Sodium-Ion Batteries to Diversify Energy Storage Industry

By Shazan Siddiqi, Senior Technology Analyst at IDTechEx

Sodium-ion (Na-ion) batteries are being developed due to their potential costs, safety, sustainability, and performance characteristics over traditional lithium-ion batteries. These batteries can be made with widely available and inexpensive materials, with sodium being significantly more abundant than lithium. Furthermore, sodium-ion batteries can use aluminium for the anode current collector instead of copper, which is used in lithium-ion cells. This ultimately reduces the supply chain risks. Furthermore, they can be safer than lithium-ion batteries as they can be stored at zero volts, causing less risk during transportation. Traditional lithium-ion batteries are generally stored at around 30% state of charge. Also, the electrolytes used in sodium-ion systems generally have a higher flashpoint than lithium-ion battery systems, reducing flammability risks. Another advantage is that the process for making sodium-ion batteries is very similar to that of lithium-ion, meaning that the scale-up of the technology can benefit from existing lithium-ion battery production lines. IDTechEx’s new report, “Sodium-ion Batteries 2024-2034: Technology, Players, Markets, and Forecasts”, provides in-depth coverage of this emerging industry.

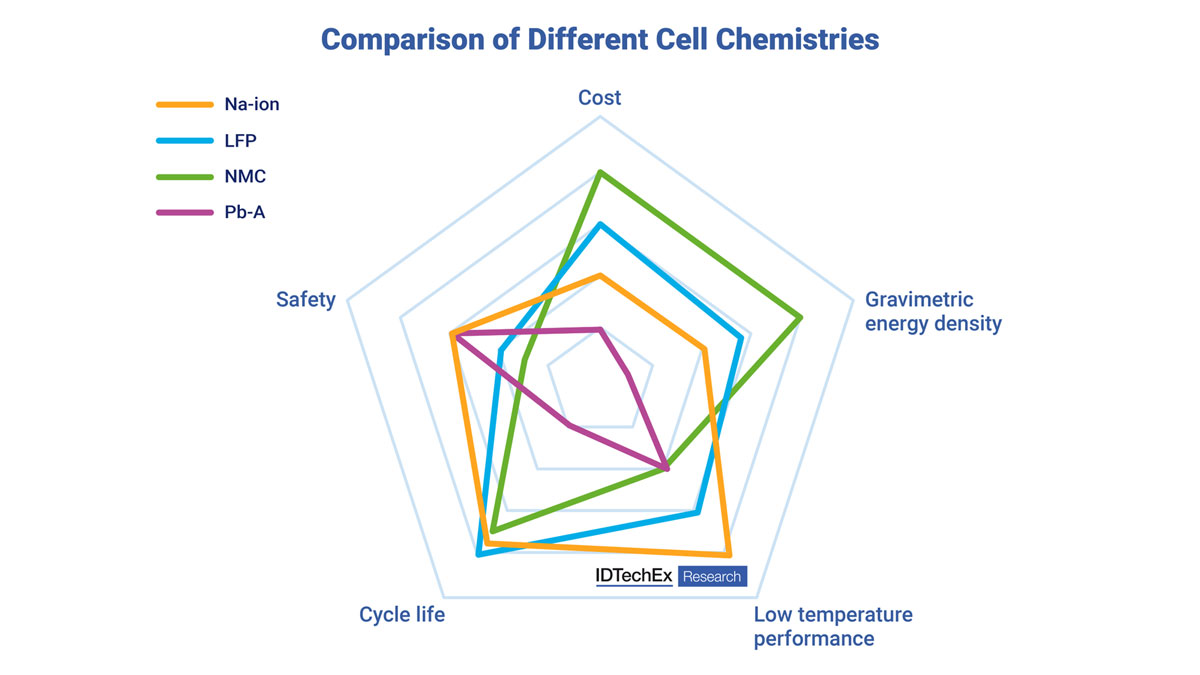

Comparison of Na-ion with various other cell chemistries

Comparing the different performance characteristics, one can see the general pros and cons of each battery chemistry right now. The energy density for sodium-ion batteries is still lower than high-energy lithium-ion cells, which use nickel, but they are approaching the energy density of high-power lithium iron phosphate (LFP) cells. The cycle life of cells is reasonable in some configurations, but one of the interesting elements not shown in the image is that sodium-ion batteries can have quite high-power characteristics with reports of ~1000 W/kg, which is higher than NMC (~340-420 W/kg) and LFP (~175-425 W/kg) cells. They also exhibit better low-temperature performance.

Sodium is a heavier element than lithium, with an atomic weight 3.3 times greater than lithium (sodium 23 g/mol vs lithium 6.9 g/mol). However, it is important to note that lithium or sodium in a battery only accounts for a small amount of cell mass and that the energy density is mostly defined by the electrode materials and other components in the cell. Hence, while current sodium-ion batteries have relatively low energy densities, there is the potential for this to increase in the coming years.

Cost comparison

One of the key arguments for the use of sodium-ion batteries is that they are lower cost. It has been estimated that at scale, a sodium ion battery with a layered metal oxide cathode and hard carbon anode will have ~25 to 30% lower material costs than an LFP battery. Unpacking this a bit more, it is known that two of the main differences between a sodium-ion cell versus a lithium-ion cell is that they replace lithium and copper with cheaper sodium and aluminium, which gives around a ~12% cost reduction with most of this being due to the aluminium current collector. As mentioned earlier, most of the cost of a cell will be defined by the electrode materials. Hard carbon is emerging as one of the most popular anode materials. However, because hard carbon has a lower density than graphite used in lithium-ion batteries, this means that for the same amount of active material, more electrolytes will need to be used, which adds cost and mass. Furthermore, hard carbon is generally more expensive than natural graphite, with some hard carbons having lower performance than graphite.

The IDTechEx report compares the costs of different lithium-ion and sodium-ion battery configurations to find that there are potential cost advantages, but the exact number depends heavily on the chemistry being used. In the near term, this is likely to be a battery with a sodium-layered metal oxide cathode with a hard carbon anode, but in the future, the cathode may well improve with some viewing future anodes having a blend of phosphorus, which has a higher specific capacity. It is important to note that material prices do vary, and there is still uncertainty around future material performance.

The sodium-ion chemistry will certainly not be the answer for all applications; however, it will be well-suited to complement, rather than displace, the existing and future lithium-ion technologies in many applications.

The new report from IDTechEx, “Sodium-ion Batteries 2024-2034: Technology, Players, Markets, and Forecasts”, has coverage of over 25 players in the industry and includes granular 10-year forecasts, patent analysis, material, and cost analysis, and identifies target markets for this emerging beyond-lithium technology.