Hydrogen: Is this the future? (Part II)

In the second part of the analysis ‘Hydrogen: Is this the future?’ >> (See part ONE), we are going to be addressing the applications, technologies, distribution challenges and the future of Hydrogen.

Applications

Hydrogen has the potential to serve as an energy source for different mobility purposes. It can be used as a combustion fuel in the internal combustion engine which is nowadays the dominant energy converter in road transport. However, the most important and promising combination for the future of the energy and mobility industry is the fuel cell as energy converter and hydrogen as the main energy source. In direct use, (pure) molecular hydrogen (H2) is used by the transportation means directly, i.e. without further conversion, as an energy source. In this case hydrogen can be used both in internal combustion engines and in fuel cells (fuel cell systems). In indirect use, hydrogen produces final energy sources or is converted by means of additional conversion steps into gaseous or liquid hydrogen-containing fuels. Such PtG (Power-to-Gas) and PtL (Power-to-Liquids) fuels can be used in heat engines.

In principle, hydrogen fuel cell systems are suitable for virtually all means of transport, but their technological maturity varies according to the means of transport and the way in which it is used. Industrial trucks such as forklifts or tractor units for material handling are technically almost fully mature and are already at the early stages of commercialization. Passenger cars have reached series production, while buses are close behind. Material handling equipment has been manufactured in the highest numbers. In North America there is a fleet of over 11,000 forklifts and tow trucks is in operation. Fuel cell passenger cars are able now to offer the same features (performance, comfort, refuelling time or effective range) as those driven by internal combustion engines. Buses have been under intensive testing more than any other means of transport, thanks to public funding projects. There is still a lot of development work to be done with regard to trains, ships and aircraft: light rail vehicles and commercial vehicles (including lorries) may benefit from proven bus or passenger car technology. There are no plans as yet for commercial aircraft or merchant ships, but they can use fuel cells as an efficient energy source for auxiliary power units (APUs). Taking into consideration the above, we should focus on a very important sector of our everyday lives, that is heavily hit by the recent pandemic and also from the uncertainty of the existing technologies: passenger cars and the potential of hydrogen mobility.

Along with battery electric vehicles, hydrogen-powered fuel cell passenger cars are the only zero-emission alternative drive option for motorized private transport. The first fuel cell passenger cars were tested back in the 1960s as demonstration projects. A new boost to fuel cell development came in the 1990s. In most cases the fuel cell test vehicles were converted cars that had originally been fitted with an internal combustion engine. At the time, however, the early test models were still not competitive, either technically or economically. In addition, up until about 10 years ago petrol engine prototypes were still being tested with hydrogen as an alternative energy and low-emission fuel. These were vehicles with modified bivalent engines, which could run on both petrol and hydrogen (Eichlseder/Klell 2012). Owing to the fuel, hydrogen-powered internal combustion engines not only achieve significantly higher efficiencies than in petrol operation, they also emit almost zero levels of pollutants. Although hydrogen is a clean fuel with excellent physicochemical properties, it has been unable to gain acceptance as a fuel for motorized road transport. For passenger cars the focus is now almost entirely on hydrogen-powered fuel cells as a source of energy. Currently there is abundance of practical experience available with fuel cell prototype passenger cars. A number of major car manufacturers are starting to offer early series-production vehicles, which are in the same level as conventional internal combustion engine cars in terms of functionality. The number of fuel cell cars manufactured over the coming years is estimated to range from several hundred up to thousands of units (US DOE 2016). The prices for medium-sized vehicles fitted with fuel cells are still well above those for passenger cars with internal combustion engines – at around 60,000 EUR/USD (IEA 2015b). However, with the launch of FCEV series production, vehicle cost and prices are expected to fall substantially. The fuel cell stacks in the latest fuel cell models have an output of 100 kW or more. As compared with battery electric cars they have a significantly greater range (400 to 500 kilometres) and with a lower vehicle weight and of course much shorter refuelling times of three to five minutes (US DOE 2016) compared to electric cars which sometimes might need more than 5-6 hours depending on the type of charger. FCEVs will be able to carry 4 to 7 kg of hydrogen on board, stored in pressure tanks at 700 bar.

Fuel cell electric vehicles are estimated to become less expensive because of technological development, learning curve effects and effects of scale in production (IEA 2015b). The hydrogen consumer prices could also fall as a result of a more cost-efficient hydrogen supply retail, refuelling infrastructure and rising demand. If the price for a fuel cell electric vehicle were to be reduced by 50%, combined with a moderate reduction in hydrogen refuelling station prices, the ownership costs for an FCEV would be lower than those for a petrol car after just 50,000 to 60,000 km. In addition, fossil fuels could also become relatively more expensive than hydrogen, and this could also increase the attractiveness of an FCEV compared with a conventional petrol car.

Coming to Battery electric vehicles (BEVs), it is a fact that this technology has a head start of several years over fuel cell electric vehicles in terms of market development. This head start is expressed in the greater variety of battery electric vehicles and in lower purchase prices. If the gap in purchase costs between FCEVs and BEVs starts to decrease, the costs for fuel cell electric vehicles and battery vehicles (per kilometre) would be very similar. Under these circumstances, and knowing the advantages in terms of range and charging time, some buyers would probably be attracted more to choose fuel cell electric vehicles. Hydrogen-powered fuel cell electric vehicles (FCEVs) are much more efficient than passenger cars driven by an internal combustion engine. Hence, FCEVs can make an important contribution to the diversification of the energy supply and to energy savings in motorized road transport.

Distribution

A major advantage of hydrogen is that it can be produced from (surplus) renewable energies, and unlike electricity it can be stored in large amounts for long periods of time. For that reason, hydrogen produced on an industrial scale could play an important part in the energy transition of our time. As a chemical energy store, hydrogen could act as means of sector coupling in integrated energy schemes. Physical storage methods are the most mature and the most frequently used. A distinction is made between high-pressure storage and cooled hydrogen storage. As hydrogen has to be cooled down to very low temperatures in order to liquefy, the term cryogenic hydrogen storage is also used. Finally, if compression and cooling are combined, this is also referred to as hybrid storage.

High-pressure storage Compressed Gaseous Hydrogen, CGH2

From production through intermediate storage and on to distribution to the end user, hydrogen is handled at different gas pressures. A low-pressure storage tank operates at just 50 bar. For intermediate storage in high-pressure tanks or gas cylinders, pressures of up to 1,000 bar are technically possible. Only special solid steel or steel composite pressure vessels are suitable for high-pressure storage. When it comes to the industrial storage of hydrogen, salt caverns, exhausted oil and gas fields or aquifers can be used as underground stores. Although being more expensive, cavern storage facilities are most suitable for hydrogen storage. Underground stores have been used for many years for natural gas and crude oil/oil products, which are stored in bulk to balance seasonal supply/demand fluctuations or for crisis preparedness (IEA 2015b).

When storing liquid hydrogen, the tanks and storage facilities have to be insulated in order to keep in check the evaporation that occurs if heat is carried over into the stored content, due to conduction, radiation or convection. Existing storage facilities are rarely able to prevent such effects completely, i.e. they can only delay them (EA NRW 2013). LH2 tanks or storage vessels generally have a double hull design, with a vacuum between the inner and outer container. To regulate a pressure rise caused by evaporating hydrogen in the inner container, small amounts of gas have to be released (boil-off).

Cold- and cryo-compressed Hydrogen (CcH2)

In addition to separate compression or cooling, the two storage methods can be combined for better results. When a gas is cooled, it follows from Gay-Lussac’s gas law that the volume of an (ideal) gas held at constant pressure behaves proportionally to the temperature. This relationship also applies in principle to real gases. That is why hydrogen is cooled first. Depending on how much the hydrogen is cooled, it is referred to as cold-compressed hydrogen (above 150 K) or cryo-compressed hydrogen (CcH2). Cryo-compressed hydrogen is cooled to temperatures close to the critical temperature, but it still remains gaseous. The cooled hydrogen is then compressed (US DOE 2006; BMW 2012). CcH2 is a further development of hydrogen storage for mobility purposes. The advantage of cold or cryogenic compression is a higher energy density in comparison to compressed hydrogen.

Road transportation

Gaseous hydrogen can be transported in small to medium quantities in compressed gas containers by truck. For transporting larger volumes, several pressurized gas cylinders or tubes are bundled together on so-called CGH2 tube trailers. The large tubes are bundled together inside a protective frame. The tubes are usually made of steel and have a high net weight. This can lead to mass-related transport restrictions. The newest pressurized storage systems use lighter composite storage containers for lorry transport. A tube trailer cannot store compressed gas as compactly as a tanker for liquid fuels (petrol or diesel fuel). This means that the available tank volume for hydrogen per tanker is lower. Single tube trailers carry approximately 500 kg of hydrogen, depending on the pressure and container material.

The largest tank volumes for gaseous hydrogen transport are currently 26 cubic meters. Taking account of the low hydrogen density factor at 500 bar, this results in a load of around 1,100 kg hydrogen per lorry. This figure extrapolates to approximately 12,000 normal cubic meters of hydrogen. At 250 bar, both the weight of hydrogen and its transport volume in Nm3 would be roughly halved. As an alternative, hydrogen can be transported in liquid form in trucks or other means of transport. In comparison to pressure gas vessels, more hydrogen can be carried with an LH2 trailer, as the density of liquid hydrogen is higher than that of gaseous hydrogen. At a density of 70.8 kg/m3, around 3,500 kg of liquid hydrogen or almost 40,000 Nm3 can be carried at a loading volume of 50 m3. Over longer distances it is usually more cost-effective to transport hydrogen in liquid form, since a liquid hydrogen tank can hold substantially more hydrogen than a pressurized gas tank. For the purposes of liquid transport, the hydrogen is loaded into insulated cryogenic tanks.

Pipelines

A pipeline network would be the most suitable option when it comes to an extended and large-scale use of hydrogen as an energy source. However, pipelines require high levels of initial investment, which may pay off, but only with large volumes of hydrogen passing through. Nevertheless, one possibility for developing pipeline networks for hydrogen distribution is local or regional networks, known as micro-networks. These could subsequently be combined into transregional networks.

When examining the above distribution methods, we should always consider that hydrogen may have several environmental advantages but it is a combustible gas. And if combustible gases are released, they can form explosive mixtures with air. Hydrogen is known from chemistry lessons in particular for the so-called oxyhydrogen or Knallgas explosion. It is therefore legitimate to ask how safe is hydrogen and what factors have to be taken into account to ensure it is handled safely. For the safe handling of hydrogen, it follows that: Unlike liquid fuels hydrogen is stored and transported in pure form and in closed resp. completely sealed systems/tanks. Hydrogen pressure tanks, which are most commonly used should have high safety margins and be fitted with relief valves. Ignition sources must be avoided. Since hydrogen is lighter than air, it escapes upwards. Therefore, hydrogen should either be stored in the open air or, if in enclosed spaces, with good ventilation. The use of special hydrogen sensors could also increase safety in these storage facilities.

The development and spread of hydrogen mobility will require a new infrastructure to provide a comprehensive supply network for fuel cell electric vehicles (FCEV). As of the beginning of 2017, there are around 280 hydrogen refuelling stations and some 4,000 FCEVs worldwide. Hydrogen refuelling stations and fuel cell vehicle fleets have so far been concentrated in the USA, Western Europe and Asia/Japan. The ambitious scenario ‘2DS high H2’ developed by the International Energy Agency, (shaped in line with the climate action goal of limiting the global temperature rise to 2°C), predicts that the number of fuel cell electric vehicles in three key markets (USA, selected European markets and Japan) will increase to about 113 million units by 2050. This scenario is based on an estimated increase in annual FCEV registrations in the EU and USA to 1 million by 2030, rising to a total of 10 million new registrations per year in the three regions by 2050.

As Wilhelm Ostwald (Nobel prize winner) at the 2nd annual meeting of the Association of German Electrical Engineers in 1884 (Verband Deutscher Elektrotechniker) said: “The fuel cell is a greater achievement of civilization than the steam engine and will soon banish the Siemens generator into the museum.”

Is this the future?

It seems very hard to make prediction on such a highly complex and still evolving process like the hydrogen ascension in the global energy mix. We cannot really set clear timeframes before we see a robust global clean hydrogen market is outlined. Much will depend on whether the world will be successful in scaling up cost-competitive production and use in the next ten years. In addition, key questions will be whether a clear winner will emerge from the currently considered transport modes and how fast the cost of shipping will come down. It is too early to tell how efficiently the cost of transport will develop and how fast this global hydrogen market will be established for good.

The very recent McKinsey report suggests a significant potential for intercontinental clean hydrogen trade already in 2030. Governments need to play a key role in setting the right framework conditions and stimulate common standards and guarantees of origin. International organizations like IEA and IPHE (International Partnership for Hydrogen and Fuel Cells in the Economy) can help to pave the way.

Green hydrogen can in principle be shipped around the world to places that are less well endowed with cheap renewable energy sources. Japan is leading several important pilot initiatives aiming at determining the best way to transport green and blue hydrogen over large distances by ship.

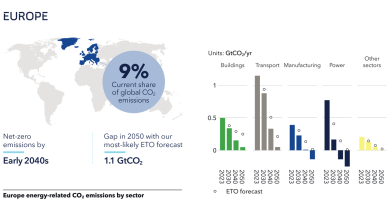

For Europe and its paradigm shift that may mean several things. First, that it may indeed take more time for the cost of green hydrogen to come down to levels near those of grey and blue hydrogen. The scale-up of electrolysis needs to drive down the cost. Even more critically, massive production will require large amounts of cheap green electricity. The projected scale-up in offshore wind production in Northwest Europe is expected to take more than a full decade, if not two, leading to well past 2030s. Some big industrial players, like ENGIE, have set an explicit cost target for green hydrogen to reach grid parity with grey hydrogen by 2030. Danish power company Ørsted recently announced that its bid in an offshore wind auction in the Netherlands includes the production of green hydrogen for industrial use. That shows that new business models are being invented as we speak, raising the possibility of positive surprises ahead. Swedish power company Vattenfall has calculated that producing a EUR 20,000 car from CO2-free steel (using green hydrogen) rather than regular steel would add just EUR 200 to the price. That suggests premium markets could be developed for consumers willing to pay 1% to 3% more for products manufactured using green hydrogen.

In an increasing number of countries with ample low-cost energy resources, governments and companies are seriously reviewing the possibilities of developing a clean hydrogen export industry. Australia and Brunei have already been mentioned, with Australia explicitly focusing on exports in their recently published hydrogen strategy. But we observe similar trends, in several countries across all continents, where the focus is on green hydrogen from cheap solar or wind-energy. For others, it’s both green hydrogen and blue hydrogen from fossil fuels with CCUS (Carbon Capture, Utilization and Storage).

As we are getting a sense of which countries are potential next-exporters of clean hydrogen, the same is the case for potential net-importing countries. In Asia, Japan and Korea have already clearly signalled the need for large-scale imports of clean hydrogen. For China and India, the situation is less clear so far. In Europe, Germany, the Netherlands and Belgium are among the countries where most experts think that if the scaling-up in the use of clean hydrogen in the next ten years is successful, the domestic production won’t be sufficient to meet the demand. Potentially, the needs could be doubled compared to now.

This could complicate the evolutionary process but it is a very real and indicative sign for what the future might behold. Hydrogen seems to be indeed a very promising potential solution but there is no concretely clear roadmap yet and before thinking about the future, we need to take care of the present.

Co-author: Konstantinos Michalopoulos, Dipl. Mining & Metallurgical Engineer at National Technical University of Athens