expand sustainable, responsible critical minerals production and processing in the United States.

Is Washington worried about China’s weaponization of rare earths industry one day?

So, the United States are starting to take this risk more seriously than ever, what could be a good thing not only for them but for the world too.

No doubt, critical minerals will fuel high-tech manufacturing and renewable energy transition. The issue is how the world will cope with this upcoming competition over rare earths.