Renewable Power Now Cheaper than Coal

Renewable power is now cheaper than coal, according to the International Renewable Energy Agency (IRENA).

IRENA found 56% of renewable capacity added last year achieved lower electricity costs than new coal power plants. Furthermore, by the end of 2021 it would be cheaper to build new photovoltaic facilities than to keep running active coal power plants of as much as 1.2 TW, more than half of the world total, according to a recent report published by IRENA entitled Renewable Power Generation Costs in 2019.

New solar and wind projects are undercutting the cheapest and least sustainable of existing coal-fired plants, the International Renewable Energy Agency, IRENA, said in a study. Auction results show the trends are accelerating, reinforcing the case to phase out coal entirely, it added and attributed the shift to improving technologies, economies of scale, competitive supply chains and growing developer experience. The trends are accelerating, reinforcing the case to phase out coal entirely, IRENA concludes.

The report highlights that new renewable power generation projects now increasingly undercut existing coal-fired plants. On average, new solar photovoltaic (PV) and onshore wind power cost less than keeping many existing coal plants in operation, and auction results show this trend accelerating – reinforcing the case to phase-out coal entirely. Next year, up to 1200 gigawatts (GW) of existing coal capacity could cost more to operate than the cost of new utility-scale solar PV, the report shows.

Replacing the costliest 500 GW of coal with solar PV and onshore wind next year would cut power system costs by up to USD 23 billion every year and reduce annual emissions by around 1.8 gigatons (Gt) of carbon dioxide (CO2), equivalent to 5% of total global CO2 emissions in 2019. It would also yield an investment stimulus of USD 940 billion, which is equal to around 1% of global GDP.

“We have reached an important turning point in the energy transition. The case for new and much of the existing coal power generation, is both environmentally and economically unjustifiable,” said Francesco La Camera, Director-General of IRENA. “Renewable energy is increasingly the cheapest source of new electricity, offering tremendous potential to stimulate the global economy and get people back to work. Renewable investments are stable, cost-effective and attractive offering consistent and predictable returns while delivering benefits to the wider economy.

“A global recovery strategy must be a green strategy,” La Camera added. “Renewables offer a way to align short-term policy action with medium- and long-term energy and climate goals. Renewables must be the backbone of national efforts to restart economies in the wake of the COVID-19 outbreak. With the right policies in place, falling renewable power costs, can shift markets and contribute greatly towards a green recovery,” Francesco La Camera added.

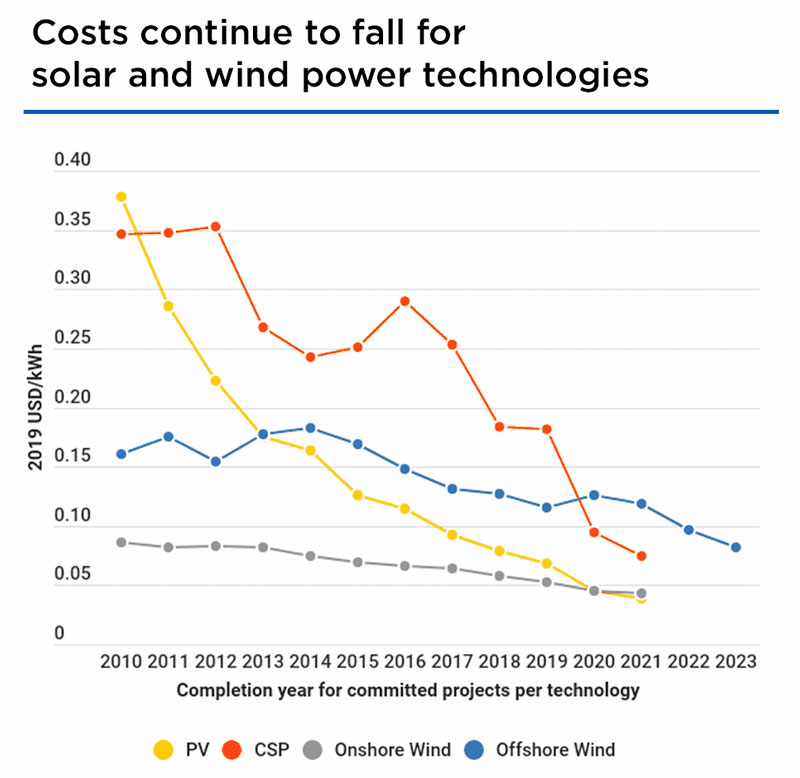

Renewable electricity costs have fallen sharply over the past decade, driven by improving technologies, economies of scale, increasingly competitive supply chains and growing developer experience. Since 2010, utility-scale solar PV power has shown the sharpest cost decline at 82%, followed by concentrating solar power (CSP) at 47%, onshore wind at 39% and offshore wind at 29%.

Costs for solar and wind power technologies also continued to fall year-on-year. Electricity costs from utility-scale solar PV fell 13% in 2019, reaching a global average of 6.8 cents (USD 0.068) per kilowatt-hour (kWh). Onshore and offshore wind both declined about 9%, reaching USD 0.053/kWh and USD 0.115/kWh, respectively.

Recent auctions and power purchase agreements (PPAs) show the downward trend continuing for new projects are commissioned in 2020 and beyond. Solar PV prices based on competitive procurement could average USD 0.039/kWh for projects commissioned in 2021, down 42% compared to 2019 and more than one-fifth less than the cheapest fossil-fuel competitor namely coal-fired plants. Record-low auction prices for solar PV in Abu Dhabi and Dubai (UAE), Chile, Ethiopia, Mexico, Peru and Saudi Arabia confirm that values as low as USD 0.03/kWh are already possible.

For the first time, IRENA’s annual report also looks at investment value in relation to falling generation costs. The same amount of money invested in renewable power today produces more new capacity than it would have a decade ago. In 2019, twice as much renewable power generation capacity was commissioned than in 2010 but required only 18% more investment.

Solar and photovoltaic technologies to become cheaper

Solar and wind power costs have continued to fall, complementing the more mature bioenergy, geothermal and hydropower technologies. Solar photovoltaics (PV) shows the sharpest cost decline over 2010-2019 at 82%, followed by concentrating solar power (CSP) at 47%, onshore wind at 40% and offshore wind at 29%. Electricity costs from utility-scale solar PV fell 13% year-on-year, reaching nearly seven cents (USD 0.068) per kilowatt-hour (kWh) in 2019. Onshore and offshore wind both fell about 9% year-on-year, reaching USD 0.053/kWh and USD 0.115/kWh, respectively, for newly commissioned projects. Costs for CSP, still the least-developed among solar and wind technologies, fell 1% to USD 0.182/kWh.

Cutting costs by up to USD 23 billion per year

Replacing the costliest 500 gigawatts of coal capacity with solar and wind would cut annual system costs by up to USD 23 billion per year and yield a stimulus worth USD 940 billion, or around 1% of global GDP.

Replacing the costliest coal capacity with renewables would also reduce annual carbon dioxide (CO2) emissions by around 1.8 gigatonnes, or 5% of last year’s global total.

By 2021, up to 1200 gigawatts of existing coal-fired capacity would cost more to operate than new utility-scale solar PV would cost to install.

Continuing cost declines confirm the need for renewable power as a low-cost climate and decarbonisation solution, aligning short-term economic needs with medium- and long-term sustainable development goals.

Renewable power installations could form a key component of economic stimulus packages in the wake of the COVID-19 pandemic.

Along with reviewing overall cost trends and their drivers, the report analyses cost components in detail. The analysis spans around 17000 renewable power generation projects from around the world, along with data from 10 700 auctions and power purchase agreements for renewables.