DNV Study: Dutch Industrial Decarbonization Policy Successful in Encouraging Industrial Decarbonization

DNV, the independent energy expert and assurance provider, has found that policies implemented to support carbon capture and storage (CCS) in the Netherlands have so far been successful in encouraging industrial decarbonization.

DNV has also found that despite its availability in quantities that could feed a solid market, hydrogen (either blue or green) is not yet sufficiently incentivized by policy mechanisms to bring confidence to investors and industry. However, a recently announced redesign of the hydrogen subsidy scheme, if implemented, could kick-start the hydrogen economy and accelerate decarbonization.

Clear ambitions for deep industrial decarbonization

To drive the energy transition, the Netherlands requires its domestic industries to reduce GHG emissions by 59%[1] by 2030 and become climate neutral by 2050.

The challenge for the Dutch industry is to decarbonize in adherence to the Nationally Determined Contribution to the Paris Agreement (NDC), while maintaining international competitiveness.

Public ambitions have driven the adoption of policy instruments prioritizing well-established and cost-effective decarbonization solutions over emerging technologies such as green hydrogen and electrification.

The Dutch government has therefore established a Sustainable Energy Transition subsidy scheme (Stimulering Duurzame Energietransitie – SDE++), working as contract-for-difference scheme that compensates the additional costs for adopting low-carbon technologies that are already used or close to deployment, such as CCS.

An already successful push for carbon capture and storage…

Though CCS is mainly perceived as a transitionary technology to prevent fossil fuel lock-in (with subsidies scheduled to end after 2035), SDE++ backing has been crucial in enabling its early deployment in the Netherlands and proving it to be a cost-effective solution for industrial decarbonization. Subsidized CCS projects can contribute to up to 7.8 megatons of CO2 emission reduction by 2035.

Cluster energy policies, shared infrastructures and a subsidy mechanism that has removed carbon price uncertainty have brought forward successful projects, and DNV finds that CCS policy has been a success in the Netherlands thus far.

… and more efforts to come to kick-start the hydrogen economy

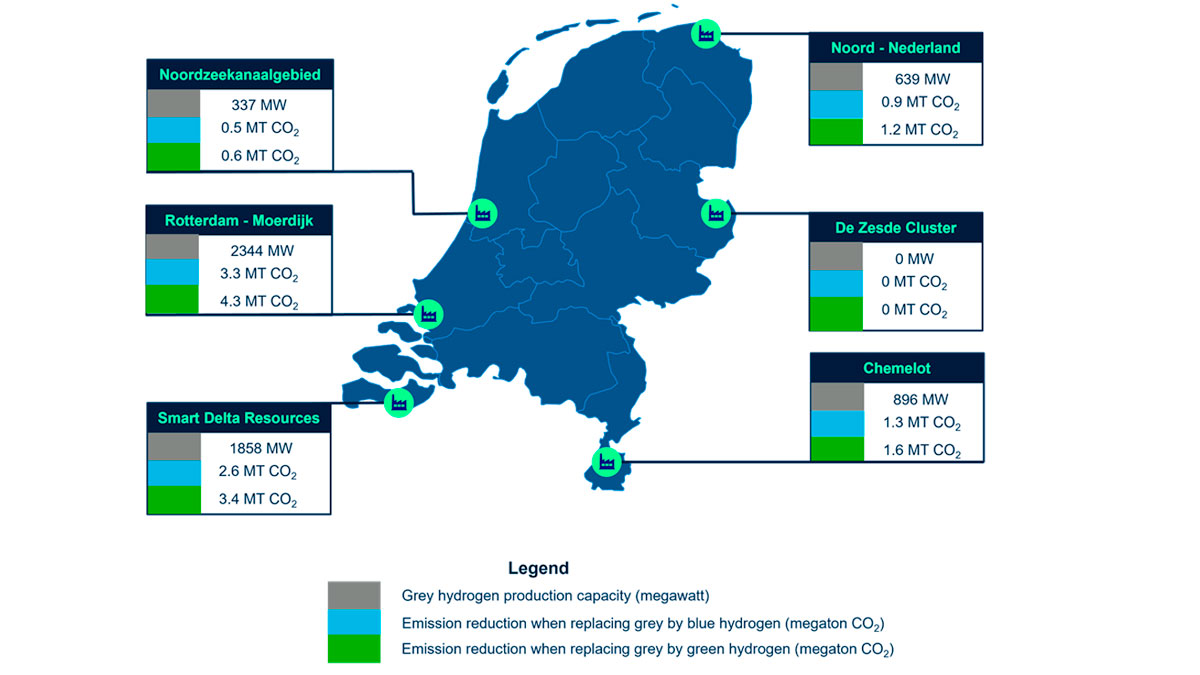

On the other hand, hydrogen projects are not sufficiently incentivized under SDE++ to align with emission reduction targets, and their profitability remains low in the Netherlands – despite DNV’s analysis that the significant amount of grey or fossil hydrogen currently produced (exceeding 6 GW) could support solid market opportunities for green or low-carbon hydrogen.

Blue hydrogen has the potential to develop the hydrogen economy in the Netherlands and pave the way for green hydrogen in the longer term. Announced projects, if executed, could lead to a reduction of up to 5.2 megatons of CO2 emissions by 2030. Replacing grey hydrogen with blue hydrogen through the application of CCS could reduce industrial emissions by more than 8.5 megatons (nearly 60% of industrial emissions target). Replacing the existing grey hydrogen with green hydrogen can reduce emissions by more than 11 megatons (nearly 78% of industrial emissions target).

Figure 1: more than 60% of the industrial emissions target can be met by replacing grey hydrogen production with low-carbon or green hydrogen, however this requires acceleration of policy support.

Public support is currently insufficient to enable the scaling up of green hydrogen projects, since its correction amount within SDE++ is determined by the indexed Title Transfer Facility (TTF[2]) gas price, and thus does not take power price into consideration. This exposes operators to power market risks, and scaling costs cannot be recovered within the current framework.

Following recent announcements, new SDE++ tender categories for costlier technologies[3] are expected to be introduced by the government during the 2023 subsidy auctions. DNV analysis finds that such a redesign of the SDE++ scheme would support investment in emerging technologies and could radically change the Dutch hydrogen landscape by improving the business case for green and blue hydrogen.

To go even further than this proposed policy evolution, DNV also finds that including both gas and power prices in SDE++ corrections would reduce uncertainty and improving hydrogen’s bankability.

Projects amounting to a total capacity of 7GW of green hydrogen by 2030 have already been announced. However, clarity on the timeline and modalities of the new mechanisms is required to give confidence to investors and bring these projects to fruition.

Prajeev Rasiah, Executive Vice President for Energy Systems, Northern Europe at DNV said: “The Netherlands is strategically positioned to take a leading role in the energy transition, with good conditions for offshore wind close to the country’s industrial clusters, a network of some of the world’s largest and busiest seaports, and extensive natural gas infrastructures that can be utilized for both domestic and cross-borders hydrogen and CO2 transport.

“Part of the success of the energy transition will be determined by public engagement and the availability and scope of effective policy instruments. Our analysis finds significant achievements in cost-effective decarbonization in the Dutch industry thanks to targeted support. While there still is a margin for improvement where emerging technologies are concerned, the progress we already see should inspire policymakers in the EU and the world to support and accelerate the elevation of industrial decarbonization technologies”.

“These results give us important insights on how other European countries can look to kickstart their industrial decarbonization efforts,” stated Magnolia Tovar, Global Director Zero Carbon Fuels at CATF, who played a key role in supervising the study on the part of CATF. “We hope that this study will help raise the profile on the kinds of policy mechanisms that governments can implement in order to move the needle on this long-overlooked piece of the climate challenge.”

About DNV

DNV is the independent expert in risk management and assurance, operating in more than 100 countries. Through its broad experience and deep expertise DNV advances safety and sustainable performance, sets industry benchmarks, and inspires and invents solutions.

Whether assessing a new ship design, optimizing the performance of a wind farm, analyzing sensor data from a gas pipeline, or certifying a food company’s supply chain, DNV enables its customers and their stakeholders to make critical decisions with confidence.

Driven by its purpose, to safeguard life, property, and the environment, DNV helps tackle the challenges and global transformations facing its customers and the world today and is a trusted voice for many of the world’s most successful and forward-thinking companies.

In the energy industry DNV provides assurance to the entire energy value chain through its advisory, monitoring, verification, and certification services. As the world’s leading resource of independent energy experts and technical advisors, the assurance provider helps industries and governments to navigate the many complex interrelated transitions taking place globally and regionally, in the energy industry. DNV is committed to realizing the goals of the Paris Agreement and supports customers to transition faster to a deeply decarbonized energy system.

About Clean Air Task Force

Clean Air Task Force (CATF) is a non-profit organization working to safeguard against the worst impacts of climate change by catalyzing the rapid global development and deployment of low-carbon energy and other climate-protecting technologies.

[1] 14.3 million tons of CO2 per year

Source: Industrial Decarbonization utilizing CCS and Hydrogen in the Netherlands, DNV 2022

[2] Title Transfer Facility (TTF) is a pricing location within the Netherlands relying on a physical pipeline index – it does not usually take into consideration liquefaction, grid access and other such costs.

[3] For instance, the production of hydrogen from residual gasses, direct lines from offshore wind to electrolysis and separate gates for hydrogen and other green gasses