H2 Production Projects in Romania ahead of Government’s Strategy

The Ministry of Energy in Romania has launched the state aid scheme for supporting investments in building green hydrogen production capacities in electrolysis plants. With a budget of EUR 148,752,500, the call session ended on July 31 and funding is ensured within the National Recovery and Resilience Plan (NRRP). Although for now there is no national hydrogen strategy, the projects aiming at producing and using the new fuel are multiplying rapidly.

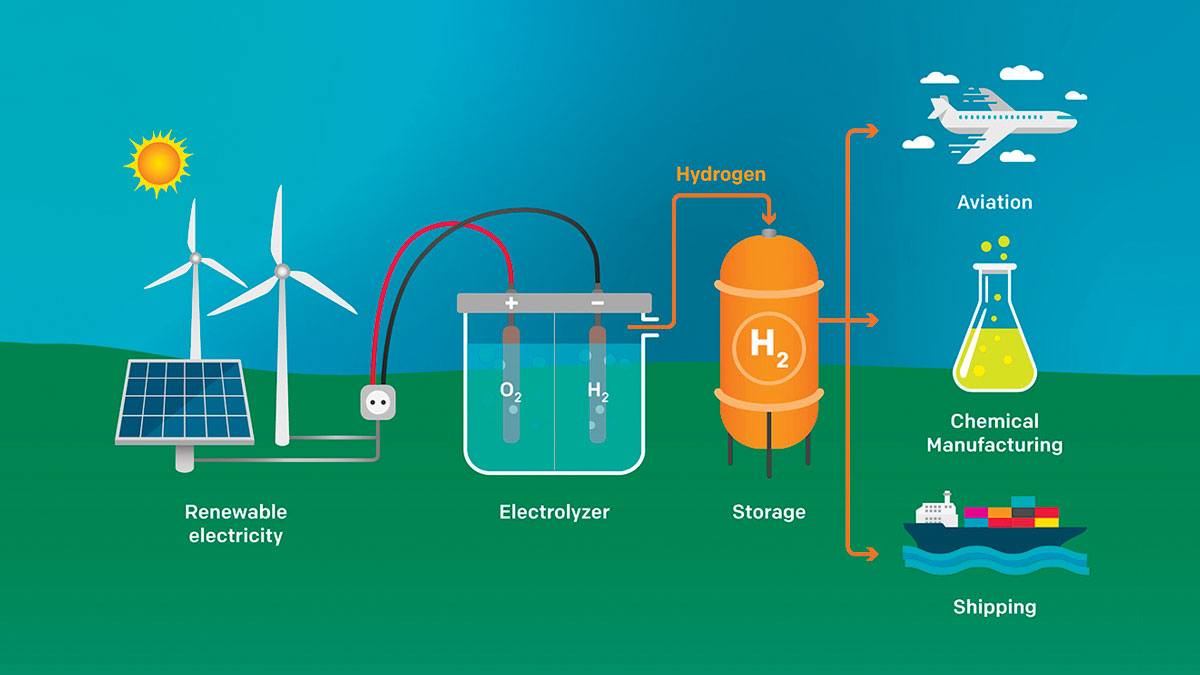

According to NRRP provisions, the intervention aims at promoting investments in building new capacities of at least 100 MW in electrolysis plants, with an estimated generated quantity of at least 10,000 tons of renewable hydrogen per year and must be carried out by Q4/2025. The maximum funding that can be granted for each project is EUR 50 million. According to the clean energy report in Romania, developed in 2021 by Energy Policy Group (EPG), the most promising uses for hydrogen in Romania are in industry (steel, ammonia, fertilizers, refineries, and high-value chemicals), transport (long-distance air transport, maritime transport, heavy vehicles, and certain railway segments), district heating systems and, potentially, long-term, or seasonal energy storage after 2030. In 2021, based on market research, consultation with representatives in the field and discussions carried out with the stakeholders, the Fuel Cells and Hydrogen Joint Undertaking (FCH JU) estimated the total annual demand for hydrogen in Romania at 184,506 tons.

European strategy

The European Commission in 2020 adopted a hydrogen strategy and at the end of last year published a draft legislative package concerning the hydrogen and decarbonized gas market proposing a recast of Regulation No. 715/2009 on conditions for access to the natural gas transmission networks (Recast Gas Regulation) and Directive No. 2009/73 concerning common rules for the internal market in natural gas (Recast Gas Directive). This strategy includes three strategic phases by 2050, year when the EU should reach climate neutrality. The three phases cover the period 2020-2024 (first phase), 2025-2030 (second phase) and 2030-2050 (final phase).

In the first phase, which covers the period 2020-2025, the main objective is to install at least 6 GW of renewable hydrogen electrolysers in the EU and the production of up to 1 million tons of renewable hydrogen, to decarbonize existing hydrogen production, e.g., in the chemical sector and facilitating take up of hydrogen consumption in new end-use applications such as other industrial processes and possibly in heavy-duty transport.

In the second phase, which covers the period 2025-2030, the objective is to install at least 40 GW of renewable hydrogen electrolysers by 2030 and the production of up to 10 million tons of renewable hydrogen in the EU.

In the third phase, which refers to the period 2030-2050, renewable hydrogen technologies should be implemented hard to decarbonize sectors, where other alternatives might not be feasible or have higher costs. In this phase, renewable electricity production needs to massively increase as about a quarter of renewable electricity might be used for renewable hydrogen production by 2050.

The situation in Romania

For now, Romania does not have a national hydrogen strategy, but officials from the Ministry of Energy promised, at the end of last year, that this would happen in the first part of 2023. Studies based on Fit for 55 package proposals on hydrogen use show that an electrolysis capacity between 1,470 MW and 2,350 MW should be installed in Romania by 2030 and this will require between 3 GW and 4.5 GW new renewable energy sources to be installed in addition to the capacities included in the National Energy and Climate Plan.

Domestic projects are multiplying

More and more Romanian companies are already directing their attention to the development of hydrogen production capacities. For example, Hidroelectrica has announced its intention to build two green hydrogen production units, using water electrolysis. One would be installed on the Olt River, and another on the Danube. The two units would operate in tandem with two photovoltaic parks, so that electricity produced by them supplies the hydrogen production units.

Another key company in the energy system interested in hydrogen is Transgaz. The technical operator of the national transmission system has concluded an agreement with the Three Seas Initiative Investment Fund (3SIIF) for the development or one or several projects concerning hydrogen transport by pipelines, the investment value being able to reach up to EUR 626 million.

Petrochemical plant Oltchim Ramnicu Valcea also considers building a hydrogen production unit, the investment being estimated at EUR 500 million – EUR 1 billion.