Could Europe Survive Without Russian Gas?

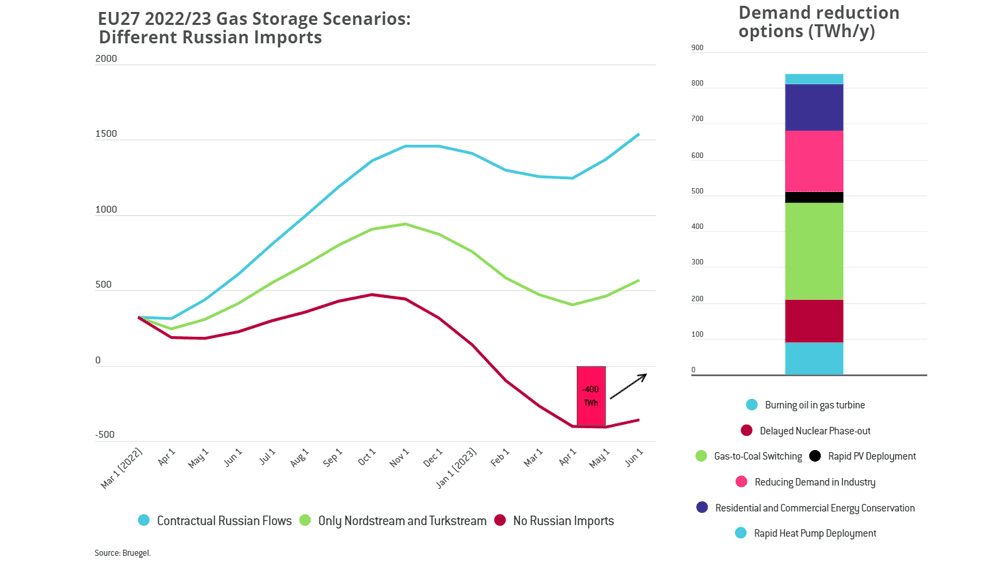

If Russia were to fully cut supplies to Europe, the gas quantity stored in the European Union (EU) countries would cover, at the lowest level, at least 10 years, say the analysts from Bruegel group.

What amount of hydrocarbons does Russia supply around the world?

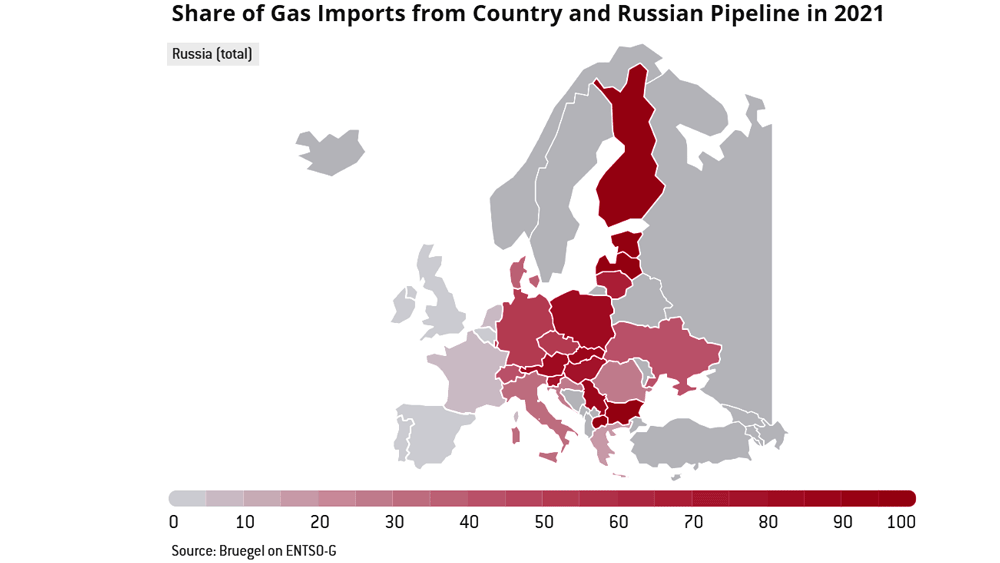

Russia is the third largest oil producer in the world, after the US and Saudi Arabia. Out of approximately five million oil barrels exported each day, more than half of this quantity reaches Europe. A large part of Europe depends to a great extent on Russian gas, Russia supplying around 40% (on average) of EU’s gas imports.

If exports from Russia are stopped, prices will increase even further

Russian Deputy Prime Minister Alexander Novak has stated that the rejection of Russian oil would lead to “catastrophic consequences for the global market”. The countries should get more supplies from elsewhere – which would be extremely complicated for natural gas. If Russia were to stop gas supplies, Italy and Germany would suffer the most, as they receive the largest gas quantities from Russia.

Gas deficit – chain side effects

Gas prices reached a new all-time high on the European market, due to concerns of Russian export disruption. The European Union brought 155 billion cubic meters of gas from Russia in 2021, i.e., 45% of its imports and 405 of the total consumption.

Although Russia covers only around 5% of UK’s gas demand and the US imports no Russian gas, prices in the UK and US are still rising significantly, due to the side effect of supply shortage in other parts of the world. Finding alternative sources is not easy.

“Logistically, it is more difficult to replace gas, as we have these big pipelines that take Russian gas to Europe. As regards oil, in theory it should be easier, as there aren’t so many pipelines – there are some coming from Russia, but there are also a lot of shipments from elsewhere,” says Ben McWilliams, energy policy analyst.

Europe could import more liquefied natural gas (LNG) from the US, but it could also boost the use of other energy sources; however, it is not easy to do so. The implementation of renewable sources takes time, so in the short run this isn’t a solution – renewable sources being medium-term solutions.

In the short term (so for next winter) what could make a difference is changing the fuel, such as opening coal-fired power plants, as Italy and Germany plan to do in case of emergency. Another way to deal with any Russian restriction would be to cut energy demand.

Perhaps the most striking conclusion is that of the Bruegel Group, which predicts that if Russia were to completely cut off Europe’s supply, the amount of gas stored in EU countries would be enough, at the lowest level, for at least a decade.

France: Extreme scenario without Russian gas

European and French imports of Russian gas have been on the rise since the beginning of the war in Ukraine. What happens?

Engie’s long-term contracts with Gazprom, controlled by the Russian state, accounted for about 20% of the company’s total gas sales in 2021. At a time when there are ever-increasing tensions on energy markets, Engie will continue to prioritize the security of energy supply to its customers and will comply with any European sanctions that could affect Russian gas supplies to Europe. Engie representatives warned on the major impact that such move would have on the market.

If European sanctions affect Russia’s supply – which accounts for 40% of the total European gas supply to all operators – Engie would comply with such a decision at all levels, but in these exceptional circumstances, governments and regulators would act given the significant supply tensions that could be expected for 2022/2023. France purchased a total of 12.4bcm of Russian gas from Gazprom in 2020, i.e., around 29% of France’s gas consumption.

However, Engie has a portfolio of long-term contracts with several other gas suppliers outside Russia, including from Norway, Netherlands, Algeria, and the US.

TotalEnergies to remain Novatek’s shareholder

On March 1st, TotalEnergies said it supported sanctions in response to Russia’s invasion of Ukraine and would not invest in new Russian energy projects, but that it would maintain its role in Russia’s largest LNG production facilities, Yamal LNG, and Arctic LNG 2.

France’s Economy Minister Bruno Le Maire pointed out the ethical issue raised by the presence of large French companies such as TotalEnergies and Engie in Russia. Bruno Le Maire brought into the spotlight two major French energy suppliers, TotalEnergies and Engie, highlighting the ethical issue of maintaining trade relations with Russia as it militarily attacks its Ukrainian neighbor. In particular, he called into question the idea of continued participation in the capital of Russian companies, pursuing investment programs and industrial cooperation with these companies, not only internationally but also in Russia, while the Western camp seeks to paralyze Russia’s economy by all means.

The French energy company “condemns Russia’s military aggression against Ukraine, which has tragic consequences for the population and threatens Europe”. At humanitarian level, the group also ensures that it will “mobilize to provide fuel to the Ukrainian authorities and aid to Ukrainian refugees in Europe”. TotalEnergies claims that it approves “the scope and strength of the sanctions put in place by Europe,” specifying that it will implement them regardless of the consequences (currently being assessed) on its activities in Russia. In fact, the group assumed the geopolitical risk inherent in its international activity and knew how to manage it.

Germany accelerates works at the first LNG terminal

Faced with the immediate risk of skyrocketing gas prices along the Rhine caused by the conflict in Ukraine, the German Ministry of Economy and Climate has announced the construction of a first major liquefied natural gas (LNG) terminal. Although this type of project may take years, the project partners are working on the implementation “as soon as possible”.

While the conflict led by Russia against Ukraine continues, Germany, extremely reliant on gas from the belligerent country, must urgently build alternatives for its supply. While Russia supplies 55% of its gas imports, the forecast has also become particularly critical in terms of supply and demand, linked to the suspension of Nord Stream 2 gas pipeline.

Therefore, Berlin must speed up the construction of a first major LNG terminal, located on the mouth of the Elbe. A European market in which the United States plan to compete with Russia. The German Government, through the public bank KfW, Dutch public operator Gasunie and German energy group RWE have signed a Memorandum of Understanding for the construction of a LNG import terminal on the Brunsbüttel site, located in the north of the country. In a speech described as ‘historic’, Chancellor Olaf Scholz no longer rules out the use of nuclear energy or even the use of coal reserves. “It is necessary to reduce as soon as possible reliance on Russian gas imports,” commented Economy Minister Robert Habeck. But, unlike the onshore pipelines that directly carry gas, LNG requires a terminal and shipment by sea.

The future infrastructure, financed 50% by KfW and operated by Gasunie, will have an annual regasification capacity of 8 billion cubic meters to directly supply the German market with natural gas.

Maintaining the carbon neutrality targets

However, the new coalition in place will not give up the country’s ambitious target of reaching carbon neutrality by 2045. The future LNG terminal will therefore be equipped from the outset to switch as soon as possible “to green hydrogen or hydrogen derivatives,” so that it becomes the first European economy to converge towards climate neutrality. In addition to meeting environmental commitments, the ruling coalition must above all be careful not to reduce the purchasing power of its households, leading to a major social crisis. Already subject to post-Covid recovery inflation, the Germans have already seen their gas bills explode. Politically, the Olaf Scholz government must even undertake a real witch hunt to satisfy public opinion, starting with former Chancellor (SPD) Gerhard Schröder, close to Vladimir Putin and appointed in the Supervisory Board of the Russian giant Gazprom.

Algeria to help Italy, heavily dependent on Russian gas supplies

Algerian public hydrocarbon giant Sonatrach has stated that it was ready to supply more gas to Europe, especially by transport through the Transmed gas pipeline, which links Algeria to Italy, which depends 45% on gas imported from Russia. Sonatrach CEO Toufik Hakkar reminded that Europe is Algeria’s “preferred neutral market,” contributing with 11% to its gas imports. Sonatrach is “a reliable gas supplier for the European market and is willing to support its long-term partners in the event of difficult situations,” CEO Toufik Hakkar stated. Additional gas or LNG supplies remain however dependent on “the availability of a surplus once the national demand and ‘contractual engagements’ are met,” he added.

Italy could also increase gas imports from Algeria, but also from Azerbaijan, Tunisia, and Libya.

United States, the largest global LNG exporter

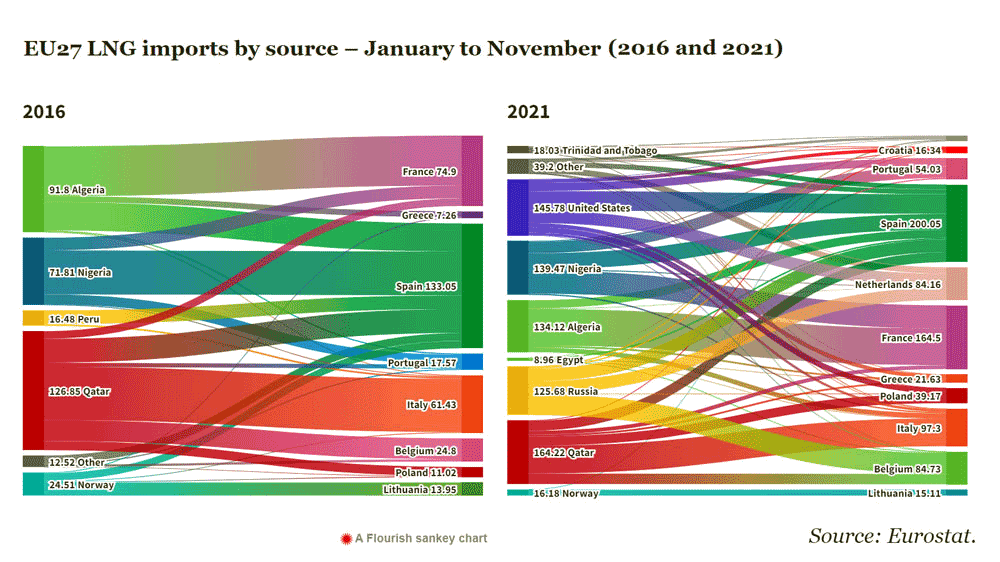

The European energy crisis has allowed the United States to become the world’s largest exporter of liquefied natural gas (LNG), ahead of Qatar and Australia, with the long-term challenge of reducing Europe’s dependence on Russian gas and increasing its market share. Considering this dependence, which is turning natural gas into a geopolitical weapon, we must not ignore Washington’s repeated warnings against Berlin and the Nord Stream 2 project.

The crisis in Europe shows its dependence on gas imports. This helped the United States, which became the world’s largest exporter of liquefied natural gas (LNG) for the first time in December 2021, replacing Qatar and Australia. According to Bloomberg, U.S. LNG export terminals sent out a record 1,043 cargoes in 2021, with Asian nations making up nearly half of the destinations and Europe making up one-third.

According to the Federal Energy Information Administration (EIA), ongoing projects are expected to bring in new capacity in 2022, such as the Calcasieu Pass terminal of Venture Global from Cameron Parish, Louisiana (with an annual capacity of 10 million tons). Billions of dollars have been invested in industry and infrastructure over the past fifteen years to turn gas into liquid by cooling it and loading it into LNG carriers to transport it around the world. Today, the two main LNG terminals in the United States for export are Sabine Pass, Texas, on the shores of the Gulf of Mexico, managed by Cheniere, and Freeport LNG on Quintana Island.

European Union without Russian gas. Alternatives

Since the first trade disputes in 2006 on gas prices between Russia and its transit country Ukraine, then the annexation of Crimea in 2014, the EU had already attempted to reduce its Russian gas imports. But supply could be further reduced or even suspended, at Russia’s initiative or not, in response to economic sanctions, or due to the closure or destruction of Ukrainian gas pipelines.

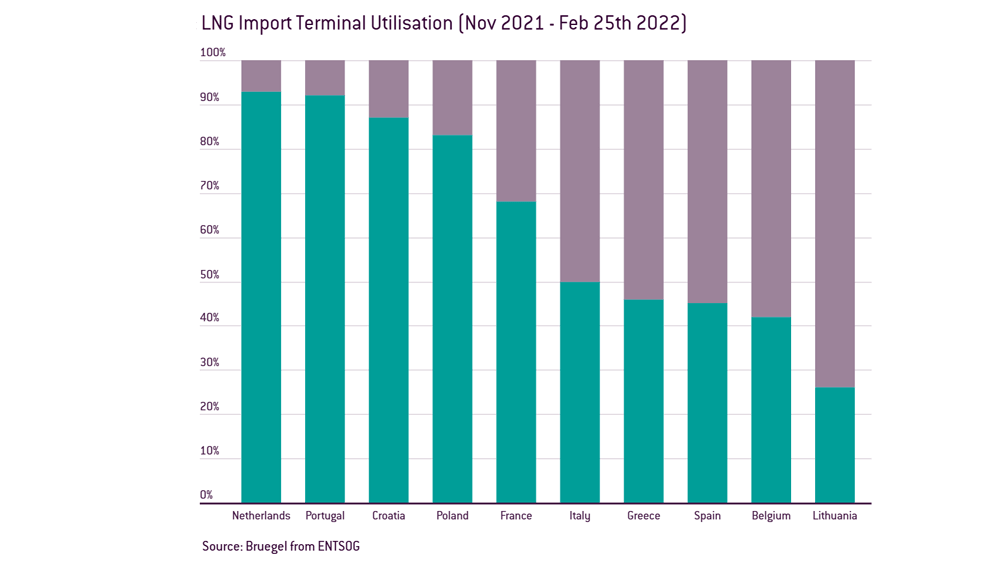

Rising imports from other European suppliers, such as Norway, is less likely, as they are already at the maximum production capacity. Transfers between neighboring countries by interconnecting gas pipelines could be realized as a matter of urgency, but the price would be high, and the quantities limited, as they would depend on the agreement of the initial customers deprived of part of their gas order. Increase in LNG imports, which today account for a quarter of European imports, is not the best option either, as terminals have a limited available capacity, which couldn’t absorb the additional supplies. And the increase in LNG volumes is also related to long-term contracts, whose terms cannot be amended.

Inventories at the lowest level

In terms of European inventories, they are currently at an all-time low, affected by an extended winter in 2020, rising global demand and insufficient supply. Europe has around one month of reserves, to which the reserves held by commercial suppliers must be added.

Exiting one dependence and entering another

This is what Europe seems to be pursuing by increasing imports of liquefied natural gas (LNG) from the United States, a major emitter of greenhouse gases. Amid the Ukrainian crisis, Europe wants to reduce its dependence on Russian gas, thus paving the way for alternatives incompatible with its ambitions for climate and energy sovereignty.

Many European countries could benefit from liquefied natural gas unloaded through the many terminals on the EU’s southern and northern coasts, except Romania, Hungary, Czechia, and Slovakia. Last year, the United States (26%) was the largest exporter of LNG, followed by Qatar. The problem is that the United States has at some point reached its maximum export capacity to Europe, and EU demand will face China’s growing demand.

Bulgaria: “We are too dependent on Russian gas”

Prime Minister Kiril Petkov said Bulgaria supports sanctions on Russia to halting its invasion of Ukraine but will likely seek an exception on banning Russian natural gas and oil imports. “Bulgaria would support all kinds of measures, because we are really against the war, but these two (oil and gas), maybe we would ask for an exception… We do not have current alternatives right now, we are too dependent,” PM Petkov said.

Bulgaria is almost completely dependent on gas supplies from Gazprom, and its only oil refinery, owned by Russia’s LUKOIL, supplies more than 60% of the country’s fuel. The Bulgarian government will also start buying 1.5 million tons of wheat to strengthen its food supply until next year’s harvest and to avoid the risks that could arise because of any possible accident at the nuclear power plants in Ukraine. Bulgaria, which produced more than seven million tons of wheat last year, has no plans to ban wheat exports, while increasing its reserves of corn and sunflower seeds. Prime Minister Kiril Petkov has also stated that Bulgaria will maintain its goal of joining the eurozone in January 2024. He said inflation in Bulgaria would be like that of eurozone countries.

Romania: Dependence of only 10% on Russian gas

Romania depends on Russian gas at a rate of only 10% and officials say it should be replaced mostly by Romanian gas. It is known however that Romania has done nothing to unlock its Black Sea or onshore gas reserves, the domestic production fell for the first time to around 8.6bcm in 2021, while imports exceeded 30% in a consumption of 12.2bcm. In 2021, Romania paid over USD 1bn on imports, almost triple the amount in 2020.

“Currently, Romania consumes about 40mcm/day and with what we produce, i.e., almost 24mcm/day, with what we withdraw from storage, 16mcm/day, we are almost covered. Temperatures also help,” says Vasile Carstea, General Manager of Depogaz, Romgaz’s subsidiary that manages over 90% of Romania’s storage capacity.