Fire from Ice: A Case Study of Methane Hydrates in the Eastern Mediterranean

Methane hydrates is a source of methane gas which is found in crystalline formation that look like ice and can be found in permafrost regions or under the sea in outer continental margins.

We are living in times of fundamental changes in the energy landscape, driven by uncertainty, unstable energy prices, disruptive technologies, geopolitical gambits and subsequent attempts for regulatory interventions. While governments and corporations are trying to adjust to the new landscape and guess the name of the game, they need reliable sources of power to make predictions and critical strategic decisions.

Historical & geopolitical context

The era of hydrocarbons does not seem to be over, but there might be some indications in the horizon. We like it or not, they will still account for the vast majority of the global energy mix by 2050, despite significant breakthroughs in renewables. Many new players come in the energy market with the elusive promise of additional and cheaper resources and the will to disrupt the game – and eventually make money out of it.

Furthermore, the growing tension between public policy and private initiatives has been boiling and has been more than just an understatement for decades. The under-investment that we observe now due to lower prices and risks could become chronic and the global output of energy resources could lead to secure supply deficit.

Gas is believed to gradually replace coal, which is a source of distress for some existing players. The world is facing a proliferation of Liquified Natural Gas (LNG) supplies that are already impacting gas markets and competing with pipeline gas. Some of the largest and most significant consuming nations are contemplating reform or unbundling, which could mean some take or pay contracts become stranded and an increasing oil price is likely to reinforce the price arbitrage between long-term and spot pricing.

There is undeniably a constant call for further investments in renewables, but lower oil, gas and coal prices and increased efficiency (or very effective lobbying) might slow this down. The global players do take into consideration the call for renewables (like solar and wind energy), either for publicity purposes or even because they do believe that this could be the future.

The European Union seems determined to proceed with all legislative acts regrading renewables and the energy mix. A unified European energy market will allow Europe to increase its security of supply by allowing energy to flow freely across borders, therefore avoiding unforeseen complications or imbalance between union members. But the union members do seem to have some conflicting interests which they subtly but firmly pursue.

Russian perceptions of energy security are apparently very different than those of the EU (not the whole EU – also apparently) and primarily about predictability and stability of energy prices because they heavily rely on hydrocarbon revenues. Russia does not want to be vulnerable to Ukraine transit problems, so will accelerate development of alternative routes including Nord Stream 2 and potentially Turkish Stream. Just to set a clear example on Europe’s complicated interests: Germany and the Baltics are supporting Nord Stream while other members (and the ever-present US partner) definitely see it as a Russian manipulation gambit.

With the existing global turmoil within the energy market there has been a hope for a new ‘gamechanger’: gas- or methane- hydrates. The supporters of this new potential energy source evangelize that gas hydrates may be seen as a fuel for future and can meet energy requirements of future generations.

Methane gas hydrates is a source of methane gas which is found in crystalline formation that look like ice and can be found in permafrost regions or under the sea in outer continental margins. It is estimated that the total amount of carbon in the form of methane hydrates could be almost double the carbon content in all the fossil fuel reserves put together.

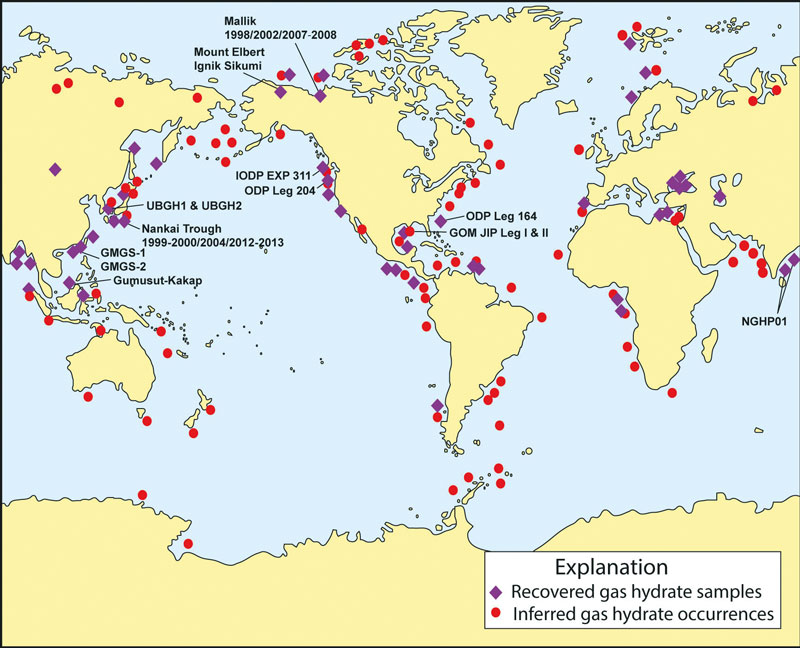

Enormous amounts of methane hydrate have been found beneath Arctic permafrost, beneath Antarctic ice, and in sedimentary deposits along continental margins worldwide. In some parts of the world they are much closer to high-population areas than any natural gas field. These nearby deposits might allow countries that currently import natural gas to become self-sufficient. The current challenge is to inventory this resource and find safe, economical ways to develop it.

In 1930’s it was found that solid gas hydrate formed in the oil and gas transmission pipelines in the U.S. were accountable for the clogging of pipelines. After this, gas hydrate was seen as a curiosity and definitely not positive. The first such example responsible for blocking the pipes due to gas hydrate was provided by Hammerschmidt in 1934 who invented the first algorithm for calculating the amount of methanol to inhibit the formation of natural gas hydrates.

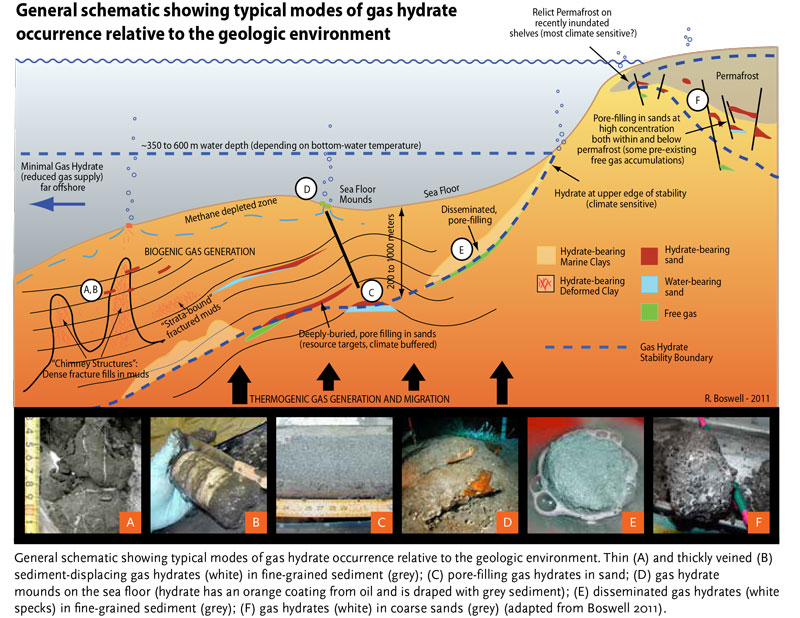

More than half a century ago, natural gas hydrates were located for the first time as gas hydrate deposit in the vast wasteland of Siberia. Since then there has been always a discussion about its potential to become the alternative energy solution. It was also discovered that the low temperature and high-pressure conditions is the necessity for the hydrate formation which should present extensively around the globe, under the deep oceans and in permafrost regions. The occurrence of gas hydrates in oceanic sedimental layers was first observed through seismic observations before the Ocean Drilling Program started intentionally identifying hydrate deposits, bringing samples to the surface. The last decade the efforts of research and development in the field of gas hydrates has resulted into the discovery of occurrence of gas hydrates in the continental margin areas.

Despite this promise, future production volumes are speculative because methane production from hydrate has not been documented beyond small-scale field experiments. Large-scale commercial operations to develop gas-hydrate deposits are still further away in the horizon.

There are many challenges in exploiting gas hydrates. Drilling operations intended to extract methane from hydrates have to cope with the most crucial challenge, that of the volatile nature of the gas and its subsequent expansion as it rises to the surface from a high-pressure to low-pressure environment.

Additionally, there is criticism for methane as is it is indeed a potent greenhouse gas and the impact to climate change as a result of hydrate exploitation is a significant concern. A given volume of methane causes 15 to 20 times more greenhouse gas warming than carbon dioxide, so the release of large quantities of methane to the atmosphere could exacerbate atmospheric warming and cause more gas hydrates to destabilize in a destructive spiral.

Some research suggests that this has happened in the past. This is the case of the Paleocene-Eocene Thermal Maximum, 55 million years ago, when global warming may have been related to a large-scale release of global methane hydrates. Some scientists have also advanced the Clathrate Gun Hypothesis to explain observations that may be consistent with repeated, catastrophic dissociation of gas hydrates and triggering of submarine landslides during the Late Quaternary (400,000 to 10,000 years ago).

While the vast majority of methane hydrates would require a sustained warming over thousands of years to trigger dissociation, gas hydrates in some locations are dissociating now in response to short-term and long-term climate processes. The level of danger varies depending on the placement of the deposits that can be broken down to 4 general categories:

Thick onshore permafrost: Gas hydrates that occur within or beneath thick terrestrial permafrost will remain largely stable even if climate warming lasts hundreds of years.

Shallow arctic shelf: The shallow water continental shelves that circle parts of the Arctic Ocean were formed when sea level rise during the past 10,000 years inundated permafrost that was at the coastline. Subsea permafrost is thawing beneath these continental shelves and associated methane hydrates are likely dissociating now. If methane from these gas hydrates rises to the ocean floor, it will likely reach the atmosphere.

Upper edge of stability: Gas hydrates on upper continental slopes, beneath 1,000 to 1,600 feet of water, lie at the shallowest water depth for which methane hydrates are stable. The upper continental slopes, which ring all of the world’s continents, could host gas hydrate in zones that are roughly 30 feet thick. Warming ocean waters could completely dissociate these gas hydrates within the century.

Deepwater: Most of the earth’s gas hydrates, approximately 95%, occur in water depths greater than 3,000 feet. They are likely to remain stable even with a sustained increase in bottom temperatures over thousands of years. Most of the gas hydrates in these settings occur deep within the sediments. If they do dissociate, the released methane should remain trapped in the sediments, migrate upward to form new gas hydrates, or be consumed by oxidation in near-seafloor sediments.

Methane hydrates – A deeper introduction

As discussed above, natural gas is expected to have an upgraded role among renewables in the future, and partake in the energy mix. The new unconventional source of natural gas, methane hydrates, could be considered a game changer in future gas production.

Countries, such as the United States of America, Japan and Canada, have invested in finding ways to produce natural gas from hydrates. These countries have actually managed to get a small-scale production, proving that extracting natural gas from hydrates is technically feasible. Significant methane hydrate samples have also been recovered in the Eastern Mediterranean Sea under the EU-funded ‘Anaximander Project’ (2003-2004).

Since then, no further progress was made with regard to carrying exploration programs and production test programs. This approach aims to highlight the importance of the methane hydrates resource among the conventional already available hydrocarbon sources.

Methane hydrates – Energy potential & characteristics

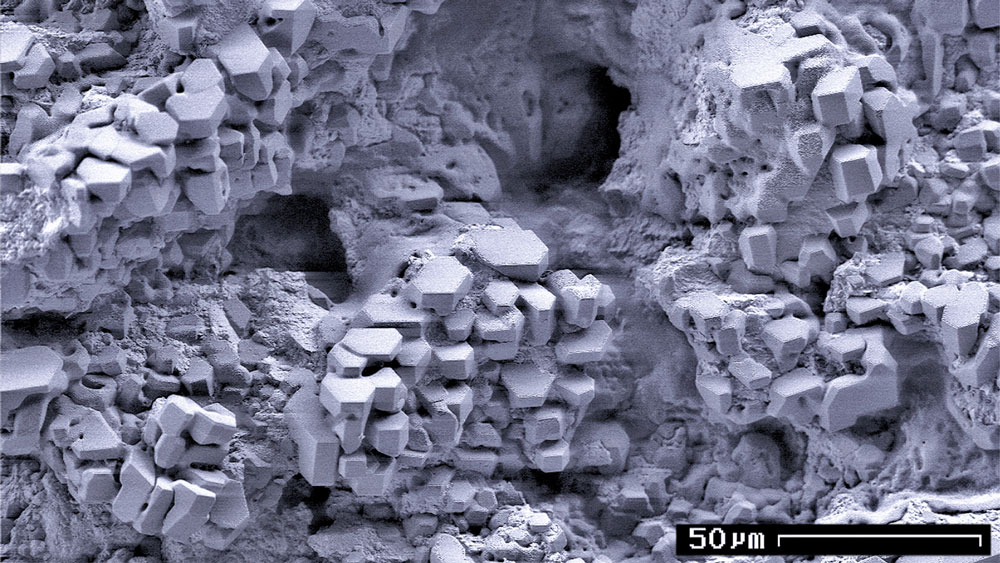

Methane, is the primary component of natural gas. When referring to methane hydrates, the gas molecules are not chemically bound to the water molecules but instead are trapped within their crystalline lattice. The resulting substance looks remarkably like white ice, but it does not behave like ice.

When methane hydrate is ‘melted,’ the solid crystalline lattice turns to liquid water, and the enclosed methane molecules are released as gas. Methane hydrate is a fairly concentrated form of natural gas. When dissociated, one cubic foot of solid methane hydrate will release about 164 cubic feet of methane gas. This proportion is exactly the reason why methane hydrates make for a potential source of energy supply.

It is clear that we are discussing about an abundant resource existent in many regions around the globe, with recovered hydrate samples already found in some of them (e.g. in the Eastern Mediterranean Sea).

Japan, Canada and United States have shown early interest in methane hydrates and have made considerable investments in production test programs to extract gas from hydrates, and managed to get a small-scale production of gas from hydrates. In 2002, an international consortium, led by Japan and Canada and including the U.S., conducted short-duration production testing at the Mallik site and demonstrated, for the first time, that methane could indeed be produced from hydrate.

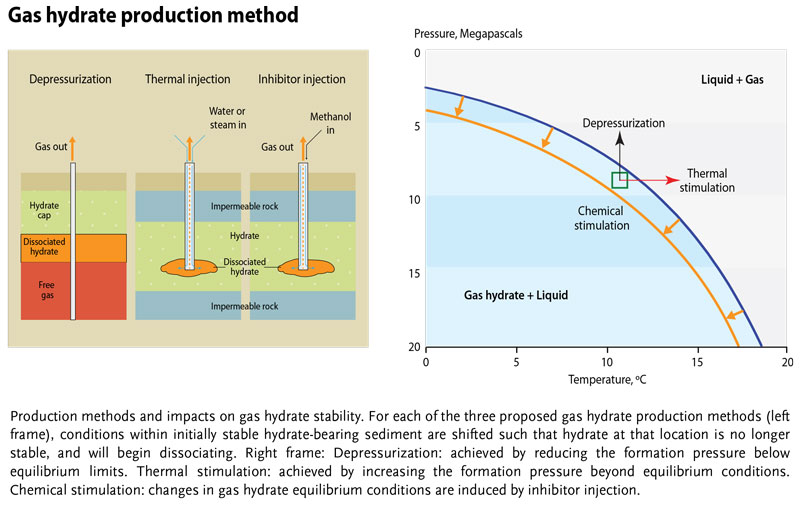

As with all unconventional hydrocarbon resources, there are several challenges that need to be met when it comes to field production and gas hydrates are not an exception. After several production tests three main methods of extracting the methane from hydrates were distinguished:

- Depressurization;

- Thermal stimulation and;

- Chemical stimulation.

The methods are presented briefly below.

Depressurization: Reducing the formation pressure from equilibrium conditions.

The depressurization technique is considered the most cost-effective and practical way to dissociate gas hydrates (Moridis et al., 2009). The method involves reducing reservoir pressure by mechanical means. To achieve this, you can directly reduce the reservoir pressure, by removing pore fluids, or by reducing the pressure in the underlying or overlying sediments in contact with the hydrate reservoir. This pressure change will transfer to the reservoir naturally. The important part here is that you can achieve the goal by using conventional drilling technology (this can solve many issues compared to new untested methods and keep the cost relatively low). Depressurization can be accomplished by perforating the production well casing at the target interval and reducing the weight of the fluid within the well. Normally, a well is filled with fluid from top to bottom. The weight of the fluid is balanced against the pressure of the reservoir in order to prevent the contents of the reservoir (oil, gas, and/or water) from flowing up the well uncontrolled. In the case of a gas hydrate reservoir, once the pressure is reduced below the gas hydrate stability condition, dissociation of gas hydrates will occur in the vicinity of the perforations, releasing gas and water that will then flow to the well. Then the extraction is pretty much similar to a conventional well of natural gas.

Thermal stimulation: Reducing the formation pressure from equilibrium conditions.

The objective of the reservoir-heating technique is to increase the temperature within the reservoir beyond the localized pressure-temperature threshold for gas hydrate stability. The only full-scale field production test using this technique was conducted at the Mallik site as part of the 2002 gas hydrate production-testing program (Dallimore and Collett 2005).

Thus, the test permitted assessment of the efficiency of heat conduction into the formation (that is, with no direct heat transfer by formation fluids). With only 500 cubic metres of gas produced over the entire testing period, the 2002 Mallik test was not particularly productive. However, the objective of the test was to demonstrate the feasibility of producing gas that originated indisputably from hydrate deposits, rather than the maximization of such production. Moridis and Reagan (2007a) and Moridis et al. (2009) demonstrated through numerical simulation studies that thermal stimulation is thousands of times less effective than depressurization as a dissociation-inducing method for gas production from hydrates.

Chemical stimulation: Are induced by inhibitor injection in gas hydrate equilibrium conditions.

Gas hydrate production by chemical stimulation involves the manipulation of gas hydrate phase-equilibrium conditions by injecting dissociation-inducing chemicals, such as salts and alcohols, into the reservoir.

These chemicals cause dissociation by altering the energy potential of water in contact with the solid gas hydrate phase. This approach was common for years to ensure flow assurance in gas wells and to prevent blockages in pipelines due to formation of gas hydrates. The utility of chemical injections for field-scale production of gas hydrates appears limited. The costs associated with injecting large volumes of chemicals into the reservoir are a major drawback even in testing field scale production. There is a new concept based on chemical processes at the molecular level that has been the subject of laboratory and modelling studies (McGrail et al. 2007; Graue et al. 2006; Stevens et al.2008).

The main idea is to release methane by introducing another gas, such as carbon dioxide, which would change the chemical conditions in the reservoir and replace the native methane hydrate with carbon dioxide. This process could also be a solution to other environmental issues and allow for synergistic storage of carbon dioxide. However, the ability to inject carbon dioxide into water bearing formations with low permeability is limited. A successful trial of this concept in Alaska in 2012 employed a mix of nitrogen and carbon dioxide to enable injection. (Schoderbek et al. 2012).

Methane hydrates – The financial aspect

The most important factor in assessing the production cost for extracting natural gas from methane hydrates concentrated zones is to find an economic viable way to extract them. As mentioned above, to date three countries have made systematic attempts for the assessment of the most technically and economically viable extraction of natural gas from methane hydrates, namely Japan, USA and Canada. Currently, Japan has an active production test program, USA plans to carry production tests, while Canada has also conducted production tests but has put on hold any further development.

According to the Methane Hydrates 21 Research Consortium in Japan: “The fact that the existing systems are capable of supporting methane hydrate development systems means that the production of methane hydrate is able to be carried out almost in the same way as oil and natural gas development once methane hydrate is dissociated in the layers. However, the development of methane hydrate differs from the development of oil and natural gas in many aspects. The following lists shows the major differences.

- Oil and natural gas simply flow out when a well is drilled, on the other hand, methane hydrate requires an extra step of dissociating in the layers, and this mechanism must be included in the development system.

- Oil and natural gas exist in the deep portion 2,000 to 4,000 m beneath the ground or sea level. On the other hand, methane hydrate is at superficial portion of up to approximately 500 m below the seafloor.

- Therefore, oil and natural gas exist in many cases in already consolidated layers, but many of the methane hydrate layers exist in unconsolidated layers. Unconsolidated layers can induce productivity reduction unique to these layers.

- When the depressurization method is employed for production purposes, the daily production volume of methane gas will be one digit smaller than that of natural gas (100,000 m³ on an average) (even when the simple depressurization method is employed, the current estimated production volume is around 50,000 m³).”

Therefore, once the most efficient way to dissociate methane hydrates in the layers is selected, the extraction method and costs will be similar to those of conventional natural gas. The additional cost associated with production from deep-water gas hydrates as compared to conventional gas deposits is USD 3.40 to USD 3.90 per MMBtu. The International Energy Agency has estimated that methane hydrates will be produced by 2025 at a cost of USD 4.70 to USD 8.60 per MMBtu.

Furthermore, in order to extract natural gas from methane hydrates concentrated zones in a competitive way, there are certain fundamental conditions that should be met. Cost of production should be equal to or lower than the cost of conventional gas reserves to make technical and economic sense of the extraction. The price of natural gas produced from methane hydrates should be equal to or lower than the price of conventional gas resources (or unconventional ones, such as shale gas). Quantities available for extraction must be enough to secure a continuous production of gas in order for the investment to have a viable rate of return. After assessing the production costs, we need to calculate the transportation costs in order for the gas to reach the European market.

Of course, it will be easier to assess such costs since there is a lot of experience in the construction of offshore pipelines worldwide and there are available studies conducted on the transportation of conventional natural gas from the fields in Eastern Mediterranean area. If the above-mentioned conditions are met, then the opportunity cost of investing in natural gas will be lower than that of methane hydrates.

Classification of a gas hydrate resource

Despite the significant techno-economic analysis that Europe should conduct in order to assess whether methane hydrate resources from Eastern Mediterranean can be considered as reserves, we must emphasize that the decision to move forward is not based only on technical and economic issues. Evaluation of future gas hydrate development will be influenced by social, economic, environmental, and political considerations, not just scientific and technical issues. Prominent among these considerations is the need to reduce emissions of greenhouse gases as well as energy security issues. Given the high costs involved, gas hydrate production research would likely continue to be facilitated primarily by government funding, with industry participation.

Project Anaximander- Recovered gas hydrate samples in the Eastern Mediterranean

During the implementation of the EU-funded project Anaximander, not only were mud volcanoes (such as Amsterdam, Kazan, Athena and Thessaloniki) discovered in the area of the survey, but also seven cores containing gas hydrates from five new sites were recovered from Amsterdam Mud Volcano. It was proven that active mud volcanism and the presence of gas hydrates in this sector of Eastern Mediterranean are considerably more extensive than previously thought, with several new sites where gas hydrates were sampled.

These recovered samples are proof of existing gas hydrates and they are also strong indications of conventional hydrocarbon resources.

We can easily assume from the above facts that the specific area, will be of major economic and scientific interest in the near future. There are strong indications that volumes of conventional hydrocarbons exist along with volumes of methane hydrates. This means that it is possible, areas with conventional sources of natural gas could also have the potential of producing natural gas from methane hydrates that occur in the same area. This could really be a game changer in economic terms and greatly increase the total production of natural gas for the area.

The East Mediterranean has in the recent past experienced what could be described as a gas revolution. Having historically seen limited exploration activity, resulting in modest proven hydrocarbon resources, the region is now considered a ‘new frontier’ for offshore gas exploration in the Middle East and North Africa (MENA). The discovery since 2009 by Israel and Cyprus of large gas deposits, estimated to contain a combined 980 Bcm (35 Tcf), has spurred a flurry of exploration activity, leading some to believe that the discoveries are potentially so vast that the economic map of the region is already being redrawn. By adding the possibility of an extra rich source of energy, the interest in the region will be more intense and lead the oil and gas industry to investigate further the potential production of natural gas from methane hydrate formations in the Eastern Mediterranean.

Geopolitical consequences in Eastern Mediterranean & game theories

Apparently, the potential climatic effects are not the only emerging out of this ‘game changing’ discovery; there is also the geopolitical side. The recent emergence of the Eastern Mediterranean as a new hotspot for energy has turned also into a potential warzone – more than what it had already been.

The gas reserves discovered in the territorial waters of Israel, Cyprus and Egypt are already contributing to the energy potential and the subsequent energy security of these countries, and their allies. For example, the vast Mediterranean gas reserves can potentially be useful to the EU, which aims to diversify its energy suppliers, also with the blessings of the United States.

The surge of the East Mediterranean as a future gas-exporting region after the discovery of major gas fields in Israel (Tamar 2009; Leviathan 2010), Cyprus (Aphrodite 2011) and Egypt (Zohr 2015) is recent and also subject to uncertainty over the real gas reserves and thus the difficulty of evaluating the financial viability of their full exploitation. Both Israel and Cyprus expect to begin gas delivery around 2020, if everything goes smoothly.

The major source of geopolitical turmoil in the region is a direct result of Turkey’s aggressive claims over the share of the energy pie. Turkey, catapults itself in the discussion using the occupied part of Cyprus as its base for geopolitical argumentation; acting “in the name of protecting the rights of the Turkish-Cypriot population” they challenge Cyprus and its dominance over its Exclusive Economic Zone (EEZ) openly. This is preventing the construction of a gas pipeline to connect the Leviathan field with Ceyhan in Turkey, since the pipeline would have to cross the EEZ of Cyprus. The export of Israeli and Cypriot gas to the EU gas market through pipelines connecting in Greece is unlikely in the short to medium term due to extremely high construction costs involved in relation to the supply expected.

Rapidly growing gas demand in Egypt, as well as the recent discovery of the Zohr field, which has increased the total national gas reserves to 2,180 bcm – significantly more than the Israeli and Cypriot reserves put together – makes Egypt the major regional player in the gas sector and the potential catalyst of the Eastern Mediterranean gas hub. In addition to exploiting its own natural gas resources, Egypt is likely to start importing gas from the Cypriot and Israeli gas fields by 2020, which could partly offset the current expensive spot-market LNG imports, which Egypt needs in order to satisfy its domestic demand.

The context for Cyprus gas is almost opposite to that of Egypt: with no background in the hydrocarbon sector and actually no domestic gas demand, the pressure on the country’s energy sector is almost all external. Indeed, the possibility of new and greater discoveries, the tensions in the north with Turkey and the Turkish Republic of Northern Cyprus (TRNC), the need to consolidate its energy partnerships in the south with regional powers and to end its isolation via LNG and a gas pipeline have been a huge priority for the small European State. The aim is clear: to secure its protection from Turkish aggression which casts shadows on the country’s energy future and its aspiration as an energy hub.

Cyprus did not have proved oil or gas resources until 2011, the year in which the US energy company Noble discovered the Aphrodite gas field in block 12, the southernmost part of the Cypriot offshore concession area. The volume discovered is significantly smaller than Zohr but this value is likely influenced by the recent start and the limited size of the exploration activities conducted until now, particularly due to the unclear definition of the EEZs between Cyprus and its neighbours. While these have been settled with an agreement with Egypt in 2003, with Lebanon and earlier with Syria and Israel, they are still unsettled with Turkey and the TRNC.

Foreign companies’ interest in exploration is however strong: the first licensing round, which led to the discovery of Aphrodite, was shortly followed by two others which gathered significant attention, the last receiving bids also from ExxonMobil and Qatar Petroleum in July 2016. The two companies, which had previously not shown interest in Cyprus resources, add to the already existing contracts with Delek, Eni, Noble, Total and Shell. Potentially, Cyprus holds a set of advantages in becoming a gas hub, if compared to Turkey, its closest rival; despite being farther from Central Asian gas reserves, it is closer to Southern Mediterranean fields. Its small domestic market, with limited possibilities of growth, avoids making domestic consumption a cumbersome competitor to exports (as in the case of Turkey and Egypt). Finally, Cyprus has a priority lane towards the EU gas market thanks to its membership. However, Cyprus’ ambition to become a Mediterranean energy hub depends on the success of its exploration activities and its security status.

While the resolution of the Cyprus controversy has stalled in the past years, exploration activities are proceeding at a fast pace. So far Cyprus has decided to keep the development of offshore gas reserves separate from the reunification dossier, as stated by Cypriot Minister of Energy, Yorgos Lakkotrypis, in May 2016. The aim is likely to exploit the geographical position of current discoveries – in the south – and the connection with energy-thirsty Egypt, to limit Turkish interference. Yet, as Turkey has proved aggressive enough to reach block 12 with its research and other naval vessels, the emerging risks bring forth the possibility of an open conflict (also according to UN Secretary-General Antonio Guterres).

Just to scale this game up, these developments upset the regional status quo long dominated by the United States and NATO, particularly in the security domain. At the end of the Syrian (?) war, Russia and Iran find themselves having secured basing and commercial rights in Syrian ports and Moscow won port- and energy-related agreements and privileges from both Lebanon and Syria.

China’s new global Silk Road is aiming at establishing a dominant Chinese transport and logistical presence all along the Mediterranean coast, including the ports of Piraeus (Greece) and Haifa (Israel). The Chinese naval presence in the Red Sea port of Djibouti could very well show this pattern of connecting the Silk Road all the way from China to the Mediterranean.

Earlier this year, the Greek Cypriot government signed a deal with a consortium made up of Dutch-British Shell, US company Noble Energy and Israel’s Delek on the distribution of revenues from natural gas exploitation from the Aphrodite field. The agreement allows for the exploitation of an offshore field that is estimated to hold more the 4 trillion cubic feet of gas. This partially solidifies the claims of Cyprus through the military might of Israel (and with Greece being always in the background). The Cypriot government recently issued an international arrest warrant for personnel of the Turkish drillship Fatih and officials from companies cooperating with the state-run Turkish Petroleum Corporation, in response to the Turkish violations of its EEZ and the subsequent aggressions in the area.

Meanwhile, US think tanks and the administration can obviously see Russia’s and China’s position being solidified in the Eastern Mediterranean and cannot remain idle; for now, stability in the region and the security of Cyprus cannot be jeopardized – not even by Turkey. Erdogan’s protests count for little in Washington. The US Congress and the Trump administration support Cyprus’s unfettered energy development in the Eastern Mediterranean and the lifting of restrictions on arms sales to Cyprus. Those moves reflect the growing importance to Washington of security and energy concerns in the Eastern Mediterranean and Turkey’s estrangement from Washington on yet another key foreign policy issue. Additionally, the Eastern Mediterranean energy roadmap could give a solution to European energy independency from Russia (and potentially a powerful level for the US to block Nord Stream 2).

Concluding, we have 3 distinct geopolitical levels, emerging from the situation in the Eastern Mediterranean:

- The immediate: Concerning the monetization potential and the distribution of wealth between Cyprus, Israel, Egypt, Turkey (and potentially Lebanon, the Palestinian Authority and Syria);

- The intermediate: Concerning the European Union (and the conflicting interests even within it) and its energy security and diversification from Russia;

- The global: Concerning the global geopolitical powerplays between the US, Russia and China, followed by the interested spectators like Iran and the OPEC countries (regarding the effects of the situation on them).

The emergence of a new sustainable energy source, located in the region, could spark even bigger tensions, focusing the global attention in a few square kilometres of sea.

Conclusion

The energy sector is undeniably rapidly changing, following our volatile nature as a species; technology, politics, wars and interests keep challenging and shifting the status quo on every field. Therefore, new potential ‘gamechangers’, like gas hydrates, should always be expected as the only thing that has been the everlasting denominator for our species is the totally human need for ‘more’.

The know-how is still being developed regarding harvesting ‘Fire from Ice’ and thus making the gas hydrates an efficient (and safe) energy source. As we are discovering more about the nature of the resource, we are also discovering new fields, wielding potentially tremendous amounts, like the ones in Eastern Mediterranean near and around Cyprus.

The region has historically been a problematic one, even before, Turkey’s invasion and possession of the northern sector of the island; the nearby Middle East speaks for itself regarding turbulence and wars. Nearby Greece, one of the guarantors for the safety of Cyprus and the surrounding region, cannot be certain if it can guarantee anything more than its 1-year bonds in the global financing markets. Russia and China have de facto moved in the region to secure their advancing steps towards solidifying global power and the United States have been observing while isolating themselves, leaving a power vacuum in the area; a dangerous power vacuum as the children in this neighbourhood are more than rough and have shown that they are totally comfortable with beating each other to the ground when left without parental control.

The truth is that the children are presented with a huge potential opportunity, presenting itself in the forms of gas hydrates, giving them ‘Fire from Ice’. In every article circulating the Internet every analyst – or not analyst – claims that the energy game in the region does not have to be a zero-sum game. I claim that this depends on the basis that we are examining each case; indeed, if we were talking about Luxemburg having to share some resources with France and Belgium (or even Germany) we could speak on a non-zero-sum basis game. But here we are talking about a roster of not very prudent or stable players like Turkey, Cyprus, Greece, Lebanon, Syria, Egypt, Palestinian Authorities playing a VERY zero-sum game, along with the interwoven global interests and the tug-of-war between the US, Russia, China, EU and the OPEC countries.

Afterall, this discovery of gas hydrates could prove dangerous; maybe the ice is very thin and the kind of fire that we might get out of it is not the one that makes lives better but rather the one that takes them away.

Text by Evgenios Zogopoulos

Co-author: Konstantinos Michalopoulos Dipl. Mining & Metallurgical Engineer, National Technical University of Athens